Why Tecguan (RM1.87)? Significant improvement in profit after tax and revenue (palm oil company)

itjustabouttheprofit

Publish date: Sun, 09 Oct 2016, 02:47 AM

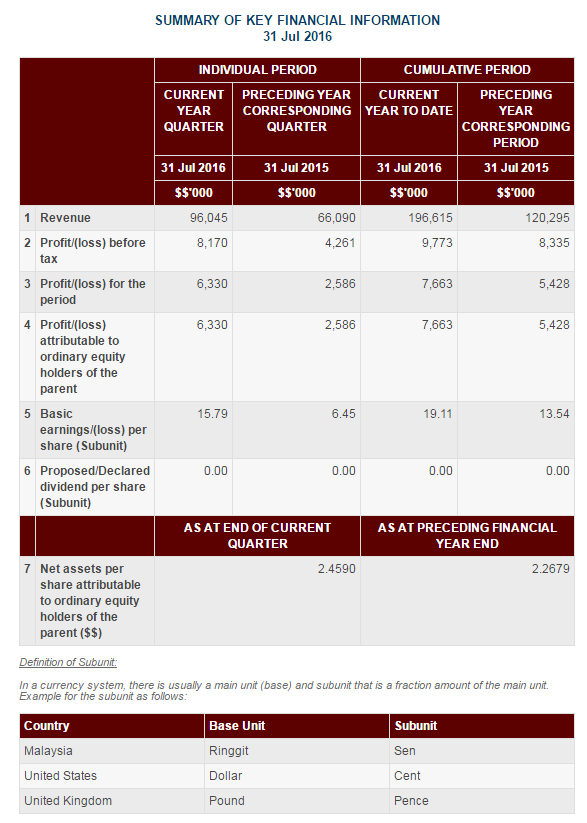

Latest quarter result:

31/7/2016 - 15.79sen

30/4/2016 - 3.32sen

31/1/2015 - 0.04sen

31/10/2015 - 5.59sen

Total - 24.74sen

Current PE ratio : 7.56 (RM1.87)

Net assets: RM2.4590

Company background

Tech Guan is a Malaysia-based diversified multinational founded by the late Datuk Seri Panglima Hong Teck Guan in 1935. The company is principally an investment holding company with its subsidiary companies involved in the integrated and synergistic cocoa operations beside oil palm cultivation.

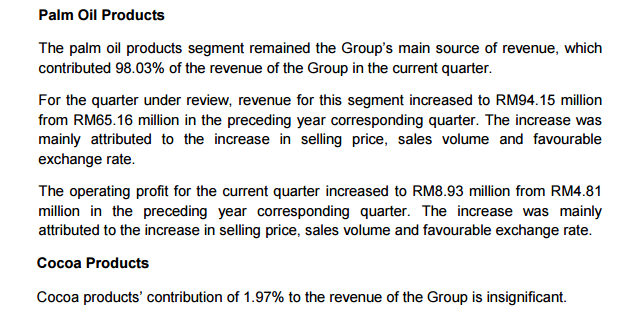

The company's business involved

1) Oil palm products (98% of total revenue)

2) Cocoa products (2% of total revenue)

According to annual report 2016, all planted areas under palm oil segment of the Group have attained maturity, with average crop age of 14 years.

