KLCI waves

hotstock1975

Publish date: Sun, 01 Mar 2020, 01:57 PM

28/Feb/2020.

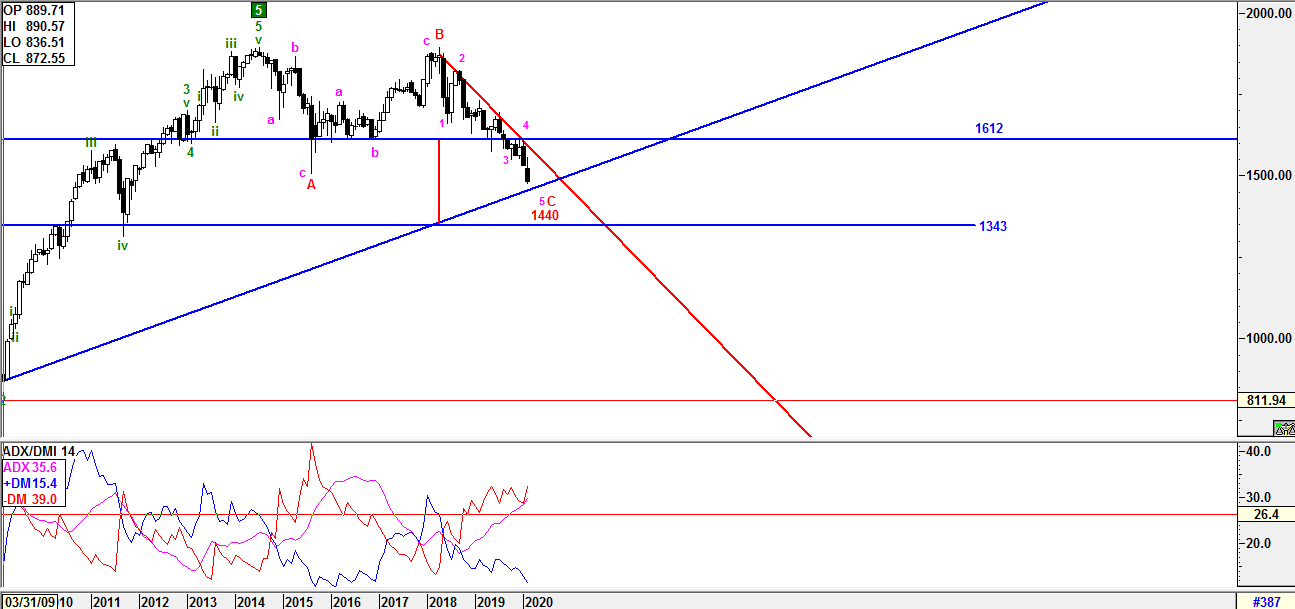

The chart above is derived from Monthly time frame which provides longer term view based on Elliot Wave Theory.

From the price actions above, we can see KLCI has formed an Double Top formation which first and second top occurred in 2014 and 2018 respectively. The probability of the formation validity is high when it broke below the support 1612 on September 2019 and target price level is 1343. ADX indicates Bear is still strong and selling pressure is in favour.

From Elliot Wave perspective, the Final major degree bullish 5th Wave was ended in 2014 and expanded irregular major degree ABC correction waves has been emerged until now which comprises 3-3-5 lower degree sub-wave formation. Wave A (3 sub waves) & B (3 sub waves) had been achieved on August 2015 & April 2018 respectively. Currently, KLCI is still forming a major degree Wave C with lower degree 5th sub wave which expecting to end at 3 possible levels below:

a) 1460 - reversal above upper trend line and earlier double bottom formation may be void.

b) 1440 - break below upper trend line and reversal above upper trend line as false break.

c) 1343 - break below 1440 indicates extension 5th sub wave heading further lower to 1343

Once one of these 3 level achieved, it would be the end of major Wave C at the same time. Therefore, the entire ABC correction would be achieved and confirmed if it breach above the red downtrend line.

The analysis above is based on case by case basis at one point in time because of the price behavior variation.

Thank you.

Regards

Wave believer

28/Feb/2020.

More articles on KLCI waves

Created by hotstock1975 | Jan 24, 2022

Created by hotstock1975 | Jan 17, 2022

Created by hotstock1975 | Dec 20, 2021

Discussions

6 Mar 2020

After a week, its was able to trade above 1460 level after bounced from the major upper trend line. However, it seems resisted at around 1500. For longer term perspective (Weekly & Monthly time frame), 1470 must hold as immediate support and 1460 as major support for further upside test the gap resistances in between 1510 - 1527. Last but not least, minimum criteria of ending sub wave 5 or WAVE C is still intact while pending confirmation signal.

