|

| |

Overview

Financial HighlightHeadlinesBusiness Background Muhibbah Engineering (M) Bhd is engaged in providing oil and gas, marine, infrastructure, civil and structural engineering contract works. In addition to these, it also manufactures engineering products and distributes and markets construction materials. The segments in which the group operates includes Infrastructure construction, Cranes, Marine shipbuilding and ship repair and Concession. Business activity of the company is functioned through Asia, Europe, America, Middle East and Australia. Muhibbah derives most of the revenue from construction contracts, goods sold and services rendered, dividend income and rental income.

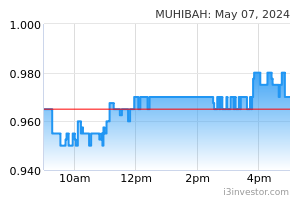

uniteen good or not also doesn't matter coz muhibbah's share remains flat. all depends on the sharks now whether it flies or not. 16/08/2024 2:23 PM uniteen muhibbah has never been able to regain its strength to pre-covid level. probably will remain like that for a long time to come. 16/08/2024 2:24 PM apple4ver @Jerung, Fundamentally yes. Back in 2018/2019, Cambodia Airport contributed ~RM150m per annum. What this agreement does is to remove one huge overhang over the stock. Total contribution from Cambodia Airport may be much smaller than pre-Covid time but it is still much better than near zero WITHOUT the agreement. And the upside comes from huge capacity of new airport @50m passenger pa when fully developed vs 5m pa from existing airport. 16/08/2024 5:17 PM laulau Morning Friends & Gentlemen! Bursa already up 9 points to 1,657! @apple4ver Good News Indeed! Accumulate on any weakness! Target price: Resistance between 0.92~0.99? Once broken with a Bullish Bursa, Soft TP 1.10~1.25 with TP 1.34! https://asia.nikkei.com/Business/Transportation/Cambodia-resolves-Phnom-Penh-airport-tensions-with-new-rights-grant Khek Norinda, a spokesperson for Cambodia Airports, Vinci's local joint venture, told Nikkei Asia that the unit signed a memorandum of agreement with the government in April giving it rights to operate the new Techo Takhmao International Airport CGS International Analysis on Muhibbah Engineering. Phnom Penh showing signs of strength Consensus ratings*: Buy 3 Hold 1 Sell 0 ■ 1Q24 results met expectations, with associate profits from its Cambodia airport concession up 32% yoy despite the sale of Siem Reap in Oct 23. ■ Favelle Favco is winning more crane jobs and beefing up recurring income. Up/downside: 35.3% ■ Reiterate Add with unchanged SOP-derived TP of RM1.34. Reuters: MUHI.KL1Q24 results met expectations Bloomberg: MUHI MK ● Muhibbah delivered a 1Q24 core net profit of RM5.9m (vs. RM0.5m in 1Q22) which was Market cap: US$153.3m within expectations at 12%/11% of our/Bloomberg consensus’s full-year net profits RM721.2m. We expect earnings momentum to pick up in the coming quarters as it progressively Average daily turnover: US$0.50m recognises its RM2bn orderbook (as at May 24).RM2.35m ● The key 1Q24 highlight was associate profit contribution of RM13.4m (+32% yoy) Current shares o/s 727.0m coming largely from its Cambodia airport concession. This is commendable as 1Q23 had included the Siem Reap airport concession that was surrendered back to the Cambodian government in Oct 23. Its 1Q24 passenger arrivals for the Phnom Penh. Key financial forecasts Airport concession (PP) and Silhanoukville airport rose 23% yoy to 1.2m, with China passengers making up 22% of the total in 1Q24 (vs. 15% in 1Q23). ● Its construction division posted an RM8.7m pretax profit in 1Q24 (vs. RM5m in 1Q23). Pretax profit for its crane business in 1Q24 rose 30% yoy to RM19m. Of its RM2bn orderbook, RM1.3bn is from construction and RM0.7bn from cranes. Favelle Favco (FF)announced contract wins of RM39m in May 24, which is a combination of tower and offshore cranes. In late-May 24, FF also announced it has entered into an agreement with an Australian developer to build two 14,000 sqm logistic warehouses on its 46,840 sqm land in Sydney, which should boost recurring income once completed in FY26F. Light at the end of