Mplus Market Pulse - 9 Mar 2023

MalaccaSecurities

Publish date: Thu, 09 Mar 2023, 09:05 AM

All eyes onto Bank Negara OPR decision

Market Review

Malaysia:. The FBM KLCI (-0.3%) pared off some of its previous session gains, spooked by the weakness on Wall Street overnight. The lower liners also edged lower, while the telecommunications & media sector (+2.7%) outperformed the mostly negative sectorial peers.

Global markets:. Wall Street closed mixed as Dow (-0.2%) remained in red as the stronger-than-expected payrolls data signals that the higher interest rate environment may prolong, but the S&P 500 (+0.1%) and Nasdaq (+0.01%) rebounded. The European stockmarkets closed mostly higher.

The Day Ahead

The FBM KLCI surrendered yesterday’s gains in line with the regional markets’ movements as investors digested the hawkish comments from the US Fed Chair during the congressional testimony. On Wall Street, we believe it might consolidate over the near term ahead of the CPI data that will be released next week, as this might dictate the interest rate direction going forward. The local bourse may remain sideways amid growing selling pressure from the foreign funds, while awaiting the OPR decision by BNM today. Commodities wise, the Brent crude oil traded below USD83, while the CPO is hovering above RM4,150.

Sector focus:. Given the elevated CPO and Brent oil price, we expect the trading interest to pick up within the O&G and plantation sectors. Meanwhile, investors may position themselves in the banking sector prior to the MPC meeting. With the rebound in Nasdaq, bargain hunting activities may emerge within the tech sector.

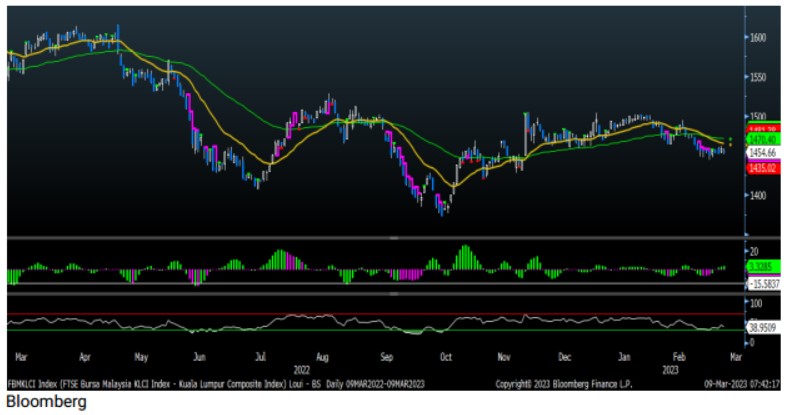

FBMKLCI Technical Outlook

The FBM KLCI retreated to close below its daily EMA9 level. Technical indicators remained mixed as the MACD Histogram extended a positive bar, while the RSI is hovering below zero. The support is located along 1,430-1,450, while the resistance is envisaged along 1,500-1,510.

Company Brief

KESM Industries Bhd’s 2QFY23 net loss narrowed to -RM720,000, from a net loss of -RM1.0m recorded in the previous corresponding quarter as new chips required for EV called for vigorous tests and certifications of new testers. Revenue for the quarter, however, fell 13.1% YoY to RM55.9m. (The Star)

Bursa Malaysia Securities Bhd has issued an unusual market activity (UMA) query to Computer Forms (M) Bhd following a sharp fall in its share price. The counter tumbled 29.7% to RM1.49 with 2.6m shares traded. Computer Forms has been asked to disclose any corporate development relating to its business and affairs that has not been previously announced that may account for the trading activity, including those in the stage of negotiations or discussions. (The Star)

Magni-Tech Industries Bhd’s 3QFY23 net profit fell 23.1% YoY to RM20.5m, due to lower contributions from its garment and packaging segments. Revenue for the quarter declined 9.9% YoY to RM281.8m. A third interim dividend of 2.0 sen per share, payable on 12th April 2023 was declared. (The Edge)

Bermaz Auto Bhd expects its order backlog of some 7,000 vehicles to provide earnings support in FY23. About 3,000 of those units are booked under the automotive sales and service tax (SST) exemption. (The Edge)

UEM Sunrise Bhd received a lawsuit from Nipponkey Sdn Bhd dated 2nd March 2023 due to several alleged breach of agreements. The three agreements include a sale and purchase agreement in Kuala Lumpur, 2 disposal and land transfer agreements in Tanjung Kupang, Johor Bahru and another 12 disposal and land transfer agreements in the same area in Johor Bahru. (The Edge)

The High Court on 8th March 2023 granted Sapura Energy Bhd and its 22 subsidiaries fresh orders to hold court-convened meetings with creditors within three months. The court also allowed a 3-month restraining order on the creditors. Both orders granted by Judge Atan Mustaffa Yussof Ahmad are effective from 11th March 2023. (The Edge)

Sunview Group Bhd through its wholly-owned subsidiary Fabulous Sunview Sdn Bhd, has formed a strategic business alliance agreement with Kulim Technology Park Corp Bhd. The agreement pertains to promoting and developing potential rooftop and large-scale solar photovoltaic (PV) projects in Kulim Hi-Tech Park (KHTP) for 2 years from 8th March 2023. The group will also be placing 2 electric vehicle charging stations at KHTP Business Car Park and Sunview’s signage on the rooftop of KHTP Business Centre building. (The Edge)

Pekat Group Bhd wholly-owned unit Solaroo RE Sdn Bhd has surrendered its money lending licence in view that the prospective money lending business is no longer feasible. This is due to a change in the group’s business strategy. The licence is revoked with effect from 1st February 2023. (The Edge)

Bursa Malaysia Securities has publicly reprimanded Toyo Ventures Holdings Bhd over the company’s decision to withdraw its final dividend for FY21, 2 months after proposing it. Paragraph 8.26(1) of the Main LR (Main Market Listing Requirements) expressly states that once the dividend had been declared or proposed, a listed issuer must not make any subsequent alteration to the dividend entitlement. (The Edge)

The Royal Malaysia Police has launched an investigation into businessman Victor Chin Boon Long’s alleged involvement in misappropriating RM30.7m in Caely (M) Sdn Bhd, a subsidiary of Caely Holdings Bhd which is now known as Classita Holdings Bhd. This follows a media report alleging Chin as making use of enforcement authorities in taking control over Malaysian corporations. The case is being investigated under Section 409 of the Penal Code, which is criminal breach of trust by agents. (The Edge)

Source: Mplus Research - 9 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

BAUTO2024-11-15

CFM2024-11-15

CFM2024-11-15

CFM2024-11-15

CFM2024-11-15

MAGNI2024-11-15

MAGNI2024-11-15

MAGNI2024-11-15

SAPNRG2024-11-15

UEMS2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-12

UEMS2024-11-11

MAGNI2024-11-11

SUNVIEW2024-11-08

BAUTO2024-11-08

BAUTOMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024