Mplus Market Pulse - 7 Apr 2022

MalaccaSecurities

Publish date: Thu, 07 Apr 2022, 09:04 AM

Re-capturing 1,600

Market Review

Malaysia:. The FBM KLCI (+0.5%) bucked the regional market weakness to climb above the 1,600 level, boosted by gains in selected plantation, energy and banking heavyweights yesterday. The lower liners extended their gains, while broader market ended mostly positive, anchored by the plantation sector (+1.8%).

Global markets:. Wall Street remained downbeat as the Dow (-0.4%) fell following the hawkish remarks from the US Federal Reserve minutes meeting that is pointing to a more aggressive stance towards interest rate hikes. The European stock markets also closed in the red, while Asia stock markets ended mostly negative.

The Day Ahead

The FBM KLCI bucked the regional downtrend as bargain hunting activities in selected plantation, energy, and banking stocks lifted the key index. Given the negative performance on the Wall Street, we expect some profit taking activities may emerge on the local front, especially on the technology stocks. Also, the crude oil price dipped, trading around the USD101 per barrel mark after the members of International Energy Agency (IEA) agreed to release oil from their emergency reserves. For the FCPO, the price continued to hold above RM5,900.

Sector focus:. We might see a pullback in O&G sector following the retracement in oil price. Meanwhile, traders might avoid technology stock in view of the more hawkish environment going forward. Nevertheless, we expect the recovery-themed sectors to remain positive amid the recovery in economic activities following the reopening of borders. Also, traders might look into the construction and building materials sectors, positioning themselves ahead of the election.

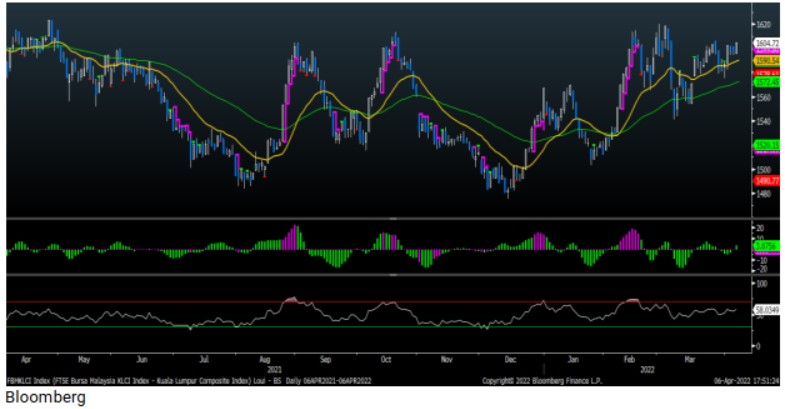

FBMKLCI Technical Outlook

The FBM KLCI remained above the daily EMA9 level as the key index bounced back above the key 1,600 level, snapping the two-session losing streak. Technical indicators are positive with the Histogram turned positive, while the RSI is hovering above the 50 level. Resistance is now set at 1,620, while the support is pegged around 1,580, followed by 1,555.

Company Brief

Tafi Industries Bhd has secured a RM9.5m construction contract from Alpha Asset Sdn Bhd. TAFI said its wholly owned unit, TAFI Home & Office Sdn Bhd secured the contract for construction and completion of a unit single storey factory and warehouse, together with two-storey office building at Telok Panglima Garang, Selangor. The contract duration is 12 months from 7th April 2022 to 6th April 2023. (The Star)

Kerjaya Prospek Group Bhd has secured an RM265.0m contract to undertake main building work for a proposed development project located at Kawasan Terbusguna Tanah Seri Tanjung Pinang (Phase 2A) in Penang. The contract was awarded by Eastern & Oriental Bhd's indirect subsidiary Persada Mentari Sdn Bhd. The project comprises two blocks of apartments, housing a total of 1,020 units, a basement car park, a four-storey car park and two storeys of commercial units. (The Edge)

Transocean Holdings Bhd has been slapped with an unusual market activity query by Bursa Malaysia following a recent sharp rise in its share price and trading volume. Bursa queried whether there was any corporate development, rumour or report relating to the group’s business and affairs, or any other possible explanation that may account for the unusual trading activity. (The Edge)

Ocean Vantage Holdings Bhd's wholly-owned unit Ocean Vantage Engineering Sdn Bhd has clinched an RM71.3m contract to provide civil, building and piling works for a new onshore gas plant in Sarawak, owned by Petronas. The contract for the additional gas sales facilities 2 in Bintulu was awarded by Petrofac Engineering Services (Malaysia) Sdn Bhd. (The Edge)

Capital A Bhd has filed motions for leave to appeal to the Federal Court against the dismissal of its bids to strike out a suit filed by a Malaysia Airports Holdings Bhd (MAHB) unit over outstanding passenger service charges, as well as the summary judgment granted to the MAHB unit in the case. Its three appeals to strike out the original suit filed by Malaysia Airports Sepang Sdn Bhd (MASSB) together with its appeals against the summary judgment the High Court granted to MASSB for a total of RM41.6m against AirAsia Bhd and AirAsia X Bhd, were dismissed by the Court of Appeal on 3rd March 2022. (The Edge)

Trading in the shares of LTKM Bhd will be suspended on 7th & 8th April 2022, pending a material announcement. LTKM is principally involved in poultry farming and is one of the leading egg producers in the country, with a fully integrated poultry farming operation involving feed processing, production of eggs, processing and trading of organic fertilisers. (The Edge)

Public Packages Holdings Bhd has proposed a bonus issue of up to 75.6m shares on the basis of 2 bonus shares for every 5 shares held. The entitlement date will be determined after all approvals for the bonus issue are obtained. (The Edge)

Source: Mplus Research - 7 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

AIRPORT2024-11-17

CAPITALA2024-11-16

AAX2024-11-15

AIRPORT2024-11-14

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-11

CAPITALA2024-11-11

CAPITALA2024-11-11

KERJAYA2024-11-07

KERJAYA2024-11-07

KERJAYA2024-11-06

KERJAYA2024-11-05

AIRPORT2024-11-05

AIRPORT2024-11-05

KERJAYAMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024