Why AAX? Low cost carrier benefited from weakening of USD dollar (TP:??)

itjustabouttheprofit

Publish date: Sat, 16 Apr 2016, 12:09 PM

EPS estimation :

5.4sen (31 March 2016)

2sen (30 June 2016)

2sen (30 September 2016)

2sen (31 December 2016)

PE ratio : ??

Target price: ??

I am here to ANSWER a simple question.

Why AAX?

1) Forex gain on borrowing of more than

RM100million for quarter ended 31 March

2016 (Net effect, increase in EPS3.4sen)

2) Sales in advance increased significantly

compare to last year

3) Saving in aircraft fuel expenses and

interest expense

4) Strong growth in global February Air Traffic

Introduction

On 10 July 2013, Airasia X have been listed

in bursa Malaysia.

Since then, Airasia X share price have been

dumped from RM1.20 (IPO price) to as low

as RM0.15.

After the release of quarter result on 26

February 2016, Airasia X started to move up

to RM0.345 as per today.

1) Forex gain on borrowing of more than

RM100million for quarter ended 31 March

2016 (Net effect, increase in EPS3.4sen)

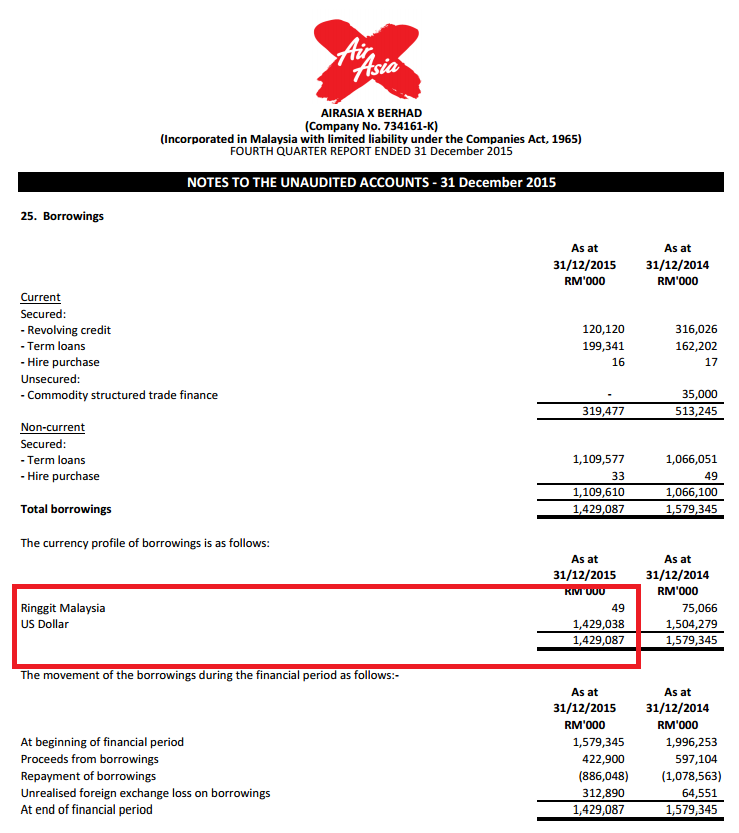

Let's us check on the currency rate of US dollar against ringgit during 31 December 2015 and 31 March 2016.

a) According to XE.com, USD1 = RM4.29750 as per 31 December 2015

b) According to XE.com, USD1 = RM3,87077 as per 31 March 2016

Now let's using the information about to calculate for the forex gain:

Refer to the page 13 of AAX for quarter ended 31 December 2015, we notice that there are RM1,429,038k of borrowing denominated in US dollar.

USD1 = RM4.29750 (31 December 2015)

Total borrowing as per 31 December 2015 (in USD) = RM1,429,038k / RM4.29750 = USD332,528k

USD1 = RM3.87077 (31 March 2016)

Total borrowing as per 31 March 2016 (in USD) = USD332,528k (assuming is the same)

Total borrowing as per 31 March 2016 (in ringgit) = USD332,528k x RM3.87077 = RM1,287,139k

Total borrowing as per 31 December 2015 (in ringgit) = RM1,429,038k

Total borrowing as per 31 March 2016 (in ringgit) = RM1,287,139k

Total forex gain = RM1,429,038k - RM1,287,139k = RM141,899k or RM142million

Effect of forex gain per shares

= RM141,899k / 4,148,000,000 shares

= EPS 3.4sen per shares

With the calculation shown as per above, I believe that the forex gain will increased the earning per share for AAX for 3.4sen per share.

2) Sales in advance increased significantly

compare to last year

Refer to the balance sheet of AAX for quarter ended 31 December 2015, we noticed that the sales in advance have been increased by RM187k or 31.69% compare to 31 December 2014. It is a positive sign shown that the sales expected to be more than last year for the outcoming quarter.

