|

| |

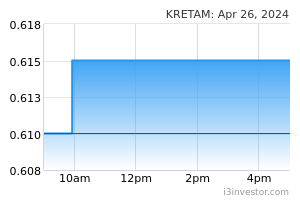

Overview

Financial HighlightHeadlines

Business Background Kretam Holdings Bhd is a Sabah-based medium-sized oil palm plantation company. The company operates through two segments namely Plantation and mill and Refinery. Its Plantation and mill segment is involved in the business of cultivation and sale of oil palm products. The Refinery segment is engaged in refining crude palm oil and producing biofuels. Its geographical area of operations includes Malaysia, Singapore, China, and the Philippines.

kmohan62 Best counter to accumulate on price pull back...integrated palm oil player...besides producing FFB,CPO + PK,company has its own palm oil refinery that produces RBD Palm oil,RBD palm olein and RBD palm sterin.And to top it up,company has its own fertiliser plant...so able to manage escalation cost of fertiliser plus able to profit from sales to other oil palm cultivators as well... 07/03/2022 12:29 PM Plato99 CPO powered Airbus https://www.bristolpost.co.uk/news/uk-world-news/airbus-a380-plane-powered-cooking-6872036 29/03/2022 12:48 PM win4896 bought at 0.58 CPO price still above RM6000...Good prospect because of high CPO price 30/03/2022 9:33 PM minato9012 No way can flush down furher. Look back last price before flying up. The shares trading at 56-58 30/03/2022 9:59 PM Plato99 Many European nations are considering reversing a ban on palm oil, not just because of the shortage of sunflower and rapeseed oils, but also because Russia and Ukraine produce 70 per cent of the supplies. It is a blessing in disguise for Malaysia when it comes to palm oil. Many political and economic pundits are saying that European nations did not expect that they may have to reverse the ban on palm oil after all the allegations that Malaysia is one of the palm oil-producing countries that indulged in deforestation. https://www.nst.com.my/opinion/columnists/2022/04/785491/europe-may-be-forced-turn-malaysian-palm-oil 03/04/2022 9:37 PM hoot9e996 wait till you see they make a u-turn when things settled down with the excuse of human rights issue 04/04/2022 11:36 AM hoot9e996 well thats 1 easy intraday profit.... thanks for company share buyback :) 04/04/2022 4:39 PM Jom123 (April 5): Oil palm growing nations will continue to supply the tropical oil to Europe as consumers in the region switch to alternatives due to the shortage of sunflower oil, according to the Council of Palm Oil Producing Countries. 05/04/2022 6:13 PM Plato99 https://www.theedgemarkets.com/article/oil-palm-growers-supply-europe-amid-sunflower-oil-shortage 06/04/2022 9:17 AM redhotpepper Anyone knows the QR date? This share have chance to go beyond 0.80 sen? 12/04/2022 8:25 PM redhotpepper Hmm, ya seems no demand and volume, no uptrend at all. What's happening to this counter? For display purposes only? 13/04/2022 3:12 PM Plato99 All plantation stocks will be gems in FY22/23. Buy at your own valuation. 14/04/2022 9:52 AM kmohan62 Aggressive buy-back by company indicates better earning prospect in the near term...stock under valued... 14/04/2022 7:46 PM redhotpepper Buy and keep till year end maybe. Not for short-term, risky. CPO up 3% does not have effect, EU can suddenly says My uses force labour and choose other different oil like soybean. So this really for long-term, short-term maybe makan ketam can la... 15/04/2022 8:41 PM s3phiroth Many ppl do not aware that despite the ban on palm oil, EU is still Msia's 3rd largest palm oil export destination after china and india. 16/04/2022 4:47 PM s3phiroth Palm oil export by destination in 2021 ----------------------------------------- India - 23% China - 12% EU - 10% 16/04/2022 4:52 PM Sepolcmd Soon become big company. They have and produce a lot of fertilizer and palm oil. Both rising price very fast 11/05/2022 1:40 PM Mcaresdk91 kretam= ketam.slowly but surely q handsome profit .stable n highly recommended stox 21/05/2022 8:52 PM Raymond Tiruchelvam kretam has good upside, looking at few factors 1) price upside still there (current price 61c is still the same as what it was in early Feb), 2) decent Q result of 1.97 eps, and assume x4 thats PE of 7.6x; 3) usd to rm exchange rate enables better earnings (as CPO sold in us$), 4) lower harvest dragged eps lower so had upside in next Q.... happy investing 01/06/2022 1:25 AM Max2838 After 5 years, Kretam's FFB production todate Sept in 2022 is the same as 2018, where's the upside? 11/10/2022 6:48 PM Dehcomic01 A decade ago, Kretam ROE underperformed those of my 2 reference Bursa plantation companies – Bplant and KLK. But over the past 2 years, Kretam had caught up with them and even surpassed that of BPlant. https://www.youtube.com/watch?v=9KhboTCMdEg But I was dissuaded from digging further into Kretam when I found the following ROE vs price trend. https://i.postimg.cc/DyWybKnR/Kretam.png I think that the market had priced in the improvements. What do you think? 12/12/2023 8:39 AM calvintaneng Blog: THE IMMENSE VALUE OF TSH'S 80,000 ACRES PRIME LANDS IN BONGAN, (Only 43.9 KM from TiTik Nol IKN NUSANTARA, By Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-03-12-story-h-186519186-THE_IMMENSE_VALUE_OF_TSH_S_80_000_ACRES_PRIME_LANDS_IN_BONGAN_Only_43_9 12/03/2024 2:25 AM KingKoil Kretam slow but will move like CPO price https://theedgemalaysia.com/node/705361 21/03/2024 8:34 AM | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||