(CHOIVO CAPITAL) LCTITAN (5284) – An Update on Naptha, Polyolefin & Butadiene Prices

Choivo Capital

Publish date: Mon, 19 Oct 2020, 09:49 PM

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) LCTITAN (5284) – An Update on Naptha, Polyolefin & Butadiene Prices

========================================================================

Well, since my last article on a call for LCTITAN on 26 September 2020, the share price of LCTITAN have increased from RM1.96 to RM2.51, a gain of RM0.55 or 28%. For those who have taken action the moment the summary was posted on I3, they would have been able to buy it at RM1.81, for a gain of RM0.70 or 38%.

Now, if you’ve read my article, you would know that the key to the explosive earnings for Q3 and Q4 lie mainly on 3 factors,

- Current and Future Naphtha Prices

- Current and Future Polyolefin & Butadiene Prices

- Sentiment and How much is priced in?

Lets look at each factor.

Current and Future Naphtha Prices

Since my article was written, Naphtha prices have increased slightly from USD353 to USD383. However, they have since gone on a downward trend.

Having said that, prices are still significantly lower than the 2016 averages (when they recorded all time high profits).

With that in mind, and coupled with Polyolefin and Butadiene prices holding steady or increasing since i last wrote (i will elaborate on this next), Q3 and Q4 are likely to record an explosive growth in earnings, the only question would be the quantum of the its profitability.

Studying the development in oil prices (which correlate tightly with Naphtha prices), its difficult to predict where prices would go in the next few months within 5% upwards or downwards.

Having said that, i think my thesis still stands.

Currently, demand for oil have fallen structurally by about 10-12% due to lower transportation and airlines still being unable to fly internationally.

Supply have also naturally fallen due to shale rigs in the US going bust, and most of the producers cutting productions to control prices. OPEC+ (actually just Russia and Saudi Arabia) have reiterated that their current production cuts (which should prevent oil prices from falling), but there are others like the US who are now restarting oil production.

In addition, they are countries like Kuwait, who rely very much on the sale of crude oil, to meet their national budgets.

The current oil crisis have resulted in a downgrade of Kuwait’s bonds, by Moody’s due to liquidity risk, and as of today, Kuwait are actually unable borrow money in the bond markets, and are forced to dip into their general reserves.

I imagine their current situation would mean that if prices every got a little higher, they would open the taps secretly to get some extra cash. This would apply to a lot of other oil producing countries. Malaysia for one is not cutting output.

If i have to make a guess, i think oil prices should remain range-bound, absent a resurgence in demand, something that looks quite unlikely in the next few months especially with COVID-19 cases increasing.