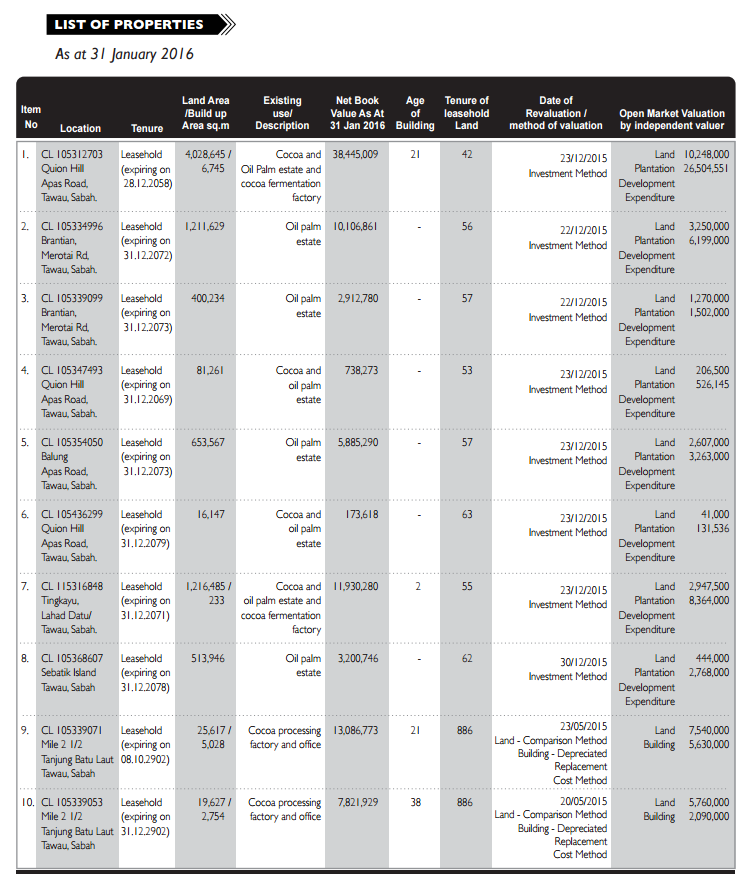

The company have more than 2,000 arces of palm oil and cocoa estate plantation in Tawau, Sabah.

I am here to ANSWER a simple question.

Why TECGUAN?

1) Significant improvement in revenue and

profit after taxation for the quarter ended

31 Jul 2016

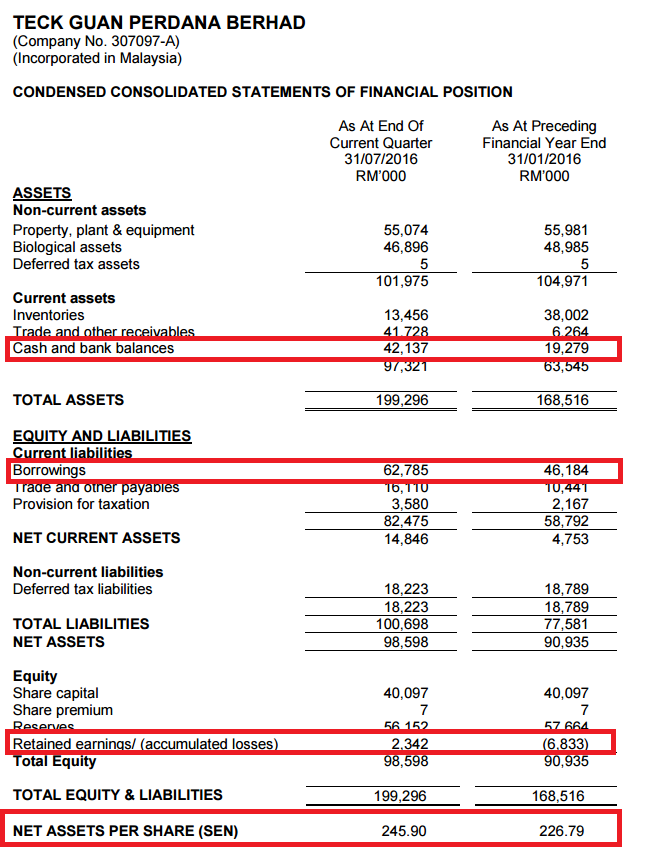

2) Improvement in balance sheet

3) Crude palm oil's price increase compare

to prior year

4) Others

1) Significant improvement in revenue and

profit after taxation for the quarter ended

31 Jul 2016

2) Improvement in balance sheet

From the balance sheet as per 31 July 2016, we have noticed that the net debt position have been improved from RM26,905mil to RM20,648.

Net assets position improved from RM2.2679 per share to RM2.4590 per share.

Also, for the first time in many years, the company's finally having retained earnings.

As the company have no declared any dividend since 2007, maybe it is time for them to start rewarding their shareholder again?

3) Crude palm oil's price increase compare

to prior year

Information extracted from: http://www.mpoc.org.my/dailypalmoilprices.aspx?catID=b4ad7d4e-d7d0-410b-be86-9a80af0f4693&print=&ddlID=28abbe06-f695-4fd0-8bde-85d8a2ee9ccd

