Bullish Alert - SYCAL (Code 9717) - Ichimoku Cloud Breakout

Investhor

Publish date: Fri, 05 Apr 2019, 05:43 PM

Hi to all fellow investors and traders !

Recently, government has announced revival of many infrastructure projects. This has lifted the positive sentiment on all construction counters. I would like to share my personal opinion on SYCAL (BSKL Code 9717), which I detected a major trend change and would possibly further continue in coming time.

SYCAL (BSKL Code 9717)

Personal TP Short To Mid Term : 33c, Long Term : 43c

Here are my thoughts :

1. Technical Analysis

I would like to start with TA point of view because this is how I had spotted this change of trend. Refer below its weekly chart as of 5th April 2019. This counter had been on a downtrend since it hit a high of 53 cts in April 2015 (4 years downtrend). With the recent positive announcements by government on infrastructure, sentiment for this stock has been lifted and it has started to gain traction over last 2 weeks. With the recent closing of 26 cts, the stock has is seen bullish due to few reasons:

a. Ichimoku Cloud Breakout above 25 cents, now the stock is trading in the bull region above the cloud

b. Breakout of Double Downtrend Channel which is drawn from the peak of 2015

I see that the immediate strong resitance will be at 33 cents for the next upcoming wave.

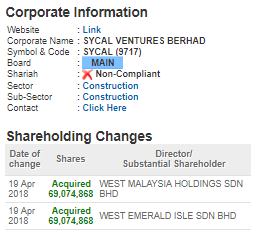

2. Major Shareholders Increasing Stake

Refer below screenshot taken on the latest major move by largest shareholder. Increase in 69 million (16.5%) shares by major shareholder last year indicates to me that they have confidence in the future of the company.

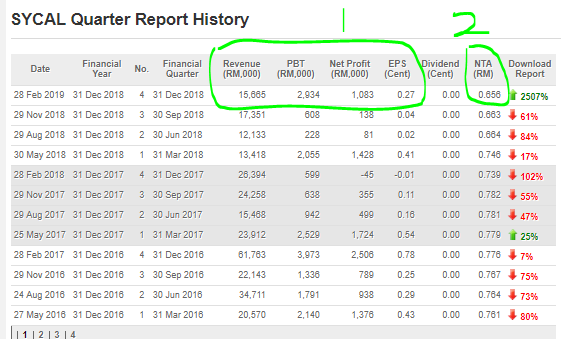

3. Financial Analysis

Refer below latest Quarter Report released by company in February 2019. We can see from Circle 1, that the company has sustained its revenue at RM 15.7 million which is roughly similar to past 3 quarters, however its net profit had jumped 8 times (800%) compared to last quarter.

PBT stood at RM 2.9 million and Net Profit was RM 1.083 million.

The company also has strong assets with NTA at 65.6 cents. Therefore, now the company is trading at 39% of its NTA value.

Should the company be able to continue improving its net profit for coming quarters, we should see better reflection of stock price with the better earnings.

CONCLUSION

Based on my opinion, SYCAL is in bullish bias mode, based on below:

a. Technical Analysis - ICHIMOKU Cloud Breakout and Double Downtrend Channel breakout on weekly chart

b. Major Shareholders Increasing Stake - Increase in 69 million (16.5%) shares by major shareholder last year to show further confidence in company

c. Improving FA - improved net profit and good prospects ahead due to better infrastructure spending by government

Thanks for reading and see you in the next post.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Investhor

below is the Chinese Version

https://klse.i3investor.com/blogs/InvesthorsHammer/201206.jsp

2019-04-06 08:01