HONG KONG Superman: Li Ka-shing-Investing In Pengerang shows Oil & Gas Bull Run In Malaysia, Calvin Tan comments

calvintaneng

Publish date: Tue, 12 Mar 2019, 11:34 PM

Newsbreak: Li Ka-shing-backed venture to build STS hub in Johor

A new ship-to-ship (STS) marine gas oil (MGO) and marine fuel oil (MFO) storage and supply hub will be built off the Port of Tanjung Pelepas in southern Johor, say sources familiar with the matter. It is touted to be the largest in the world.

The construction cost of the hub — to be developed by little-known KA Petra Sdn Bhd, partnering Hong Kong tycoon Li Ka-shing’s Hutchison Port Holdings Ltd — is estimated at RM500 million, a Hutchison Port official tells The Edge.

“KA Petra has been in the STS business since 2005, providing offshore storage and MGO and MFO supply services between vessels in the waters off Port Klang, Selangor, Tanjung Beruas, Melaka, and Tanjung Pelepas, Johor.

“In Johor, it is one of four operators licensed by the Ministry of Transport to provide STS services to vessels coming to the Port of Tanjung Pelepas (PTP) and Port of Singapore,” says the official.

Hutchison Port will have an up to 30% stake in the completed STS hub, the official adds. The project will have a gross development value of RM8 billion to RM12 billion.

A check with the Registrar of Companies shows that KA Petra is a distributor of marine lubricants and provider of shipping and oil and gas-related services. It is almost wholly owned by Datin Lelawati Raffik.

According to RoC, for the financial year ended Dec 31, 2017 (FY2017), KA Petra recorded a 170% year-on-year increase in profit after tax (PAT) to RM2.05 million on revenue of RM336.88 million.

The STS hub will be developed by KA Petra’s wholly-owned subsidiary, KA Petra STS Hub Sdn Bhd, the company in which Hutchison Port will be investing.

The company official says the STS hub will be able to handle up to 30 very large crude carriers (VLCCs) at any given time, compared with the existing STS operation there, which can only handle nine.

The new STS hub will have mooring buoys and “dolphins” to berth the tankers. The usage of dolphins — isolated marine structures for berthing and mooring vessels — enables mother ships to be berthed without the need for large piers or docks.

The current STS operation, where the mother ships — large tankers and crude carriers — are anchored in an offshore area to transfer fuel and other liquid hydrocarbon products onto other vessels without being tied to any permanent structure, is taking up too much space.

This is because VLCCs and their daughter ships — the vessels used to transport liquid hydrocarbon from the mother ships to their destinations — tend to swing due to the ocean currents, explains a source from the maritime industry. The area can only cater for only nine VLCCs at any given time due to the vessel swing factor, the source adds.

The area where the STS hub will be built stretches 2,800 acres between PTP and the Johor Baru port limit.

“With the STS hub being developed, the number of VLCCs that can be moored off PTP will treble to up to 30 at any given time, which will make the waters off PTP the largest STS hub in the world,” the source says.

But is there a need to develop the STS hub? It will raise the volume of oil products traded in Malaysia, which would increase the country’s weightage in the Platts’ Free-on-Board (FOB) Straits pricing of oil products.

In 2014, Platts, the leading global energy, petrochemicals and metals information provider, introduced the FOB Straits benchmark to replace the FOB Singapore and FOB Malaysia oil products reference rate.

These oil products are traded through Singaporean terminals, as well as four Johor ports, namely Tanjung Bin in the southwest, and Pasir Gudang, Tanjung Langsat and Pengerang Independent Terminal in the southeast.

If the STS hub materialises by 2021, Johor’s petroleum product storage capacity will increase further, in line with the federal and state governments’ aspiration to turn the state into one of the largest petroleum products trading hubs in the world.

ATT Tanjung Bin Sdn Bhd (ATB), which operates a petroleum product storage terminal in Tanjung Bin, has a storage capacity of almost one million cu m. ATB is a joint venture between MISC Bhd and Vitol, a leading global petroleum product trading company.

Pengerang, on the southeast coast of Johor, has the largest petroleum product storage capacity in the state. Phase 1 of the Pengerang Deepwater Terminal (PDWT) has a storage capacity of 1.3 million cu m of petroleum products, while Phase 2 has a capacity of 2.1 million cu m.

The PDWT is a joint venture between Dialog Group Bhd, Royal Vopak NV and Johor’s State Secretary Inc for Phase 1, and the three parties plus Petroliam Nasional Bhd for Phase 2.

KA Petra’s STS hub will not have an installed storage capacity, as its capacity depends on the size of the tankers moored at its piers. However, as an illustration, a VLCC can typically carry 300,000 cu m of petroleum products.

Calvin comments:

Hi guys,

Until now many are still oblivious to the Mightest Oil & Gas Bull Run Thematic Stocks of Malaysia

Even Hong Kong Superman Li Ka Shing sees an Oil Boom Time in Malaysia

And he put his money where he finds real value

Li Ka Shing expect Oil & Gas Activity to Boom & Boom in Malaysia from now onward.

He is investing Rm500 Millions into A Ship to Ship Refuelling Hub

Why so?

BECAUSE THE BIGGEST SHIPS IN THE WHOLE WIDE WORLD WILL CARRY OIL FROM SAUDI TO PENGERANG AS WELL AS FROM THE OIL FIELDS OFF PENINSULA, AND OFF SHORE OF SABAH & SARAWAK

See

The company official says the STS hub will be able to handle up to 30 very large crude carriers (VLCCs) at any given time, compared with the existing STS operation there, which can only handle nine.

