Hi to all fellow investors and traders !

Today I would like to highlight the following counter:

SEDANIA INNOVATER BERHAD or SEDANIA (Code 0178, Ace Market)

SEDANIA - Improving FinancialPerformance - Good Quarter Coming ???

Here are my thoughts :

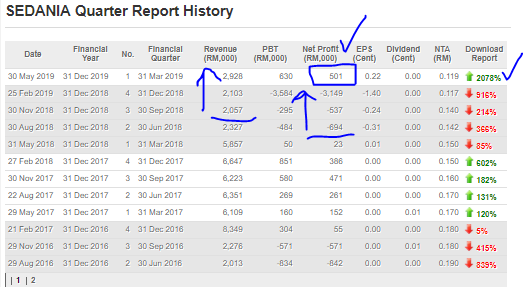

1. Short Analysis on History of Quarter Results - Improving Revenue, and Posted Profit in May 2019 after 3 straight Quarter Losses

Refer below summary of last 3 years SEDANIA QR. As we can see, since Nov 2018, the company revenue had been improving every quarter. And for the most recent QR, SEDANIA managed to post Net Profit of RM 501K compared to previous 3 losses.

This shows a sign of improvement and that the worst is over for this company.

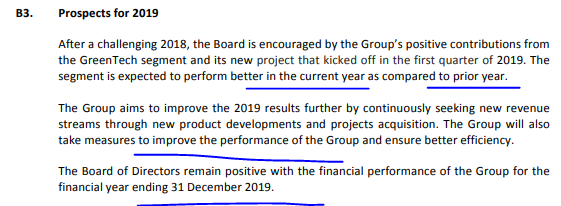

Also, refer below comments on 2019 prospects by SEDANIA in latest QR. They mentioned that the Board remains positive on the performance of the FY 2019 as compared to prior year.

2. Article in Paper 16th May 2019 - SEDANIA OPTIMISTIC ON PROFIT GROWTH THIS YEAR

Refer below article from The Star in May 2019. From what I can conclude, below:

i. Continuous contribution from fintech segment and new innovations are expected to contribute to company earnings in FY 2019

ii. Internet of Things (IoT) segment prospects are expected to improve his year

iii. Making good progress in green tech segment in FY 2019

3. Technicals - Bull Flag Consolidation - Low Risk Entry below Mid BB

Refer below daily chart of SEDANIA from April 2019 till now.

A few observations below:

i. SEDANIA hit a high of 31 cts on 12/4/2019. Since then it has been consolidating inside the bull flag with support at 13 cts.

ii. Current price is still below mid Bollinger Band (BB) which represents a low risk entry for investors and traders alike

iii. Longer term resistances seen at 18 & 20 cts

iv. MACD is nearing to cross te signal line indicating bullish momentum forward

CONCLUSION

Based on my opinion, I believe upcoming SEDANIA QRs might be showing good improvements. based on below:

i. Improved Revenue for 3 quarters in a row and started to post QR profit compared to 3 previous losses

ii. Prospects in fintech, IoT & greentech expected to contribute to FY 2019 earnings

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR