A LOOK AT 4 LUMBER STOCKS WITH OWN TIMBER & FOREST CONCESSION LANDS PLUS ONE PLYWOOD COMPANY, Calvin Tan Research

calvintaneng

Publish date: Mon, 17 May 2021, 11:32 AM

Dear Friends & Investors of i3 Forum,

We have already found out that for Stocks to Rise there must be CATALYSTS

The Bull Run of OGSE Stocks were due to the Catalyst of Petronas Rm50 Billion Upstream Job Awards in Year 2019

The Once A Century Medical Glove Bull Run was Triggered by the Covid 19 Pandemic Catalyst

Palm oil is slowly warming up to the Catalyst of Rising Soyoil, Biofuel & China's Rebuilding Swine Herd Demand

And now

THERE IS A RAGING HOT DEMAND FOR LUMBER IN THE USA

Why the Sudden Rise of Lumber by 300%?

There are some reasons

1) Covid 19 Lock-Down has caused demand for Housing Space like never before. As people stay home there is a lot of time for Home Improvement & Extention for more space.

2) There is a Titanic Shift to work from Office to work from Home (office)

3) The Hollowing Out of Congested Cities to the Suburbs

From selling High Priced City Condos & Shifting to lower cost housing released Cash for Building New Houses, New Renovations & New Room Additions

4( Facebook even tell its Employees to work from Home (office) & gave them USD1,000 (Rm4,100) for Renovation Expense

See

Facebook is giving $1,000 to all of its 45,000 employees

San Francisco (CNN Business)Facebook is giving each of its employees a $1,000 bonus to help support them during the coronavirus outbreak.

Originally posted

Updated on March 22 at

4:49 pm

The wood industry is a great area to invest. It’s unlike any other industry and two lumber stocks stand above the rest. Each is in a unique position to push profits higher.

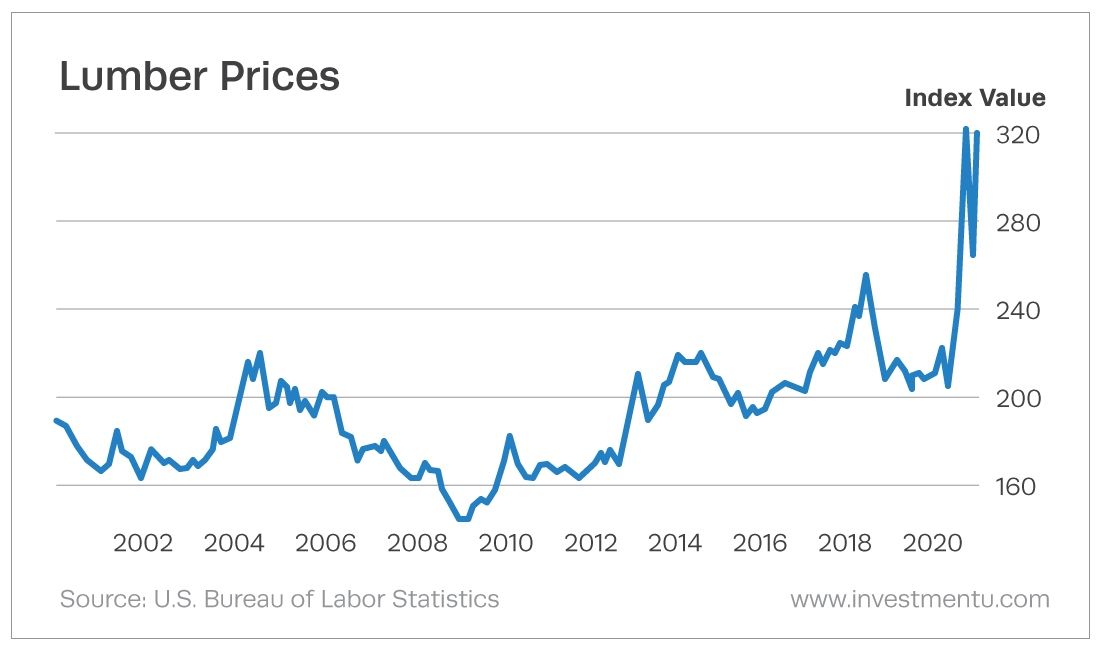

As you can see in the chart below, lumber prices have moved mostly sideways over the past 20 years. We saw a big spike last year, though, and prices have remained higher. These increased prices are leading to higher sales and should help lumber companies grow.

