KLCI waves

KLCI waves 5

hotstock1975

Publish date: Mon, 04 May 2020, 02:24 AM

Monthly Time Frame

KLCi was able to close in green at 1407.78 and almost formed a bullish piercing line formation. Therefore, KLCI must close above 1411.12 on 29/5/20 in order to succeed the piercing line formation for further potential upside in coming months. Besides that, KLCI has been holding well above 1343 which was double top level. PTI reading is 21 indicate Failed 5th sub wave is possible.

Weekly Time Frame

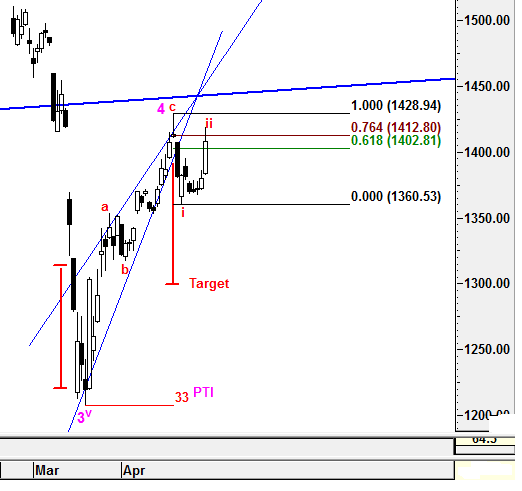

KLCI had tried to write off the dark cloud cover formation and failed to close above the high of 1428.95 with lower volume. ADX is flattening with high volitility is still taken place. -ve DMI continued heading down and meeting resistance while +ve DMI was resisted and turning down. This implied that bearish sentiment might be taken place. The PTI reading reduced from 33 to 28 to indicate Failed 5th sub wave is possible.

Daily Time Frame

For the last 2 weeks, 2 sub minuette waves was formed. 2nd sub min wave was believed to end at 1418.42 where exceeded 76.4% fibo level. A short term double top might be emerged If 1359 support broken and 3rd sub min wave would be taken place there after. Since the recent evening star and wedges formation are still under the spot light, we will be very caution if any upside move towards the high of evening star formation at 1428.95. Moreover, the upper gap resistance at 1419 is still playing as a critical level whether it can be breached which to imply that any further upside move can be realized. The PTI reading 33 is still remain the same to indicate Failed 5th sub wave is possible.

The above wave counts are generated based on current prices level and may subject to change if neccessary.

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments