Chinese developers expand their presence in Johor. By Samuel Tan (Comments from Calvin Tan Research)

calvintaneng

Publish date: Fri, 16 Dec 2016, 11:24 PM

Chinese developers expand their presence in Johor

Chinese developers have continued to expand their presence in Johor. In the third quarter of this year (3Q2016), Shanghai government-linked Greenland Group launched the Iskandar Malaysia Greenland Smart City Experiential Centre (SMARTXP) in Helios Cove, Permas Jaya.

KGV International Property Consultants (Johor) Sdn Bhd executive director Samuel Tan, in presenting The Edge-KGV International Property Consultants Johor Bahru Housing Property Monitor 3Q2016, says the focus was on Helios Cove during the quarter. The market was watching if the development will get a good response like Country Garden Pacificview Sdn Bhd’s Forest City, he adds.

When completed, Helios Cove will be a fully integrated township with waterfront residences as well as commercial and retail outlets across five main zones. The 128-acre township will offer panoramic views of the Straits of Johor, and is set to become a new international landmark in the southern region of Malaysia.

“Helios Cove was opened for public viewing in 3Q2016,” says Tan. “The mammoth and innovative concept caught many by surprise. It is indeed a courageous move by the developer… against all the odds, it managed to attract key tenants to its commercial zone. The serviced apartments are expected to be launched soon. The developer has no qualms about the marketability of its products.”

Etice, Phase 1 of Helios Cove, will be a commercial integration zone with commercial, residential and office units as well as a hotel and show gallery. Phase 2, Circa, will be an education and cultural zone with a school, snow theme park and Confucius centre.

Phase 3 will be an arts and cultural zone called Ethon, which will have a Malay cultural street and arts and culture boulevard.

Phase 4, Asiph, will have a traditional medicine centre, residential units and a waterfront resort. Phase 5, Helia, will be the location of the upscale waterfront villas.

Tan says Permas Jaya and its surrounding area are expected to benefit from the development, with infrastructure to be upgraded and higher demand for residential rental units.

“Commercial activities will increase due to the number of workers who will be mobilised for the project,” he explains. “If we take Forest City as an example, Helios Cove should do well too, albeit with the China-based customers first.”

According to Tan, droves of Chinese tourists are visiting Johor Bahru daily to view Forest City and other projects from China-based developers, with many hotels reporting good occupancy rates.

According to Tan, droves of Chinese tourists are visiting Johor Bahru daily to view Forest City and other projects from China-based developers, with many hotels reporting good occupancy rates.

“We have seen many new three and four-star hotels built over the last three years and they have performed well, even in the initial years of operation,” says Tan.

“Projects of this nature also involve a large number of workers and this has resulted in demand for houses. In Johor Bahru, houses in Taman Bukit Indah and those near Gelang Patah are highly sought after. Rental rates have increased over the last few years.”

