(CHOIVO CAPITAL) KFIMA (6491) - A 3.6 PE Palm Oil Plantation Company with 5% Dividend Yield & 100% ROA Business Segments

Choivo Capital

Publish date: Fri, 08 Jan 2021, 09:12 AM

For a the original copy with high resolution pictures, better formatting and additional details.

Go here.

(CHOIVO CAPITAL) KFIMA (6491) -

A 3.6 PE Palm Oil Plantation

Company with 5% Dividend Yield &

100% ROA Business Segments

========================================================================

https://t.me/Choivo_Capital

This writing is based on my own assumptions and estimations. It is not a buy or sell call of the company and the contents of this report should not be considered as professional financial investment advises or buy/sell recommendations. I strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest. I make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on my report and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analysis the information at their own risk and we shall not be held liable for any losses and damages.

========================================================================

Released 28 December 2020

Overview

As many would have been aware, prices of palm oil prices have been rising for the last few months and as of December 2020, have reached an 8 year high.

Why have this happened?

Well, the current high palm oil prices are due to a combination of,

- Less new hectarage being planted due to lower prices from 2018 to 2019;

- Pressure from NGO’s and European Governments; and

- La Nina which results in colder and wetter weather, resulting in lower yield.

All of this resulted to what Godrej’s Mistry described to Bloomberg as, “A perfect storm for vegetable prices”.

And this has naturally resulted in the share prices of palm oil plantation companies in Malaysia breaking new 1 – 2-year highs.

However, most plantation companies in Malaysia consist of two types.

- If they are good, they are also very expensive. With companies like Genting Plantation, Kuala Lumpur Kepong, Batu Kawan Berhad, IOI Corp, Sime Darby Plantations and United Plantations trading at 30-40PE’s with 0.5-2% Dividend Yields. Only Sarawak Oil Palms is trading at reasonable valuations.

- And then there is the companies like FGV, Jaya Tiasa, TDM, Rimbunan Sawit, the 2nd tier ones. Who are heavily in debt, largely loss making (even with high palm oil prices), with sub-par management, who despite the above, are trading at 2019-2020 year highs. And if its cheap (on a book value basis), its usually for a very good reason, ie the companies do not treat minority shareholders well.

It's almost as if, “Cheap and Good” does not exist for plantation companies in Malaysia. Except, I think I found one.

An Overview on Kumpulan Fima

Berhad (KFIMA)

KFIMA was for incorporated by the Malaysian Government on 24 February 1972 for the development of Agro based industries within the framework of the then New Economic Policy.

On 1979, they started their liquid bulking terminals in Port Klang and Butterworth (a key cash cow for the company), and in 1981 became the controlling shareholder (with 60.02%) of FIMA Corporation Berhad (FIMACOR), a company that was primarily involved in the printing of security documents (another cash cow for the company). In 2002, their subsidiary FIMACOR started a joint venture with Giesecke & Devrient for the printing and production of bank notes for governments around the world.

In 1991, the company underwent a Management Buy-Out in line with the privatization policy of the Malaysian Government, with the new owner being Tan Sri Dato’ Haji Basir bin Ismail and his family. Till today, his family oversees and owns the business.

And in 1995, they ventured into the food business via a mackerel canning project (among others) in Papua New Guinea, which today makes a profit consistently, and have been increasingly its profitability.

They had also owned a stockbroking business in the 1990’s, that business along with the rest of the company was almost wiped out in the 1998 financial crisis. They have since sold that business to focus on their low risk and high profitmaking businesses in the printing of Security Documents and Liquid Bulking.

The losses incurred by the stockbroking business in 1998 resulted in large debts, which were fully paid off by 2007 due to the strong profitability of the Security Documents and Liquid Bulking division.

In 2007, just before Palm Oil prices shot up to a high of RM3,683 per tonne in 2008, they purchased an 80% stake in PT Nunukan Jaya Lestari for RM94 million, an Indonesian palm oil plantation company with 18,000 hectares (6,200 hectares plantation) in East Kalimantan.

Since then, they have made this a third core business, and most of the profits from the printing of Security Documents and Liquid Bulking (excluding the dividends steady dividends of about 5% at today’s share price) have been invested into expanding the plantation business in Indonesia and Malaysia, which is quite profitable.

Why the share price stagnated

Despite being quite well managed, with significant dividend yield, a burgeoning cash pile, and a growing plantation business, over the last 8 years, the share price has generally stayed even at RM1.7-RM2.5.

Why was this the case?

- Close to zero coverage by investment analysts, and a management that does not see a need to talk to investment analysts.

- The loss of one of the contracts in the security document division, which has resulted in profits falling temporarily (it has since recovered due to the increasing profitability of the plantation and food division.)

- Legal problems by the Plantation Division in Indonesia which resulted in multiple impairments and writebacks, which hid the true operating performance of the company, which has been resolved.

- The purchase of greenfield plantation developments in Malaysia, which required significant investments to clear the land, build required infrastructure, worker hostels, bunds, estate drains, palm nurseries, GPS mapping to ensure maximum efficiency etc, and lastly the planting of palm seedlings.

Most of these new palm oil plantations in Malaysia only hit maturity in 2020.

With the above in mind and record high oil palms prices, I think KFIMA is ripe for a re-rating.

Understanding KFIMA’s Businesses -

Printing of Security Documents

KFIMA’s involvement in the Printing of Security Documents business started when they acquired a 60.02% stake in FIMACOR in 1981, which is the largest contractor for the Malaysian Government when it comes to printing of security documents.

FIMACOR was also previously the only government agency in charge of printing security documents for the government before they were privatized.

What are these security documents? To put them simply, they are documents issued by the government, which uses special papers, inks, watermarks and presses to ensure that it is not easily faked.

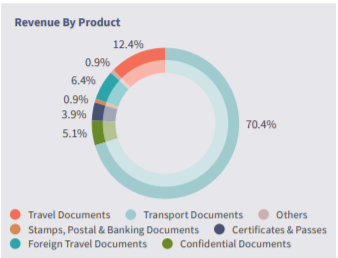

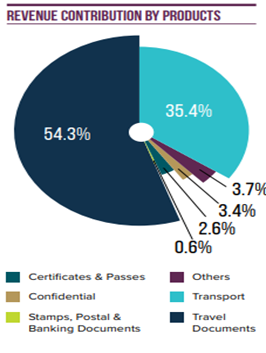

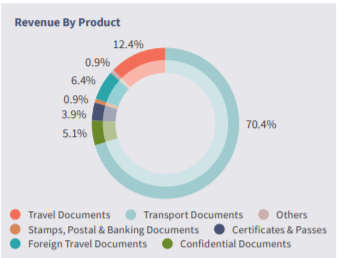

In terms of product mix, as of 2020,

A large portion of the security documents produced by KFIMA is related to “Transport Documents”. These are basically your Road Tax Stickers,

This category also includes other items such as your car ownership certificates etc.

This category also includes other items such as your car ownership certificates etc.

So, how good of a business is this?

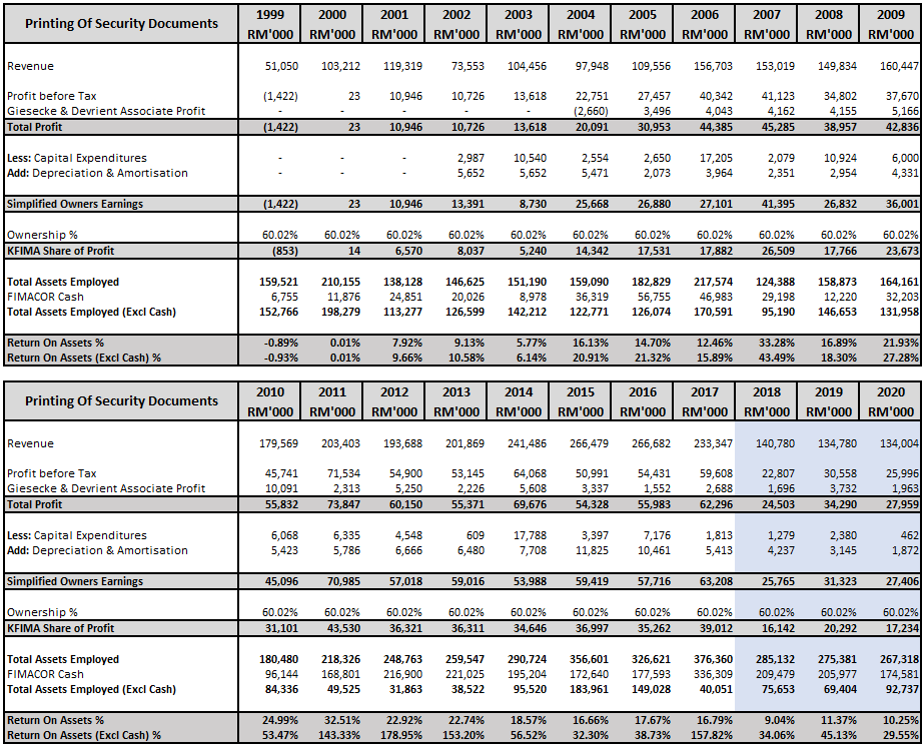

As we can see from above, this is an extremely profitable business and a strong cash generator. From 1999 to 2010, the profit generated by this business have steadily increased from a loss of RM1.4m to a profit of RM45.1m. And from 2011 to 2017, this business could generate profits of RM61.7m on average.

In addition, this is also a business that needed minimal Capital Expenditures. When comparing the Profit Before Tax and the Simplified Owners Earnings (Profit Before Tax + Non-Cash Adjustments – Capital Expenditures), on average, more than 92.2% of the profit was turned into cash.

And if we were to look at it in terms of Returns On Asset – “ROA” (For every dollar invested, how much profit do I make?), from 1999 – 2010, ROA have increased steadily from -0.9% to 25%. And from 2011 – 2020, Return on Asset have averaged.18.5%

However, as the company holds large cash balances (which does not need to be reinvested into the security document business), this depresses the ROA. Excluding the large cash balances, Return on Asset for 1999 – 2010 increases to -0.9% to 53.5%. And from 2011 – 2020, Return on Asset (excluding cash) have averaged 87%.

* To simplify things, we allocate to this division all the cash in FIMACOR, this is because the printing of security documents contributes most of the profit. In addition, unlike the security documents business, the palm oil plantation business still requires very significant investment, and most of the cash generated is reinvested into the business. This is means that the return on asset (excluding cash) for this division is marginally overstated. *

How is this business so profitable?

When it comes to the business of printing security documents for governments, or currencies, the real difficulty usually comes from getting the contract and building a reputation.

After that, given the sensitivity of the items being printed, that contract is basically yours for life, with close to zero competition.

Why is there little competition? When it comes to items like those, as a government you do not want many suppliers which increases the risk of counterfeiting significantly.

In the 29 years after the management buyout, this business has only lost 1 contract related to travel documents (passports) in 2017. The earnings have since stabilized and slowly increased again.

Having said that, even after losing the contract, the return on asset (excluding cash) of the business still averages 36% in the 3 years after. The number of businesses in BURSA that can obtain these kinds of numbers can be counted on with one hand.

The downside to this business, however, is low growth prospects.

Understanding KFIMA’s Businesses –

Bulk Terminals

Now, for many people, the question would be,

“Why KFIMA versus FIMACOR?”

Especially since purchase of FIMACOR shares give you 100% exposure to the amazing Printing of Security Documents business and the profitable Indonesian Palm Oil Plantation.

And the answer would be the incredible Bulk Terminal business that is 100% owned by KFIMA (and because KFIMA is even more undervalued than FIMACOR).

KFIMA is currently the owner of 5 liquid bulk terminals. 3 of them are located at the North Port in Port Klang and 2 of them in Butterworth Port.

These terminals have in total 271 tanks and a combined storage capacity of 275,190 MT (expansion by 20,440 CBM in 2020 at Port Klang) and can handle a wide range of liquid cargoes ranging from palm oil products to latex concentrates, oleochemicals to specialty oils, as well as petroleum products, industrial chemicals, and technical fats.

KFIMA also provide the miscellaneous services like transshipment, containerization, local dispatch, heating, blanketing, drumming of liquid products, customs declaration tracking etc.

To understand why the bulking terminals business is so great, we first need to know,

What are Bulking Terminals?

To give you an idea, here is a picture of KFIMA’s bulking terminals.

KFIMA was for incorporated by the Malaysian Government on 24 February 1972 for the development of Agro based industries within the framework of the then New Economic Policy.

On 1979, they started their liquid bulking terminals in Port Klang and Butterworth (a key cash cow for the company), and in 1981 became the controlling shareholder (with 60.02%) of FIMA Corporation Berhad (FIMACOR), a company that was primarily involved in the printing of security documents (another cash cow for the company). In 2002, their subsidiary FIMACOR started a joint venture with Giesecke & Devrient for the printing and production of bank notes for governments around the world.

In 1991, the company underwent a Management Buy-Out in line with the privatization policy of the Malaysian Government, with the new owner being Tan Sri Dato’ Haji Basir bin Ismail and his family. Till today, his family oversees and owns the business.

And in 1995, they ventured into the food business via a mackerel canning project (among others) in Papua New Guinea, which today makes a profit consistently, and have been increasingly its profitability.

They had also owned a stockbroking business in the 1990’s, that business along with the rest of the company was almost wiped out in the 1998 financial crisis. They have since sold that business to focus on their low risk and high profitmaking businesses in the printing of Security Documents and Liquid Bulking.

The losses incurred by the stockbroking business in 1998 resulted in large debts, which were fully paid off by 2007 due to the strong profitability of the Security Documents and Liquid Bulking division.

In 2007, just before Palm Oil prices shot up to a high of RM3,683 per tonne in 2008, they purchased an 80% stake in PT Nunukan Jaya Lestari for RM94 million, an Indonesian palm oil plantation company with 18,000 hectares (6,200 hectares plantation) in East Kalimantan.

Since then, they have made this a third core business, and most of the profits from the printing of Security Documents and Liquid Bulking (excluding the dividends steady dividends of about 5% at today’s share price) have been invested into expanding the plantation business in Indonesia and Malaysia, which is quite profitable.

Why the share price stagnated

Despite being quite well managed, with significant dividend yield, a burgeoning cash pile, and a growing plantation business, over the last 8 years, the share price has generally stayed even at RM1.7-RM2.5.

Why was this the case?

A bulk terminal is an industrial facility used to store large quantities of a products (chemicals, liquids, petroleum, grain, petroleum products, food oil etc) before the product is transferred to another facility for processing or delivered to end-users.

They are typically built at ports and refineries and are often an important component of larger networks of pipelines, storage facilities and processing facilities.

Now, KFIMA’s bulking terminals are centered around ports, and the thing about bulking terminals located at ports is, you only obtain the opportunity to build them when the port is first started up or the early days of operation. As you can see above, bulking terminals require very large pieces of land situated directly at the port, or very close to it to link up to its piping infrastructure.

This is because to the ships that stops at ports are usually very large, especially if they carry the kind of goods that is stored at bulk terminals, example below.

As a port develops, the ability to buy the large tracts of land becomes increasingly difficult (or impossible) and expensive (extremely so).

And this means that competition becomes limited to just the existing bulking terminal holders (who also obtained the land early). And while demand increases from the port developing over time, supply of bulking terminals remains fixed as it becomes increasingly impossible to expand capacity.

This gives bulking terminal owners the ability to charge prices as high as the market could bear (it only needs to be slightly lower than hiring lorries to move the products directly from the ship, which also happens to be a logistical nightmare).

What does it mean in terms of the numbers?

