Mplus Market Pulse - 18 Mar 2022

MalaccaSecurities

Publish date: Fri, 18 Mar 2022, 08:55 AM

Rebound may extend above 1,600

Market Review

Malaysia:. The FBM KLCI (+1.2%) climbed as rallies gained momentum amid fading concerns over Russia-Ukraine conflict and investors brushed off the hawkish tone from the US Federal Reserve. The lower liners ended higher, while the plantation sector was the only laggard on the positive broader market.

Global markets:. Wall Street ended on a positive note as the Dow (+1.2%) for the third straight session as the US Fed’s decision was broadly in line with the market’s expectation. The European markets finished mixed, while the Asia stockmarkets were mostly higher.

The Day Ahead

The FBM KLCI notched higher as positive sentiment spilt over from the regional market after authorities from China and the US signalled cooperation plan on US listed Chinese stocks and fading concerns over the Russia-Ukraine conflicts lifted the overall sentiment. We expect investors may continue the bargain hunting mode given the extended gains on Wall Street. Nevertheless, traders should remain cautious given the geopolitical risk between Ukraine and Russia still persists. Commodity wise, Brent oil price is hovering above USD100 per barrel mark, while the CPO price has declined below RM6,000.

Sector focus:. With the energy price climbing above USD100 per barrel mark again, we believe traders will put the O&G sectors on the radar. Besides, investors may favour the banking stocks under the anticipated interest rate hike environment and recovery economic activities moving forward.

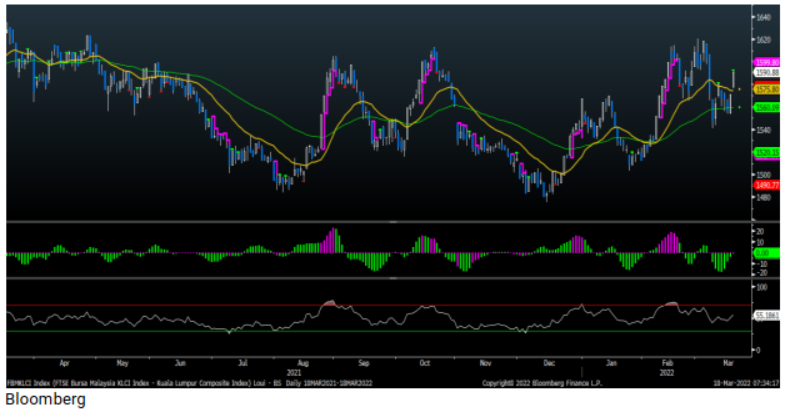

FBMKLCI Technical Outlook

The FBM KLCI surged and closed above the daily EMA9 level and the immediate resistance at 1,580. Technical indicators turned positive as the MACD Histogram located at the zero level, while the RSI climbed above 50. The next resistance is pegged around 1,600-1,620, while the support is located at 1,550.

Company Brief

Cahya Mata Sarawak Bhd (CMS) is venturing into the energy sector via the acquisition of Scomi Energy Services Bhd’s oilfield operations for RM21.0m. CMS has, through two of its subsidiaries Cahya Mata Oiltools Sdn Bhd and Oiltools International Sdn Bhd, entered into four conditional sale and purchase agreements with Scomi Energy to acquire Scomi Oilfield Ltd together with various companies and assets within the Scomi Oilfield Group of Companies. (The Star)

Padini Holdings Bhd has signed a memorandum of understanding with XTS Technologies Sdn Bhd and Huawei Technologies (M) Sdn Bhd for a warehouse automation solution using automated guided vehicles (AGVs) valued at RM1.0m. (The Star)

Eco World Development Group Bhd's (EcoWorld) 1QFY22 net profit rose 1.5% YoY to RM63.4m, thanks to cost savings on completed and near completion phases. Revenue for the quarter climbed 5.1% YoY to RM533.4m. (The Edge)

Gas Malaysia Bhd has declared a final dividend of 6.87 sen per share for FY21, payable on 27th July 2022. (The Edge)

Electronics manufacturing services (EMS) provider SKP Resources Bhd has appointed TÜV Rheinland Malaysia Sdn Bhd to conduct an independent third-party social compliance audit of its labour practices and operations. The audit will begin in April 2022 and is expected to be completed within two months. (The Edge)

Healthcare service provider LYC Healthcare Bhd has incorporated a wholly-owned subsidiary known as LYC Beauty & Wellness Sdn Bhd, which will offer cosmetics, personal care and wellness related products and services. (The Edge)

Construction and property development firm Vizione Holdings Bhd and China's Hubei Wuqiao Geotechnical Engineering Co Ltd (HWGE) plan to explore building materials trading and dealership opportunities in Malaysia. Vizione has entered into a Memorandum of Understanding (MoU) with HWGE to explore cooperation in the potential venture. (The Edge)

Sapura Energy Bhd said three more of its subsidiaries- Sapura Fabrication Sdn Bhd, Sapura Offshore Sdn Bhd, and Sapura Project Services Sdn Bhd have been served with winding-up petitions on 7th and 9th March 2022, due to non-payment of outstanding sums. (The Edge)

Allianz Malaysia Bhd has appointed Anusha Thavarajah, the regional chief executive officer (CEO) for Allianz Asia Pacific, as the group's non-independent and non-executive director, effective Thursday. (The Edge)

Sarawak Consolidated Industries Bhd (SCIB) has appointed Shamsul Anuar Ahamad Ibrahim, Ku Chong Hong and Noor Azri Azerai as independent directors on its board. Noor Azri is currently an executive director (ED) in Bintai Kinden Corp Bhd and Malaysian Genomics Resource Centre Bhd (MGRC), as well as an independent non-executive director in Serba Dinamik Holdings Bhd and NWP Holdings Bhd. Ku is also an ED at Bintai Kinden, and sits on the boards of MGRC and NWP as an independent non-executive director. As for Shamsul Anuar, he is currently serving as group corporate affairs, general manager of Permodalan ASSAR Sdn Bhd, the holding company of Amanah Saham Sarawak Bhd. (The Edge)

Source: Mplus Research - 18 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

PADINI2024-11-17

SAPNRG2024-11-16

BINTAI2024-11-16

ECOWLD2024-11-15

CMSB2024-11-15

PADINI2024-11-14

SKPRES2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-12

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-07

ECOWLD2024-11-07

SCIB2024-11-07

SCIB2024-11-06

ALLIANZ2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

VIZIONEMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024