TWO POWERFUL FACTORS WHY PALM OIL BULL RUN CAN LAST MUCH LONGER THIS ROUND, Calvin Tan Research

calvintaneng

Publish date: Tue, 11 May 2021, 10:21 PM

Dear Friends/Investors of i3 Forum

If you read the opinions of analysts and media they all surmise that CPO Prices will only be good for the 1st Half Year of 2021

And they all conclude that by 2nd Half of 2021 CPO will soften and fall lower to as low as Rm3000 a ton or even lower to Rm2700

Now we think this Time CPO Prices will go up much much higher because of these TWO POWERFUL FACTORS

1) THE RISE OF WHEAT, CORN & SOYBEAN COLLECTIVELY DUE TO DROUGHT, FLOODS & DEMAND FROM CHINA

See how High Soybean Oil has Risen

| Date | CPO, BMD (US$/MT) | SBO, ROTT (US$/MT) | PO Discount to SBO |

|---|---|---|---|

| 6 May 21 | 1023 | 1580 | 557 |

| 5 May 21 | 982 | 1558 | 576 |

| 4 May 21 | 985 | 1548 | 563 |

| 3 May 21 | 990 | 1554 | 564 |

| 30 Apr 21 | 943 | 1500 | 557 |

| 28 Apr 21 | 960 | 1525 | 565 |

| 27 Apr 21 | 992 | 1570 | 578 |

| 26 Apr 21 | 947 | 1520 |

573 |

As can be seen from the above Prices for Msay 6th 2021

CPO (Crude Palm Oil) was USD1,023 A METRIC TON & SBO (Soy Bean Oil) is USD1,580

How much higher is Soyoil

USD1,580 minus USD1,023

= USD557 EXTRA

HOW MANY PER CENTAGE MORE

USD557 Divides by USD1,023

= 54.4% More

From here we SEE that Soybean Oil is 54.4% More Expensive Than Crude Palm Oil

Other Vege Oils are all more expensive than Soybean Oil

SO THERE IS NO OTHER CHEAPER SOURCE OF VEGE APART FROM PALM OIL

Since the Difference is so Huge at 54.4% the chances of More People Turning To Cpo due to economy is getting better and better as inflation get worst.

SO WHEN PEOPLE SAY CPO PRICE GOES UP INDIA WILL STOP BUYING PALM OIL AND WILL TURN TO BUYING OTHER CHEAPER VEGE OIL (THIS IS IMPOSSIBLE AS PALM OIL IS THE CHEAPEST ON WORLD MARKET)

SOYBEAN OIL, CORN OIL, CANOLA, SUNFLOWER SEED OIL, GROUND NUT OIL, COCONUT OIL & OLIVE OIL ARE ALL WAY MORE EXPENSIVE THAN PALM OIL