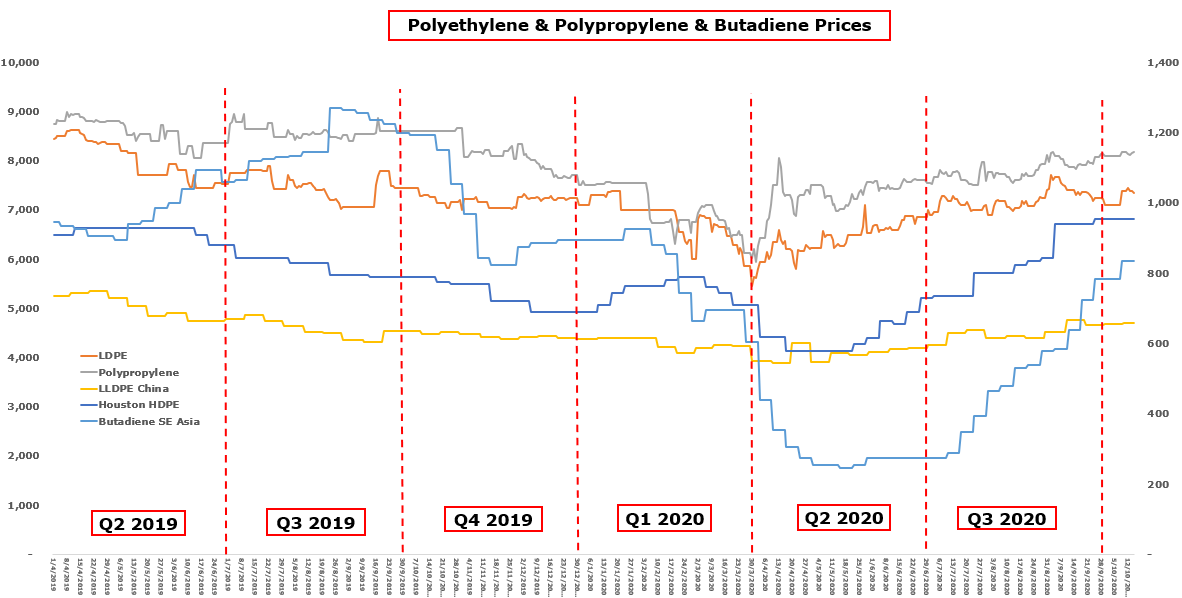

Current and Future Polyolefin & Butadiene Prices

On the other hand, Polyolefin and Butadiene prices have largely stayed even or increased somewhat due to supply constraints in the US, as well as Hurricane Laura knocking out certain refineries and Hurricane Delta that happened last week, which cut out the power.

One thing i think many are concerned about is, how will any future lock downs affect the usage of plastics, especially in terms of packaging.

Well, one reason for the strong resurgence in plastic prices was due to these lock-downs creating a strong demand for food delivery and online deliveries which massively increased the demand for plastics.

Here are some of the news flow when it comes to plastic prices, as well as its supplies and demand currently.

Weekly Resin Report: Spot Materials Remain Scarce

Oct 14, 2020

Processors scrambled to secure material to fill supply gaps, add to inventory as a buffer against additional supply-chain disruptions…

Weekly Resin Report: Spot Resin Prices Hold Flat, But at Elevated Levels

Oct 07, 2020

Resin prices were flat last week, and trading did not skip a beat as the calendar flipped to October and…

Weekly Resin Report: Processors Face Thinning Supplies and Escalating Prices

Sep 30, 2020

Heavy demand from both processors and resellers came up against insufficient supplies last week caused by…

Weekly Resin Report: Supply/Demand Imbalance Continues

Sep 22, 2020

Widespread damage and ongoing Louisiana power outages in the wake of Hurricane Laura kept some polyethylene and polypropylene producing plants from restarting. The production shortfall has become more evident and the supply/demand imbalance more…

For a more detailed read, you can go to this website PlasticsToday and do some reading.

Sentiment and What is priced in?

Now when it comes to every trade, we have to ask ourselves how much of this is priced.

At the current price of RM2.51 or RM5.7 billion; for a company with RM4 billion in net cash, and expected to make about RM300m for Q3 and Q4, i have to say not too much.

The last time it Naptha prices were this low, LCTITAN was selling at RM6.5 per share.

Now i have to admit, prices for Polyolefins and Butadiene was higher then, and so i think a reversion to mean target of RM4 is more likely.

Of course, quite a few things needs to happen for this to happen.

For one, many investors and fund managers are still slightly apprehensive about LCTITAN earning potential given the missed targets previously.

And so, they likely only bought their initiating positions and are waiting for the Q3 results to come out before taking up the rest.

And secondly, prices of Naphtha needs to remain at current levels or lower, while prices of Polyolefins and Butadiene need to remain at current levels of higher for the next 2-3 months till 31 January 2020 to result in earnings to maintain or increase for Q4.

And of course, if a result comes, rising sentiment and increasing prices have a way of reinforcing positive feedback loops, taking things to the next levels.

And as always, target prices are dynamic, and dependent on your own risk assessment and trade sizing.

So you will have to think for your own target price given the information provided in my previous article and this one, along with whatever additional information you found on your own.

Good luck.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/Choivo_Capital

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

.png)

sensonic

TOMORROW NEW IPO ANEKA JARINGAN EXPECTED TO OPEN AT RM 0.40 ?

2020-10-19 22:41