There are unique properties to owning forestland with timber. There’s a built-in optionality that’s great for investors. When prices are low, forestland owners don’t have to cut down and process as many trees.

The difference here is between timber vs. lumber products. “Timber” usually refers to intact trees or trees that have been cut and minimally processed. “Lumber” usually refers to wood that’s cut to standard sizes for commercial use or for construction.

Top Lumber Stocks to Watch

Weyerhaeuser is one of the largest forest product companies in the world. It owns more than 11 million acres of timberland in the U.S. It also manages millions of acres under long-term licenses in Canada.

The company has about a half a billion in cash and cash equivalents. This easily gives it the ability to meet its debt payments. On top of that, its free cash flow more than doubled in 2020 compared with the previous year. This makes sense with the increase in lumber prices.

Rayonier isn’t as big as Weyerhaeuser, but it’s still well diversified. This company owns or leases more than 2 million acres of timberland in the U.S. It also manages more than 400,000 acres in New Zealand.

Higher lumber prices are leading to higher revenue. This is putting the company in an even better position to grow and to reward shareholders.

The above examples are from USA

Let us do a breakdown

1) TA ANN (5012)

TA ANN is the Biggest Timber Owner. It is also Top Holder of SWK Plant

TA ANN is a well managed Timber Company with Saw Mill Plus investment in Sarawak Plant

So it is both Lumber & Palm Oil

We called TAANN Office to check Star Paper adverse report about Malaysia Wood product sale losing out to Indonesia (Today's news)

Ha! Not true! TA ANN said its products are 100% Certified & better than those from Indonesia.

TA ANN people are sanguine about the future

2) TSH RESOURCES (9059)

Just as Taann is Top Holder of Sarawak Plant - TSH is also the Top Holder of INNOPRISE Plant. TSH also got 150,000 acres of Palm oil lands in Indonesia just like IjmPlant (With abundant Indon workers)

Palm Oil Refinery in Indonesia is doing very well due to high export levy in Indonesia.

No wonder that TSH Insider has been buying and buying TSH non stop

| TAN AIK PEN | 14-Apr-2021 | Acquired | 400,000 | - |

|

| TAN AIK PEN | 13-Apr-2021 | Acquired | 400,000 | - |

|

| TAN AIK PEN | 12-Apr-2021 | Acquired | 500,000 | - |

|

| TAN AIK PEN | 09-Apr-2021 | Acquired | 300,000 | - |

|

| TAN AIK PEN | 08-Apr-2021 | Acquired | 200,000 | - |

|

| TAN AIK PEN | 07-Apr-2021 | Acquired | 200,000 | - |

|

| TAN AIK PEN | 06-Apr-2021 | Acquired | 250,000 | - |

|

| TAN AIK PEN | 05-Apr-2021 | Acquired | 200,000 | - |

|

| TAN AIK PEN | 02-Apr-2021 | Acquired | 300,000 | - |

|

| TAN AIK PEN | 01-Apr-2021 | Acquired | 300,000 |

TSH Best Kept Secret is it over 200,000 Forest Concession Lands of which it is extracting wood for its Privatised Ecowood

Ecowood exports wood products to the booming US constuction housing market

3) WTK (4243)

WTK is a smaller version of TA ANN. It is also CASH RICH & Pays a Dividend. WTK has 70% Timber & 30% Oil Palm. Plus its Tape division is doing extremely well due to E-Cmmerce Pakaging Tape & Also Health-care Social Distancing Tape

Today Star paper did an old report about WTK plywood export to Japan being affected (We called WTK office in Sibu for Mr. Francis WTK Secretary. He said that this year Jan to May 17, 2021 Prices of Plywood have increased) Things are not so bad as Star paper described. Why Star paper did not consult WTK before publishing? What kind of slipshot journalism is that?

No wonder naive peope who read Star without knowing the Real Truth (Updated truth that is current) have sold their WTK shares this morning

WTK also said its Loytape exports to USA is doing fine

So we bought more WTK from paniced ignorant sellers

4) JAYA TIASA (4348)

The Best Kept Secret of all

Jtiasa also got its own lumber lands & saw mills

Jtiasa (Giant Treasure) in its Reports say it owns Forest Concession Lands 11 times the size of Singapore

For that we know Singapore land Size is 180,000 Acres

And in Jtiasa Annual Report.

JTIASA HAS 1.98 MILLION ACRES OF FOREST CONCESSION LANDS (ABOUT 11 X SINGAPORE SIZE OF 180,000 ACRES)

ONE MORE HIDDEN GEM?

See:

Now please go and find out

Net Cash or Cash Equivalent alone over Rm1.00 per share

NTA is Rm2.49

1) CASH & INVESTMENT SECURITIES

3) PLYWOOD & SAW MILLING & EXPORT PLYWOOD TO USA

Which Stock is that Hidden Gem?

Calvin Tan Research

In doubt please consult your Remisier or Fund Manager

HOUSE ALREADY SOLD (NOW BUILDING IN PROGRSS) Cost gone up by Extra USD36,000 Due to High Lumber Prices)

Americans love to build their homes with Wood & Lumber.

<p style="box-sizing: border-box; margin-top: 0px; margin-bottom: 1rem; color: rgb(33, 37, 41); font-family: runda, -apple-system, BlinkMacSystemFont, " segoe="" ui",="" roboto,="" "helvetica="" neue",="" arial,="" "noto="" sans",="" sans-serif,="" "apple="" color="" emoji",="" "segoe="" ui="" symbol",="" emoji";"="">

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 24, 2024

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Discussions

VenFx I like most Calvin sifu s articles recently.

Very informative

17/05/2021 5:42 PM

TYVM

Today due to Middle east unrest which is so faraway KLSE more than 1,000 stocks sold down in panic

GREAT TIME TO BUY!!

https://www.google.com/search?safe=active&sxsrf=ALeKk01DapisASwbtFvRJlzearuzpkMr8g:1621253095027&source=univ&tbm=isch&q=tell+you+a+secret+be+greedy+when+others+are+fearful+warren+buffet+images&sa=X&ved=2ahUKEwjK0Ma21tDwAhVBWH0KHe4CBa8Q7Al6BAgDEAs&biw=1375&bih=644#imgrc=ht2Yg2obnyrqbM

2021-05-17 20:05

Hahaha!

What is that hidden gem?

Cash is over Rm1.00

Net net assets is Rm2.49

Selling at less than 75 sen?

Only one person whatasped to ask so far ?

2021-05-17 20:42

No. Not Flb as it is doing specialty plywood for RV(recreational vehicle )

2021-05-17 22:03

The correct answer is Eksons

Eksons has these

1. Cash and cash equivalent of over Rm1.00

2. Net assets of Rm2.49

Net assets consist of Lands in Serdang

Shops called The Atmosphere of which one Mrt station will be there

3. Plywood export to USA.

Eksons is very undervalue

2021-05-17 23:22

The Lumber prices refers to US Lumber. The Lumber there are mainly Spruce Pinewood which are plantation logs.In Malaysia (Sabah/Sarawak)the Timber are from Natural Forest.The main spp are Meranti, Kuring & Kapor often refers to South Sea Logs. The main buyers are Japan and India. The prices are nowhere near to USD 1,600.00.The info is totally erroneous.

2021-05-18 01:20

This is more accurate quoted in RM...https://www.indexmundi.com/commodities/?commodity=hard-logs&months=12¤cy=myr....

2021-05-18 01:25

Densim

For Malaysian logs Govt impose restrictions on log exports for the purpose of value add in down stream saw timber and plywood processing

Prices of Logs & plywood export to India & Japan have not yet play catch-up as in the US yet but time will come as our world is small. So it is a matter of time

You must remember that even in the US the entire lumber industry was in a range bound price of around USD200 only for a 20 year long perion

Read again

As you can see in the chart below, lumber prices have moved mostly sideways over the past 20 years. We saw a big spike last year, though, and prices have remained higher. These increased prices are leading to higher sales and should help lumber companies grow.

Read one more time in BOLD PRINT

"AS YOU CAN SEE IN THE CHART BELOW, LUMBER PRICES HAVE MOVED MOSTLY SIDEWAYS OVER THE PAST 20 YEARS"

THEN?

WE SAW A BIG SPIKE LAST YEAR, THOUGH, AND PRICES HAVE REMAINED HIGHER.

Why the change?

IT IS DUE TO COVID 19 LOCK-DOWN AND THE NEW DYMANIC CHANGE OF WORKING FROM OFFICE TO WORKING FROM HOME (OFFICE)

2021-05-18 07:14

Now since only in USA there is a titanic shift of Lumber & Plywood demand (of course they will use soft wood first) When Soft wood prices fly up the sky hard work (if still so cheap) will be the alternate wood by default

Same co realtion happen to Palm oil & soybean oil

Palm oil has been in the doldrum since 2015 to 2020 for 5 years after the 2012 - 2014 price spike. It was the rise of Soybean oil that pulled up Cpo prices in tandem

So is the export of Wood Products to USA especially plywood now

And in Jtiasa website they mentioned USA is one of their export markets. TSH through Ecowood also export to the USA. And Eksons export plywood directly to the US

So look for Timber companies that have a direct or indirect exposure to America best.

Even now the Americans are going to Europe to source for wood

https://www.latimes.com/business/story/2021-05-12/lumber-prices-rising

So the new found boom in lumber wood is now spreading

2021-05-18 07:22

FOR 20 YEARS LUMBER PRICES RANGE BOUND FROM USD160 TO USD240 ONLY

Why then Lumber prices are surging up?

Answer:

Due to Covid 19 lock-down there is a Titanic shift from working in expensive city to less pricey suburb which unlock cash for renovation & addition of more space for "office" in home

In time past 50 to 100 people go to work in an office. Now they work from home - so there will sprung up 50 to 100 new "Home office"

THIS WILL CAUSE THE NEED FOR LUMBER LIKE NEVER BEFORE

IS THIS A PERMANENT STUCTURAL CHANGE OF SOCIAL BEHAVIOUR OR THE NEW NORMAL?

2021-05-18 07:34

I do not understand why you fwd prices of US Lumber when you're refering to Malaysia Timber companies. The picture you fwd is rosy for those counters like Taan, WTK, Jaya Tiasa etc....Not only US Lumber Prices has no relevance here, I also defer from your rosy picture of these companies. Sarawak Govt has changed policy ( cant remember how many yrs ago). B4 export of logs is 50% of production. This is more lucrative than selling local. It has since reduce to 20% a major set back. This not the end, local Cess was at the same time increased by 400%. The downstream activities are suffering financially. Sarawak timber has been over harvested and now has great problems with resources to fullfill their eg plywood mills.

These cos' can stay afloat bec their Oil Palm Plantation are covering their Timber Operation. The days of export log prices of USD 300+ pcm is long gone, USD250/270 is the new norm.

2021-05-21 01:58

Our world is inter connected

And these companies export wood products to USA. JTiasa, FLB, Ecowood of TSH, Eksons & others

Many of them export plywood, sawn timber & other wood products

So USA price rise will sooner or later benefit them in their exports

The same co-relation why Malaysia Glove companies did well due to USA covid 19 spike last year

So must SEE the overall future

https://toronto.ctvnews.ca/high-lumber-prices-to-remain-through-2021-forestry-expert-says-1.5393879

2021-05-21 08:54

VenFx

I like most Calvin sifu s articles recently.

Very informative

2021-05-17 17:42