Budget 2020 - Plantation - Major Beneficiary !!!

Investhor

Publish date: Sat, 12 Oct 2019, 07:33 PM

Hi to all fellow investors and traders !

Today I would like to highlight the following counter:

FGV HOLDINGS BERHAD or FGV (Code 5222, Main Market, Plantation)

FGV - Budget 2020 - Plantation - Major Beneficiary (Direct & Indirect) !!!

Here are my thoughts :

1. Take Care of Your People, and The People Will Take Care of Your Business !!! Direct Allocation of RM 810 million for FELDA Settlers A Smart Move !!!

Let me start off with a quote by Richart Branson, as above, where he said "take care of your employees and they will take care of your business. It's as simply as that"

With the Budget 2020 announcement, I see that the allocation of RM 810 million for FELDA settlers will really help boost FGV, in a direct and indirect manner. Happier employees will in turn contribute more to FGV's bottom line.

Refer below news article by The Star which highlights this matter:

In summary, allocation of RM 810 million to FELDA settlers as follows:

i. RM 250 million for income-enhancement programme benefiting 11,600 settlers

ii. RM 300 million to write off the interest of the settlers' debts

iii. RM 100 million for FELDA's water supply projects

iv. RM 70 million for housing of new generation of FELDA settlers

v. RM 90 million for upgrading of FELDA roads and basic infrastructure

2. Benefitting Indirectly From Other Allocation to Plantations & Transportation Sector

Besides the direct allocation, there are also other allocations as follows which would also benefit FGV, indirectly:

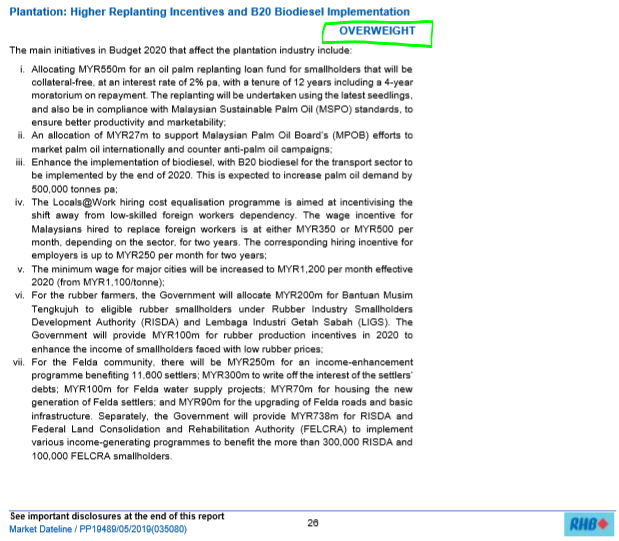

i. RM 550 million oil palm replanting loan fund for smallholders that is collateral-free at an interest rate of 2% per annum, with a tenure of 12 years including a four-year moratorium on repayment

ii. RM 27 million to Malaysian Palm Oil Board (MPOB) for its effort to market palm oil internationally and counter the anti-palm oil campaigns in Western Countries

iii. Enhancement of Biodiesel Implementation Programme in Transportation sector, in an effort to boost the use of Palm Oil. This would mean an additional 500,000 tonnes of CPO will be used for the B20 implementation from the B10 biodiesel.

From the 3 budget allocations above, we could see that the government is strongly supporting the palm oil sector on the long run as it is a major component of the country's GDP. Hence, I could only deduce that the trend for all palm oil counters should be up on the longer term.

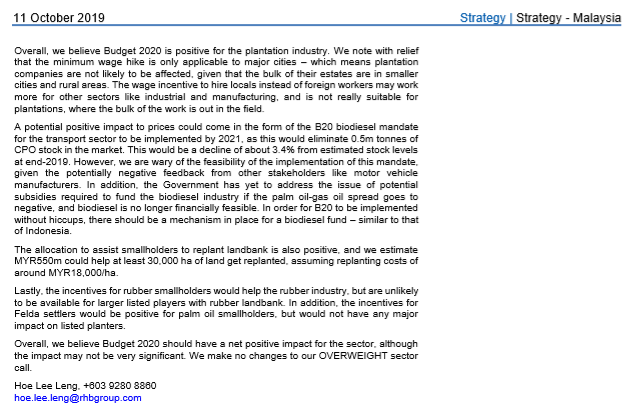

3. Budget 2020 - Plantation Sector - Overweight Call by RHB Investment (Possibly by Other IB's Too)

Refer below images extract from RHB Investment - Strategy for Malaysia 2020 Budget dated 11th October 2019.

It mentions that RHB is OVERWEIGHT on Plantation Sector as a whole, due to the many Budget 2020 initiatives which will positively affect Plantation Sector.

4. TA Analysis - Potential Breakout of Long Term Downtrend, On the Back of Strong Volume & More Banker Chips Buying In

First we look at the daily chart using HOMILY software. As we can see, recently RED CHIPS (Banker Chips) have started to accumulate into FGV. As such for now, as the red chips increase, it is expected that more strong holders are going to be joining this counter as the price moves up.

Let us look below at the daily chart, taken from January 2018 till date. A few observations below:

i. FGV hit a high of RM 2.18 in January 2018 and started to downtrend

ii. Since then, there had been 5 times of attept to break the downtrend (as circled and numbered), but failed and continue to downtrend

iii. With recent surge in volume and interest caused by the budget, it is possible that FGV could break the downtrend this time, to see major trend change from DOWN to UPTREND

iv. CLOUD breakout is seen at RM 1.06, with further resistances seen at RM 1.11, 1.24 and 1.38

CONCLUSION

Based on my opinion, I believe FGV should be seeing interesting trend in the weeks ahead. based on below:

i. Direct Allocation of RM 810 million for FELDA Settlers Welfare - Happier People Contribute to Better Bottom Line for FGV

ii. Indirect Allocations to also benefit FGV - replantion loan fund, MPOB fund for marketing palm oil, and enhancement of Biodiesel Implementation Programme

iii. OVERWEIGHT on Plantation Sector by RHB Investment (possibly by other IB's soon)

iv. BANKER Chips Weighing in on the Daily Chart - Significant Volume Buying Into FGV - For A Possible Breakout Above RM 1.06

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020