| Date | CPO price (RM) | Date | CPO price (RM) |

|---|---|---|---|

| 1/8/2015 | - | 1/8/2016 | 2,327 |

| 2/8/2015 | - | 2/8/2016 | 2,338 |

| 3/8/2015 | 2,054 | 3/8/2016 | 2,415 |

| 4/8/2015 | 2,062 | 4/8/2016 | 2,444 |

| 5/8/2015 | 2,037 | 5/8/2016 | 2,407 |

| 6/8/2015 | 2,045 | 6/8/2016 | - |

| 7/8/2015 | 2,042 | 7/8/2016 | - |

| 8/8/2015 | - | 8/8/2016 | 2,439 |

| 9/8/2015 | - | 9/8/2016 | 2,466 |

| 10/8/2015 | 2,029 | 10/8/2016 | 2,500 |

| 11/8/2015 | 2,040 | 11/8/2016 | 2,484 |

| 12/8/2015 | 1,995 | 12/8/2016 | 2,525 |

| 13/8/2015 | 2,014 | 13/8/2016 | - |

| 14/8/2015 | 2,027 | 14/8/2016 | - |

| 15/8/2015 | - | 15/8/2016 | 2,622 |

| 16/8/2015 | - | 16/8/2016 | 2,539 |

| 17/8/2015 | 2,044 | 17/8/2016 | 2,643 |

| 18/8/2015 | 2,060 | 18/8/2016 | 2,576 |

| 19/8/2015 | 2,035 | 19/8/2016 | 2,578 |

| 20/8/2015 | 1,997 | 20/8/2016 | - |

| 21/8/2015 | 1,986 | 21/8/2016 | - |

| 22/8/2015 | - | 22/8/2016 | 2,543 |

| 23/8/2015 | - | 23/8/2016 | 2,578 |

| 24/8/2015 | 1,916 | 24/8/2016 | 2,600 |

| 25/8/2015 | 1,906 | 25/8/2016 | 2,561 |

| 26/8/2015 | 1,867 | 26/8/2016 | 2,552 |

| 27/8/2015 | 1,925 | 27/8/2016 | - |

| 28/8/2015 | 1,991 | 28/8/2016 | - |

| 29/8/2015 | - | 29/8/2016 | 2,517 |

| 30/8/2015 | - | 30/8/2016 | 2,526 |

| 1//9/2015 | 2,013 | 1/9/2016 | 2,520 |

| 2/9/2015 | 1,989 | 2/9/2016 | 2,595 |

| 3/9/2015 | 2,032 | 3/9/2016 | - |

| 4/9/2015 | 2,031 | 4/9/2016 | - |

| 5/9/2015 | - | 5/9/2016 | 2,644 |

| 6/9/2015 | - | 6/9/2016 | 2,629 |

| 7/9/2015 | 2,048 | 7/9/2016 | 2,598 |

| 8/9/2015 | 2,092 | 8/9/2016 | 2,609 |

| 9/9/2015 | 2,113 | 9/9/2016 | 2,640 |

| 10/9/2015 | 2,157 | 10/9/2016 | - |

| 11/9/2015 | 2,134 | 11/9/2016 | - |

| 12/9/2015 | - | 12/9/2016 | - |

| 13/9/2015 | - | 13/9/2016 | 2,592 |

| 14/9/2015 | 2,192 | 14/9/2016 | 2,564 |

| 15/9/2015 | 2,148 | 15/9/2016 | 2,594 |

| 16/9/2015 | - | 16/9/2016 | - |

| 17/9/2015 | 2,128 | 17/9/2016 | - |

| 18/9/2015 | 2,103 | 18/9/2016 | - |

| 19/9/2015 | - | 19/9/2016 | 2,642 |

| 20/9/2015 | - | 20/9/2016 | 2,693 |

| 21/9/2015 | 2,151 | 21/9/2016 | 2,677 |

| 22/9/2015 | 2,183 | 22/9/2016 | 2,725 |

| 23/9/2015 | - | 23/9/2016 | 2,676 |

| 24/9/2015 | - | 24/9/2016 | - |

| 25/9/2015 | 2,342 | 25/9/2016 | - |

| 26/9/2015 | - | 26/9/2016 | 2,715 |

| 27/9/2015 | - | 27/9/2016 | 2,663 |

| 28/9/2015 | 2,394 | 28/9/2016 | 2,605 |

| 29/9/2015 | 2,451 | 29/9/2016 | 2,616 |

| 30/9/2015 | 2,375 | 30/9/2016 | - |

| 1/10/2015 | 2,414 | 1/10/2016 | - |