BUT CRITICS & DOUBTERS SAY BY NEXT HALF OF 2021 PRODUCTION OF CPO WILL INCREASE SO PALM OIL PRICES WILL GO DOWN OR LOWER

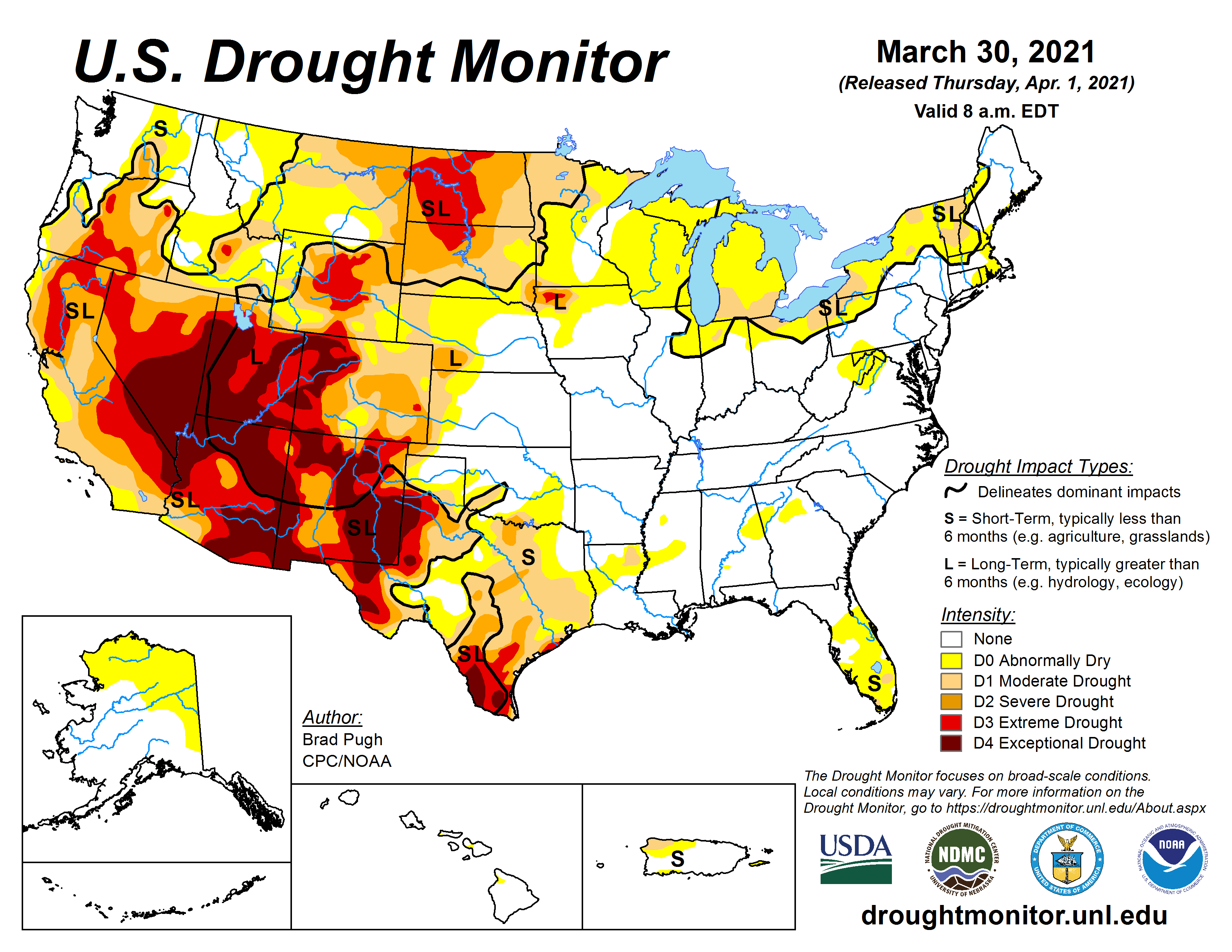

Again look at the Dry Weather in USA, Brazil & Argentina - All Major Corn & Soybean producing Countries Now in Drought

See

As you can see

HALF OF USA IS IN DROUGHT. USA IS AMONG THE WORLD BIGGEST PRODUCER OF SOYBEAN & CORN

2) THE SECOND REASON WHY PALM OIL PRICES WILL REMAIN ELEVATED IS DUE TO JOE BIDEN PIVOTING TO GREEN ENERGY DUE TO CLIMATE CHANGE

AS A RESULT PHILLIPS 66 & OTHER REFINERIES ARE NOW CONVERTING TO BIOFUEL

THIS WILL FOLLOW BRAZIL IN USING CORN AS BIODISEL & INDONESIA USING PALM OIL AS BIODISEL

USA'S SUGAR, CORN & SOYBEAN WILL NOW BE CONVERTED INTO GREEN ENERGY BIOFUEL LIKE NEVER BEFORE

THAT MEANS THAT THERE WON'T BE ENOUGH COMPETING VEGE OIL EVEN FOR WHOLE OF 2021 & BEYOND AS LONG AS JOE BIDEN IS IN POWER

See

ETHANOL FROM SUGAR CANE, CORN OR SOYBEAN

THE MORE ETHANOL CONTENT THE CHEAPER AND CLEANER THE FUEL

See Phillips 66

Phillips 66 Plans to Transform San Francisco Refinery into World's Largest Renewable Fuels Plant

Conversion is expected to reduce the plant’s greenhouse gas emissions by 50%

HOUSTON--(BUSINESS WIRE)-- Phillips 66 (NYSE: PSX), a diversified energy manufacturing and logistics company, announced today that it plans to reconfigure its San Francisco Refinery in Rodeo, California, to produce renewable fuels. The plant would no longer produce fuels from crude oil, but instead would make fuels from used cooking oil, fats, greases and soybean oils.

The Phillips 66 Rodeo Renewed project would produce 680 million gallons annually of renewable diesel, renewable gasoline, and sustainable jet fuel. Combined with the production of renewable fuels from an existing project in development, the plant would produce greater than 800 million gallons a year of renewable fuels, making it the world’s largest facility of its kind.