30 BIGGEST OIL CARRIERS WILL DOCK IN PENGERANG

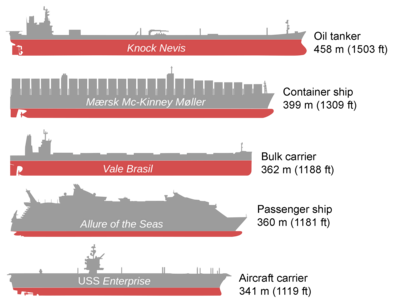

THESE ULTRA LARGE OIL CARRIER ARE MUCH BIGGER THAN EVEN AIRCRAFT CARRIER

See

VLCC and ULCC

"Supertankers" are the largest tankers, and the largest man-made mobile structures. They include very large crude carriers (VLCC) and ULCCs with capacities over 250,000 DWT. These ships can transport 2,000,000 barrels (320,000 m3) of oil/318,000 metric tons.[42] By way of comparison, the United Kingdom consumed about 1.6 million barrels (250,000 m3) of oil per day in 2009.[44] ULCCs, commissioned in the 1970s, were the largest vessels ever built, but the longest ones have already been scrapped. By 2013 only a few ULCCs remain in service, none of which are more than 400 meters long.[45]

Because of their great size, supertankers often cannot enter port fully loaded.[21]These ships can take on their cargo at off-shore platforms and single-point moorings.[21] On the other end of the journey, they often pump their cargo off to smaller tankers at designated lightering points off-coast.[21] Supertanker routes are typically long, requiring them to stay at sea for extended periods, often around seventy days at a time.[21]

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Created by calvintaneng | Aug 03, 2024

Discussions

fangyew thank you calvin , you are great !

13/03/2019 08:49

How is everything over there in Sutera Utama?

2019-03-13 10:20

https://www.thestar.com.my/business/business-news/2018/11/09/straits-inter-logistics-to-acquire-38pct-stake-in-hk-bunker-oil-trader/

Bro Calvin..is this just a coincidence?..

(shhh...load before it fly)

2019-03-13 12:41

this investment of making a hub due to IMO 2020 will actually benefit service oriented company like dayang.....not velesto

2019-03-14 23:01

THE BEST INVESTMENT STRATEGY IS THAT U BET WITH LOW RISK AND WITH VERY HIGH POTENTIAL RETURN LOH.....!!

SAPNRG IS THE BEST PICK BCOS IT MAKE ITS OWN FUTURE MAH....!!

WHY LEH ??

1. SAPNRG HAS OIL EQUIPMENT N MACHINE WHICH CAN DO VERY COMPLICATED JOBS, IT IS THIS REASONS IT HAS RM 19 BILLION CONTRACT IN HAND TODATE AND THIS IS BASING ON ONLY 50% OF ITS CAPACITY UTILIZATION LOH...!!

SAPNRG STILL HAS BALANCE CAPACITY TO TAKE UP ANOTHER RM 20 BILLION MORE JOBS LOH.......!!

2. UNLIKE OTHER OIL & GAS COMPANY SAPNRG IS ACTUALLY A MINI PETRONAS...BESIDE IT CAN DO SERVICES AND CONTRACT, IT HAS ITS OWN MANY OIL FIELDS THAT IS VERY RICH IN DEPOSITS AND CAN CONTRIBUTE STRAIGHT TO SAPNRG BOTTOM LINE AND GROWTH VERY QUICKLY....THRU ANYTIME INCREASING ITS OIL EXTRACTION... VERY QUICKLY IS NOT A PROBLEM

3. IT IS EXPECTED SAPNRG OWN INTERNAL OIL FIELD WORKS CAN CONTRIBUTE AT LEAST RM 4 BILLION OF CONTRACTS TO SAPNRG PA....THATS THE REASONS WHY RAIDER SAYS SAPNRG...ORDER BOOKS IS INCREASING AND GROWING EVERYDAY AND MINUTES, BCOS OF THIS OWN INTERNAL WORKS THAT CAN FLOW IN ANYTIME LOH....!!

THE BOOMING OIL CONDITIONS WILL KICK START SAPNRG RECOVERY FROM BEING A PENNY STOCKS OF RM 0.34 TO ITS RIGHTFUL ORIGINAL POSITION OF A PRECIOUS BLUECHIPS AT RM 3.00 GIVING IT MKT CAP OF RM 70 BILLION LOH...!!

SAPNRG HAVE THE FOLLOWING MOST IMPORTANT ALLIES LOH...!!

1. PETRONAS ...THEY HAS AWARDED THE MOST CONTRACT TO SAPNRG COMPARE TO ANY OTHER OIL & GAS LISTED CO IN MSIA.

2. OMV ITS REPUTABLE JOINT VENTURE PARTNER..THAT INVOLVE WITH HUGE OIL EXTRACTION AND OILFIELD RESERVES ENHANCEMENT ASSETS...THAT WILL INCREASE ITS REVENUE AND REDUCE THE COST OF PER BARREL OF OIL LOH...!!

3.PNB WHICH PROVIDE CORPORATE ADVISORY, FUNDING REQUIREMENT AND GOOD CORPORATE GOVERNANCE, THUS SAFEGUARDING THE MINORITY SHAREHOLDERS.

WITH THIS IN PLACE WE ARE PRETTY SURE & SAFE THAT SAPNRG WILL GROW EXPONENTIALLY AND SUSTAINABLY...THATS WHY RAIDER SAYS ALL OUT SAILANG ON SAPNRG, WHEN IT IS VERY CHEAP MAH....!!

2019-03-14 23:04

.png)

fangyew

thank you calvin , you are great !

2019-03-13 08:49