| 2/10/2015 | 2,387 | 2/10/2016 | - |

| 3/10/2015 | - | 3/10/2016 | 2,636 |

| 4/10/2015 | - | 4/10/2016 | 2,600 |

| 5/10/2015 | 2,415 | 5/10/2016 | 2,556 |

| 6/10/2015 | 2,372 | 6/10/2016 | 2,579 |

| 7/10/2015 | 2,319 | 7/10/2016 | ? |

| 8/10/2015 | 2,276 | 8/10/2016 | ? |

| 9/10/2015 | 2,217 | 9/10/2016 | ? |

| 10/10/2015 | - | 10/10/2016 | ? |

| 11/10/2015 | - | 11/10/2016 | ? |

| 12/10/2015 | 2,257 | 12/10/2016 | ? |

| 13/10/2015 | 2,320 | 13/10/2016 | ? |

| 14/10/2015 | - | 14/10/2016 | ? |

| 15/10/2015 | 2,287 | 15/10/2016 | ? |

| 16/10/2015 | 2,302 | 16/10/2016 | ? |

| 17/10/2015 | - | 17/10/2016 | ? |

| 18/10/2015 | - | 18/10/2016 | ? |

| 19/10/2015 | 2,274 | 19/10/2016 | ? |

| 20/10/2015 | 2,319 | 20/10/2016 | ? |

| 21/10/2015 | 2,367 | 21/10/2016 | ? |

| 22/10/2015 | 2,371 | 22/10/2016 | ? |

| 23/10/2015 | 2,328 | 23/10/2016 | ? |

| 24/10/2015 | - | 24/10/2016 | ? |

| 25/10/2015 | - | 25/10/2016 | ? |

| 26/10/2015 | 2,279 | 26/10/2016 | ? |

| 27/10/2015 | 2,322 | 27/10/2016 | ? |

| 28/10/2015 | 2,341 | 28/10/2016 | ? |

| 29/10/2015 | 2,370 | 29/10/2016 | ? |

| 30/10/2015 | 2,363 | 30/10/2016 | ? |

| 31/10/2015 | - | 31/10/2016 | ? |

| Total (RM) | RM130,048 | Total (RM) | RM115,548 |

| Total days | 60 days | Total days | 45 days |

| Average price (RM) | RM2,167 | Average price (RM) | RM2,568 |

Total increase in average price = RM401

Percentage increase in average price = 18.50%

As per calculation above, the average CPO (crude palm oil) price have been increased by 18.5% (updated until 6 October 2016). With a higher average CPO price, I foresee that the revenue and profit will increased on the next quarter as the total increased in average price will be fully recorded as profit if the cost of sales remain the same.

![]()

4) Others

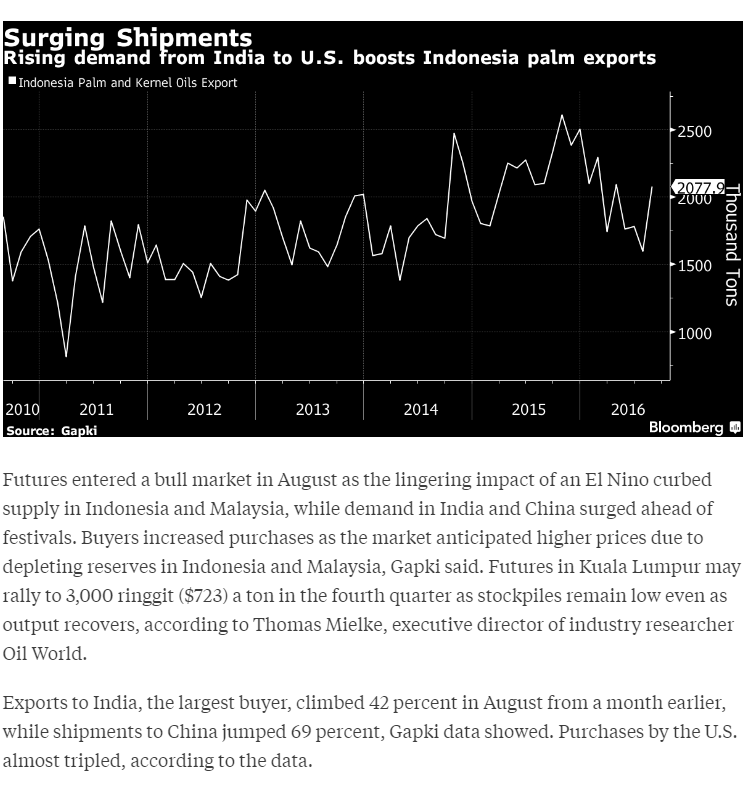

http://www.thestar.com.my/business/business-news/2016/08/18/palm-oil-enters-bull-market-as-demand-rises/

http://www.bloomberg.com/news/articles/2016-10-06/indonesian-palm-reserves-drop-as-exports-jump-most-in-22-months

Thank you for your time. Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Aug 28, 2016

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

itsjustaboutprofit...pls share its land acreage & palm planted area information if you already have... it becomes easy to check how undervalue it is. Thanks

2016-10-09 11:30

If China stocks don't pay dividend a lot of questions. Why no similar question in TecGuan?

