[TGUAN 7034] 踢馆 ? 剃光? ╭∩╮(‵□′)╭∩╮

zefftan

Publish date: Tue, 24 May 2016, 01:50 AM

这一役 , 踢馆会否成功? 赢的话,自然山珍海味;反之,输了则需不需要 剃光 出家呢? lol...

TGUAN(通源工业,7034 主版-工业)的公司背景这一篇就不描述了,新读者可以参考这这贴旧文章: http://klse.i3investor.com/blogs/zefftan/88508.jsp

“天下大势,合久必分;分久必合” ,股坛里也莫过如此,过去人人为之疯狂的出口股今年今年也丢失了其亮丽的一面,大多股价表现每况愈下。

然而,被套在出口股里边住套房的股友仍然随处可见,因为普罗大众都对出口股尚保留一线希望,市场对出口股的业绩期望度还是很高的。过去,业绩表现不如人意的股票都被一击绝杀,最典型的例子莫过于昔日的“歌神”,即现在的“割肾”7197 ;做咖啡机的 “萎缩”6963; 电子股“击倒你”7022 ;以及今天早上的"翻脸"5197.

To be honest, 我手上也仍然保持着一些出口股,

因为投资数额牵涉较大,以及看着一些出口股一个接一个倒下,这逐渐刺激我的神经,让我坐立不安。在各种元素的挑战之下,我决定拿出TGUAN的同行来做个超级比一比,以买个心安,毕竟管理层曾经在3月份时对报章说明 Q1因为festive season 而导致order比较slow, 但肯定比去按季相比年好。

我筛选了4 家做stretch film的同行做了一系列对比:(只是纯比较plastic film业务)

USD Exposure 的意思是公司是否有positive exposure 或者是negative exposure

Positive exposure的解说 :USD 对公司的影响是 USD 涨, 公司就有forex gain ; 反之, 就forex loss

Negative exposure的解说为 :公司的债务以USD计算,需要付美元利息,因此USD涨,公司就会面临 forex loss;反之,就forex gain

根据上图,BPPLAS和SLP 都属于 0 负债公司,跟FLBHD,, LCTH 一样, 只要USD一跌,就有forex loss的风险, 除非自身业务和生意能够赶上而弥补了这一个缺口 ,最好的例子是 LIIHEN, 虽然面临接近7m的forex loss,业绩仍然扶摇直上

然而,SCIENTX 和 TGUAN 都属于美元借贷公司,必须交付美元利息,所以打从去年开始都一直面临net 外汇亏损

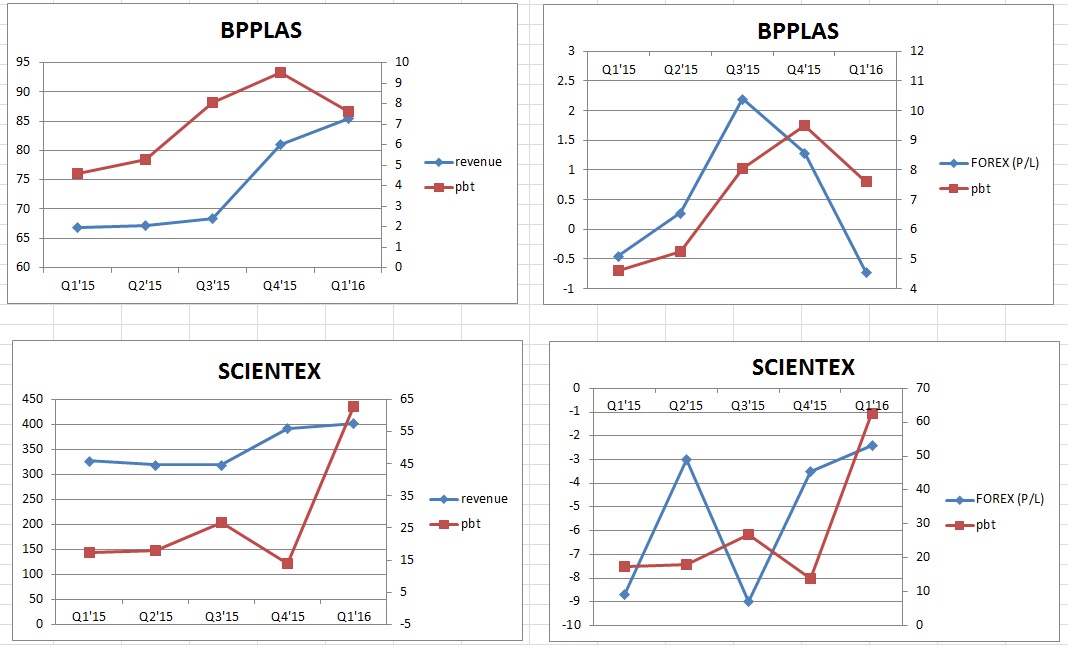

以上的chart 验证了 BPPLAS 和 SLP 对外汇的敏感度, 只要有forex gain,业绩就肯定上升

而, scientex 和 tguan 的就比较缺乏规律性 , 可能是因为比起BPPLAS 和 SLP ,他们大量增加产能而导致贡献的盈利吧。

毕竟两家都在forex loss的情况下盈利依然逐步攀升

这个月BPPLAS 和 SLP 的业绩 都出了,两家公司都属于 YoY增长, 但QoQ 却出现下滑的迹象,有趣的是,股价却没因此而下跌。

好消息:

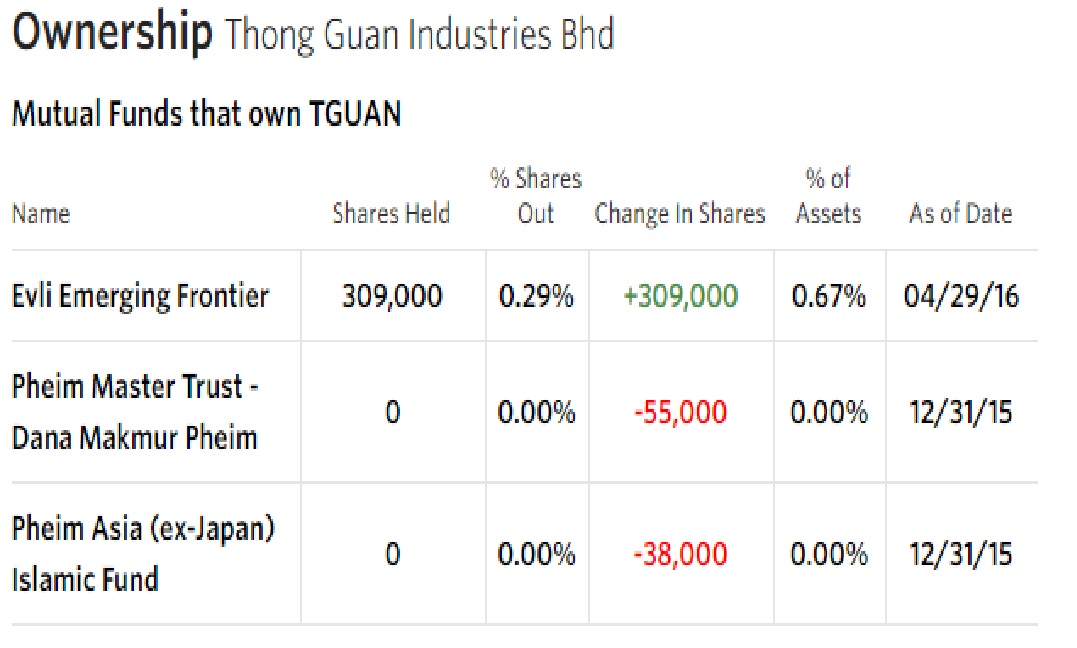

笔者发现到欧洲一个著名基金 Evli Emerging Frontier 也在上个月购买了TGUAN一些股权。

同时,这基金也购买了dufu 和 airasia。

TGUAN的有机面食业务在3月开始贡献盈利,但是管理层没交代清除COFCO联营公司洽谈到如何

(老实说organic noodles在大马好像没什么看头哈哈,重头戏就在中国)

TGUAN的很多貌似很先进的机器好像都在今年准备就绪,希望可以提升profit margin

TGUAN今年年尾去德国参展,然后筹备明年新的里程碑

坏消息:

管理层说 plastic film 在Q1 的订单没去年年尾那么多,但依然比去年同期来得好

结论:

上天请别派我去做和尚

~纯属功课分享,无买卖建议~

祝你好运

Zeff Tan

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 笔随意走

Discussions

2. I don't feel surprise with the SLP and BPPLAS price moving up simply because the PE has already corrected for past few months which i treat it as correction to the forex gain. Latest Slp and bplas core profit are actually good if not better. The share price should continue to move up as their expansion are not end yet.

2016-05-24 09:20

3. Tguan share price correction is not justifiable to me. But i suppose market always move in same direction generally.

2016-05-24 09:20

further more, management already give very positive note to the result expectation

2016-05-24 09:44

if you use RM 160 mil as based case, that is additional RM 9.6 mil additional profit. Added up RM 4.6 mil of Q1 2015, that should work out at least RM 14.2 million profit.

2016-05-24 09:47

A well researched and insightful article. Hope what you had written is in line with the results very soon to be released by TGuan.

2016-05-24 10:00

Hi YiStock, Q1 2016 is expected better than Q1 2015. But, if compare with Q4 2015 ?

2016-05-24 11:17

I also appreciate YiStock's point of view. Very well spoken and also in line with my thinking. YiStock, Please continue to write more articles on TGuan after the quarter result. Thank you in advance.

2016-05-24 11:22

For YiStock, last quarter pretax and after tax profit are 18.1 and 16.2 millions respectively. If RM10/- after tax profit is achieved, then it would not have increase 6% as per your comment earlier, unless you tabulate the figure for the whole of next year.

2016-05-24 16:13

chan, 6% is the % or margin. If the revenue registered is lower, i expect the quantum of impact to net profit will be greater. % margin and dollar value always not moving in tandem. That is the key risk. Also i'm refering to Q1 2015.

2016-05-24 16:20

YiStock

Zeff, allow me to share my opinion:

1. all above companies i believe do have either both/negative foreign currency exposures along the way depending on the receivable/deposit/payable/loan. However, these company has demonstrated their ability to mitigate their net forex risk. We should feel safe to put our money with them.

2016-05-24 09:19