KLCI waves

KLCI waves 16 - Higher Degree of Corrective Waves

hotstock1975

Publish date: Mon, 20 Jul 2020, 12:36 AM

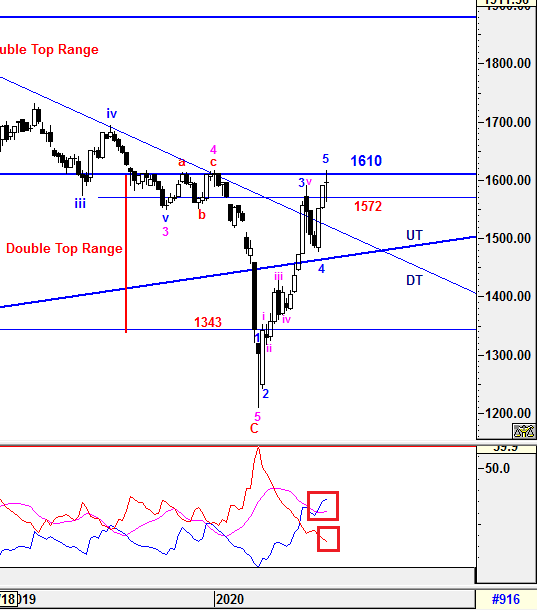

Weekly Time Frame

KLCI was unable to sustain above 1610 after reached the high of 1617.36 and formed an doji star which indicated uptrend has been halted. Therefore, the prior Double Top Range effect is yet to be written off.

On the other hand, the higher degree of 5th wave has been completed which will be elaborated further in daily time frame.

-DMI (red line) is still heading down and made new low indicates bearish sentiment is continuing decrease. +DMI (blue line) continued curve up with lower margin indicates bull strenght is slowing down. However, ADX (pink line) is starting to curve up which implying the volatility of the current bull trend is gradually returned. Since the volatility is showing some sign of the current bull trend might continue, i am expecting there would be some knee jerk reaction along the way up.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Support - 1572

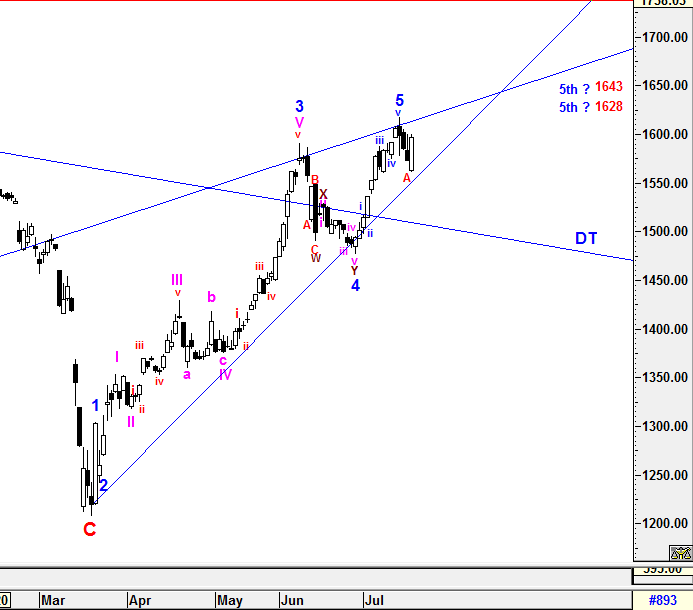

Daily Time Frame

Due to the changes of the magnitude, the minimum criteria level of higher degree of 5th wave has been revised and it realized earlier than expected at 1617.36 instead of 1628.

As expected, 5 sub minutte waves structure was formed to complete higher degree of 5th wave with an complex wave forms structure during 4th sub minutte waves which led to the changes of magnitude. This could be seen at lower time frame instead of daily time frame. However, the minutte waves were able to be labelled clearly in daily time frame.

If the wave counts above is valid, the entire of the impulsive higher degree 5 waves has been realized from the low of 1207.08 to 1617.36. Therefore, higher degree of correction waves could be underway currently and started with sub minutte wave A which was formed at low of 1563.01 (38.2% Fibo). Then, sub minutte wave B is underway with an Bullish Engulfing Formation emerged.

Due to the Bullish Engulfing and ascending wedges formation, i won't rule out that there could be another complex correction waves or even invalidate the current corrections assumption to revisit higher degree of 5th waves at higher level with prior projected target such as 1628 or 1643 if it able to breach above 1617.36 and upper wedges convincingly. Therefore, magnitude of the trend would still be monitored closely and quantified to anticipate any complexity.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement has changed.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1617.36

Immediate resistance - 1610

Immediate support - 1572

Support - 1563.01

To Recap, the Major Classic Bull Run Cycle is still valid and do expect market hiccup or correction waves before a new implusive waves taken place to achieve higher level.

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021