If you want to make money, stop looking at EPS growth and focus on ROIC first

Ricky Yeo

Publish date: Tue, 26 Apr 2016, 12:35 PM

You receive a statement from the bank where your 100K is sitting in FD (fixed deposits). The statement shows that you earned RM3,000 on interest last year, and this year you earned RM3,090 or RM90 more. You are excited because the 'EPS(earning per share)' of your FD is 'growing' so you decide to put more money into it.

But you are not easily fooled. You realized you earn more this year because you reinvested all the interest last year. The fact that the bank still pays you 3% of interest for both years has not changed.

If a company earns the same return aka return on invested capital, ROIC for short (in FD example that's 3%) on 2 consecutive years but the EPS has increased, does that mean the stock has become more valuable (or become a hidden gem) & deserve a higher PE multiple?

If you feed a person enough food everyday, eventually he will become obese. Throw enough money into a business, the EPS almost always grows, but that doesn't mean the business is more valuable now.

You asked 2 friends how much their business is making a year and Ali told you he made $10,000 a year whereas Ahmad told you he made $100,000 a year. You don't want to talk to Ali already. Ahmad is definitely smarter and has a more profitable business. But Ali forgot to tell you he made that profit using $20,000 capital, a 50% return whereas Ahmad had to pour $1 mil into it, a return of 10%.

Return on invested capital (ROIC)

Hopefully now you understand that looking at EPS growth only gives you a small snippet of the big picture. It is like telling your friend you ran at the park for an hour yesterday but leave out the key part “Was that 1km or 10km?”.

Share price is driven by value creation. And value creation is the principle where companies can create value by investing capital to generate future cash flows at the rates of return higher than the cost of capital.

“At the rates of return higher than the cost of capital” - This sentence differentiates and explains why companies like Wellcal is selling at 8x book value and Hartalega at 5x while Leon Fuat and Khind have persistently sold below book.

When companies use the money from shareholders (in the form of equity) and banks (borrowings) to grow their business, shareholders demand a satisfactory return for their money, that’s the cost of capital. Or they will ask “If this business only gives me a return of 3% a year I might as well put it in FD that carry a lower risk?”

Investors are willing to pay a premium for Wellcal or Hartalega and the likes because they have proven that they can generate a return above the cost of capital. ROIC is a critical metric to find out how efficient a company can generate returns from its capital.

***

Return on Invested Capital (ROIC) =

Net Operating Profit After Tax (NOPAT) / Invested Capital (IC)

***

Source: Valuation: Measuring & Managing the Value of Companies

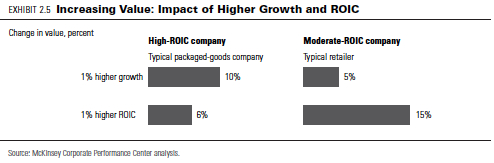

Exhibit 2.5 shows that a high ROIC company can create more value by focusing on stronger growth whereas moderate ROIC company should focus on improving ROIC before growth. Although the exhibit used packaged-good company and retailer as example but the idea behind applies to all industries. The rational is that if a company’s long term ROIC is below cost of capital, growing the company will only destroy shareholders value. Thus all effort should be put on increasing profit margin and asset turnover, the 2 drivers for ROIC.

Source: Valuation: Measuring & Managing the Value of Companies

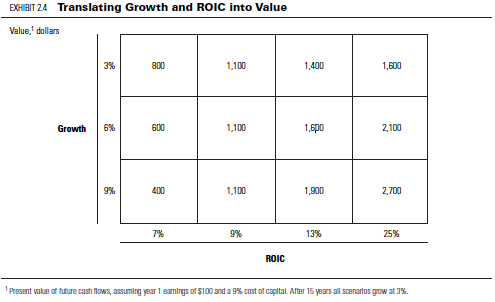

Exhibit 2.4 explains this further. The figure inside the box is the value of the business. With cost of capital at 9%, any ROIC below that (in this case 7% ROIC) destroys value the faster a company grows. That’s why some stocks sold below book. If a stock manage to get a return the same as cost of capital, it doesn’t matter how fast the growth in EPS is, the value remains the same.

For calculating cost of capital, you can either use Capital Asset Pricing Model (CAPM) or for simplicity sake, use 10% for all stocks. ROIC for most companies range between negative to +40%, trying to find out whether the cost of capital is 8% or 9% is not going to make much of a difference.

You know ROIC is the key driver to value creation, should you start heading out there and buy up all high ROIC stocks? A company’s ROIC is not a secret; everyone knows it, that’s why the price of Wellcall or Hartalega have been bidden up to reflect its future prospects. Therefore, it is unlikely to give you an above-average return. Or worse, you might actually underperform.

Say you are a great chef. Whenever you cook for your diners, they would expect nothing less but the best quality food from you and your restaurant. After a while it becomes a challenge to surprise them because your culinary skills are already at the very top. The room for improvement is limited.