the tunnel for PP scenario? ● We had highlighted in our 2 May report (link) that its PP will likely see a favourable outcome, even though a new international airport for Phnom Penh, known as Techo International Airport, located in Kandal, is currently under construction and scheduled to start operations in 1H25F, according to Cambodia’s State Secretariat of Civil Aviation (SSCA). We believe Techo International Airport will replace the current Phnom Penh International Airport that is operated by Muhibbah. ● Muhibbah said negotiations with the authorities are progressing well and it will likely receive compensation for the loss of its existing operations of PP (likely at BV) and be engaged to operate the new airport at Kandal. This is because the new airport is being built by a JV between SSCA and the Overseas Cambodia Investment Corporation Price performance 1M 3M 12M(OCIC), both of whom do not have the expertise to run an airport. An article in the Khmer Times published in Mar 24 also stated that a favourable result for all parties is expected, based on the government’s win-win policy, but details are sparse presently. Reiterate Add and TP of RM1.34 ● We like Muhibbah as a proxy for a recovery in tourist arrivals with its Cambodian airport concessions, while its marine expertise and Petronas fabrication licence should enable to clinch more Petronas jobs, in our view. Key downside risks are patchy execution track record and higher raw material costs. Re-rating catalysts include better earnings delivery and stronger tourist arrivals in Cambodia. 20/08/2024 10:34 AM laulau Good Morning Friends & Gentlemen! More Good News From Muhibbah! Recommendation: Accumulate on any weakness! Pahang poised to become Malaysia's first comprehensive maritime hub By Bernama / Bernama 20 Aug 2024, 08:47 pm Menteri Besar Datuk Seri Wan Rosdy Wan Ismail said the RM2.1 billion project (KMH) which will be a central hub for maritime activities, supporting a range of trade and industrial operations, is expected to make a significant impact on both the local and national economy. "I guarantee the state government's full cooperation in ensuring the project's success, supported by our political stability. I am confident that Muhibbah Engineering (M) Bhd will deliver this project (KMH) smoothly and successfully,” he said. https://theedgemalaysia.com/node/723567 21/08/2024 10:07 AM laulau Good Morning Friends & Gentlemen! Looks like a good Qtr. 2 for Muhibbah? Recommendation: Accumulate on any weakness! 26/08/2024 10:23 AM uniteen told you sharks are the ones controlling the share price. nobody seems to be accumulating muhibbah share on weakness.🐞 28/08/2024 2:34 PM ValueMaker Favco reported lower profit mainly due to Forex. If take out all the one off items & forex from both quarters, the Q2 core PBT actually slightly higher compare Q1. Q2 core PBT: 14.863m Q1 core PBT: 14,686m 28/08/2024 3:47 PM Qwertyuiop Where to find such counter in bursa that is being severely undervalued and overlooked, with almost 500m cash on hand. Crazy 29/08/2024 5:30 PM Qwertyuiop While Market cap only 586m as of today. Revenue and profit all increased significantly without one off items 29/08/2024 5:32 PM Qwertyuiop The last few days and even weeks were shaking off the weak holders. Time to move up to its true value in tandem with its fundamental. Top top 29/08/2024 5:37 PM laulau Good Morning Friends & Gentlemen! Dow Jones is now at Record High! A PBT of RM78.5 million and Order Book of RM1.632 Billion is announced by Muhibbah for current Qtr, A Rebound is Coming Soon! Once Muhibbah exits Penny Stock Status, Muhibbah will be re-rated with more Foreign & Institutional Fund Buyers, soft target 1.25 with TP 1.34! Recommendation: Accumulate on any Weakness! MUHIBBAH ENGINEERING (M) BHD REVIEW OF GROUP PERFORMANCE (YTD 2024 vs. YTD 2023) The Group reported higher consolidated revenue with higher profit before tax of RM78.5 million for the financial period ended 30 June 2024 as compared to consolidated revenue of RM694.9 million and profit before tax of RM23.1million respectively for the corresponding period ended 30 June 2023.This improvement in both Group revenue and Group profit before tax are mainly contributed by Concession division and better performance of Marine Shipyard and Infrastructure Construction divisions. COMPARISON WITH PRECEDING QUARTER RESULTS (Q2 2024 vs. Q1 2024) The Group reported higher consolidated revenue of RM728.0 million ascompared to RM413.9 million in the preceding quarter mainly due to higher revenue from all divisions.This quarter reported higher profit before tax of RM47.5 million as compared to RM30.9 million in the preceding quarter mainly due to better performance from Infrastructure Construction, Marine Shipyard and Concession (Airport). GROUP'S PROSPECT Secured Order Book As at 22 August 2024, the Group's total outstanding secured order book in hand for the construction and cranes division is RM1.623 billion. Prospect The regional infrastructure and oil & gas industry are seeing more capital investments in near future which is a boon for the Group's business moving forward. 30/08/2024 8:59 AM uniteen even with a good quarter, muhibbah is still a penny stock. waiting for the sharks to see the value. 30/08/2024 12:07 PM laulau That's why the Recommendation is Accumulate on Weakness before the Sharks & Foreign Funds come! Now only nibbling, more chance to grab while still penny stock & we wait for the Breakout! 30/08/2024 1:16 PM ming Muhibah’s 24Q2 result 1. Crane segment (Favco) - accidentally lower earning from crane business as lack of one off gain, eg forex (24Q2 -1.5m vs 24Q1 +4.1m / 23Q2 +7m) - If take off all the one off items, the core PBT in 24Q2: 14.9m vs 24Q1: 14.7m / 23Q2: 7m 2. Concession segment (mainly from airports) - Recorded PBT 16.9m in 24Q2 (+40.6% compare 24Q1 / +77.2% compare 23Q2) - Surprising good as Q2 & Q3 used to be low travel season in Cambodia - Passengers in 24Q2 recorded 1.136m (+13% compare 23Q2) - Passengers in July continue growth with +23% y-y 3. Infrastructure Construction segment - reported PBT 40m (compare 8.7m in 24Q1 / loss 1m in 23Q2) - highest quarter profit since 2018 Overall fantastic result. But concern of order-book replenish as year-to-date yet to get any award. 30/08/2024 1:56 PM laulau Yes! GROUP'S PROSPECT Secured Order Book As at 22 August 2024, the Group's total outstanding secured order book in hand for the construction and cranes division is RM1.623 billion. Prospect The regional infrastructure and oil & gas industry are seeing more capital investments in near future which is a boon for the Group's business moving forward. 30/08/2024 2:14 PM gndthx CIMB Analyst report 29.08.24 https://rfs.cgsi.com/api/download?file=ae6d1589-9311-44b2-8be5-379acfc63b75 30/08/2024 2:43 PM ming Base on CGS/Cimb report, Q1 oni achieve 10% of full year consensus profit base on Tp 1.34. Q2 now alrdy climb back 50%. Q4 use to be strongest in history trend (in term of core profit) High chance to exceed their full year consensus profit then. Raise TP ! 30/08/2024 3:05 PM ValueMaker base on past 2 years history, Muhibah used to clinched in contracts during the year end: RM 479m award in 2023 Nov RM 438m award in 2022 Dec 30/08/2024 3:13 PM uniteen after a week, muhibbah is dropping even further. where are the so-called accumulators? LOL 11/09/2024 9:52 AM ming The outstanding Regulated Short Selling (RSS) has reduce to 1,559,400 unit now~ compare peak at 2,935,200 during mid Sep. The lowest since end of July crash~ 25/09/2024 1:15 AM uniteen time to accumulate again? accumulating since 2020 leh. how long more? hahahaha 07/10/2024 11:00 AM Bettyem Go Muhibbah Go! 24Q3金边机场抵达航班数量增至4,717架次。 平均每周 363 趟航班。 旅游旺季回来,第四季度将更加精彩! 第 4 季度第一周航班数量跃升至 381 架(行动管制令以来的最高数量) 24Q1:356 航班/周 24Q2:356 航班/周 24Q3:363 航班/周 10/10/2024 4:33 PM laulau Morning Friends & Gentlemen! Accumulate before news is out! Muhibbah Engineering (M) Bhd is expected to benefit from a tourism recovery in Cambodia, analysts say. The company owns a 21% effective stake in Cambodia Airports which manages two operating airports in Cambodia. It is also likely to clinch more Petroliam Nasional Bhd (PETRONAS) jobs via its PETRONAS fabrication licence, CGS International Research (CGSI Research) said in a report. “We hosted a meeting with Muhibbah’s management on Sept 12 and in our view, the key takeaway is possible large lumpy wins after a lull,” the research house said. It noted Muhibbah’s order book for construction and cranes remained resilient at RM1.6bil as of Aug 24, albeit down from its recent Nov 23 peak of RM2.4bil. “It has yet to win any material contracts this year but has submitted a large tender for an engineering, procurement, construction and commissioning role for the Lang Lebah gas field in Sarawak. “Given its prior experience with similar projects in Gansar, Bekok and Bindu in Terengganu, we see it being a frontrunner for this project,” the research house said. CGSI Research said that passenger arrivals at the two Cambodian airports rose 18% year-on-year (y-o-y) to 2.3 million in the first half of 2024 (1H24), and should hit five million for the entire year. The research house added that Cambodia Airports accounted for most of Muhibbah’s 1H24 associate profits, which rose 63% y-o-y to RM30mil. “This is commendable as 1H23 included the Siam Reap airport concession. “ Citing The Khmer Times, the research house said the construction of Techno International Airport in Kandal, near Phnom Penh was 80% complete and will open in mid-2025, replacing the current Phnom Penh airport. “We maintain our view that the most likely scenario involves Cambodia Airports receiving compensation for investment incurred until the Phnom Penh airport concession is surrendered and that it will be engaged to operate the new airport at Kandal, based on a fixed-fee structure and with some element of profit sharing,” the research house said. While it said it liked Muhibbah for its cheap valuation at next year’s financial year price-earnings ratio of eight times versus the sector’s 17 times, it noted key downside risks were the non-continuity in earnings delivery and higher raw material costs. Re-rating catalysts for the company include better earnings delivery and stronger tourist arrivals in Cambodia, the research house said. https://www.thestar.com.my/business/business-news/2024/09/23/muhibbah-to-ride-on-tourism-recovery-in-cambodia 11/10/2024 9:29 AM laulau Muhibbah is also likely to clinch more Petroliam Nasional Bhd (PETRONAS) jobs via its PETRONAS fabrication licence, CGS International Research (CGSI Research) said in a report. https://www.upstreamonline.com/field-development/petronas-unveils-platforms-bonanza-for-malaysian-projects/2-1-1575593 11/10/2024 10:09 AM laulau Muhibbah Engineering Bhd Target price: RM1.34 ADD CGS INTERNATIONAL (SEPT 17): The key takeaway from a recent meeting with Muhibbah’s (KL:MUHIBAH) management is possible large lumpy wins after a lull. Muhibbah’s order book (construction and cranes) remains resilient, at RM1.6 billion as at August 2024, albeit down from its recent November 2023 peak of RM2.4 billion. It has yet to win any material contracts this year but has submitted a large tender for an engineering, procurement, construction and commissioning (EPCC) role for the Land Lebah gas field. Given its prior experience with similar projects in Gansar, Bekok and Bindu in Terengganu, we see it as a frontrunner for this project. We are also encouraged that its construction earnings delivery has picked up strongly in 2Q24, driven mainly by its EPCC and installation role for the Gansar project for Petronas Carigali. We like Muhibbah for its cheap valuation at FY25F PER of eight times (versus the sector’s 17 times) and for being a proxy for a recovery in tourist arrivals via Cambodia Airports, while its Petroliam Nasional Bhd fabrication licence should enable it to clinch more Petronas jobs, in our view. Key downside risks are non-continuity in earnings delivery and higher raw material costs. https://theedgemalaysia.com/node/727766 11/10/2024 10:46 AM laulau Trading View, Recommends a Very Strong Buy at current low price! https://www.tradingview.com/symbols/MYX-MUHIBAH/ 11/10/2024 10:55 AM laulau Analysis By Foreign Analyst. Muhibbah Share Price vs Fair Value What is the Fair Price of MUHIBAH when looking at its future cash flows? For this estimate we use a Discounted Cash Flow model. 