JAYA TIASA (4383) PALM OIL JEWEL: ALL ROUND IMPROVEMENTS: Lower gearing by Cash Inflow, Resume dividend payout & Highest FFB harvested, Calvin Tan

calvintaneng

Publish date: Sat, 05 Aug 2023, 10:12 PM

Dear Friends of i3 Forum,

We are happy to include JAYA TIASA (Always Successful) in A TRILOGY OF 3 PALM OIL JEWELS

And these are the salient factors

1. High Cash Inflow Pares Down Jtiasa Debt from Rm1.5 Billions to only Rm190 Millions

Yes, please see the past 6 years of Jaya Tiasa Balance Sheet

Every year we saw Less and Less Debt till latest now only Rm190 Millions left

With High FFB & Cpo Prices Jaya Tiasa will soon be another Debt Free Cash Rich Palm Oil Co

2. JAYA TIASA HAS RESUMED GIVING OUT DIVIDENDS

See

| 28-Feb-2023 | 14-Mar-2023 | DIVIDEND | First Interim Dividend | RM 0.0150 | |

| 30-Aug-2022 | 27-Sep-2022 | DIVIDEND | Interim Dividend | RM 0.0280 | |

| 30-Oct-2018 | 30-Nov-2018 | DIVIDEND | First and Final Dividend | RM 0.005 | |

| 27-Oct-2017 | 29-Nov-2017 | DIVIDEND | First and Final Dividend | RM 0.005 | |

| 28-Oct-2016 | 28-Nov-2016 | DIVIDEND | First and Final Dividend | 1.3% | |

| 30-Oct-2015 | 30-Nov-2015 | DIVIDEND | First and Final Dividend | 1.0000% | |

| 30-Oct-2014 | 01-Dec-2014 | DIVIDEND | First and Final Dividend | 1.5% | |

| 04-Nov-2013 | 28-Nov-2013 | DIVIDEND | First and Final Dividend | 1% | |

| 05-Nov-2012 | 29-Nov-2012 | DIVIDEND | First and Final Dividend | 5.15 |

please note carefully

every year jtiasa declared First and Final Dividend

For this year in March 2023 Jtiasa Declared a FIRST INTERIM DIVIDEND

Will there be a second dividend coming. Just wait & see.

3. JAYA TIASA HAS THE BEST FFB HARVESTED AMONG PALM OIL COMPANIES

Disclosure On Quarterly Production

| JAYA TIASA HOLDINGS BHD |

| Production figures for current quarter and year to date |

| | Individual Quarter (quarter) | Cumulative Period | ||||

| Current Year Quarter | Preceding Year Corresponding Quarter | Changes (Amount / %) | Current Year To - Date | Preceding Year Corresponding Period | Changes (Amount / %) | |

| 30 June 2023 | 30 June 2022 | 30 June 2023 | 30 June 2022 | |||

| PLANTATION | ||||||

| Crude Palm Oil (MT) | 44,187.00 | 33,186.00 | 33.00 | 80,248.00 | 59,122.00 | 36.00 |

| Fresh Fruits Bunches (MT) | 224,649.00 | 188,400.00 | 19.00 | 415,009.00 | 339,642.00 | 22.00 |

| Palm Kernel (MT) | 10,050.00 | 6,910.00 | 45.00 | 18,201.00 | 12,654.00 | 44.00 |

| TIMBER | ||||||

| Log Production Volume (Cubic Metres) | 19,496.00 | 23,799.00 | -18.00 | 39,664.00 | 43,437.00 | -9.00 |

| Production figures for current quarter compared with immediate preceding quarter |

| | Current Quarter | Immediate Preceding Quarter | Changes (Amount / %) | |

| 30 June 2023 | 31 March 2023 | |||

| PLANTATION | ||||

| Crude Palm Oil (MT) | 44,187.00 | 36,061.00 | 23.00 | |

| Fresh Fruits Bunches (MT) | 224,649.00 | 190,360.00 | 18.00 | |

| Palm Kernel (MT) | 10,050.00 | 8,151.00 | 23.00 | |

| TIMBER | ||||

| Log Production Volume (Cubic Metres) | 19,496.00 | 20,168.00 | -3.00 | |

Announcement Info

| Company Name | JAYA TIASA HOLDINGS BHD |

| Stock Name | JTIASA |

| Date Announced | 31 July 2023 |

| Category | Disclosure On Quarterly Production |

| Reference Number | DMP-31072023-00001 |

Excellent indeed

YoY Cpo production up by 36%

QoQ up by 23%

Like a Jumping horse Jtiasa overtakes all others!

