|

| |

OverviewFinancial Highlight

Headlines

Business Background TSH Resources Bhd owns oil palm plantations, mills, and forest areas in Southeast Asia. Crude palm oil and palm kernel are extracted from the oil palm plantations. The products are transferred to a mill and processed into ready-to-sell products. Additionally, one branch of the business focuses on generating and supplying electricity from a biomass plant. The forest areas are cultivated to manufacture and trade wood products. Reforestation becomes an integral part of the process to safeguard against shortages. Furthermore, the company will manufacture, sell, and trade cocoa products. Its processing facility primarily produces cocoa butter.

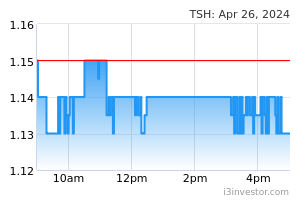

prudentinvestor "Tsh cost of Cpo production Rm2000 to Rm2200" CalvinTTP, Tsh's cost of CPO production is unlikely to be in the region RM2,000 to RM2,200. TSH's total CPO production this year should be close to 200,000 tons and assuming an average price of RM4,000 a ton, it stands to make a pretax profit of over RM300 million on CPO alone and a EPS of at least 20sen net. No way it can achieve such kind of earnings. 16/11/2024 5:53 PM dompeilee Such a lovely song for a vintage commercial for my latest takeover target: https://www.youtube.com/watch?v=js-rMeXrgVg 今日から安心 17/11/2024 9:14 AM calvintaneng With Trump imposing tariff as high as 60% against China Palm oil is the safest and only game left https://www.tradingview.com/symbols/MYX-FCPO1!/ 17/11/2024 8:22 PM calvintaneng Read very very very carefully Tsh cost of cpo production Rm2k to Rm2.2k Mt Kmloong also has Cpo cost of production Rm2.2k So Kmloong Mr Gooi said Cpo at Rm3000 good enough This is what Mr. Gooi said 👇 Cpo at Rm3000 already good See https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2021-08-28-story-h1570606253-Kim_Loong_Resources_eyes_record_year_amid_high_CPO_prices_The_Lessons_R 17/11/2024 8:26 PM calvintaneng So according to Kim Loong Cpo at Rm3000 already good enough Then see https://www.tradingview.com/symbols/MYX-FCPO1!/ 17/11/2024 9:04 PM calvintaneng https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-07-12-story-h-157019176-WHOLE_WORLD_PALM_OIL_IN_BULL_RUN_WHEN_WILL_MALAYSIA_RESEARCH_HOUSES_UPG 18/11/2024 3:57 AM calvintaneng Tsh moving up to phase 5 & 6 Better hurry or it will Be like jumping tiger (jtiasa) jumped up from 63 sen to Rm1.17 https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2023-09-26-story-h-218987595-THE_7_PHASES_OF_A_SUCCESSFUL_PALM_OIL_COMPANY_Calvin_Tan 18/11/2024 4:15 AM mf Dow Jones Dow Jones Industrial Average 43,444.99 -305.87 0.69% Nasdaq NASDAQ Composite 18,680.12 -427.52 2.23% 18/11/2024 5:14 AM calvintaneng Mf This Dow crash does not apply to 🌴🌴🌴 Why Palm oil prices will remain high B40 to B50 Then B100 https://indonesiabusinesspost.com/insider/indonesia-to-build-additional-biodiesel-plants-for-b50-fuel-production/ 18/11/2024 6:23 AM calvintaneng Mf This Dow crash does not apply to 🌴🌴🌴 Why Palm oil prices will remain high B40 to B50 Then B100 https://indonesiabusinesspost.com/insider/indonesia-to-build-additional-biodiesel-plants-for-b50-fuel-production/ 18/11/2024 6:23 AM calvintaneng Palm Oil Export Levy Sufficient to Fund B40 Biodiesel Mandate Focus |19 November 2024 , 05:28 WIB |Read : 32 |by : Administrator This article has been published on InfoSAWIT English with the title © Palm Oil News - Palm Oil Export Levy Sufficient to Fund B40 Biodiesel Mandate Click to read: https://en.infosawit.com/news/14822/palm-oil-export-levy-sufficient-to-fund-b40-biodiesel-mandate-- 19/11/2024 2:43 PM prudentinvestor "Cpo at Rm3000 already good enough" CalvinTTP, CPO averaged RM3,817 a ton in 2023. What was TSH's eps in 2023? It could lose money if CPO drops to RM3,000 a ton. 19/11/2024 5:13 PM titan3322 Shares with call warrants issued by IBs always subject to IBs manipulation when warrants expiry date is near. Buy TSH for the dividend this financial year. Very safe investment at this level with CPO above RM 4500/tonne 19/11/2024 5:22 PM calvintaneng Very safe is correct TSH still got 2 call warrants Nov 26 is C8 benchmark at Rm1.15 Nov 29 C9 priced at Rm1.20 As such from now till End Nov 2024 IB banks will control Tsh mother share price at between Rm1.10 to Rm1.20 This will kill all their Call warrants holders as they intend to let C8 and C9 expire out of money thus by hook or by crook Tsh will be bombarded with RSS short selling and it presents us a Wonderful opportunity to pick up Tsh shares below Rm1.20 just buy from IB banks short selling which they will have to do 20/11/2024 10:36 AM titan3322 Most of the times warrants holders are the suckers lost money and also no dividend received IBs of course they made sure you lose not them 😄🪤🪱🤣🤣 20/11/2024 10:53 AM calvintaneng IB bankers have been doing this dirty job all along since Jesse Livermore wrote "REMINISCENCES OF A STOCK OPERATOR" long ago During Glove Super bull all the glove call warrants went ballistic IB bankers were having sleepless nights so they ganged up to stop Glove price surge by suddenly announcing Limit prices for gloves then Cut down margin loans this was done in unison that was why after Supermax surged over Rm9.00 it suddenly pulled back below Rm7.00 due to margin loan limit leading to margin call After IB banks have scooped up enough Glove shares and neutralized their glove call warrants they only loosen the glove bull now lately Ytl power shot up like rocket from 60 sen to over Rm5.00 25 ytl power call warrants were caught in the upward spike again causing headache for many IB Bankers It is now of great suspect why Got "parties" complained to Macc about Ytl power bistanet? why only now dig this very old news out ? is it done by some dirty IB hands ??? to crash ytl power and therefore suppress ytl power call warrants? Only God knows how dark is the darkness so it is no surprise they now watch all their call warrants like a hawk good for us is we take longer term view to buy palm oil shares on offer 20/11/2024 11:09 AM Siow Looi The only reason they can control the prices is because of our low public float requirements. It's an unfair advantage for the big boys. Small fishes got no chance and usually sitting ducks waiting to get massacred 20/11/2024 3:04 PM calvintaneng Exactly ! Dr Neoh Soon Kean in his 1985 Classic about STOCK INVESTMENT IN MALAYSIA Already stated in no uncertain term that Bursa or Klse is infested by 🦈🦈🦈 He talked of JAWS 1 JAWS 2 JAWS 3 AFTER 40 YEARS WE NOW KNOW TO OUR HORROR IB BANKERS ARE SOME OF THE BIGGEST 🦈🦈🦈 20/11/2024 3:10 PM calvintaneng HS PLANT (5138) EXCELLENT RESULTS CONFIRM BUYING PALM OIL UPSTREAM SHARES IS THE BEST WHEN CPO PRICES ARE HIGH, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-11-21-story-h474695872-HS_PLANT_5138_EXCELLENT_RESULTS_CONFIRM_BUYING_PALM_OIL_UPSTREAM_SHARES_ 21/11/2024 1:46 AM calvintaneng See this good news If Felda small time farmers can do so well Tsh with economy of scale in purchasing cheaper fertilizer by bulk buying should do even better 👇 https://www.nst.com.my/news/nation/2024/11/1136956/felda-settlers-earn-rm20000-monthly-oil-palm-prices-surge 21/11/2024 7:17 AM calvintaneng Congratulations to all who picked up Tsh bravely from Rm1.15 to Rm1.18 due to Ib banks doing Rss short sell today Well done! 21/11/2024 10:57 AM calvintaneng Fantastic Tsh Resources declared an interim dividend of 2.5 sen Making a total of 5 sen this year Many thanks to the BOD of Tsh Well done indeed! 