Mplus Market Pulse - 8 Apr 2022

MalaccaSecurities

Publish date: Fri, 08 Apr 2022, 09:11 AM

Defending the 1,600 level

Market Review

Malaysia:. The FBM KLCI (-0.2%) edged slightly lower after trading in a lacklustre manner with more than half of the key index components ended in the red yesterday. The lower liners also staged a pullback, while only the plantation (+0.2%) and property (+0.02%) sectors outperformed in the broader market.

Global markets:. Wall Street rebounded from their intraday lows to close mildly higher as the Dow (+0.3%) rose, boosted by strong labour data after unemployment benefits claims fell to 166,000 last week. The European stock markets, however, extended their slide, while Asia stock markets were pained in red.

The Day Ahead

The FBM KLCI shed gains in tandem with regional peers after the US Federal Reserve meeting minutes put investors’ focus on the possibility of more aggressive US interest rate hikes. Still, we expect the local bourse to trade in a consolidation mode as investors mulled over the US hawkish stance as well as the Russia sanction. Nevertheless, we believe the downside risk may be cushioned by the recovery in business activities. Commodities wise, both the crude oil and CPO were traded lower, hovering above USD100 and RM5,800 respectively.

Sector focus:. Given the elevated crude oil and FCPO prices, we expect Investors to favour plantation and selected O&G counters over the near term until the May reporting season. Meanwhile, we remain optimistic on the recovery-themed sectors as well as the construction and building material segments as traders may position themselves ahead of the GE15 albeit the timeline is still unclear.

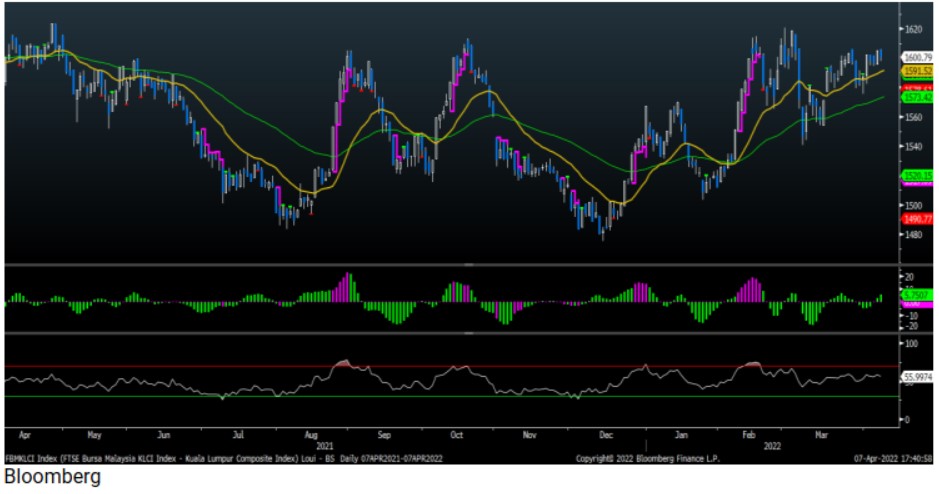

FBMKLCI Technical Outlook

The FBM KLCI staged a mild pullback but managed to hold above the daily EMA 9 level. Technical indicators were positive as the MACD Histogram is above the zero line, while the RSI hovered above 50. Resistance is envisaged at 1,620, while the support is set around 1,580, followed by 1,555.