2016-10-09 12:27

Agree. So many questions on China stocks not paying dividend so similar question should be on Tecguan profit.

Posted by kino318 > Oct 9, 2016 12:37 PM | Report Abuse

there is a potential fraud if no dividend paid.

2016-10-09 12:40

Who know director use co. money to buy big house, big car or pay themselves high salary but not us shareholders a single sen dividend.

2016-10-09 12:41

probability: Thank you for your suggestion. I have added the information about the palm oil planted area in this article.

2016-10-09 14:00

thank you so much IJATP......that will help a lot.

You are always one of the pioneers in detecting huge potential upside..

2016-10-09 14:08

Thx ijatp for the screening of share for us kind of new trader. It seems to be a huge potential to up! Cool

2016-10-09 14:24

Nice stock, thanks for sharing. Have been followed u for ur last few blogs, never regret of reading ur blog!

2016-10-09 14:31

1. it's better to compare CPO price this coming quarter compared to the last quarter to see if revenue will keep increasing

2. CPO production is expected to increase post-El Nino while US soybean production is also expected to be at record high next year. in fact, soybean over CPO premium has been declining over past few months, so it may be a bit simplistic to assume CPO price will remain or keep increasing from current level

2016-10-10 01:18

the company is not very transparent. the commentary usually are as as well as no commentary. the past 2 quarters revenue has shot up, probably as a factor of both higher volume and CPO price. CPO price should not be too low for next quarter but volume is unknown since company does not really tell much.

btw, the company mainly sells crude palm kernel oil so I'm just talking on CPO price assuming kernel oil will track CPO price movement

stronger USD is good for the company. for the 6.3m profit last quarter, 1.4m is from forex gain. Oct USD may come off a bit but Aug-Oct USD overall should still remain relatively strong

IMO, the market price seems quite fully valued. based on the latest quarter, I think the fair price would be roughly RM2-2.20, not much upside left considering the risk as the company's track record was not very good. any earnings disappointment and you could be looking at a nasty selloff

price still below NA, but all estates were quite recently revalued so have been mostly priced in NA. 2000 acres plantation is considered very small plus average age at 14 is end prime and some may need replanting

2016-10-10 01:40

yup..the revenue does not seem to arise from internally derived Palm Kernels. The land bank cannot justify this revenue level.

It seems they are buying palm kernels externally, processing it and selling the palm kernel oil....the significant gain suggests it is due to price fluctuations -rise in palm kernel oil price during this quarter. All prices remaining stable, they cannot repeat such high margins.

Palm kernel seed price will rice according to the kernel oil price.

2016-10-10 02:07

I agree with Xinguan..this cash rich company but look at history NEVER appreciate the other shareholder to give dividend. The price movement only move because profit improvement and catalyst. Like I say they NEVER paid dividend

2016-10-10 12:18

pak cik: they have accumulated losses. according financial standard report, they cannot pay any single sen dividend. it is against the law.

2016-10-10 13:05

Pigdan,I 'm not prejudice this company. i know all type company from Sabah region especially from my local area Tawau. even they have profit on 2011(RM6 million), 2013(3 Mill), 2014 (7 Mill) & last financial result January 2016 7 million didt declare dividend.You can compare to they peer QL/TSH or Hap Seng Plantation Division. Check the historical DY. They suppose appreciate the other shareholder to give dividend.

2016-10-10 17:05

pak cik: i see your point. haha maybe as shareholder we need to request from management on the dividend

2016-10-10 17:36

yes pigdan agree...but trader also can make profit for this share...short term

2016-10-10 19:40

Such a great information. Thanks for this amazing info. Looking forward for your next creation. Thanks!!

<a href="http://blog.firstadviser.in/stock-market-tips/" rel="noopener" target="_blank">Stock Market Tips</a>

2019-09-30 19:10

why_no_dividend

Net debt company so no dividend?

2016-10-09 04:09