(CHOIVO CAPITAL) WCE (3565) – A 2021 Update

Choivo Capital

Publish date: Fri, 08 Jan 2021, 11:13 AM

For a the original copy with high resolution pictures, better formatting and additional details.

Go here.

(CHOIVO CAPITAL) WCE (3565) – A 2021 Update

========================================================================

https://t.me/Choivo_Capital

This writing is based on my own assumptions and estimations. It is not a buy or sell call of the company and the contents of this report should not be considered as professional financial investment advises or buy/sell recommendations. I strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest. I make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on my report and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analysis the information at their own risk and we shall not be held liable for any losses and damages.

========================================================================

In terms of price movements, WCE have done quite well since my previous sharing. Increasing from RM0.28 to RM0.41 (hitting a high of RM0.485)

However, the share price fell almost 10%, along with most of the Malaysian Market due to COVID fears.

For many people, even if they understand the business well, falling share prices have a way of making one feel a certain trepidation in their hearts.

And so, I would like to share my perspective on some developments regarding WCE.

4 Sections Opening is 1H 2021

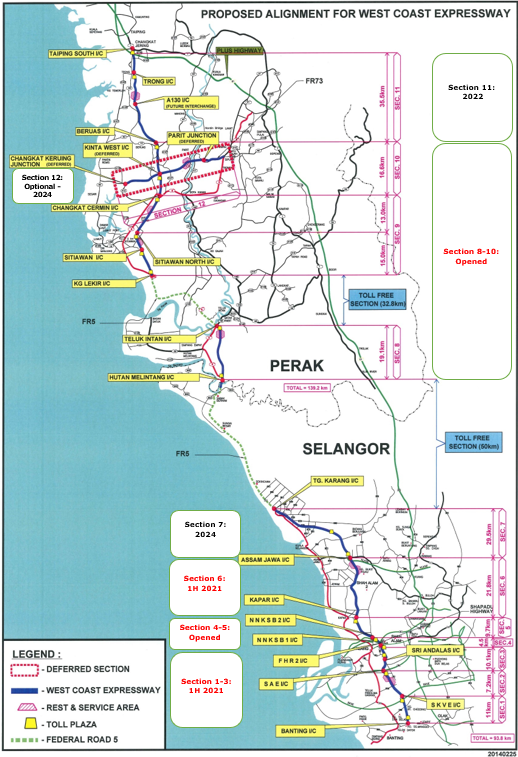

As explained in my previous article, 4 additional sections will be opening in 2021. To provide some context and where these sections are located, here is a detailed map of the alignment.

As you can see from the map above, the 4 sections being opened in 2021 are all the key and high traffic sections in Selangor, they run closer to Port Klang and touches key areas in Selangor around NKVE, SKVE and KLKSE, highways with significant traffic congestions.

Additional observation needs to be done on the traffic to see how accurate they are in line with projected numbers. Having said that, even given my worst case scenario, which uses a starting traffic of RM230m, that is 16% below the worst case given by the rating agency (RM275m) which is in turn 40% lower than the projection made by WCE.

Discounted cashflow still result in a RM0.57 per share (even after assuming max dilution), and the current price of RM0.41 per share is far below this amount, much less the cost of the majority shareholders of >RM1.00.

I think there is still significant margin of safety.

Purchase of Shares by Majority

Shareholder

As I understand from a few friends, a copy of my research ended up in the hands of the CEO of WCE Berhad, Dato’ Neoh Soon Hiong,

It had then naturally passed to one of the major shareholders, Tan Sri Dato Surin Upatkoon, who is also the majority owner of companies like Magnum and MPHB, it clearly made sense to him, as he then took the opportunity to buy additional shares.

Conclusion

As explained in my previous article, the nature of highway concessions means we will not be seeing accounting profit figures immediately, as this is ultimately a 50+10-year concession.

However, 2020 was a key turnaround for them with the long outstanding land acquisition issues being solved, and 2021 is the year, most sections will be completed, with the key and high projected traffic sections in Selangor being completed.

Given the margin of safety, and upcoming catalysts, I think it is something worth waiting for.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Same like Ekovest? Once start to operate, the real monster (depreciation & finance cost) will come out eat up all

2021-02-07 20:43

paperplane

Umobie listing soon, got money to buy more, wakaka

2021-01-13 14:14