Increasing yields

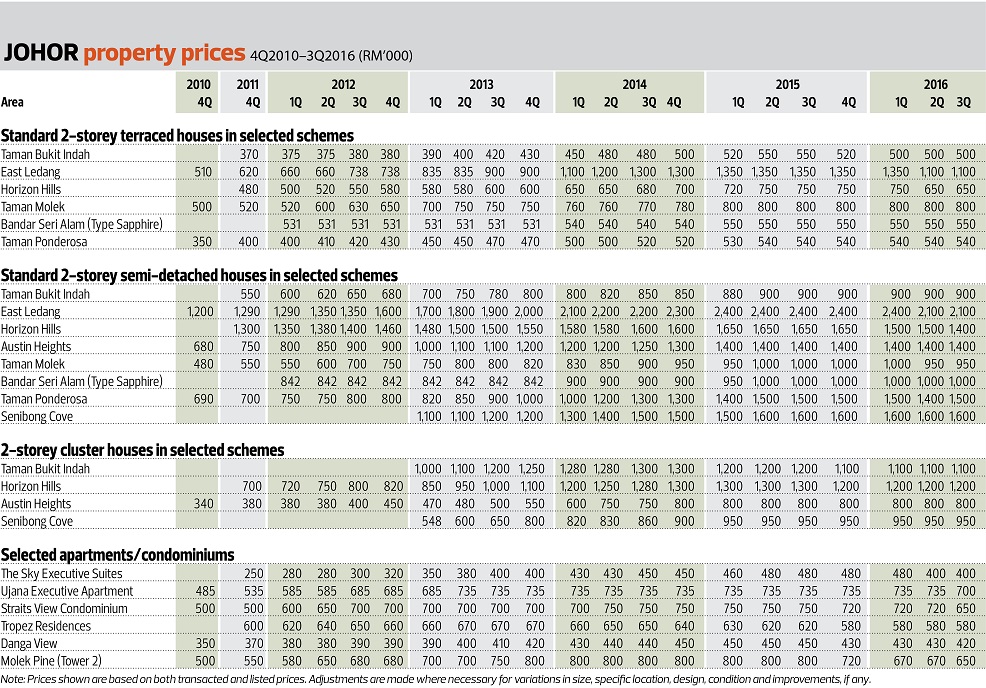

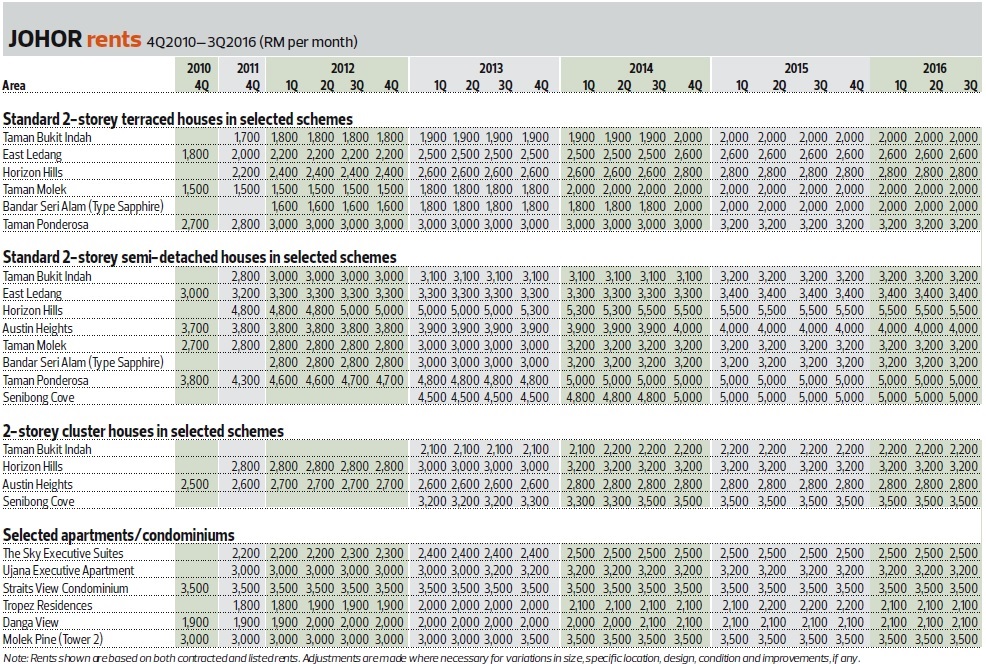

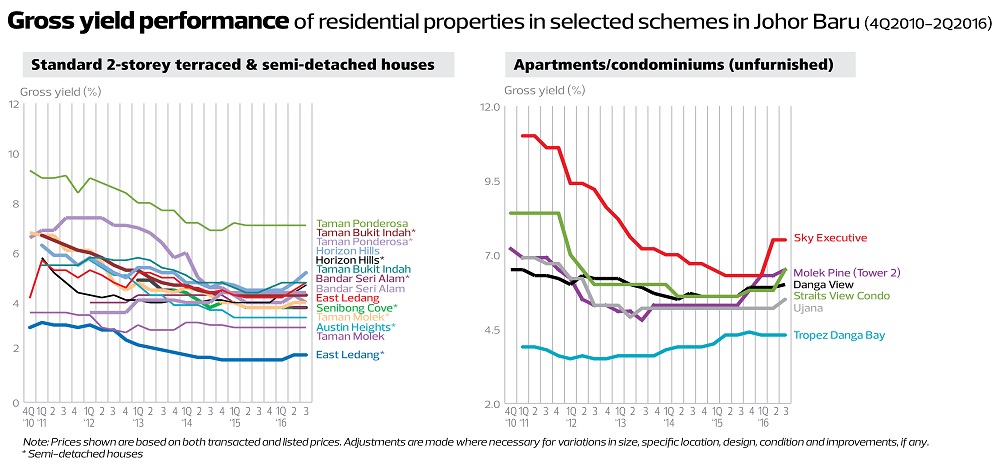

According to KGV data, the gross monthly rental for all the residential properties it sampled, be they landed or non-landed, remained flat in 3Q2016. Nevertheless, the gross yield performance of some of these properties increased.

