Mplus Market Pulse - 17 Nov 2020

MalaccaSecurities

Publish date: Tue, 17 Nov 2020, 09:58 AM

Market Review

Malaysia: The FBM KLCI (+0.6%) climbed in tandem with its regional peers on the positive market sentiment following Asia Pacific nations signing the Regional Comprehensive Economic Partnership (RCEP). The lower liners finished higher while the broader market ended mixed.

Global markets: The US stockmarkets started the week on a positive note as the Dow (+1.6%) and S&P 500 (+1.2%) both hit new record highs, spurred by Moderna’s near 95% effective Covid-19 vaccine news. Both the European and Asia stockmarkets also closed in green.

The Day Ahead

It was another firm performance on the local bourse, despite a choppy trading session yesterday. We reckon that gains would likely to extend for the FBM KLCI to power beyond the 1,600 psychological level owing to the positive progress over the Covid-19 vaccine development from Moderna. At the same time, gains will be backed by the positive momentum on Wall Street overnight, coupled with expectations that the economy will continue to deliver a quicker-than-expected recovery. We also think that the lower liners may continue their upbeat momentum, spurred by the liquidity driven market.

Sector focus: The Regional Comprehensive Economic Partnership (RCEP) is expected to boost the transportation & logistics sector. We continue to favour the technology sector that remains on track for further upside owing to positive outlook, whilst the energy sector may take cue from the higher crude oil prices.

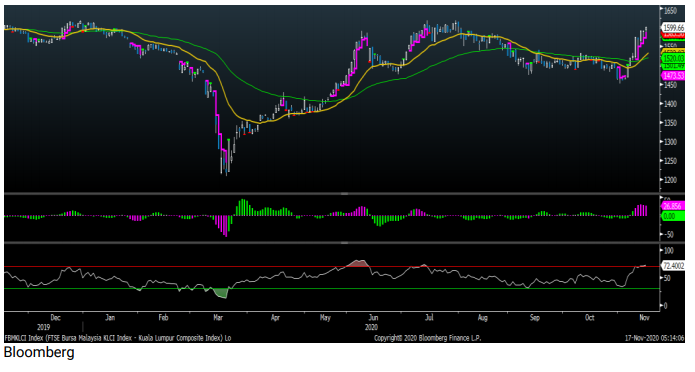

FBMKLCI Technical Outlook

The FBM KLCI remained upbeat as the key index formed another bullish candle to close at 3 months high. Amid the increasingly toppish momentum, we reckon that a pullback is due with immediate support at 1,540, followed by 1,520. Additional upsides, if any will be capped towards the immediate resistances at 1,600-1,615. Indicators remained positive as the MACD Histogram has extended another green bar, while the RSI is slightly overbought

Company Brief

Dialog Group Bhd’s 1QFY21 net profit slipped 10.9% YoY to RM146.6m on weaker topline contribution. Revenue for the quarter declined 48.6% YoY to RM331.7m. (The Star)

Sapura Energy Bhd units have secured contracts totalling RM611.0m for engineering and construction and drilling in Qatar, off Malaysia and Thailand, and Congo. The works are expected to be completed between 4QFY21 to 3QFY22. (The Star)

Top Glove Corp Bhd is seeking clarification over the Enhanced Movement Control Order (EMCO) placed on its foreign workers dormitory in Meru, Klang. Senior Minister (Security Cluster) Datuk Seri Ismail Sabri Yaakob was reported to have said that the dormitory in question would be placed under an EMCO from 17th November 2020 to 30th November 2020, after 215 Covid-19 cases were reported there. Approximately 13,190 staff and some 1,200 residents in the area will be impacted by the move. (The Edge)

Lii Hen Industries Bhd’s 3QFY20 net profit rose 32.2% YoY to RM28.9m as it saw higher demand for most of its products, boosted by a slightly better conversion rate of the US Dollar against the Ringgit. Revenue for the quarter rose 42.2% YoY to RM302.1m. A third interim dividend of 5 sen per share, payable on 18th December 2020 was declared. (The Edge)

MSM Malaysia Holdings Bhd’s 3QFY20 net loss narrowed to RM71.2m, from a net loss of RM185.1m recorded in the previous corresponding quarter, thanks to improved sales margin and new export products. Revenue for the quarter improved 11.8% YoY to RM594.6m. (The Edge)

MMAG Holdings Bhd acquired an 80.0% stake in chartered flight company JT Aerotech Solutions Sdn Bhd for RM21.4m cash. The acquisition will allow MMAG to complete its supply chain with first mile, middle mile and last-mile delivery to be the nation’s first local full-fledged integrated supply chain management company from the private sector with its own air cargo services. (The Edge)

IOI Corp Bhd’s 1QFY21 net profit increase 86.5% YoY to RM277.9m, on higher crude palm oil and palm kernel prices. Revenue for the quarter grew 39.5% YoY to RM2.48bn. (The Edge)

KKB Engineering Bhd’s 3QFY20 net profit declined 42.9% YoY to RM11.0m, on slower site work activities. Revenue for the quarter decreased 28.8% YoY to RM117.8m. (The Edge)

FGV Holdings Bhd plan to collaborate to internationalise palm oil futures with the Dalian Commodity Exchange has fallen through after two years. The MoU signed between the two expired on 14th November 2020. (The Edge)

Yi-Lai Bhd has appointed former chief secretary to the government Tan Sri Dr Ali Hamsa as an Independent Non-Executive Director on its board. He last served as the 13th Chief Secretary to the Government of Malaysia from 24th June 2012 until 28th August 2018. (The Edge)

Revenue Group Bhd has secured a contract to develop and implement the MyDebit tokenisation platform (TSP) for Payments Network Malaysia Sdn Bhd (PayNet), the national payments network and central infrastructure for Malaysia's financial markets. The platform will be integrated with and used by more than 30 banks throughout Malaysia upon completion. (The Edge)

Source: Mplus Research - 17 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-18

TOPGLOV2024-11-17

SAPNRG2024-11-15

IOICORP2024-11-15

IOICORP2024-11-15

IOICORP2024-11-15

IOICORP2024-11-14

IOICORP2024-11-14

IOICORP2024-11-14

IOICORP2024-11-14

TOPGLOV2024-11-13

IOICORP2024-11-13

IOICORP2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

TOPGLOV2024-11-12

DIALOG2024-11-12

FGV2024-11-12

IOICORP2024-11-12

IOICORP2024-11-12

IOICORP2024-11-12

KKB2024-11-12

KKB2024-11-11

TOPGLOV2024-11-11

TOPGLOV2024-11-09

IOICORP2024-11-08

FGV2024-11-08

FGV2024-11-08

FGV2024-11-08

IOICORP2024-11-08

IOICORP2024-11-08

KKB2024-11-08

KKB2024-11-08

KKB2024-11-08

KKB2024-11-08

TOPGLOV2024-11-08

TOPGLOV2024-11-07

FGV2024-11-07

IOICORP2024-11-07

IOICORP2024-11-07

IOICORP2024-11-07

KKB2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-06

IOICORP2024-11-06

IOICORP2024-11-06

IOICORP2024-11-06

IOICORP2024-11-06

IOICORP2024-11-06

IOICORP2024-11-06

IOICORP2024-11-06

LIIHEN2024-11-06

TOPGLOV2024-11-06

TOPGLOV2024-11-05

IOICORP2024-11-05

IOICORP2024-11-05

IOICORP2024-11-05

REVENUE2024-11-05

REVENUE2024-11-05

REVENUE2024-11-05

REVENUE2024-11-05

REVENUEMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024