(CHOIVO CAPITAL) MASTER (7029) – Packaging Boom, All Time Low Pulp Costs, Record Revenue by Major Customer

Choivo Capital

Publish date: Tue, 01 Dec 2020, 02:29 PM

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) MASTER (7029) – Packaging Boom, All Time Low Pulp Costs, Record Revenue by Major Customer

========================================================================

Packaging Boom, All Time Low Pulp Costs,

Record Revenue by Major Customer

Overview

This pandemic resulted in a packaging booms for both Paper and Plastic based packaging, due to the online delivery boom, as demand for online delivery of goods increases drastically.

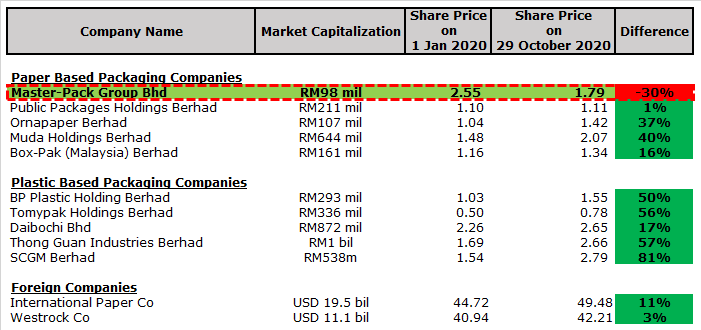

And we see this reflected in the share prices of plastic and paper packaging companies in Malaysia and Globally.

However, Master-Pack Group Berhad is a major laggard, despite also being the most direct beneficiary of the Solar Boom, with their major customer US’s First Solar Q3 sales rising by 70%.

The solar industry makes up 67% of Master’s revenue, with the rest being the Food & Beverage as well as Medical, both of which have also seen a boom this year.

Master Pack Berhad - A Background

MASTER is primarily engaged in the business of manufacturing corrugated packaging products, wooden packaging and providing one stop packaging solution, warehousing as well as Vendor Managed Inventory with 28 years of history.

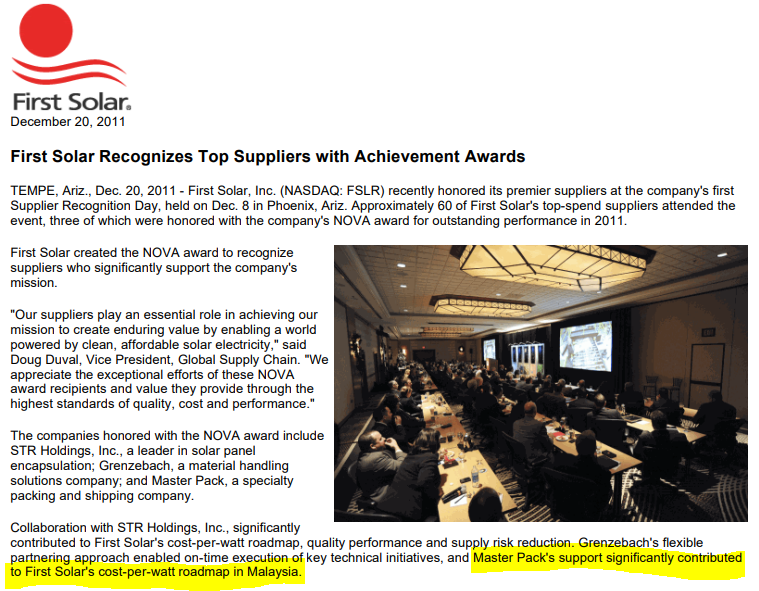

Over the years, they have built up their reputation as the key packaging player in the solar industry, starting with First Solar (one of the largest American solar companies in the world), where in 2011, they won an award as their top supplier.

This is because the boxes used by the solar industry tend to be custom made, to account for the unique product being shipped.

And from there, they built up their customer base in the solar industry. And today, the solar industry makes up 67% of their sales.

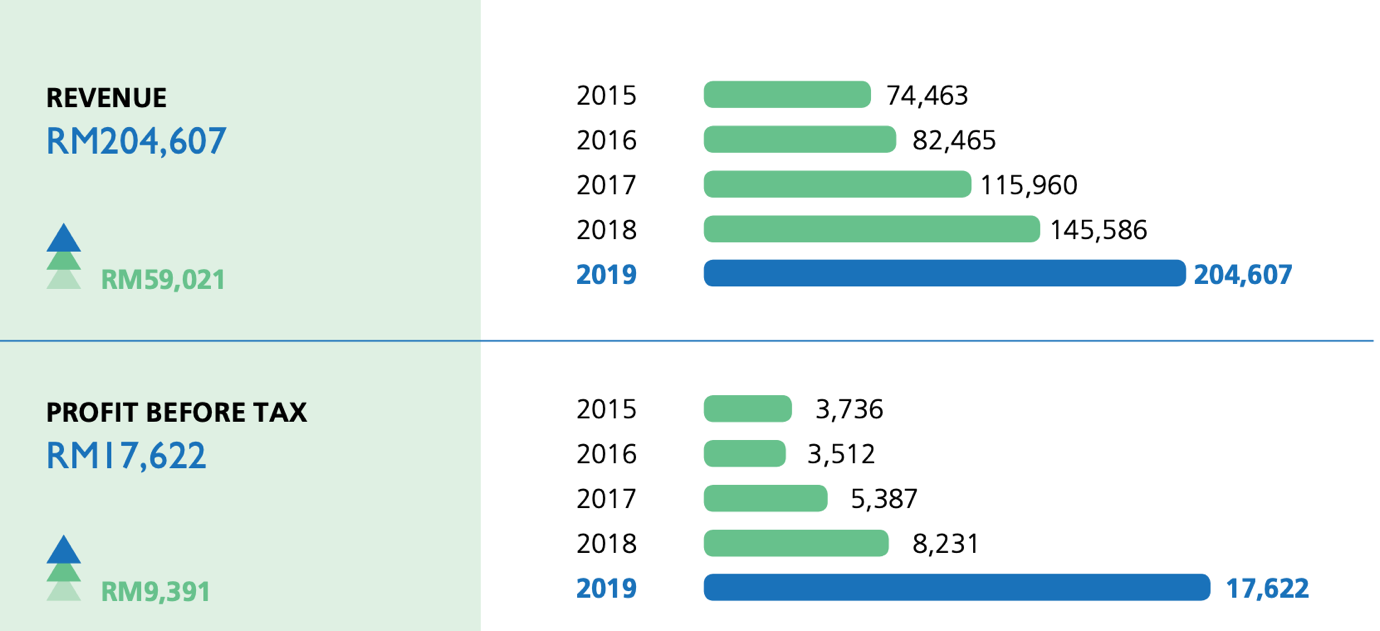

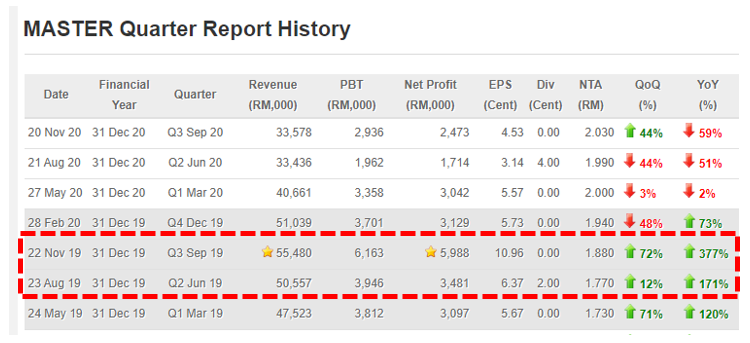

Resulting in their below historical results,

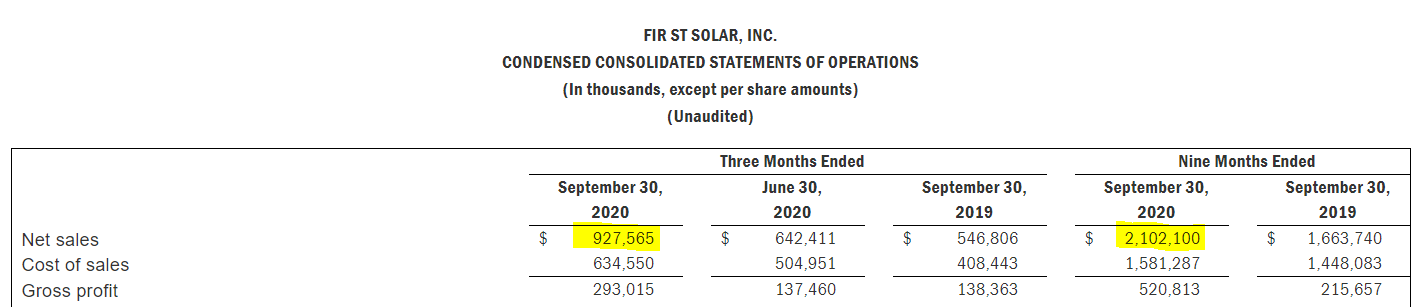

Which is in line with their major customer, First Solar’s own explosive results.

Catalyst – Falling Costs

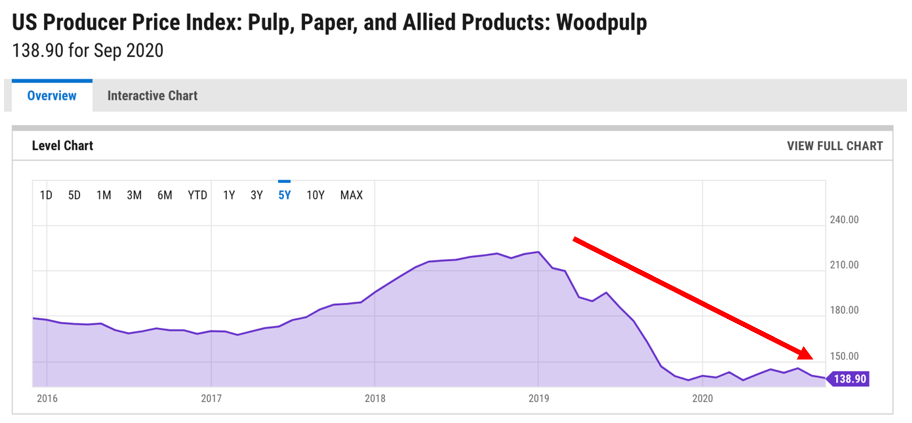

Since the second half of 2019, prices for wood pulp have fallen drastically and have stayed down mainly due to reduced usage of papers, while capacity expansions by wood pulp companies coincided with the coronavirus pandemic. Until the current industry consolidation is completed, prices for wood pulp are expected to stay low.

Low wood pulp prices are also the main reason why paper packing companies like MUDA, ORNA, PPHB and MASTER remained profitable throughout the pandemic.

Catalyst – First Solar Blockbuster Q3 Results

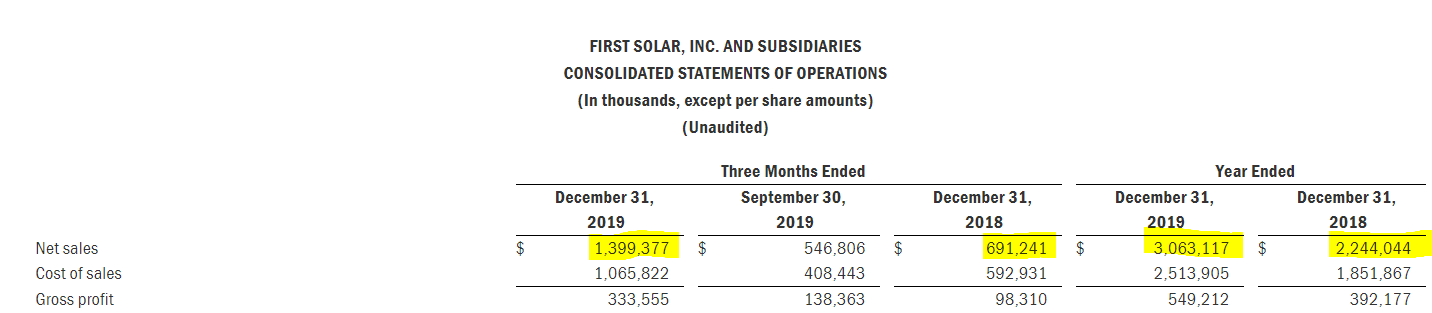

For the third quarter, their major customer First Solar have recorded an incredible 70% growth over the previous year, and 44% over the previous quarter.

Like in 2019, when First Solar’s Revenue exploded upwards, resulting in a 38% growth in revenue and 146% growth in profit for MASTER, a similar result should occur this time as well.

Long Term Catalyst – First Solar 2nd Factory in

Malaysia & Biden Presidency

With Biden being the new American President, solar energy demand supplies, incentives are expected the skyrocket, growing the renewables industries further.

And this is something First Solar is planning to capitalize on by opening their second factor in Malaysia.

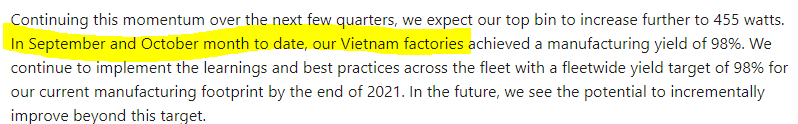

In addition, the First Solar factories in Vietnam have also hit a 98% manufacturing yield, resulting in higher outputs. This should also result in additional order for Master Pack’s factories in Vietnam, where they also support First Solar’s factory.

All of which are likely to bode very well for First Solar, who is their premier packaging supplier in Malaysia and Vietnam.

Risks – Lower Revenue in Q3 2020 (continued)

Now, for the first two quarters of 2020, MASTER recorded a lower revenue, due to their Malaysian factories only being allowed to run at 50% capacity. However, this was partially set off by their Vietnam factories which started up in Mid-2019 to support First Solar.

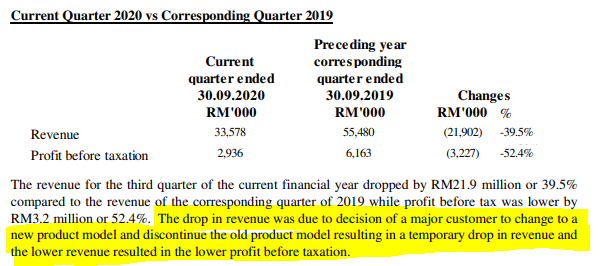

However, for Q3 2020, revenues for MASTER fell. Why is this the case?

This is mainly from First Solar, recommissioning their current remaining Series 4 lines in Kulim, Kedah to manufacture Series 6 solar panels. This resulted in a temporary drop in revenue. According to First Solar’s Q3 Earnings Call Transcripts, this conversion has be completed in late Q3.

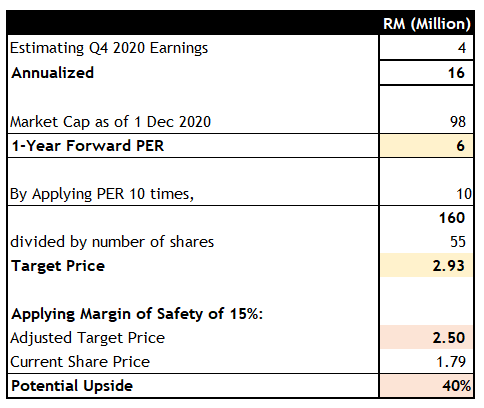

Projected Profit for Q4 2020 & Target Price

Given the completed conversion in the Malaysians First Solar Factory, as well as impending orders by First Solar, who recorded record revenues in Q3 2020 and expected to record even higher revenue in Q4.

I think it would be conservative to project a back to normal earnings for Master, and a slight increase on top especially with the Vietnam factories contributing fully from the second half of 2019.

For the purpose of our projection, we will use Q2 and Q3 2019. Mainly due to the Q4 2019 results being impacted from reduced demand in China due to the Covid 19 cases.

Now, I do think using Q4 2019 RM6m in earnings may be to optimistic. However, Q2 2019 earnings are a little too low as it does not include the full Vietnam factory contribution. With that in mind, we will use a conservative RM 4m in net profit for our projections.

And so, we arrive to our target price of approximately RM2.5, when earnings for Master Pack return to the mean.

Do note this does not price in the additional orders that are likely to come from the second factory from First Solar which is expected to start Q1 2021.

And, One Last Thing.

Is it priced in?

Other than the brief pop back in April-May 2020, which affected all stocks, it has only gone down since then and is way below its Dec 2020 closing price of RM2.55, despite being projected to make more money in Q4 2020, and have earnings increase further after the new First Solar factory is started up in Q1 2021.

Clearly the market still thinks that the drop in revenue or earnings is not temporary, resulting in this mispricing. I don’t think the market is pricing in any of the facts I have written above have not been priced into the stock at all.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/Choivo_Capital

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) LIONIND (4235) - Budget 2021, Rising Steel Prices

========================================================================

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

supersaiyan3

ok, buy little bit lah.

(Yesterday asked to quote corrugated boxes, didn't expect it to be such a high price. Minimum order costs RM13k, that's enough boxes for 6 years for me. )

2020-12-02 00:32