The project scope includes the construction of pre-treatment units and the repurposing of existing hydrocracking units to enable production of renewable fuels. The plant will utilize its flexible logistics infrastructure to bring in cooking oil, fats, greases and soybean oils from global sources and supply renewable fuels to the California market. This capital efficient investment is expected to deliver strong returns through the sale of high value products while lowering the plant’s operating costs.

SO FROM THESE EXAMPLES WE KNOW THERE IS NOW A LONG TERM STRUCTURAL CHANGE FOR THE USE OF PALM OIL ALONG WITH SOYBEAN OIL AS A RENEWAL BIOFUEL

BEST REGARDS

Calvin Tan Research

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Created by calvintaneng | Jul 10, 2024

Discussions

Don't dream!

Substitute for palm oil are plenty.

The crash is just around the corner.

2021-05-11 22:37

Talk is empty

Name here one Vege Oil that is cheaper and better than Palm Oil?

2021-05-11 22:41

Nice one.

The best is Swkplnt

Highest growth and lowest valuation.

https://klse.i3investor.com/m/blog/dollardollarbill/2021-03-10-story-h1542122361-SWKPLNT_most_underrated_plantation_stock_dollardollarbill.jsp

2021-05-12 00:18

Bot Bplant for the past 6 months still waiting for the counter to ride the CPO price hike momentum

2021-05-12 08:34

Remember 2 of the world most richest & savvy investors w.buffet & bill gates like investing in farmland now mah!

U can emulate them now too mah....!!

Thats why the 2 richest savvy investors have taken note the point of concern that palmoil & commodity price cannot going up forever like the case of glove & eventually the commodity price will also fall 1 day mah!

To address this issue or concern w.buffet & bill gates, say buy farmland & palmoil plantation, even the commodity price fall, u still have great protection on the value of cheap plantation land & farmland mah..!

If u buy into cheap land, u have both margin of safety accorded by cheap land plus prospect of reaping great profit from high palmoil price loh!

Thus u should Quickly Buy into palmoil plantation now, b4 its price shoot up mah!

Time to be a little bit more contraian in view of mkt at reasonable high level mah!

Warren buffet says inflation is definitely coming in view of low interest interest and speculative sign such as bitcoin, rubbish stock price run up sky high and unrealistic stock valuation & expectation and now raw commodities price run up mah!

Bill Gates already bought alot of farmland at low in preparation & in anticipation for the coming armmagedoom coming mah!

Why would one the world tech best richest owner switch alot of his investment into farmland, this bcos farmland or value real estate if it is bought at reasonable low price, u cannot go wrong over longterm bcos the availability of land is limited, u cannot manufacture land like bitcoin mah!

Coming back to msia the equivalent to farmland is oil plantation, u still can get it real cheap & it is paying u reasonably good dividend loh...this is the best defensive & offensive play like bill gates and warren buffet had highlighted mah!

As calvin sifu said timber is at record price & palmoil at record price surely some optimism will spillover to plantation & timber share price mah!

But this up 1 to 2 sen is chicken feed mah, why up so little leh ??

Timber & palmoil share r suffering from lack of production mah and also huge impairment losses on its assets mah & previous falling share price mah!

Thus they are jittery on recovery of palmoil & timber share loh!! They want to see actual profit b4 jump in loh!!

That means if u base on profit...as indicator that means the share price will be lagging loh!

Then why promote Wtk leh ??

1. The owner , directors and insiders already accumulating quietly without fanfare mah!

2. The palmoil & timber production volume of wtk, mhc, jtiasa, boustead, ijm plant already creeping up loh...this is further support by the record price of its commodities. Just imagine u have higher prices & higher volume....that will be a very important sign of higher big profit coming mah!

3. The share price already corrected over 3 yrs of downtrend previously, when there is a big shakeout of all the weak holders...u can only grow more optimistic as time past by loh!

4. Wtk is sitting on some prime land that invested at a very low cost near major town & city, they are good development mah!

5. With all the liquidity & quantitative easing & low interest rate environment, u can see big inflation will be coming loh...!! Wtk in commodities business plus very big cheap land bank is a very good inflation protector mah!

Based on the above i think wtk , jayatiasa & ijmplant is the best pick to make profit & this is concur by sifu calvin findings also mah!