3) Saving in aircraft fuel expenses and

interest expense

Refer to page 6 of quarter report for period ended 31 March 2015, the average fuel expenses is at USD83.94. For the period from 1 Jan 2016 to 31 March 2016, the oil price moving around USD25 to USD40.

Other than that, we noticed that from 31 December 2015, the average fuel expenses is at USD62 per barrel. We expected that for the upcoming quarter, the average fuel expenses will be lesser than USD62.

Also, with the currency rate against US dollar have been appreciated, hence we expect another cost saving in the interest expenses.

4) Strong growth in global February Air Traffic

http://www.businesstravelnews.com/Transportation/Air/IATA-Strong-Growth-In-Global-February-Air-Traffic

Fueled by strong international flight demand, low oil prices and an extra leap-year day, global passenger air traffic in February increased 8.6 percent year over year, as measured in revenue passenger kilometers, according to the International Air Transport Association.

February traffic on international routes increased 9.1 percent year over year, led by a 12.7 percent increase in Africa and an 11.6 percent increase in the Middle East, according to IATA. North American international revenue passenger kilometers increased 3.6 percent, the lowest increase among global regions. European international demand increased 7.7 percent.

February domestic RPKs increased 7.9 percent year over year and 8.9 percent in the United States.

Global capacity, as measured in available seat kilometers, increased 9.9 percent year over year. Load factors, however, dropped by 0.6 percentage points, the first such year-over-year decline since mid-2015.

"It is unclear whether this signals the start of a generalized downward trend in load factor, but it bears watching," IATA director general and CEO Tony Tyler said in a statement.

As KLIA2 is one of the largest (if not the largest) low cost carrier terminal, I believe that I will also being affected from the strong growth of Air Traffic.

Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Aug 28, 2016

Created by itjustabouttheprofit | Jun 05, 2016

Discussions

And if you are portfolio manager holding some export shares, you want some exposures to shares benefitting directly from ringgit appreciations.

2016-04-16 17:01

I saw you wrote Magni with RM6.90 nine months ago, now RM4.20, SAM to hit TP 10.15 6 months later which is now but just RM6.11, Latitude TP RM9 now RM5.60, SHH TP RM3.33 now just half of that.

CEPCO is not due for 6 months yet, and now Airasia. Is that why you stop assigning TP to Airasia?

2016-04-18 08:19

I think the information is important. Author's TP is irrelevant

Good work you have done itisjustaboutprofit, please continue

2016-04-18 09:32

interesting good read on AAX. Main focus -savings on US Borrowing and lower fuel cost ( Y-o-Y ). Main driver will higher sales revenue

2016-04-18 10:07

Thank you my first fans Ricky Yeo or JT Yeo. Keep follow my post since I am first written article. Ya maybe for some share that i have shared not meet the target. But i tink you are wrong with Magni. Magni was RM3.80 when i written this. What is the price now? RM4.19 after bonus issue. You are totally wrong with this. Please go and check the date before commend.

I writing AAX not Airasia. You not even reading the title correctly before commend.

When you criticize people, please read carefully before you commend.

2016-04-18 16:30

My bad for seeing AAX as Airasia.

The price is higher now doesn't mean your prediction is correct make sense? You gave a PE 11, that is your prediction 6 months ago, so whether you are right or wrong is based on the PE you assign, not where the share price is right now.

I comment on most of your article isn't to criticize you, but to make you aware you are wasting your time estimating EPS or using PE. I understand your work is essentially a 'fundamental trading' but by now you should see the flaw in using PE to derive a TP and think the market will agree with you and move to that TP.

Your analysis is good but how you estimate valuation needs some changing. The thing that can move share price in a huge way is 2 things: Market expectation and ROE. Not EPS or PE.

Market expectation - Do you see why lose making companies or company that doesnt really make money, when they report a good quarter and suddenly the share price can rocket? Their PE can remain so low but you will easily make 100-300%. That is because 1) Market expectation - No one wants the stock, no one likes it, zero expectation, human become superman, the market says wow so the price skyrocket. and 2) ROE improvement - investors see ROE improvement and extrapolate. That is good news for fundamental trader.

Low market expectation x ROE improvement = Is what you need to look for.

2016-04-19 07:36

stockmanmy

oil price and currency is the obvious catalyst.

but there are others eg....Qantas moved from $ A 1.00 Jan 2014 to $A 4 now on the back of efficient improvements....

Tony can see it happening . Can you?

efficiency improvements based on the internet revolution, cutting off the middle men, big data analytics, multiple sources of income beside selling seats, better planes,

.....but the biggest catalyst of them all.....in the prisoners dilemma game between MAS and Tony, they have learn to cooperate- cooperate instead of killing each other. I do think Mueller of MAS must be Tony best friend.

Just hope local authorities do not kill the goose that lay the golden eggs.

400% increase in AAX means the share price go back to IPO price only.

2016-04-16 14:12