KLCI waves

KLCI waves 7

hotstock1975

Publish date: Mon, 18 May 2020, 04:06 AM

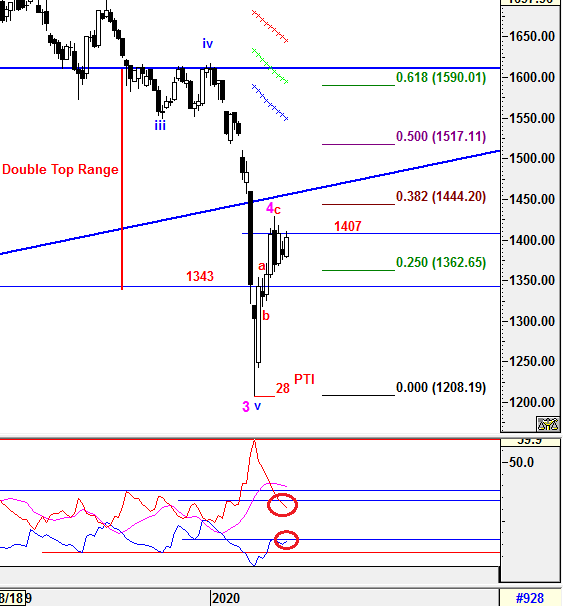

Weekly Time Frame

To reiterate from prior session, both bearish formations (Dark Cloud Cover & Bearish Harami) is still valid as KLCI was unable to break above 1407 for initiating any upward move. -DMI is still heading down and +DMI is curving up which both implying bearish momentum is decreasing. However, +DMI up curve has met the resistance where we have to stay caution from now. We have remained the similar viewed that prevailing trend could be emerged if levels listed below was broken:

Immediate Resistance - 1407

Immediate Support - 1369

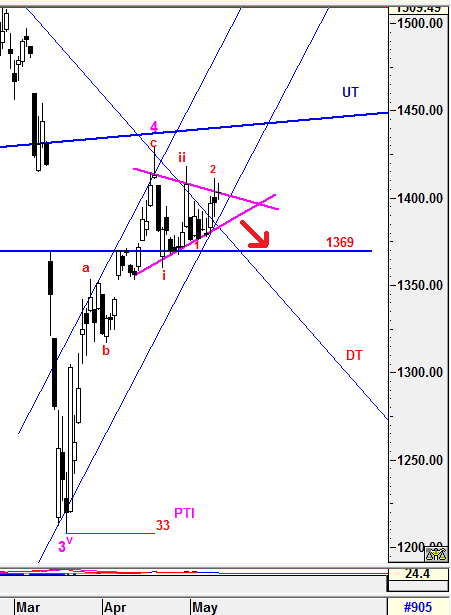

Daily Time Frame

KLCI is still consolidating within the symmetrical triangle formation. Eventhough, the formation is inclined toward bullish bias but the prior bearish view is still hold since KLCI is yet to breach above the high of minuette sub wave ii at 1418.42. However, DT line has been breached and indicates further upwards may taken place.

Due to contraction signals from daily timeframe, we are still monitoring 2 possible outcomes which either bearish or bullish sentiment might take place if certain critical levels is breached respectively.

a) Bearish view

Two lower degree of sub minuette 1 and 2 were formed after failure of breaking the high of minuette sub wave ii at 1418.42. If there's a breakout below the triangle's lower line, it would head towards to test the support 1369. The 3rd minuette sub wave extension downward would be implusive if last support 1369 broken.

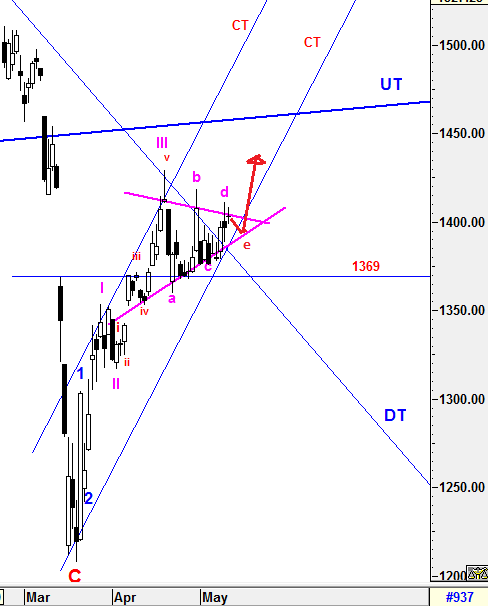

a) Bullish view

We have narrowed down from 2 to 1 possible formation outcome that the sub 4th wave correction is being constructed as Symmetrical triangle "a-b-c-d-e" minuette waves before sub 5th wave upward.

Therefore, "d" wave has just ended at 1411.08 and next "e" wave would head to lower triangle line at around 1390 before breakout upwards to initiate sub 5th wave up.

Conclusion

As weekly time frame's bearish view is still remained intact, we will be caution when the daily bullish signal is getting stronger which may alter the wave counts and implying that major WAVE C might be ended at 1207.8 and new wave of Bull Run might just started. Nevertheless, we are watching very closely 4 critical levels which will initiate a strong continuous trend towards the waves objective/target.

Critical Resistance - 1418.42

Immediate resistance - 1407

Immediate Support - 1389

Critical Support - 1369

Let's watch how Mr Market path the way.

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 2 of 2 comments

Closed above 1418.42 convincingly could spur some strength towards upside. Let's see Mr Market is able to pave the way.

2020-05-19 10:58

hotstock1975

Both mentioned resistances 1407 and 1418.42 have been broken without creating 'e' wave. It meant the sub 4th wave correction has ended at 'c' wave and sub 5th wave is on it way up. Let's see whether the current momentum can drive it to a potential target of 1450-1460 which is just beneath the UT line shown.

2020-05-19 09:23