👏 👏 👏 21/11/2024 6:17 PM OneOracle Already said lower revenue doesnt mean drop in profit 33 mil this qtr . Next qtr with 20% increase in production and 30% in price, very likely above 60 million. 21/11/2024 6:30 PM s3phiroth Tsh won the court case therefore operation disruption will be lifted and resume back to normal + improved net profit + surprise dividend = To the moon. 21/11/2024 8:18 PM titan3322 Next Qtr PAT would even be higher by at least 30% and can expect a special dividend ! 21/11/2024 10:37 PM calvintaneng This month is the final month in which IB Banks will do RSS Short Sell TSH due to 2 more call warrants Better buy now 22/11/2024 9:29 AM calvintaneng In year 2020 we bought Jtiasa at 63 sen We are improving fundamental Then in Year Fong Siling aka Cold Eye bought 5,000 shares of Jtiasa By now Jtiasa over Rm1.12 So matter of time Cold Eye will come to TSH 22/11/2024 9:30 AM calvintaneng So many promoters also cannot up? Short term only cannot Why? Answer: 4 Ib banks got issued Tsh call warrants to BET AGAINST TSH to kill call warrrant holders Wait till the Kamikaze bombing over Then the Tsh Aircraft carrier Battleship will sail on to success So now we see Victory ahead Just hold tight Got extra cash then buy even more 22/11/2024 10:10 AM titan3322 Collect ! Dividend yield should exceed 5% with very low risk especially with CPO price above RM 4500/tonne ! Rather than loosing your money dabble in high risk stocks ! 22/11/2024 11:26 AM 5354_ Down 2 sen after QR announced. If CW the problem choose CPO counters without CW better. 22/11/2024 12:40 PM calvintaneng If want can chose Inno Inno has no cw so no Rss short sell by Dirty ib 22/11/2024 12:55 PM calvintaneng But know this All Directors of Tsh fully loaded up on Tsh and not Inno Reason is There is a possible take over privatisation of Tsh just like they took Kulim private at Rm4.10 Ijmplant at Rm3.10 Bplant at Rm1.55 Tsh bought all its 190,000 acres with sweat and blood Fully owned by Tsh Nobody can take Inno private as Inno owns absolutely nothing All the lands of Inno are owned by Sabah Govt 22/11/2024 12:59 PM calvintaneng Ib banks very afraid to issue call warrants on Inno If Suddenly Sabah Govt want to take Inno private Ib banks can die standing 22/11/2024 1:01 PM cilifu123 On the chart today , price hit key support area with 1.75 printed on the tape. From here it could be slow volatile recovery (if it can) back up to 2+ area for a start, otherwise it will be a grind down to objective 1.60/1.50. Get popcorns ready for the show. 22/11/2024 1:02 PM s3phiroth Page 10 of 24Q3 qr: Additionally, operational disruptions at one of our plantation entities stemming from a social dispute related to the Community Plantation Development Scheme (“Plasma”), also contributed to the decline. However, on 13 November 2024, a significant breakthrough was achieved when the Indonesian Administrative Court ruled decisively in favor of the affected plantation entity within the Group, affirming it has met its obligations under Indonesian regulations regarding Plasma. This ruling is expected to expedite the resolution of the dispute, enabling the Group to resume normal operations and stabilize productivity at the affected plantation entity. With the dispute nearing resolution and biological cycles expected to normalize, the Group is committed to enhancing operational efficiencies and optimizing yields. 22/11/2024 2:26 PM calvintaneng B40 by Jan 2025 in Indonesia will be long term structural support for palm oil prices https://www.businesstoday.com.my/2024/10/23/indonesia-firm-on-b40-biodiesel-eyeing-b50/ 22/11/2024 3:14 PM | |