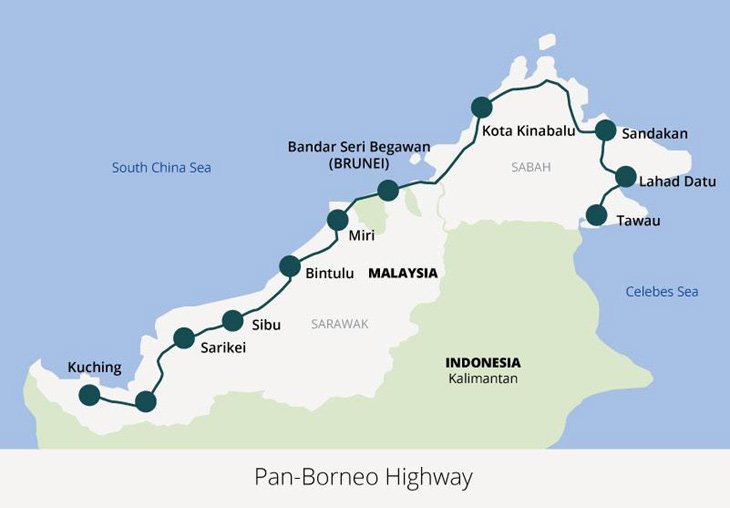

4. JAYA TIASA'S LANDS ALONG PAN BORNEO HIGHWAY WILL SEE ASSET APPRECIATION

With 206,000 Acres Jtiasa not only see Higher Palm Oil Output its Landbanks along Pan Borneo Highway will see long term price appreciation upside

Let's see this piece

Refer Bursa Webpage Under Jaya Tiasa (Properties owned by the Group)

Tanjung Manis, Sarikei

Sare Land District

Block 3, Lot 143

Leasehold land

expiring on 19.06.2062

Vacant 158.4 Hectares - Industrial Land

Book Value: Rm2,331,000

Let's do a breakdown

In Sarikei (Along Pan Borneo Highway) Jtiasa has 158.4 Acres of Industrial Land

Book value a mere Rm2.331 millions

To get acre multiply 158.4 hectares by 2.471

= 391.4 acres

To get cost per acre divide Rm2,331,000 by 391.4

= Rm5,955

Now let us go See advert Industrial lands for sale in Sarikei today

See

Agricultural

Sarikei Pan Borneo High Way Main Road Land For Sale Mixed Zone Land Area: 4.15ac, +/- Hilly Land Surrounded with commercial units, rest stop & school (SJK Bulat) High Potential for future development Total Price:RM1.5Million www.wasap.my/60168939010/sarikei...

ok we see Rm1.5 millions for Agriculture/Mixed Zone lands at only 4.15 acres

To get cost per acre divide Rm1,500,000 by 4.15

= Rm361,445 acre

That small 391 acres already worth Rm141 Millions

Remember: Jtiasa has total 206,000 Acres and 391 acres not even half a thousand acres or or less than 0.1%

Jaya Tiasa (GIANT TREASURE) Cost only a mere Rm5,955 an acre??? THAT IS VERY VERY CHEAP INDEED!

So like all others JTIASA Also Sitting on "GOLD MINE" LANDS

At 71.5 sen with NAV Rm1.36 JTIASA IS SELLING AT HUGE DISCOUNT OF 48% DISCOUNT TO NAV (STILL AT OLD BOOK VALUE)

This gives us more than 30% Margin of safety advocated by the Great Benjamin Graham

As Value Investor we like Jtiasa for its Strong Earnings and High NAV

Who else like Jtiasa?

Ok go See Top 30 Holders of JTIASA

1. Malaysia Nominees (Tempatan) Sendirian Berhad

Pledged Securities Account For Tiong Toh Siong Holdings Sdn Bhd 145,000,000 14.98

