Amazon 3Q Preview

ATFX

Publish date: Mon, 21 Oct 2019, 05:21 PM

Amazon 3Q Preview

Amazon will share its Q3 earnings results on October 24, 2019. Amazon is the largest e-commerce platform but also the largest public cloud provider in the world, and the third-largest digital ad platform behind Facebook (FB) and Google (GOOGL). Amazon continues to launch new products and services and is targeting growth markets such as China and India for expansion. Amazon and Walmart-owned Flipkart managed to increase their online sales by 30% YoY. This happened during India’s six-day festival season, a holiday that is similar to Black Friday in the US.

Amazon has successfully diversified its sales base. AMZN e-commerce business and third-party seller services account for 71% of its sales, and its cloud computing business is quickly gaining traction. Amazon’s cloud sector should continue to expand as the company invests heavily in infrastructure. Amazon introduced the all-new Echo Show 5, which features a compact design, 5.5-inch display, rich sound, HD camera, and built-in camera shutter. Amazon continues to grow Alexa’s features and capabilities. Amazon Go, is a checkout-free experience enabled by our Just Walk Out Technology, and has now expanded to New York City with two new stores. Amazon Go has thirteen stores open in Seattle, Chicago, San Francisco, and New York.

AMZN Stock Performance

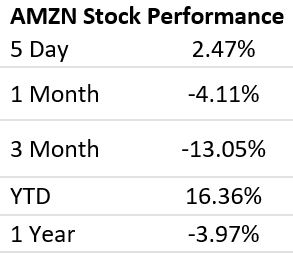

Amazon (AMZN) stock has lost 13.4% after its second-quarter earnings report on July 25, 2019. The fall came by lower-than-expected earnings, volatile equity markets, and antitrust allegations.

AMZN is up 16.36% year-to-date, which is lower than the S&P 500 (SPY) return of 17.1% in 2019. In the trailing-12-month period, AMZN has fallen 3.97% compared to the 2.2% gain in the S&P 500.

Amazon reported 2Q mixed second-quarter results, topping sales forecasts but missing on earnings estimates. The EPS came in at $5.22 vs. $5.29, the revenue came in at $63.4 billion vs. $62.5 billion. Excluding the $814 million unfavourable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 21% compared with second-quarter 2018. Amazon had a net margin of 4.80% and a return on equity of 26.27%. The operating income increased to $3.1 billion in the 2Q, compared with operating income of $3.0 billion in second-quarter 2018.

Third Quarter 2019 Guidance

Amazon forecast its revenues to grow year-over-year by 17%–24% to $66 billion–$70 billion in the third quarter. In the second quarter, Amazon’s revenue rose 20% YoY to $63.4 billion.

However, Amazon forecast its operating earnings to drop from $3.7 billion in Q3 2018 to $2.1 billion–$3.1 billion in Q3 2019. The company considered higher transportation costs in its guidance. In the second quarter, Amazon’s operating income rose 3% to $3.1 billion.

- Net sales are expected to be between $66.0 billion and $70.0 billion, or to grow between 17% and 24% compared with the third quarter 2018. This guidance anticipates an unfavorable impact of approximately 30 basis points from foreign exchange rates.

- Operating income is expected to be between $2.1 billion and $3.1 billion, compared with $3.7 billion in third quarter 2018.

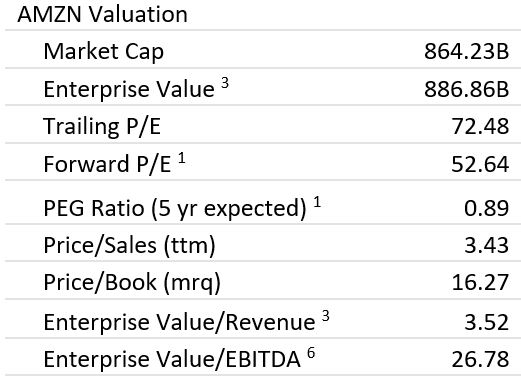

In the last five years, AMZN has been able to grow its earnings at an annual rate of 108.6%. Amazon’s share is trading at a forward PE multiple of 72x, which might seem high at first glance. However, the company’s robust expected earnings growth rate supports this multiple.

AMZN Technical Analysis

Shares of Amazon had lost 4.1% over the past month, lagging the Retail-Wholesale sector's loss of 1.96% and the S&P 500's loss of 0.91% in that time. AMZN’s short term momentum is bearish as it trades below all major daily moving averages. Immediate support for the stock stands at 1,721 the low from October 14th hile more offers will be met at 1,680 the low from October 3rd. On the flipside immediate resistance stands at 1,780 the 50-day moving average, while next strong resistance stands at 1,838 the 100-day moving average. Amazon needs to break above the descending trendline in order to regain the positive momentum, and the 3Q results might be the catalyst.

About Amazon

Amazon.com, Inc engages in the retail sale of consumer products and subscriptions in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It sells merchandise and content purchased for resale from third-party sellers through physical stores and online stores.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021