51.8% Undervalued Current Price RM 0.93 Fair Value RM 1.92 REWARDS: #Trading at 51.8% below our estimate of its fair value Earnings are forecast to grow 31.83% per year #Became profitable this year RISK ANALYSIS: #No risks detected for MUHIBAH from our risk checks. 11/10/2024 11:54 AM laulau According to Wall Street analysts, the average 1-year price target for MUHIBAH is 1.295 MYR with a low forecast of 1.212 MYR and a high forecast of 1.407 MYR. Lowest Price Target 1.212 MYR 31% Upside Average Price Target 1.295 MYR 40% Upside Highest Price Target 1.407 MYR 52% Upside https://www.alphaspread.com/security/klse/muhibah/analyst-estimates 11/10/2024 1:46 PM minichart https://www.minichart.com.sg/2024/10/11/muhibbah-engineering-breaks-out-gearing-up-for-further-upside/ CGS International recommends a Technical Buy for Muhibbah Engineering. The stock recently surged, breaking out of a downtrend, underpinned by a long white candle and closing above key exponential moving averages (EMAs). This indicates a bullish shift in momentum. Entry Price Range: RM0.90 to RM0.925 Stop Loss Level: RM0.83 Target Price 1: RM0.96 Target Price 2: RM1.03 Thank you 11/10/2024 3:00 PM ValueMaker RSS outstanding has reduce to 755,200 now; compare peak at 2,935,200 one month ago 18/10/2024 2:52 AM sailang_now Morning Guys, Don't Miss! Buy on any dips as Muhibbah already broken Resistant 0.96 and reached RM0.965, with positive momentum!. Market should retest 0.96~0.965 again?, it's expected to exit penny stock and retest Resistant RM1.03 soon! Further upside is expected for a post Budget rally in anticipation of good news, contract win from Petronas & Lang Lebah gas field in Sarawak? Next Resistant is RM1.03, followed by Resistant RM1.10 ~1.31 with Target Price RM1.34!...tut tut Target Price 1.34 Resistant 1.31 Resistant 1.24 Resistant 1.17 Resistant 1.10 Resistant 1.03 Resistant 0.965 Price 0.94 Support 0.925 Verdict: Positive Momentum is Confirmed! Note: Based on 2 years historical contract wins, Muhibah contract award for Nov/Dec. 2024 from Petronas/Lang Lebah Sarawak Gasfields could exceed RM527m based on expected 10% annual increase on CAPEX spending by bullish Oil & Gas Players? Quote: "ValueMaker Based on past 2 years history, Muhibah used to clinched in contracts during the year end: RM 479m award in 2023 Nov RM 438m award in 2022 Dec" Neom Project, Cambodian Airport & Petronas Projects Beckons? https://klse.i3investor.com/web/blog/detail/cgscimbresearch/2024-02-27-story-h-187496462-Muhibbah_Engineering_4Q23_Kitchen_Sinking_Improved_Core_Earnings https://www.businesstoday.com.my/2024/09/18/muhibbah-set-for-large-construction-and-crane-jobs/ 24/10/2024 8:56 AM laulau Morning Friends & Gentlemen! CGS Analysis on Muhibah. Accumulate on any weakness! Possible large construction and crane wins ■ Possible large construction and crane wins on the horizon ■ Cambodia Airports working towards a win-win outcome by 2Q25F ■ Valuations remain cheap at FY25F P/E of 8x (vs. sector average of 17x); Up/downside: 64.4%reiterate Add, with an unchanged SOP-based TP of RM1.34 Construction earnings picking up, bidding for large projects. We hosted a meeting with Muhibbah’s management on 12 Sep 24. In our view, the key takeaway is possible large lumpy wins after a lull. Muhibbah’s orderbook (construction and RM593.8mcranes) remains resilient, at RM1.6bn as at Aug 24 (Fig 5), albeit down from its recent peak of RM2.4bn. It has yet to win any material contracts this year but has submitted a large tender for an EPCC role for the Land Lebah gas field. Given its prior experience with similar projects in Gansar, Bekok and Bindu in Terengganu, we see it being a frontrunner Free float: 73.3%for this project. We are also encouraged that its construction earnings delivery has picked up in strongly in 2Q24 with pretax profit of RM40m (2Q23: RM1m pretax loss) driven mainly by its EPCC and installation role for the Gansar project in Terengganu for Petronas CarigaliKey changes in this note(RM400m-500m remaining, including additional scope of RM318m awarded in late-2023). We raise FY24F/FY25F/FY26F EPS by 5%/4%/2% to account for additional scope Muhibbah’s value proposition is not in government infrastructure or the data centre space for its engineering, procurement, but more in marine-based construction and offshore platforms leveraging on its Petronas construction and commissioning (EPCC) job fabrication licence, in our view. Its crane business under Favelle Favco has been invited to for the Gansar project, and EPCC and tender for the supply of tower cranes for the world's biggest construction project known as installation of Bindu A (jacket and topside)Neom in Saudi Arabia; the tender will close at end-Sep 24 with a potential award by early next year. Another key division within its infra segment is CiTech, a supplier of waste heat recovery units (WHRUs) with an orderbook of RM25m and tenderbook of RM1.1bn as at Aug 24. CiTech’s clientele includes Petronas Carigali, Siemens and Keppel. Working towards a win-win outcome for Cambodia airports. Muhibbah owns a 21% effective stake in Cambodia Airports, which manages two operating airports in Cambodia – in Phnom Penh and Sihanoukville. Passenger arrivals to the two airports rose 18% yoy to 2.3m in 1H24, and should hit 5m for 2024F, in our view. Cambodia Airports accounted for most of Muhibbah’s 1H24 associate profits, which rose 63% yoy to RM30m; this is commendable as 1H23 included the Siam Reap airport concession. The Khmer Times on 3 Sep 24 highlighted that construction of Techno International Airport in Kandal, near Phnom Penh was 80% complete and it will open in mid-2025F, replacing the Phnom Penh airport. We maintain our view that the most likely scenario involves Airports receiving compensation for investment incurred until the Phnom Penh airport concession is surrendered and that it will be engaged to operate the new airport at Kandal, based on a fixed fee structure and with some element of profit sharing. Reiterate Add and SOP-based TP of RM1.34. We like Muhibbah for its cheap valuation at FY25F P/E of 8x (vs. sector of 17x) and for being a proxy for a recovery in tourist arrivals via Cambodia Airports, while its Petronas fabrication licence should enable it to clinch more Petronas jobs, in our view. Key downside risks are non-continuity in earnings delivery and higher raw material costs. Re-rating catalysts include better earnings delivery and stronger tourist arrivals in Cambodia. 06/11/2024 11:05 AM laulau Morning Friends & Gentlemen! If you have missed CTOS, don't miss Muhibah! Be Greedy when others are Fearful. Accumulate on current weakness and let's wait for the Rebound! https://www.thestar.com.my/business/business-news/2024/09/23/muhibbah-to-ride-on-tourism-recovery-in-cambodia 12/11/2024 9:22 AM ming Phnom Penh airport recorded total 395 arrival flights this week~ the highest number since MCO ! ** the 2nd highest number was recorded in first week of Oct as 381 arrival flights Compare with: 24Q1: average 356 flights / week 24Q2: average 356 flights / week 24Q3: average 363 flights / week Q4 number looks encouraging~ 15/11/2024 11:14 AM ming Cambodia’s airports record 21 percent rise in passengers https://www.khmertimeskh.com/501594562/cambodias-airports-record-21-percent-rise-in-passengers/ 20/11/2024 3:16 PM ming FAVCO 24Q3 result: If exclude the one off items (eg: forex, allowances, derivatives & etc), core PBT stood as: 24Q3: 27.231m 24Q2: 14.863m 24Q1: 14.686m 23Q4: 50.988m 23Q3: 22.040m 23Q2: 7.088m 23Q1: 9.994m Forex loss of RM 27m in Q3 due to rapid strengthening of MYR. Good thing is bulk of this still remain unrealised loss as yet to convert back to Ringgit. Ringgit start weaken significantly since early Q4 22/11/2024 8:28 PM ming Without the one off items, Q3 result actually much better than Q1 or Q2! Q4 should look much more better now; especially add back the unrealized gain in forex 22/11/2024 8:30 PM | | ||||||||||||||||||||||||||||||||||||