2021-05-12 08:44

Palm oil has stronger fundamentals than technology-overhyped. many technology no revenue, loss making but so high crazy defying logic wakaka

2021-05-12 11:48

ahbah is clever

Today Calvin bought Fgv, Ijmplant, Thplant

Also for the 1st time ever. Bought Wilmar of Singapore below S$5.00

2021-05-12 15:17

Forget WTK as the business same as Rsawit every quarter report huge loss. When CPO rally maybe can report tiny profit. If really want play plantation go for Jtiasa.

2021-05-12 19:01

WTK should be able to make reasonable profit few years later.

WTK's segmental performance for the past 4 quarters.

Palm Oil division LOSSES (excluding revaluation of Biological Assets)

31 Dec 20 - 11.1m

30 Sep 20 - 45.6m (included impairment PPE 22.2m)

30 Jun 20 - 3.2m

31 Mar 20 - 3.8m

Timber division LOSSES

31 Dec 20 - 7.9m

30 Sep 20 - 112.2m (included impairment PPE 59.8m)

30 Jun 20 - 13.9m

31 Mar 20 - 17.8m

2021-05-12 19:20

Actually if you did deeper into the balance sheet of WTK there is no real losses except from impairments due to no sale, depreciation & others all skin deep losses

At its core all the value is still there

I have seen so many in KLSE that depreciates their lands, factories, houses & condos to the amazing value of One Ringgit book value

Can you imagine a freehold assets bought for hundreds of thousands can continue to depreciate until it became One Ringgit

In MSM Sugar Assets even Factories got book value at ZERO!

Really amazing only in KLSE Stocks got such kind of Rm0.00 (Zero) Book Value for a Big Land with factories

2021-05-12 20:03

There are many many high NTA companies with small segment in plantation ie Orient, Kseng, KSL ..

2021-05-12 20:15

Since the main thrust is very high Cpo prices go for these ones with largest palm oil land exposure

Small cap

Thplant over 230,000 acres of palm oil

Jtiasa over 206,000 acres of palm oil

Bplant over 200,000 acres of palm oil

These penny stocks will all rise up to cross Rm1.00

2021-05-12 21:33

Do not be silly loh!!

Palmoil is 7 times more efficient than soya bean loh!

Just imagine without palmoil....u need 7 times more the size of palmoil estates, to produce equivalent volume of soya bean oil to replace palm oil, that means u are damaging 700% more of the environment mah!

Posted by MuttsInvestor > May 13, 2021 11:19 AM | Report Abuse

ENEMY NUMBER ONE to TO ENVIRONMENT ============ HUMANS ( Animals are MUCH more Environment Friendly ) ......... So ... Remove HUMANS from This World ???

2021-05-13 11:30

Philip ( buy what you understand)

But money still stuck in netx how? Where got money to buy pain oil counters leh? Calvin got sell 8 houses to buy netx before I remember...

2021-05-13 17:08

Philip sold his Topglove too early and missed the Glove Superbull

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2020-05-24-story-h1507830969-THE_MOST_FOOLISH_THING_DONE_BY_PHILIP_AND_HE_IS_TOO_DUMB_TO_KNOW_IT_Cal.jsp

You leave i3 people alone to invest in this Super Bull run time of Palm Oil

2021-05-13 17:53

Don't talk nonsense

Calvin never con anyone

Calvin shares good stocks

See

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2020-10-27-story-h1535484485-A_LOOK_AT_CALVIN_TAN_REASEARCH_STOCK_PICKS_AS_RECORDED_BY_PHILIP_NOT_PE.jsp

Anyone who invest a modest amount in each of above highlighted stocks & keep even till now will do ok

The Sum Total of all Gains minus Sum total of all losses still come out VERY POSITIVE

ALL PLEASE TAKE THE ORIGINAL PRICES AND COMPARE THEM ONE BY ONE NOW

DON'T FORGET SUPERMAX EX ONE FOR ONE FREE BONUS WHILE MANY GOT GOOD DIVIDENDS

FOR NOW IF CAN SELL ALL OF THE ABOVE & PUT INTO PALM OIL FOR ANOTHER GREAT COMING SUPERBULL TIME

Many Happy Returns

Calvin

2021-05-13 18:08

Hope in future Calvin don't promote penny stock to us. So far all the penny stocks is like shit!

2021-05-17 14:57

bulldog

Thks Calvin

Huat chaiii

2021-05-11 22:31