ICPS: It takes AGES to reach the Billion Shares Club

Warrants and Preference Shares

BLee

Publish date: Sat, 06 Feb 2021, 01:34 PM

I have noticed a preference tradings of company Warrants vs company Preference Shares; example shown below.

(Source: klse screener)

Fintec Mother Shares Trading at 0.085 with high volume.

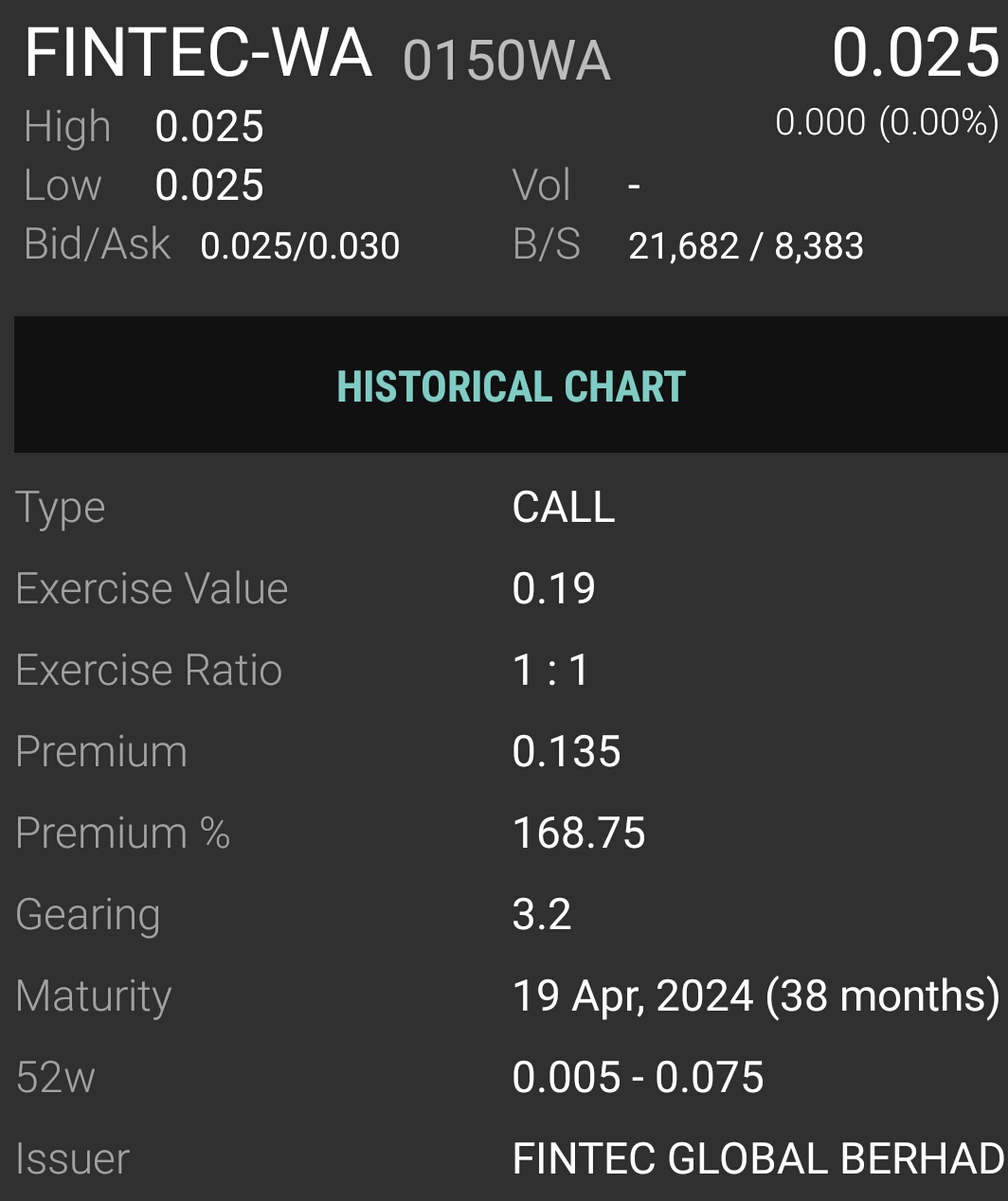

Fintec Warrants-WA Trading at 0.025 with no volume. This is mainly due to exercise price of 0.19