2 AMSEC Nominees (Asing) Sdn Bhd

KGI Securities (Singapore) Pte. Ltd. for Genine Chain Limited 91,055,164 9.41

3 Tiong Toh Siong Enterprises Sdn Bhd 50,449,008 5.21

4 Amanas Sdn. Bhd. 48,294,961 4.99

5 Nustinas Sdn. Bhd. 48,293,154 4.99

6 Asanas Sdn Bhd 47,459,343 4.90

7 Tiong Toh Siong Holdings Sdn Bhd 45,730,471 4.72

8 Pertumbuhan Abadi Asia Sdn. Bhd. 21,864,045 2.26

9 RHB Capital Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Tiong Toh Siong Holdings Sdn Bhd 18,000,000 1.86

10 CIMB Group Nominees (Asing) Sdn. Bhd.

Exempt An For DBS Bank Ltd (SFS-PB) 16,790,250 1.73

11 Roseate Garland Sdn Bhd 16,282,331 1.68

12 Diong Hiew King @ Tiong Hiew King 8,871,408 0.92

13 Olive Lim Swee Lian 8,764,200 0.91

14 Alliancegroup Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Kong Kok Choy 8,500,000 0.88

15 Inter-Pacific Equity Nominees (Tempatan) Sdn. Bhd.

Pledged Securities Account For Tan Heng Loon 8,462,300 0.87

16 HSBC Nominees (Asing) Sdn Bhd

J.P. Morgan Securities PLC 5,698,496 0.59

17 RHB Capital Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Fong Siling (CEB) 5,000,000 0.52

18 Citigroup Nominees (Asing) Sdn Bhd

CBNY For Emerging Market Core Equity Portfolio DFA Investment Dimensions

Group INC 4,765,438 0.49

19 Ooi Chin Hock 4,190,115 0.43

20 HSBC Nominees (Asing) Sdn Bhd

JPMCB NA For Teachers’ Retirement System Of The City Of New York 3,759,200 0.39

21 Kenanga Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Tiong Thai King 3,600,135 0.37

22 CIMB Group Nominees (Tempatan) Sdn Bhd

Exempt AN For DBS Bank Ltd (SFS-PB) 3,307,500 0.34

23 Azerina Mohd Arip @ Gertie Chong Soke Hoon 3,256,725 0.34

24 TA Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Chin Yau Kong 2,970,000 0.31

25 Tiong Chiong Ong 2,920,896 0.30

26 Citigroup Nominees (Asing) Sdn Bhd

UBS AG 2,698,760 0.28

27 Public Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Chee Lai Hock (E-BMM) 2,633,900 0.27

28 HLIB Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Liew Sun Yick (CCTS) 2,598,900 0.27

29 Cartaban Nominees (Asing) Sdn Bhd

SSBT Fund 0MUA For Teachers’ Retirement System Of The State Of Illinois 2,539,900 0.26

30 DB (Malaysia) Nominee (Asing) Sdn Bhd

The Bank Of New York Mellon For Acadian Emerging Markets Small

Cap Equity Fund, LLC 2,507,800 0.26

Total 636,264,400 65.73

ok two stood out in surprise

1. SINGAPORE DBS BANK Got Two Positions in Jtiasa

2. Fong Siling aka Cold Eye has 5 Million Jtiasa shares

Others are USA Funds & Retired Teachers' Funds from USA

JTIASA WAS ONCE A DARLING STOCK OVER RM3.00 in the Early Days and Now Fallen to Bargain Levels.

Hence like Bplant we spotted at 57 sen (Now Rm1.08) & IjmPlant we spotted at Rm1.86 (KLK Took it private at Rm3.10)

We Think Jaya Tiasa at 71.5 sen is relatively cheap and undemanding in price versus its long term value

With Kind Regards

Calvin Tan

Please buy or sell after doing your own due diligence or consult your Remisier/Fund Manager

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Created by calvintaneng | Jul 10, 2024

Discussions

Summing it up

1. Soyoil rebounded in Usa so Cpo should firm up on monday

2. With non current debt pared down by another Rm150 millions the remaining Rm5.5 mil bank int incurred might go down further and good for balance sheet

2023-08-06 22:32

3. Although Cpo prices lower this qtr there is a corresponding increase of cpo production by 36% which will increase bottom line

2023-08-06 22:34

4. Since it declared first interim dividend there is a good possibility of another dividend

2023-08-06 22:35

5. Overall with Foreign Funds already in Ioi corp and Simeplant it is a matter of time more of the same will happen as Funds switch out of frothy Tech stocks to solid commodities

2023-08-06 22:36

Stick with Bplant and Jaya Tiasa as both are selling below Nav and backed by very high value assets

for Klk and Uplant both are selling are higher price to book value

others selling at below price to book value are Thplant and Tsh resources

only those with deep deep value assets like Ijmplant, Kulim, Tmakmur and Kwantas were taken private last time

so now candidates for takeover is Bplant and later these are potential - Thplant, Jtiasa and Tsh resources

2023-08-07 19:46

This was posted in Bumitama (Spore) tread

kelvin_ik4u Plam oil is always like that, start plant require cash/fund/debts to build empire. Once it empire steady and cash generated machine, it will be an auto-pilot for next 18yrs. This counter will be the next shine palm oil for this year.. it's CAGR 21% compounding for next 3 yrs, now Bumitama just sit and collect money as all it palm tree is 6-7yrs now with FFB nucleus oil >24%, 107% growth vs Q1'FY13. Strongly believe this counter will start give dividents moving forward. Since CPO price is up ard ~RM2700/tan metric, I believe will share price will skyrocket this yr. Target $2.00 before end of this year 2014.

19/05/2014 6:16 PM

https://sgx.i3investor.com/servlets/stk/p8z.jsp

What applies to Singapore Bumitama also apply to Jtiasa, Tsh, Thplant, Hs Plant and all other Palm oil Companies

JAYA TIASA Now On Auto - Pilot

Streams of Earnings translate to Future Streams of Dividends

https://www.youtube.com/watch?v=aX_efvvsyWg

WITH SUCH STRONG EARNINGS JTIASA AND ALL OTHER PALM OIL COMPANIES WILL BE OVER FLOWING WITH MASSIVE CASH INFLOW

THE OUTFLOW?

CASH DIVIDENDS LIKE DAMS DISCHARGE WATER!!!

2024-02-08 07:43

calvintaneng

See Sarikei along Pan Borneo Highway

https://www.youtube.com/watch?v=m01kEWxQ6zA

2023-08-05 22:16