Wave believer

2020-03-09 00:52

10/3/20

It seem's Mr Market has chosen to end WAVE C at lower level after broke uptrend line at 1460. After Re-assessed daily and weekly chart, the initial minor 5th wave extension would Not be realized. Instead, we had sub 3rd wave extension formed which ended at 1550 on Oct 19. It meant we would see an normal sub 5th wave or WAVE C which would end at 1380 as projected. Well, it is almost 40 away from Double Top target at 1343. Let's see how is the monthly chart close on 31/3/20.

Wave believer

2020-03-10 01:45

15/3/20

On Weekly time frame, selling pressure continued dragged the index further 1320 and closed at 1344 which was the Double Top target. Since it the Mr Market chose to complete fully double top set up, WAVE 5 criteria was also seems fully met too as straight forward normal sub 5th wave as expected in Monthly time frame without extension wave formation. To reiterate, blue upper trend line and red down trend line are still acting as resistance and confirmation level of WAVE C. we may see consolidation phase below this 2 lines before any greater actions. Let's see how Mr Market to form us more signals ahead.

Wave believer

2020-03-15 10:05

22/3/20

On Weekly time frame currently, a greater degree of selling force had pushed harder to lower lever and rebounded with a closed below 1344 which become an additional resistant lever to watch now.

Due to the greater degree of impulsive down move, we have revised from the initial sub 5th wave of WAVE C to sub 3rd wave extension instead which meant sub 3rd wave has just ended at 1207. From now, any upward move will be considered as retracement to complete sub 4th wave before continuing downward again to complete sub 5th wave and major WAVE C. The minimum target level for sub 4th wave is around 1345 - 1350 and maximum level is around 1441.

Finger cross.

Wave believer

2020-03-22 18:22

29/3/20

From weekly time frame, the minimum criteria of sub 4th wave has been achieved at range of 1345 - 1350 last week. However, we will not rule out a possible test the maximum criteria level of 1441 due to a potential bullish engulfing formation setup and a close above 1353 on these coming Friday will realize the formation. The degree of the succeeding formation would be high if the next retracement level of 1303-1306 to be hold.

I would like to reiterate that any degree of 4th wave is always being formed in longer consolidation behavior. Therefore in the coming few weeks, there would be definite formation of the sub 4th wave being formed to project the end of sub 5th wave or WAVE C.

From daily time frame, there were 3 lower degree if sub wave "abc" formed but it was just the beginning of sub 4th wave in weekly time frame.

last but not least, patient is the key.

Wave believer

2020-03-29 23:24

We will project the target of final sub 5th wave or WAVE C when the sub 4th wave end.

2020-03-29 23:46

As weekly and monthly time frames analysis has been focused here. Kindly watch out for the retracement level of 1303-1306 and monthly closing on Tuesday as there had been major sold off for the last 4 month end.

2020-03-30 00:09

1/4/20

In monthly time frame, it was a first green closing after 4 consecutively prior month end sold off. However, it was just closed above 1343 which was double top setup target level.

In order to achieve the validity of bullish engulfing setup in weekly time frame, it has to close above 1343-1353 on this Friday. Otherwise, we will expect consolidation phase with retracement level at 1303-1306 to validate the bullish formation setup in near term.

Wave believer

2020-04-01 11:04

5/4/20

In weekly time frame, the validity of bullish engulfing setup is still being watched since it was closed under 1343 - 1353 range. Since it made a halt at upper half of the engulfing setup with a Doji, we still remain our view that a consolidation phase with a favorable retracement level at 1303-1306 range to succeed the engulfing setup in near term.

Wave believer

2020-04-06 00:14

hotstock1975

3/2/2020,

We are entering into a new month of March. I will continue with analyzing in Monthly time frame basis as there has been major sold off for 3 consecutively month end since November 2019. Secondly, monthly analysis can deliver a bigger picture of major cycle for longer run. However, shorter time frame (Weekly & daily) analysis would take place when stronger signals captured which would drive longer term trend and vice versa.

On the first day of March, potential level #1 (1460) mentioned was triggered and bounced up from the upper trend line. A Doji has been formed above the trend line after closed. Although it has met the minimum criteria of completing sub wave 5 or WAVE C, it still require a confirmation of bullish reversal signals in next few days or weeks. However, we won't be carried away as long as it has not broken above the red downtrend line and there is still a chance to visit possible level 1440 & 1343. Let's see!

Wave believer

2/3/2020

2020-03-03 03:15