For example, a 3,003 sq ft standard 2-storey semi-detached house in Horizon Hills saw its gross monthly rental remain at RM5,500. But its yield increased to 4.7% from 4.4% in the previous quarter.

Meanwhile, a 1,600 sq ft unit at the Straits View Condominium saw its yield grow 0.7% to 6.5% during the quarter, despite the rent remaining at RM3,500.

Straits View Condominium saw the highest plunge in transaction prices, a decline of 9.72% to RM650,000 in 3Q2016, from RM720,000 the previous quarter. The selling price of similar units there had remained at RM720,000 for the past three quarters.

Data shows that the price of the luxury condos had reached a peak of RM750,000 in 2Q2014, before staying flat for more than a year and then falling to RM730,000 in 4Q2015. Located 9km east of Johor Bahru’s city centre, Straits View Condominium is only a 15-minute drive to Singapore.

Landed properties have performed relatively better than non-landed ones, based on transaction activities. The transaction price of all landed residential properties sampled by KGV also remained flat in 3Q2016. Some of the non-landed properties it sampled, however, saw bigger movements than before.

A 1,148 sq ft unit at the Ujana Executive Apartment in East Ledang had remained at RM735,000 since 2Q2013. During the quarter under review, the transaction price fell 4.76% to RM700,000. The 23-storey tower houses 168 executive apartments and four penthouses.

On the primary market, The Hills Residences at Senibong Cove was available for preview in 3Q2016. It offers 55 units of 3-storey landed homes, with built-ups of 4,030 to 4,590 sq ft. It is a freehold, landed strata project.

Johor has seen a number of foreign investors in the recent years, such as South Korean plastics manufacturer Lotte Chemical Corp, the Volkswagen Group and the Saudi Arabian Oil Company. This proves the significance of the state as a manufacturing hub of the country.

“Even with the slowdown in the global economy, Johor has been able to attract MNCs (multinational corporations),” says Tan. “There will be downstream effects as other supply chains will also benefit from their presence. More importantly, it is the creation of new jobs. The sub-sectors to benefit from these MNCs, apart from industrial properties, are residential properties — to house workers — and shops, to cater for their commercial needs.”

The Kuala Lumpur-Singapore High Speed Rail (HSR) has been one of the keenly awaited projects in Johor. A memorandum of understanding was signed by Malaysia and Singapore on July 19, while the agreement is expected to be signed this month to pave the way for construction to begin in 2018.

The HSR is targeted to start operation by 2026.

Tan says the signing of the HSR agreement is an important milestone as it confirms the location of the stations as well as the system it will operate in.

“The proposed station in Iskandar Putri will have two systems, namely a domestic system where the rail will start in Bandar Malaysia and stop in Putrajaya, Seremban, Ayer Keroh, Muar, Batu Pahat and Iskandar Putri, and a 15-minute daily shuttle service between Iskandar Putri and Singapore.”

He adds that the domestic system may increase the labour supply and investment in Johor Bahru due to the proximity of the city to Singapore as well as the availability of infrastructure in the state capital, such as ports and industrial estates.

The shuttle service, meanwhile, will resolve the long-standing problem of congestion at both links between Johor and Singapore. The improved mobility is expected to spur property purchasing activities in Johor Bahru. The other sub-sectors that may benefit are industrial, tourism, healthcare, logistics and education.

“To put it in a nutshell, the HSR project will offer a hope that will spur the property market until the day it is operational. This, perhaps, is the greatest effect HSR has on Johor Bahru currently,” says Tan.

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Created by calvintaneng | Aug 03, 2024

Discussions

Not to state the obvious , our desperate PM is selling land at discounted price to China in returned for financial assistance to solve his 1MDB huge losses and indebtedness .

2016-12-17 09:36

.png)

stockmanmy

is it true what Icon says? that you are estate agent moon shining here?

2016-12-16 23:33