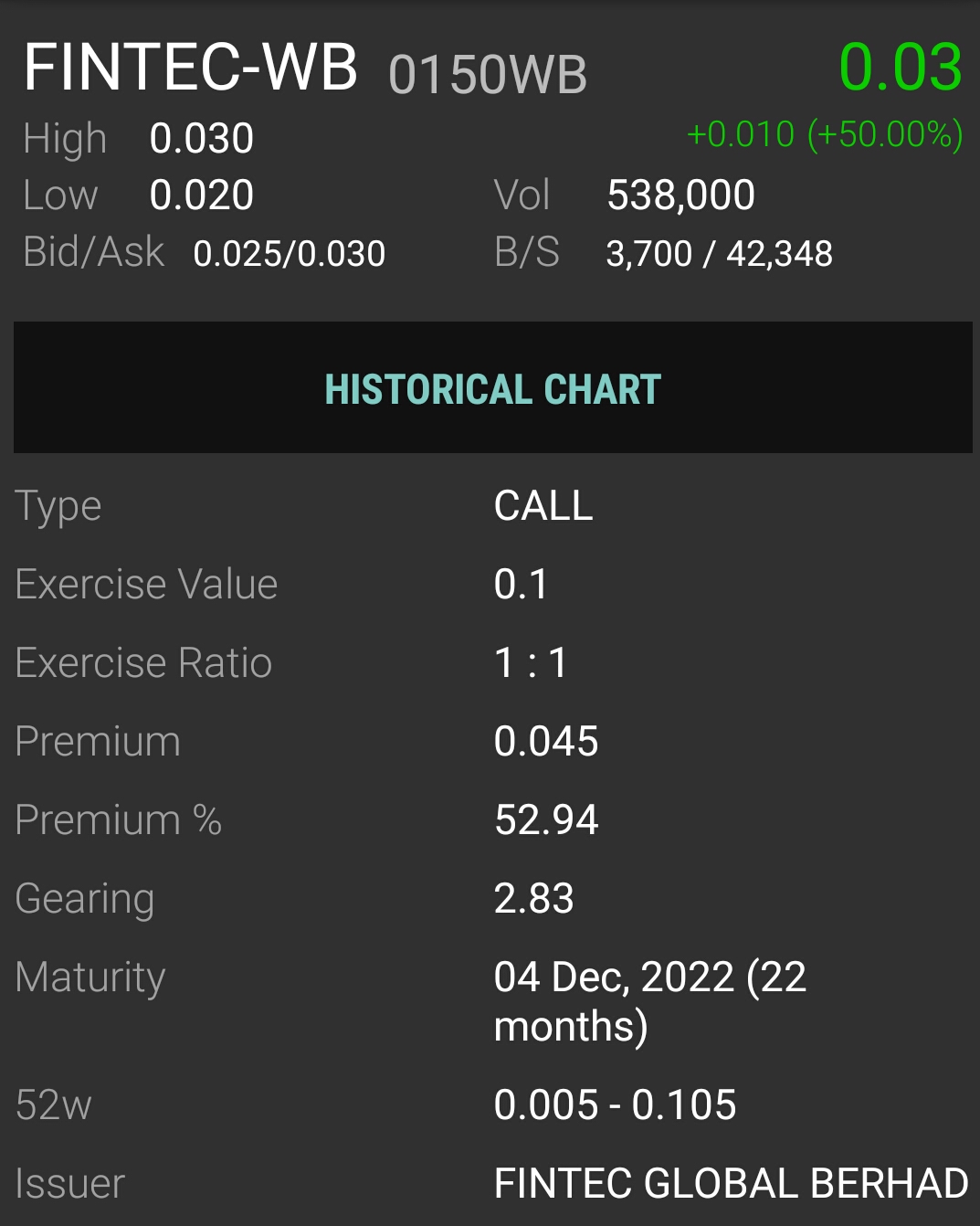

Fintec Warrants-WB Trading at 0.03 with low volume.