Company Brief

Central Global Bhd’s wholly-owned subsidiary, Central Global Construction Sdn Bhd (CG Construction) has secured a RM26.0m construction contract in Labuan from Mewajadi Sdn Bhd for the supply of labour, materials, machinery, tools and equipment for a project involving the construction of quarters for students and staff for Institut Latihan Perindustrian (ILP) in Labuan, Sabah. The contract stipulated 8th March 2022 as the commencement date and 2nd September 2024 as the completion date. (The Star)

TDM Bhd’s unit, Kumpulan Medic Iman Sdn Bhd (KMI) has entered into a heads of agreement with Mutiara Premier Sdn Bhd (MPSB) to build and lease a specialist hospital building in Kota Bharu, Kelantan. MPSB shall fund the development of the proposed project which is indicative to be at a gross development cost of RM129.4m for Phase 1 development only. The construction is expected to be completed within 30 months from the date on which the last of the condition precedent is fulfilled. (The Star)

Pekat Group Bhd has secured a contract worth RM38.3m to develop a large-scale solar photovoltaic (PV) farm from Sun Estates Sdn Bhd. Sun Estates has also inked a 2-year contract with Pekat for the maintenance of the solar PV farm, which is expected to be commissioned in December 2023. (The Edge)

Transocean Holdings Bhd, in response to an unusual market activity query from Bursa Malaysia, has reported that a major shareholder had explored proposals that could facilitate the drive of its business segments. However, the group discussions were still preliminary and the major shareholder had decided not to proceed further with any of the proposals for the time being. (The Edge)

Diversified Gateway Solutions Bhd (DGSB) will operate under the name of Divfex Bhd from 11th April 2022. Accordingly, its current stock short name DGSB will be changed to DFX, while its stock number remains unchanged. The name change was to better reflect the group’s move to refocus on its ICT business and future undertakings. (The Edge)

Unisem (M) Bhd has proposed the disposal of its land and building in Batam city in Indonesia’s Riau province for US$34.0m (RM143.3m). The group indirect subsidiary, PT Unisem, is selling the assets to PT Infineon Technologies Batam, with the proceeds to be used to fund Unisem’s operations in the form of working capital and capital expenditure. (The Edge)

Bursa Securities has rejected an application by Practice Note 17 (PN17) company Brahim’s Holdings Bhd for a time extension to submit its regularisation plan. Following the rejection by the stock exchange operator, shares of the airline caterer will be suspended from trading effective 15th April 2022 and the shares will be de listed on 20th April 2022, unless an appeal against delisting is submitted to Bursa by 14th April 2022. (The Edge)

Hong Seng Consolidated Bhd has entered into a collaboration agreement with a molecular diagnostics provider for the provisioning of healthcare products and services. Hong Seng’s wholly-owned subsidiary HS Bio Sdn Bhd is teaming up with Mediven Innovation Ventures Sdn Bhd to expand their respective coverage in the healthcare sector by leveraging on each other’s strengths, skills, expertise, network and capabilities. (The Edge)

KLCC Urusharta Sdn Bhd has awarded an RM2.6m contract to Bintai Kinden Corp Bhd's wholly-owned subsidiary Kejuruteraan Bintai Kindenko Sdn Bhd (KBK) to undertake mechanical and electrical work involving the replacement of the existing transformer at Tower 2 of the Petronas Twin Towers with a new one. (The Edge)

Public Bank Bhd (PBB) has issued the 8th tranche of the subordinated medium term notes (Sub-Notes) programme amounting to RM2.00bn yesterday. The issuance has a coupon/interest rate of 3.9% pa. and tenure of 10 years, and non callable for 5 years. (The Edge)

Caely Holdings Bhd has appointed Virdos Lima Consultancy (M) Sdn Bhd as its independent forensic auditor to look into allegations of suspicious and irregular transactions at its wholly-owned subsidiary Caely (M) Sdn Bhd (CMSB). Caely, however, did not disclose any other information regarding the allegations. (The Edge)

Source: Mplus Research - 8 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

UNISEM2024-11-16

BINTAI2024-11-15

CGB2024-11-15

DFX2024-11-15

PBBANK2024-11-15

PBBANK2024-11-15

PBBANK2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-14

PBBANK2024-11-13

PBBANK2024-11-13

UNISEM2024-11-13

UNISEM2024-11-12

PBBANK2024-11-11

PBBANK2024-11-11

PBBANK2024-11-11

PBBANK2024-11-08

PBBANK2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

PBBANK2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAIMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024