Many great companies with high ROIC encounter the same scenario. The market pays a premium and expect nothing less but great future growth and outstanding ROIC. It is hard to surprise the market when you are the leader in the industry. As an investor you will earn an average market return if all goes well. If there’s a speed bump – a soft economy; a failed overseas expansion; a fumbled acquisition etc you are very likely to suffer a large downside. And this is to the contrary belief that quality stocks are defensive.

As the saying goes “You don’t get paid finding the best horse, you get rewarded for finding the horse that’s been mispriced by the market”. Stocks that will earn you above average return with minimal risk (asymmetrical return) are the ones where there’s a big gap between price and the fundamentals. Good companies hitting speed bump or problematic stocks are all hotbed for the mispriced.

When you shift your attention from EPS to ROIC you begin to get a good idea why some stocks command a premium price while others don’t. Combine that knowledge with the understanding that most money are made from low expectation (the chef) and mispriced stocks, you can improve your chances of getting a better return by asking the right questions.

Instead of predicting where EPS will be next quarter try figure out if ROIC will improve. You can correctly predicted EPS yet fail to be rewarded. Try asking what’s the cause of falling profit margin? Is it likely to be temporary or permanent? How about asset turnover?

Conclusion

ROIC is the main driver that determines the value of a company and ultimately its share price. EPS is important but it doesn’t tell you how efficiently the company utilizing its capital. Compare the return (ROIC) of a company with its cost of capital to determine if the company is creating or destroying value.

If premium has been built into the share price of high ROIC stocks, it is unlikely you will earn above- average return. The key is to find stocks that have been mispriced by the market. By spending your time to understand how ROIC will change over time can improve your chances of earning asymmetrical return.

https://www.facebook.com/Malaysiacontrarian/

More articles on Intelligent Investing

Discussions

We should focus on what the market wants, not what we want. Ultimately, the market is the one that determine how much the stocks we hold should be priced. If market likes EPS, focus on EPS. If market likes ROIC, focus on ROIC

2016-04-26 12:57

3 kinds of participants

long term guys, portfolio guys.....and the rest of us.

the rest of us...meaning 99% of participants are traders. holding a share for 1 or 2 quarters is still a trader, 1 or 2 years is still a trader.

a long term investor such as a director has his fortunes tied to the company for the long haul that can measure a decade or so.

2016-04-26 12:59

to be a super investor, you have to sailang, to go all in , margin, sell house sell underwear, when you have done your home work and a strong opinion.

how many can be a super investor?

2016-04-26 13:09

ROIC and all the other 20 formulas are for kiasu investors who will never be super investor

kiasu investors look for 20 formulas to built their moats, these are conservative investors who does have what it takes to be a super investor.

2016-04-26 13:24

Soros keep pushing his assistant to increase his bet size after they both agreed the analysis is the correct analysis.

that is how to become a super investor.

if you listen to KYY talk, his formula cannot be simpler.

but how many have what it takes to be a super investor?

2016-04-26 13:54

Glad to know you are shifting your focus from ROE Ricky...

the trick to know what matters - is to identify where are the causes and the effects..

ROIC is one step closer to the Cause than the 'apparent effects' we see on ROE simply due to the Financing structure - D/E ratio...

now you should know that you can also start dissecting ROIC = NPM X TAT... TAT = Revenue over Invested Capital

The great thing about ROIC is that it combines the Revenue one may achieve compromising on Margin, while ensuring the bottom line - How much you make per unit time per unit invested capital.... - the true 'efficiency'.

2016-04-26 14:01

ratios are for managing a great company.

Du Pont ratio eg , is a great tool .

for investors, they are concerned with strategic issues, with big picture considerations, with the factor X ( the unknown and unknowable factors about the company's future and prospects).............

also helps explain why there is a wide range of PE ratios and ROIC for investors to choose from.

2016-04-26 14:12

Probability I still look at both but yea ROE can be distorted by leverage or large sum of cash for example

2016-04-26 14:18

If I am not mistaken, some of the main content of this article are from Valuation. A book that every value investor should read.

2016-04-26 14:35

ricky....you still have to link ROIC to the price you pay......how do you link these 2 together?

2016-04-26 15:09

Not considering debt and Excess Cash available, its simply P/IC...

People talk about P/B ratio being below 1.5 as a quick rule of thumb...however I am more keen to ensure the Price to IC does not exceed a certain value where I would get heavy damage when the ROIC reverts to 'mean', i.e the average Cost of Capital - unless it has Moats. You need to ensure your cash yield (or at the least NOPAT / P)would still be above FD rate when the ROIC becomes say 10%.

For Net Cash company , quick rule would be NOPAT / EV

For Net Debt company , quick rule would be E / P

the above has flaws...as in reality Net Cash are not paid out as Dividends or used for Buya backs...and they are all not considering the growth factor (delta-IC/IC) and the sustainability of ROIC.

2016-04-26 15:21

Good article, can you come up a suggested co list that follows roic criteria?

2016-04-26 17:41

stockmanmy

Whether it is ROIC and EPs....both come from sales and profits.

get sales and profits wrong, every thing go wrong.

2016-04-26 12:54