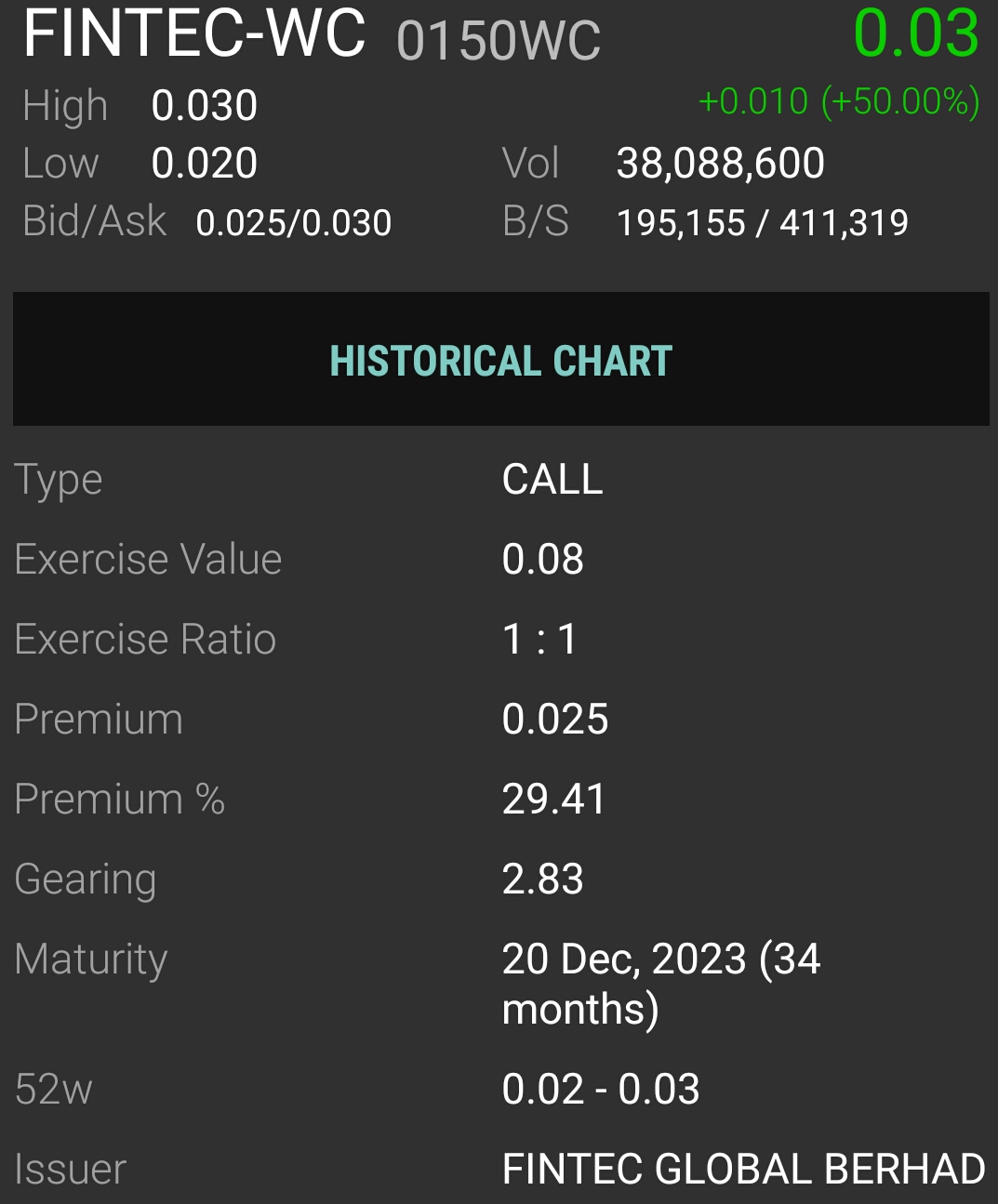

Fintec Warrants-WC Trading at 0.03 with high volume. This is the preferred Warrants by investor.

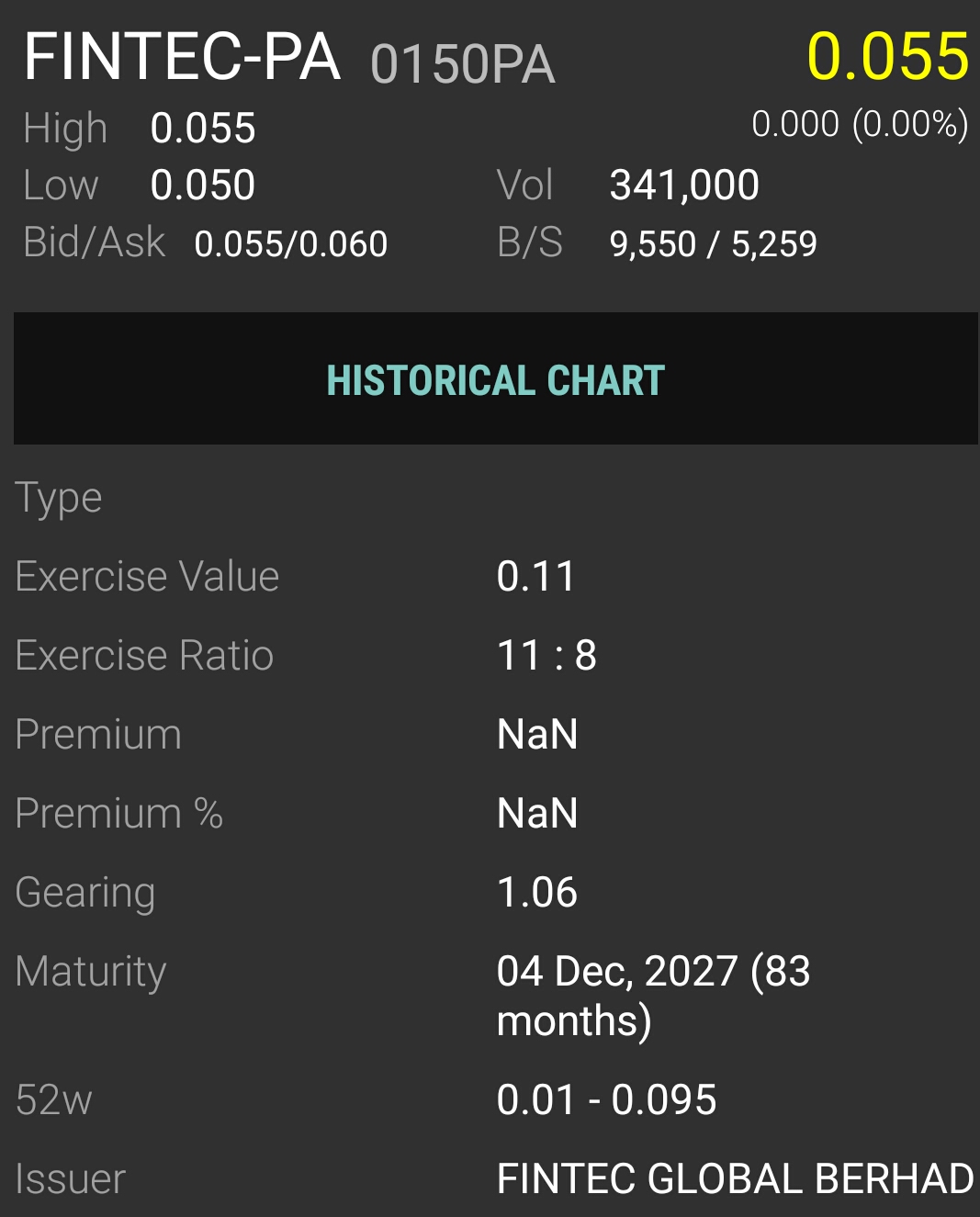

Fintec ICPS Fintec-PA Trading at 0.055 with low volume. Due to exercise value of 0.11 shown, not a preferred instrument. Unlike all the other Warrants, Fintec-PA carried a base value of 8sen (exercise ratio 11:8) and needs another 3 sen to convert to mother share.

Fintec Warrants-WC is the most preferred compared with the other 3 instruments. In terms of conversion price and expiry; obviously Warrants-WC has the advantage. How do we compare all the Warrants with Fintec-PA?

Conversion Price: Fintec-WC 11sen (3+8), Fintec-PA 8.5sen (5.5+3; i.e

base 8sen+3sen=11sen)

Expiry: Fintec-WC expired at 20 Dec. 2023 where else Fintec-PA auto-convert (mature) to mother shares at 4 Dec. 2027

Obviously, Fintec-PA has the advantage over Fintec-WC on conversion price and expiry date, but Fintec-WC is cheaper in holding cost. I do not have the answer which is better, only can suggest as an alternative.

I have done some research on Preference Shares; details are as below:

What is Preference Shares and the difference types of Preference Shares?

Preference shares, more commonly referred to as preferred stock, are shares of a company’s stock with dividends that are paid out to shareholders before common stock dividends are issued.

Source: https://www.investopedia.com/terms/p/prefDerence-shares.asp#:~:text=Preference%20shares%2C%20more%20commonly%20referred,company%20assets%20before%20common%20stockholders

Note: For Term and Condition of each issuance, please refer to individual Term Sheet for the correct rules as some do not include dividend as part of the issuance.

There are many types of Preference Shares (PS), but usually fall in 4 categories i.e.

Irredeemable (I), Redeemable(R), Convertible (C) and Non-convertible (-) or their combination.

ICPS - Irredeemable Convertible Preference Shares

As it is Irredeemable, the issuer will not be able to take back/cancel the issuance. It is Convertible, it will increase the total paid up capital (Equity) of the issuer upon Conversion.

RCPS - Redeemable Convertible Preference Shares

As it is redeemable, the issuer will be able to buy back the issuance any time or upon maturity. It is Convertible, it will increase the total paid up capital (Equity) of the issuer upon Conversion.

RPS - Redeemable Preference Shares

As it is redeemable, the issuer will be able to buy back the issuance any time or upon maturity. Usually, RPS carries a coupon rate; and the payment takes priority over the mother shares dividend if declared.

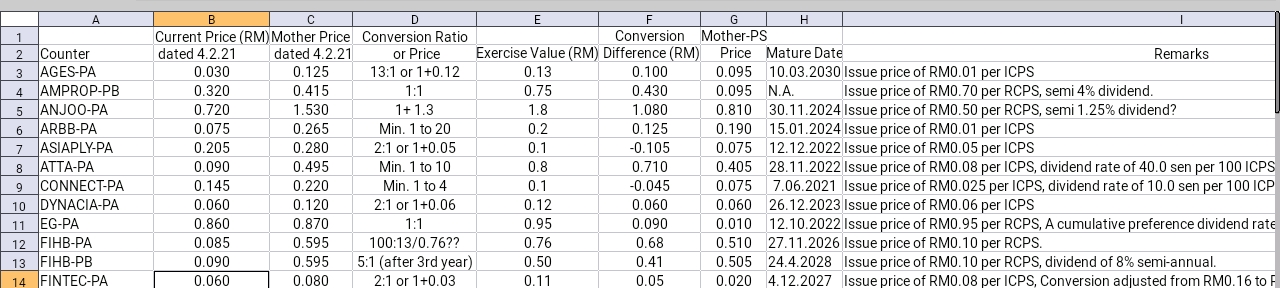

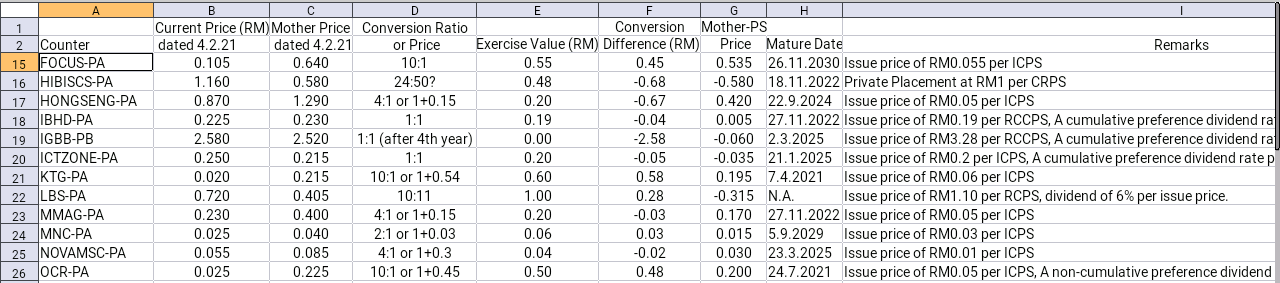

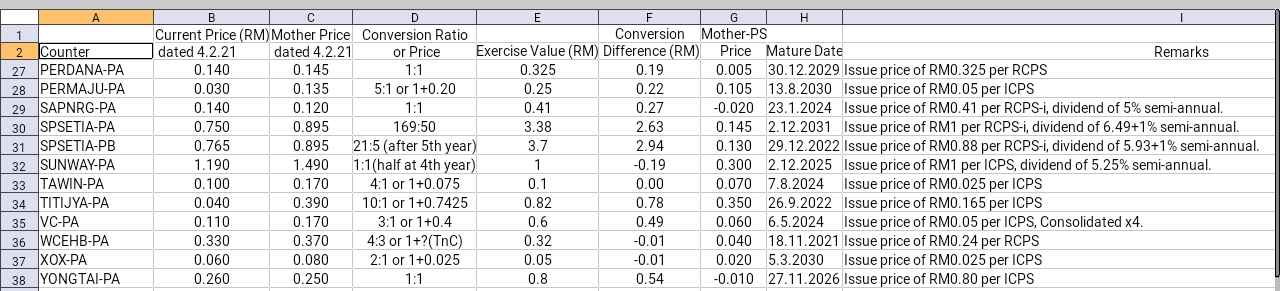

I have compiled a tabulation of various Preference Shares shown below for comparison purposes only; not a buy or sell recommendation.

General info: At present, I am holding AGES-PA and FINTEC-PA; and offered for INSAS RPS. I do not collect any fees or being paid to write (amateur); or neither a qualified analyst.

Happy Trading.

Disclaimer: The above opinion does not represent a hold, buy or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

More articles on ICPS: It takes AGES to reach the Billion Shares Club

Focus Dyn., AJR, Insas: The myth of Ir (not IngenieuR) vs R of CPS

Created by BLee | Jan 01, 2023

Continuation of article on previous ICPS investment strategy.

AGES ICULS: The 12 Billion of 2.5 sen bargain. (Updated - proposal cancelled)

Created by BLee | Mar 08, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments