(CHOIVO CAPITAL) LIONIND (4235) - Budget 2021, Rising Steel Prices

Choivo Capital

Publish date: Mon, 09 Nov 2020, 12:42 PM

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) LIONIND (4235) - Budget 2021, Rising Steel Prices

========================================================================

Overview

When thinking about the companies affected positively by the budget, we naturally look for companies whose valuations are also currently very attractive.

And I think Lion Industries Corp Berhad fits the bill, especially since they are among the top 3 largest steel rebar players in Malaysia.

Budget 2021 - Construction

For Budget 2021, the government have allocated quite a large amount towards construction and infrastructure development. The main ones being,

- RM 15 billion will be allocated to fund the Pan Borneo Highway, Gemas-Johor Bahru Electrified Double-Tracking Electrified Project and Klang Valley Double Tracking Project Phase One. In addition, several key projects will also be continued such as Rapid Transit System Link from Johor Bahru to Woodlands, Singapore and MRT3 in Klang Valley.

- RM3.8 billion to fund new projects such as,

- Construction of the Second Phase of the Klang Third Bridge in Selangor

- Continuing the Central Spine Project with the new alignment from Kelantan to Pahang;

- Upgrading the bridge across Sungai Marang, Terengganu;

- Upgrading of Federal Road connecting Gerik, Perak to Kulim, Kedah

- To continue building and upgrading Phase of the Pulau Indah, Klang Ringroad Phase 3, Selangor

- Construction of the Pan Borneo Highway Sabah from Serusop to Pituru; and

- Construction of the Cameron Highlands Bypass road, Pahang with emphasis on preserving the environment.

- RM780 million to fund regional projects such as,

- Rapid Transit Bus Transport System at 3 High Capacity Routes and construction of busway at IRDA in Johor;

- Construction of the Palekbang Bridge to Kota Bahru, Kelantan under ECER;

- Construction of infrastructure and related components of the Special Development Zone project in Yan and Baling, Kedah under NCER;

- Infrastructure Project in the Samalaju Industrial Area, Sarawak under SCORE; and

- Continuation of the Sapangar Bay Container Port Expansion Project, Sabah under SDC.

- EPF will continue the development of Kwasa Damansara with an estimated Gross Development Value of RM50 billion. It will consist of commercial, residential and more than 25 thousand houses (including 10,000 affordable homes) to be built.

- Sabah and Sarawak will receive Development Expenditure allocation of RM5.1 billion and RM4.5 billion respectively. These allocation among others are for building and upgrading water, electricity, and road infrastructure, health and education facilities.

- Additional funding of Low-cost housing amounting to RM1.2 billion.

- RM 500 million to build 14 thousand low cost housing units under the Program Perumahan Rakyat;

- RM 315 million for the construction of 3,000 units of Rumah Mesra Rakyat by Syarikat Perumahan Nasional Berhad;

- RM 125 million for the maintenance of low cost and medium-low stratified housing as well as assistance to repair dilapidated houses and those damaged by natural disasters; and

- RM 310 million for the Malaysia Civil Servants Housing Programme (PPAM)

And many more smaller development projects, including initiatives to promote and ease homeownership for the citizes

Rising Steel Prices

And even before all these are happening, steel prices have been steadily marching upwards.

In the major steel producing countries China and India, steel prices have been increasing very strong, and this is similar globally as recovery and demand picks up pace, faster than the reopening of supply.

This is also corroborated by various news articles around the world.

“Steel Prices In Asia expected to increase strongly in the second half of 2020”

“US Rebar prices hold steady in November, after rising strongly in September and October”

And these steel prices are also increasing in Malaysia, as shown by YKGI’s (a Malaysian Steel Manufacturer’s) most recent quarterly result, where they recorded a net profit of RM2.3 million after 9 quarters of losses

Net Cash & Additional Disposals

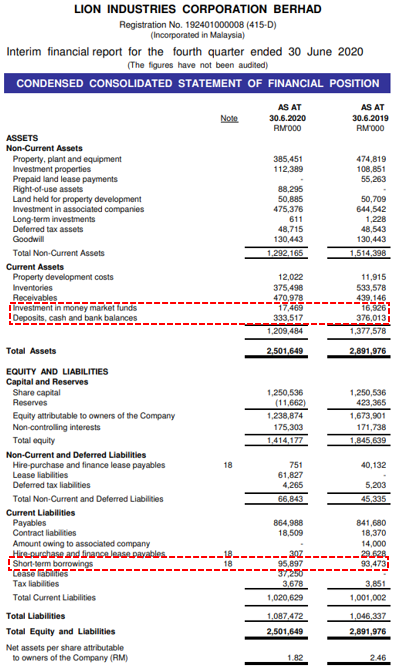

Unlike other steel companies, LIONIND is in a strongly net cash position. As of today, they have net cash totalling RM255m, this is higher than their current market capitalization of RM 193m.

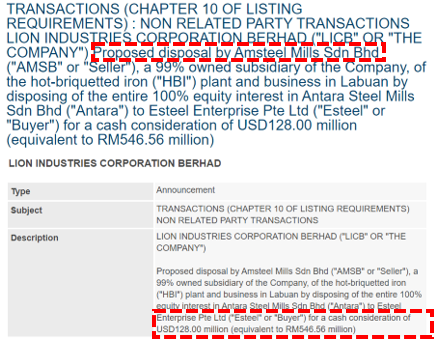

In addition, they are also in the process of disposing Antara Steel Mills Sdn Bhd for a cash consideration of RM546.56 million (USD 128 million)

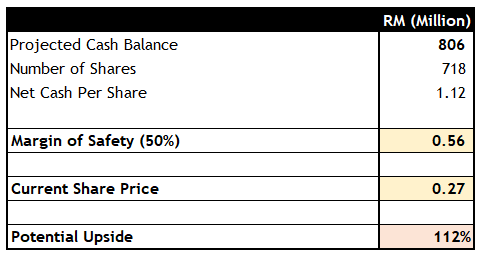

Bringing their total cash balances to RM806 million.

Target Price

Given the imminent closing of the disposal, the 2021 Budget which is expected to strongly increase the demand for rebar steel for construction in Malaysia, as well as rising steel prices around the world, I think there should be enough factors in line which should positively impact LIONIND’s share price.

One last thing,

Is it priced in?

Well, does not look like this is the case at all.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/Choivo_Capital

========================================================================

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

GLNT

I think the opposition is trying to reduce expenditure on construction projects before they approve the budget.

2020-11-09 14:08