Mplus Market Pulse - 24 Oct 2023

MalaccaSecurities

Publish date: Tue, 24 Oct 2023, 09:08 AM

Downside Move Persisted

Market Review

Malaysia: The FBM KLCI (-0.20%) closed lower for the third session as investors remained cautious of the elevated US Treasury Yields and worsening geopolitical tension. On the broader market, the Energy Sector (-1.49%) despite the firm Brent oil prices, while the Telco & Media sector (-1.49%) declined.

Global markets: Wall Street ended mostly lower as the 10-year US Treasury yields briefly surpassing 5% for in 16 years; the Dow and S&P500 extended another negative bar, but Nasdaq rebounded mildly. The European markets traded mixed, while overall Asian stock markets declined.

The Day Ahead

The local exchange remained challenging with the selling pressure extending for the fourth session, but the FBM KLCI was still supported above the 1,430. Given the elevated US Treasury yields, coupled with the ongoing geopolitical tension in the Middle East, Wall Street ended mostly lower. We believe the traders will stay cautious and shift their focus on this eventful earnings week where the mega cap corporations such as Microsoft, Alphabet, Meta and Amazon will be announcing their results. Should these results beat estimates, buying support may emerge and put a pause to the recent selling tone. Commodities wise, the Brent crude oil declined further below USD91/bbl, while the CPO traded below RM3,800/MT.

Sector focus: We think the buying interest may emerge within the Technology sector, taking cue from Nasdaq overnight; rebounding for the first time after 4 losing streaks ahead of mega cap’s earnings. Also, we expect follow-through buying support within the Construction and Property sectors as HSSEB and IOIPG have rebounded significantly for the session.

FBMKLCI Technical Outlook

The FBM KLCI ended lower, but maintaining above the 1,430 level. The technical readings on the key index were negative with the MACD Histogram forming a rounding top formation, and the RSI is slightly below 50. The resistance is envisaged around 1,450-1,460 and the support is located around 1,420-1,430.

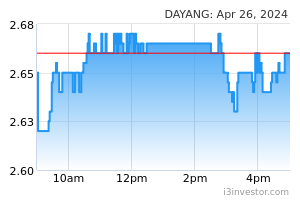

Company Brief

Dayang Enterprise Holdings Bhd said the scope of its contract to provide Petronas Carigali Sdn Bhd offshore maintenance, construction and modification (MCM) services has been expanded to cover the Sarawak Gas Area. The duration for the scope expansion is from June 22, 2023 till Dec 31, 2023. The value of the contract is based on work orders issued by Petroliam Nasional Bhd (Petronas), which wholly owns Petronas Carigali, throughout the contract duration. (The Edge)

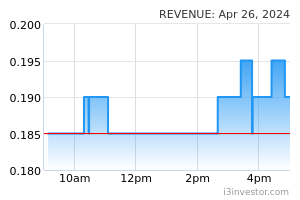

Revenue Group Bhd said its unit has received approval from the Local Government Development Ministry for an online money lending licence. With this newly acquired licence, its wholly-owned Revenue Harvest Sdn Bhd is poised to provide innovative e-lending services customised to meet the evolving needs of Malaysian businesses.The new licence is effective Oct 12, 2023 until March 31, 2025 and is renewable every two years. (The Edge)

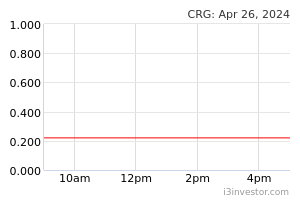

Fashion group Carlo Rino Group Bhd (CRG), which is in the process of transferring its listing from the Leading Entrepreneur Accelerator Platform (LEAP) Market to the ACE Market on Bursa Malaysia, has adjusted its exit offer price from 23 sen to 22.5 sen. The exit offer price was adjusted after taking into consideration the interim single-tier dividend of half a sen per CRG share in respect of the financial year ending June 30, 2024, with the entitlement date on Sept 1, 2023, and paid by the company on Sept 15, 2023. The exit offer price refers to the price of CRG shares that has been set for the joint offerors intending to undertake a pre-conditional voluntary general offer to acquire the remaining 383.58m offer shares not held by them, representing 47.61% of the group’s total issued share capital as at Aug 11 (the latest practicable date). (The Edge)

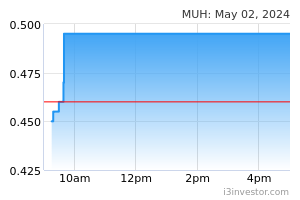

Multi-Usage Holdings Bhd (MUH) has once again received a qualified opinion from its external auditor for its latest financial statement, with regards to the group’s debt restructuring exercise in 2009. Messrs UHY said that except for the matter related to the debt restructuring, MUH’s financial statement for the year ended June 30, 2023 (FY2023) gives a “true and fair” view of its financial position, performance and cash flow. The debt restructuring in 2009 was meant to clear MUH and its subsidiaries’ debt worth RM36.13m by entering into a series of agreements with a special-purpose vehicle called Wealthy Achiever Sdn Bhd. (The Edge)

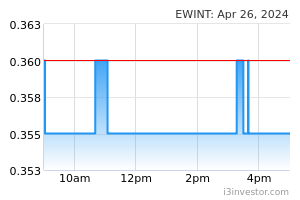

Datuk Heah Kok Boon has been appointed as a non-independent and non-executive director of Eco World International Bhd (EWI), replacing Datuk Chang Khim Wah, 59, who has resigned to focus on his executive role in Eco World Development Group Bhd, effective from Monday. Heah, 56, is currently the chief financial officer of EcoWorld and the alternate director to Tan Sri Liew Kee Sin, the executive chairman of Eco World Malaysia. (The Edge)

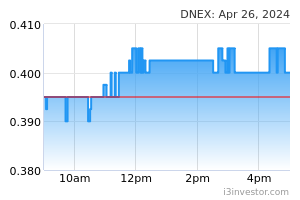

Dagang NeXchange Bhd (DNeX) is partnering with Zhongheguoji Construction Group Co Ltd (CSI) to access high tech IT solutions from China as well as to expand its geographical footprint into the Middle East and North Africa region. DNeX said it has entered into a joint venture agreement with CSI for the establishment of a joint venture enterprise to source for state-of-the-art technology and solutions from China. (The Edge)

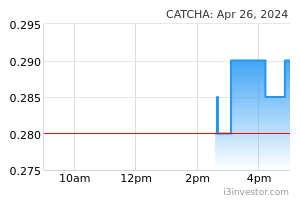

Catcha Digital Bhd has appointed Tan Guan Sheng, the founder of its recentlyacquired company Ittify Sdn Bhd, as its head of innovation. The appointment is in line with the group’s efforts to spearhead its artificial intelligence initiatives related to digital media. To recap, earlier this month, the group announced the acquisition of the remaining 49% equity interest in Ittify not already owned by the group for a cash consideration of RM3.43m. (The Edge)

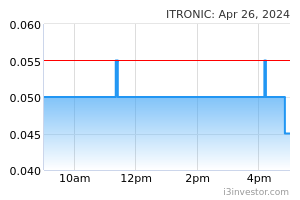

Industronics Bhd was Bursa Malaysia's 10th most briskly-traded stock on Monday, following news that it has inked a Memorandum of Agreement (MOA) with Echo Asia (Hong Kong) Ltd and CHEC Construction (M) Sdn Bhd to negotiate a proposed collaboration to construct an international duty-free city on Pulau Langkawi. The counter closed at 5 sen, up 1 sen or 25% from 4 sen last Friday, giving it a market capitalisation of RM35.38m. Earlier, the stock rose to as high as 5.5 sen, its highest level since May 3. (The Edge)

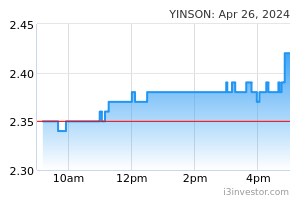

Yinson Holdings Bhd has inked a strategic partnership agreement with Selangor Information Technology and Digital Economy Corporation (Sidec) to implement and expand sustainable initiatives in Selangor. Yinson and Sidec said the collaboration will begin with the promotion of electric bikes and battery-swapping solutions offered through Yinson’s green technologies business unit, Yinson GreenTech. (The Edge)

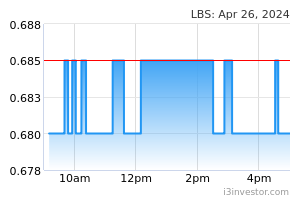

MGB Bhd, a construction and property development arm of LBS Bina Group Bhd, has signed a tripartite Memorandum of Understanding (MOU) with Saudi Arabia-based parties to explore cooperation and investment opportunities in Almadina Almonawara (Madinah). MGB said it signed the MOU with Almqr Development Co and Saudi Arabia developer Alameriah Real Estate Development Company. (The Edge)

Source: Mplus Research - 24 Oct 2023

Related Stocks

Market Buzz

2025-01-22

DNEX2025-01-22

LBS2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-21

DAYANG2025-01-21

DAYANG2025-01-21

YINSON2025-01-21

YINSON2025-01-21

YINSON2025-01-21

YINSON2025-01-21

YINSON2025-01-20

CATCHA2025-01-20

CATCHA2025-01-20

CATCHA2025-01-20

CATCHA2025-01-20

CATCHA2025-01-20

CATCHA2025-01-20

ITRONIC2025-01-20

YINSON2025-01-20

YINSON2025-01-20

YINSON2025-01-20

YINSON2025-01-17

CATCHA2025-01-17

CATCHA2025-01-17

CATCHA2025-01-17

CATCHA2025-01-17

CATCHA2025-01-17

DAYANG2025-01-17

LBS2025-01-17

LBS2025-01-17

YINSON2025-01-17

YINSON2025-01-17

YINSON2025-01-16

CATCHA2025-01-16

CATCHA2025-01-16

CATCHA2025-01-16

CATCHA2025-01-16

CATCHA2025-01-16

DAYANG2025-01-16

YINSON2025-01-16

YINSON2025-01-16

YINSON2025-01-16

YINSON2025-01-16

YINSON2025-01-15

REVENUE2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-13

YINSON2025-01-13

YINSON2025-01-13

YINSON