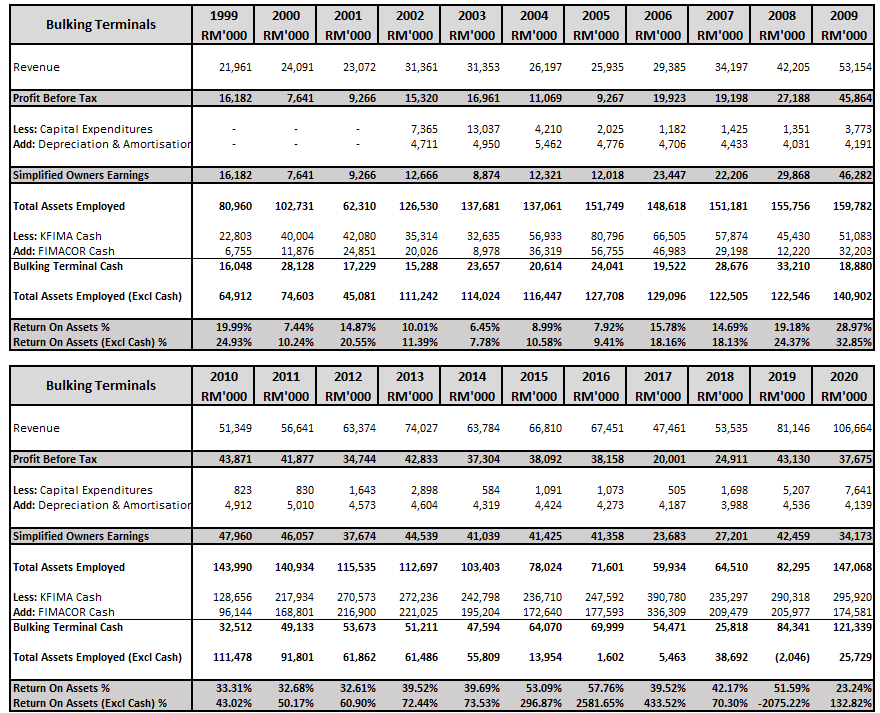

Like the printing of security documents, this is an extremely profitable business and a strong & steady cash generator. Since Day 1, this business has been profitable. (The fall in profit in 2017 and 2018 is due to low CPO production due to the draught then, which reduced supply)

And as we can see, from 1999 to 2009, as Port Klang and Butterworth Port matured in terms of traffic, the profit generated by this business have steadily increased from RM16.2m to RM45.8m. And from 2010 to 2020, this business could generate profits of RM38.8m on average.

In addition, this is also a business that needed minimal Capital Expenditures. When comparing the Profit Before Tax and the Simplified Owners Earnings (Profit Before Tax + Non - Cash Adjustments – Capital Expenditures), on average, more than 105% of the profit was turned into cash.

And if we were to look at it in terms of Returns on Asset, from 1999-2010, ROA have increased steadily from 20% to 29%. And from 2011 – 2020, Return on Asset have averaged 40.5%

However, like the Printing of Security Documents business the company holds large cash balances (which is does not need to be reinvested into the Terminal Bulking Business), this depresses the ROA.

* To simplify things, we allocate all the cash in KFIMA (less the cash held by FIMACOR which was allocated to the printing of security document division), this is because the bulking terminal contributes most of the profit in KFIMA. In addition, unlike the bulking terminal business, the palm oil plantation business still requires very significant investment, and most of the cash generated is reinvested into the business. This is means that the return on asset (excluding cash) is marginally overstated. *

Excluding the large cash balances, Return on Asset for 1999 – 2010 increases to 24.9% to 43%. And from 2011 – 2020, Return on Asset (excluding cash) is basically infinite as a negative working capital model is sometimes employed. Ie. Free Money.

Like the printing of the security documents, the downside to this business, however, is low growth prospects.

Understanding KFIMA’s Businesses –

Food

KFIMA is also in the Mackerel Canning business in Papua New Guinea, via International Food Corporation Limited which they acquired in 1995.

The business primarily sells canned mackerel under their own brand “Besta”, and the canned Mackerel’s is also exported to Europe.

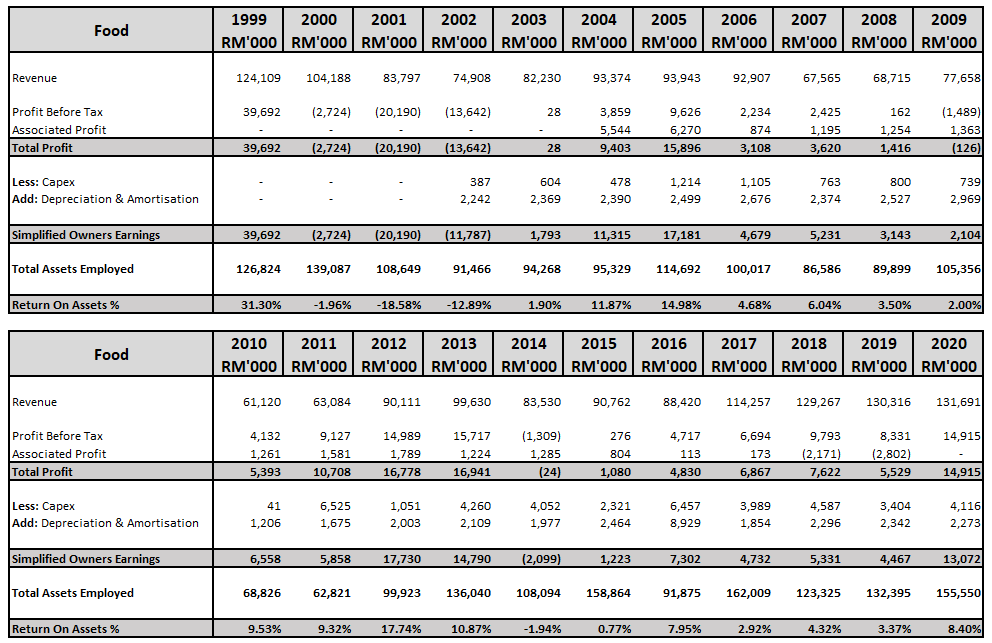

How is it in terms of profitability?

It is not a fantastic business, but over the years it is self-sustaining, profitable and contributes significant amounts of cash.

Earnings for the last few years have increased again as they started exporting more to European countries.

Understanding KFIMA’s Businesses –

Plantation

Since the start of the company, due to its agricultural background, the company always had a small Palm Oil and Pineapple Plantation in Johor.In 2006, to grow the business further, KFIMA decided to expand further into the Palm Oil Plantation business and turn it into their third pillar.

Development to expand the business was done primarily under FIMACOR. However, several estates were done under KFIMA directly as well. The details and chronology are as follows.

FIMACOR - Plantation

-

2007: 18,000 Hectares in Kalimantan, Indonesia (80% stake for RM94 mil)

- This was a relatively mature estate that did not need much additional work beyond standard maintenance and capital expenditures.

- 2012: Building of Composting Plant with 17,000 mt compost fertilizer capacity, online 3Q 2013

- 2017: Order received from Indonesian Government revoking land title due to overlap with forestry areas. Impairment of RM28.37m taken up.

- 2019: New land title received for 16,474 hectares, (which is 19,974 hectares less the 3,500 overlap with forestry areas). Writeback of RM23.63m.

- 2020: Could not sell any CKPO for 3 quarters due to plant operating license problem. Impairment of RM17.79m on decision made by the Mahkamah Agung allowing the judicial review application by the Indonesian Government.

- 2021: Pending Court Decision.

-

Throughout all these legal actions, the Indonesian Government have allowed the plantation to continue to operate.

-

2012: 785.4 Hectares in Kemaman, Terengganu (Land Purchased for RM29.11 million)

- Considered a greenfield development, with complete replanting required.

- 2014: Deal completed. 405.4 hectares consist of Palm Trees older than 28-year-old. Remaining 380 hectares unplanted.

- 2015: 380 Hectares unplanted, cleared. Replanting started on 405.4 hectares consist of Palm Trees older than 28-year-old.

- 2016: 489.1/785.4 Hectares planted.

- 2017: Replanting Completed.

- 2018: 127 Hectares (Planted from 2015-2016) or 13,672 oil palms to be replaced due to elephant encroachment. 28 Hectares are now matured.

- 2019: 117 Hectares are now matured.

- 2020: 491 Hectares are now matured. 12 Hectares or 1,295 oil palms damaged by elephants.

-

2015: 249.8 Hectares in Kuala Krai, Kelantan (99 year lease) (100% for RM3.7m)

- 2016: Site clearing and terracing expected to be completed.

- 2017: 110 Hectares Planted.

- 2020: Full replanting completed.

-

2015: 404.6 Hectares in Gua Musang, Kelantan (89% of Next Oasis for RM890 (not a typo), in exchange for bearing the cost of development)

- 2016: 249.8/404.6 Hectares cleared, and oil palm nursery sites completed.

- 2017: 230.7/404.6 Hectares planted.

- 2018: 396/404.6 Hectares planted.

- 2019: Damage to 13,672 young palms from elephant, trenches being built

- 2020: Replanting completed.

-

2016: 2,000 Hectares in Kuala Kangsar, Perak (80% of R.N.E Plantation for RM4.2 million) (60 years lease, option to renew for 30 years.

- 2018: Permission and Approvals obtained.

- 2020: Development commenced.

-

2018: 1,331 Hectares in Jeli, Kelantan (80% stake for RM33.74 million)

- 2018: 566 Hectares undergoing rehabilitation works, and replanting have started. 150 Hectares have been cleared and terraced. Infrastructure works being carried out. GPS mapping for system construction, terrace positioning and creating an efficient road system. Upgrade of existing workers quarters to accommodate up to 50 workers. Construction of 8 new quarters that can accommodate a further 64 workers.

- 2019: Rehabilitation work on 437 hectares done.

- 2020: Area under cultivation 1,162 hectares. Full replanting and rehabilitation completed.

KFIMA - Plantation

-

2011: 5,000 Hectares in Miri, Sarawak (52% equity given in exchange for developing it)

- 2012: 1,200/5,000 Hectares cleared.

- 2013: 10 blocks of living quarters completed, the rest to be completed by June 2013. 4,300/5,000 Hectares cleared. 1,115/4,300 Hectares planted.

- 2014: 4,888/5,000 hectares cleared. Remaining 112 hectares is used for housing etc. 2,187/4,888 Hectares planted

- 2015: 4,453.8/4,888 Hectares planted.

- 2016: 4,610.4/4,888 Hectares planted.

- 2017: Planting completed. 473.79 Hectares is now mature.

- 2018: 822/4,888 Hectares is now mature.

- 2019: 1,648/4,888 Hectares is now mature.

- 2020: 4,271/4,888 Hectares is now mature. Lower yield due to flooding. Will be fully mature in 2020.

To sum up the above developments,

- Only the Indonesian Plantation acquired by FIMCOR was a brownfield development that only required the standard Maintenance and Capital Expenditures.

- All other fields are greenfield developments that required significant additional capital expenditures. The most significant of which being the Miri Palm Oil Field measuring 5,000 hectares, which is 52% owned by KFIMA and will be fully mature in 2020.

- The acquisition of new fields by KFIMA over the years have resulted in large capital expenditures, and the start of Greenfield Plantations have resulted in significant gestation costs from 2013-2019.

And how does this translate into the numbers?

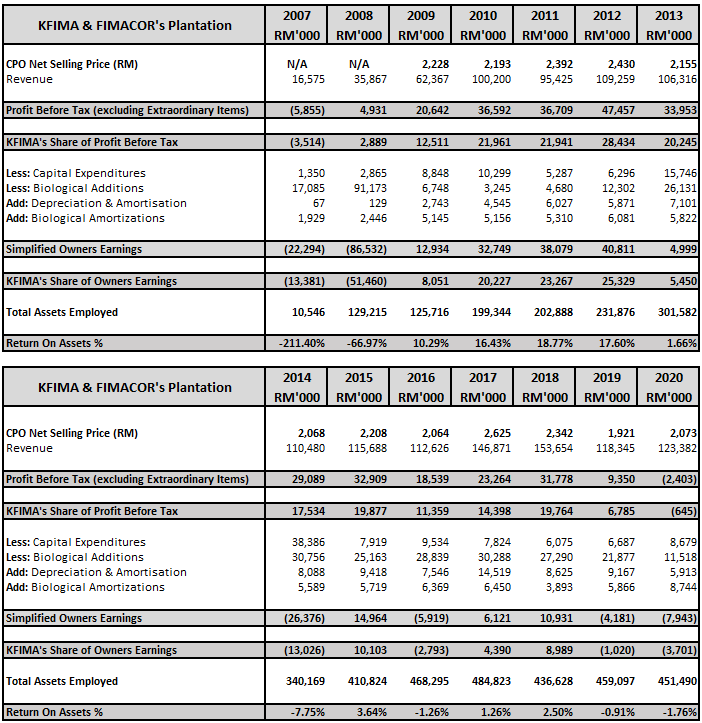

On a Group level, the contribution of the plantations are as follows.

As we can see here, historically the Group’s plantation business is profitable.

However, the results of the group from 2012 - 2020 were depressed by the initial investments into the greenfield developments, and one off items.

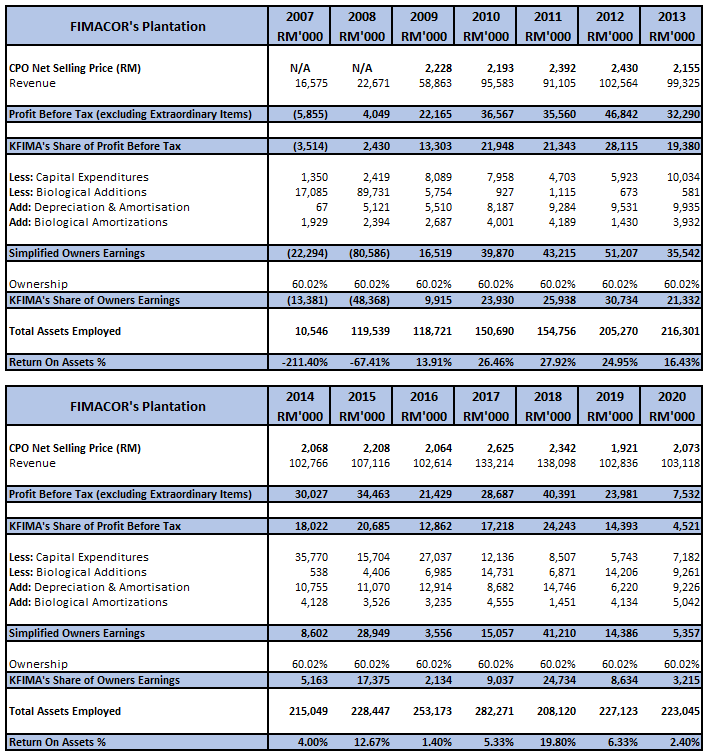

If FIMACOR’s plantation business is seen individually (as it mainly consists of the mature Indonesian plantations), the following results are obtained.

Seen individually, excluding the largest greenfield development (5,000 Hectares in Miri), FIMACOR’s plantation business is significantly more impressive.

Excluding all extraordinary items (the impairment in 2017 and 2020 and writebacks in 2019), from 2009 to 2020, the plantation business of FIMACOR have averaged Return on Asset of 13.5%.

* The Return on Asset for the plantation is depressed due to cash balances not being deducted out (as we have already allocated them to the printing of security document segment)*

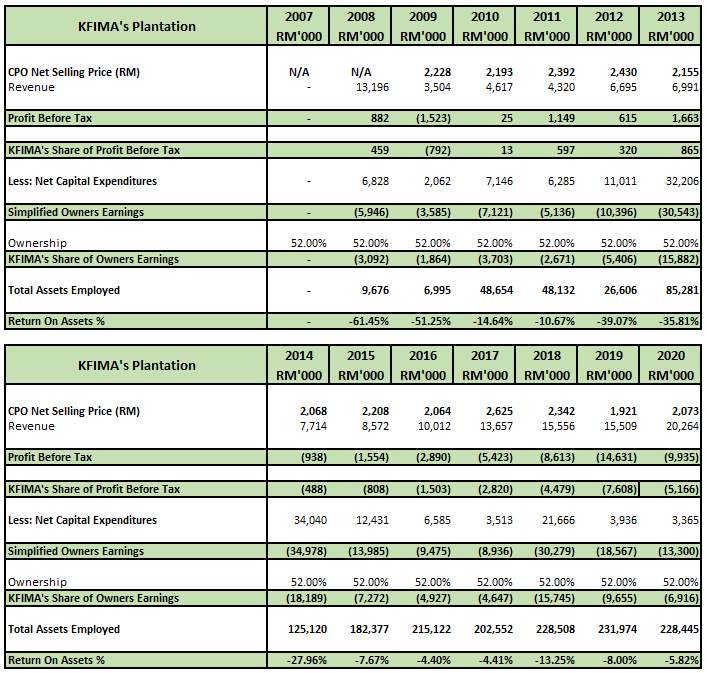

And if we are to look at KFIMA’s Plantation segment, which mainly holds the 5,000 hectare Miri Plantation.

From 2008 to 2013, the company has maintained it profitability, mainly from contributions from its existing small pineapple plantation and small palm oil plantation in Johor.

However, as we can see, since the acquisition of the Miri Plantation in 2011, capital expenditures have been quite high for 2012 - 2019 as the land is cleared, infrastructure built, and the oil palms planted.With all 5,000 acres in Miri maturing in 2020 and 2021 and coupled with record palm oil prices, I think KFIMA is ripe for harvesting.

Catalyst 1 – Maturity of Palm Oil

Plantation in Miri and Kemaman

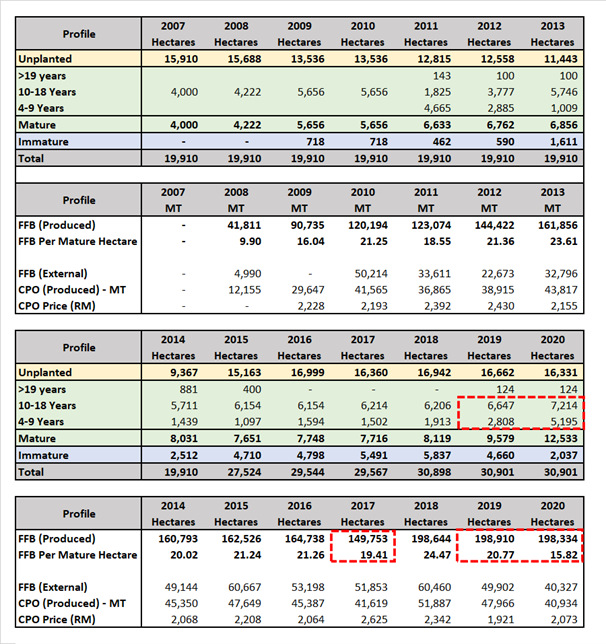

Typically for a matured estate, excluding any droughts, EL Nino and El Nina’s, “FFB Per Mature Hectare – MT” should be around 23MT per hectare, a figure KFIMA hit in 2013.

When there is a drought, you get 2017, when “FFB Per Mature Hectare – MT” is only 19.4 MT

Subsequently, as there is clearing of old trees for replanting, as well many of the new trees which have not hit maturity, the yield has stayed low.

However, if we notice, in 2019 and 2020, despite matured estates rising from 8,119 Hectares in 2018, to 9,579 Hectares in 2019 and 12,533 hectares in 2020. Production have largely stayed even.

This is mainly related to the Economic Life profit of a Palm Oil Tree.

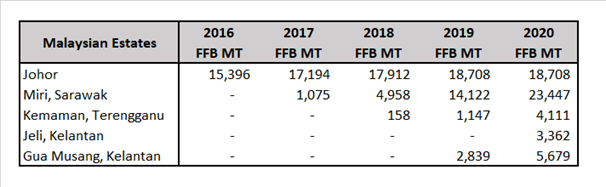

However, if we were to break it down to look at the new plantations in Malaysia, production has been increasing exponentially as these plantations achieve maturity.

And this can be seen particularly clearly in Q2 2021.

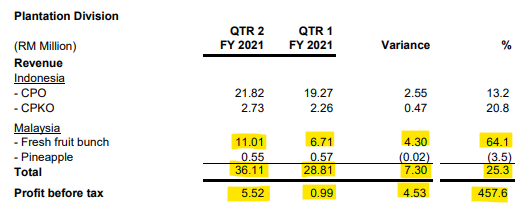

As per the quarter report, revenue from the Malaysian Plantations for Q2 2021 have increased by 64.1% (RM4.3m) versus Q1 2021.

Resulting in Profit Before Tax increasing from RM1m to RM5.5m, a 457.6% increase.

And this is mainly from the Malaysian Plantations now being profitable as the palm oil estate reach maturity.

Catalyst 2 – Recovery of business

from COVID 19, and Malaysian

Plantations making a profit.

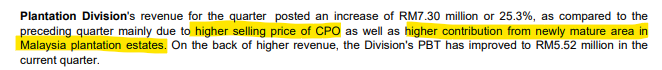

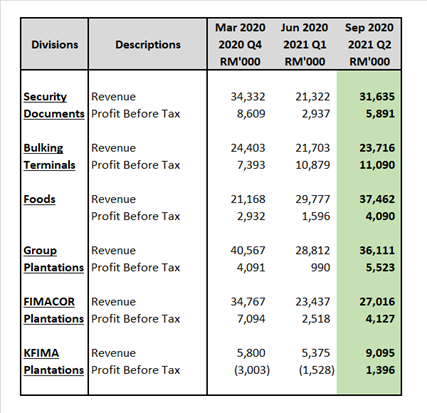

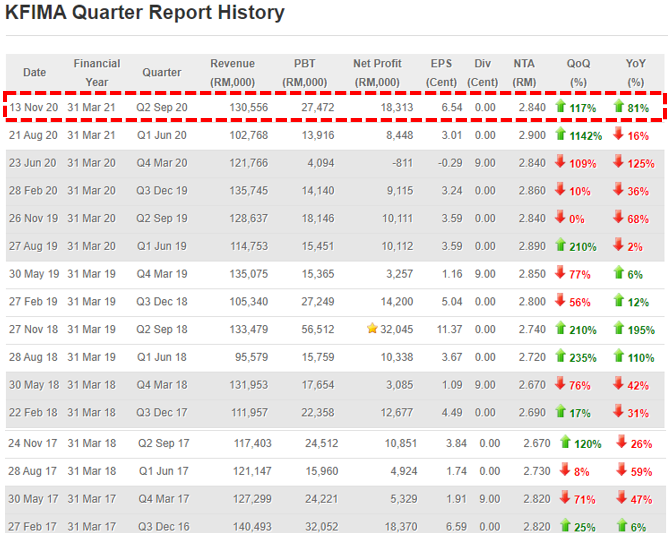

As we can see from here, all their businesses have recovered very strongly from the Covid-19 pandemic.

Some of their businesses like the Bulking Terminals, Plantations and Foods have reached new highs.

In addition, KFIMA Plantations which primarily contains the Miri Plantation, have close to doubled revenues and recorded its maiden profit.

As for their quarterly results,

KFIMA have achieved their highest operating profit in 16 Quarters or 4 years.

(Q2 2018 is excluded as it includes a RM23.6m writeback)

Risks – Loss of Contracts from the

Printing of Security Documents

Division

In 2018, the company lost a passport printing contract with the government.

The main reason for this being passports being increasingly technologically advanced, with E-Inlay’s, E-Cover’s, and E-Pages etc.

Therefore, a portion of the passport printing contract is given to another player (DSONIC if i'm not mistaken) who also obtained the contract to do all 3 of the above, to enable them to do the complete passports.

2017 2020

This resulted in Travel Documents, which previously consisted of 54.3% of their business, reduce to just 18.8% of the business.

I do not foresee much risk when it comes to their other security documents business as much of these are still relatively low tech.

In addition, based on what I have observed in their 20 plus year history so far, the management usually inform of any bad news far in advance. For example, the loss of contract which took place in Q1 2018, was informed as early as 2016. There has been no such updates recently

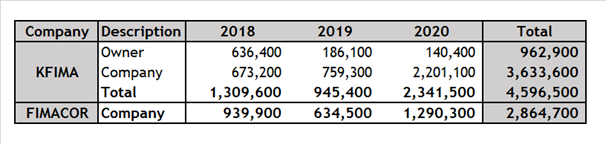

And lastly, since 2018, the family owning the company have been steadily buying more shares.

For the last three years (2018, 2019 and 2020), the purchase of shares by the owners and the company can be summarized as follows.

No owner will buy more shares if they think the company is overvalued, or if they think the company is going to lose a key contract.

And if you were to notice, only for KFIMA did the family buy shares themselves.

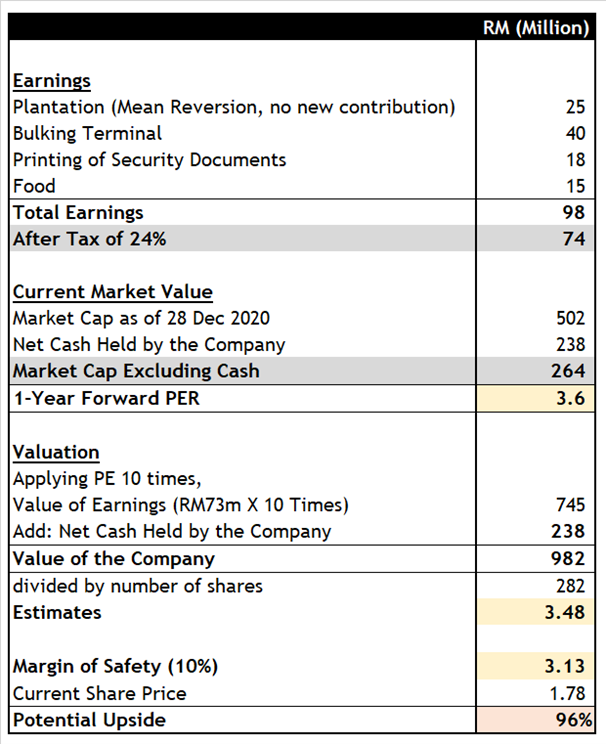

Estimates

To identify our initial fair value, to be conservative, we will use the reversion to mean earnings for Plantation (This assumes the plantation division’s previous profitability and does not include increase in CPO prices or the new contributions).

For the Bulking Terminals and Printing of Security Documents, due to their stable earnings, we will use their normal earnings.

And as for the Food Division, there have been consistent improvement in earnings over the last few years due to various measures taken, we will use the most recent earnings.

As the company typically keeps a very large cash balance, and pays a very steady dividends, we will calculate this separately in the valuation.

A margin of safety of 10% is applied (lower than the usual 20-30%) as we are already being conservative by not pricing in the new contributions from the Miri Estate as well as higher CPO prices.

In addition, a Price to Earning Ratio of 10 is used. I personally think this is too conservative, especially given the size of the moat when it comes to the terminal bulking business and printing of security documents business which can generate close 100% ROA’s or free money.

With the above, assumptions, we obtain a valuation estimate of RM3.13.

There is no other plantation company in Bursa which sells for 3.6PE and gives you a 5% dividend yield.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

the owners should just privatise it since no one in the market see the deep value...

thumbs up for the deep analysis, will re read again :)

2021-01-08 10:17

This is one of the best pick for palmoil investment exposure loh!!

Very big margin of safety & high sustainable dividend yield mah..!!

Good prospect mah!

Buy loh!

2021-01-08 11:02

Raider just bought 40k units....u should buy also mah...!!

Tq Choivo for the fine write up loh!

2021-01-08 11:04

Why the rally on cpo is sustainable leh ??

If u check the cpo spot & future from Jan 2021 to Dec 2021 all prices are above Rm 3000 until November 2021 & only December 2021 is slightly below Rm 3000 but still consider high at around Rm 2970 per tonnes.

For your info, when palmoil is average rm 2500, all the palmoil plantations make good profit mah...!!

Thus the good profit of palmoil company is sustainable very good & the average palmoil price should easily exceed average rm 3000 for 2021 mah...!!

Like calvin sifu says there are Great Safety In Palm Oil Shares loh!

Posted by calvintaneng > Jan 9, 2021 11:49 AM | Report Abuse

Cpo reaching Rm4000

Moving up to Rm4500 and Rm5000 range due to la nina

Hide in great safety of palm oil shares

Posted by calvintaneng > Jan 9, 2021 10:11 AM | Report Abuse

Happy morning all

Yesterday Soybean prices in USA closed above Usd13.70 to yet another new high due to very dry weather in South America

La nina is here with uneven weather on earth

Floods in Malaysia will deplete cpo stocks and drought will decimate Soybean crops in Brazil and Argentina

Leading to huge shortfall and panic buying later

Palm oil bull is now on course to run for all the months of 2021

2021-01-09 13:14

Trust

Choivo... good analysis on K Fima..

2021-01-08 09:31