(CHOIVO CAPITAL) BAT (4162) - Budget 2021 (The Dark Knight Rises)

Choivo Capital

Publish date: Mon, 09 Nov 2020, 08:04 PM

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) BAT (4162) - Budget 2021 (The

Dark Knight Rises)

========================================================================

Budget 2021, The Dark

Knight Rises.

Overview

One company I’ve always had at the back of my mind, is British American Tobacco (Malaysia) Berhad. Even with the advent of vaping etc, cigarettes is fundamentally a very good business. It is naturally addictive, and because of that, has a certain pricing power (the taste of one cigarette is very different from another as many smokers will attest).

The Challenges in the Malaysian

Cigarettes Industry

However, this business has faced a lot of challenges in Malaysia, mainly due to a few reasons.

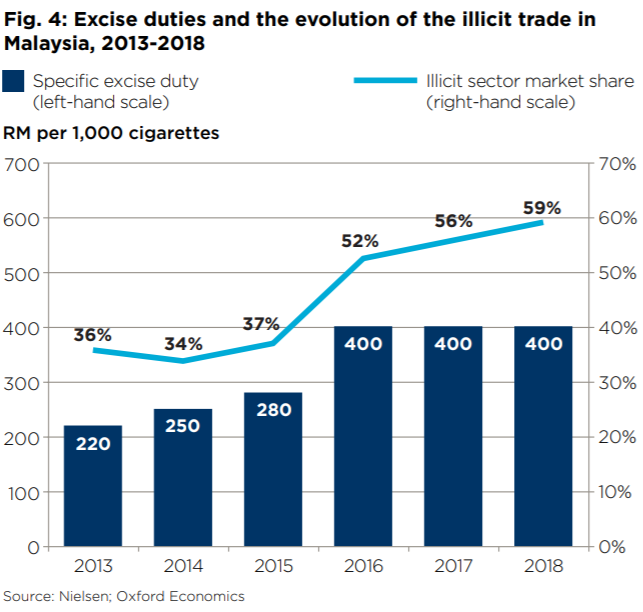

- The constant increase in excise tax on cigarettes.

Since 2004, excise duty on cigarettes have risen every year.

With a culmination of a 42.8% increase in 2016, which coupled with a lack of enforcement, resulted in an explosion in the illegal cigarettes market.

The math is simple, if a pack back then cost RM15 – RM18,while the illegal one costs RM3 - RM5, regardless of how much you prefer the taste of the other, if you’re in the B40 and M40, whose income levels have not risen in tandem with Global or Malaysian inflation, you will more likely be choosing the cheaper options.

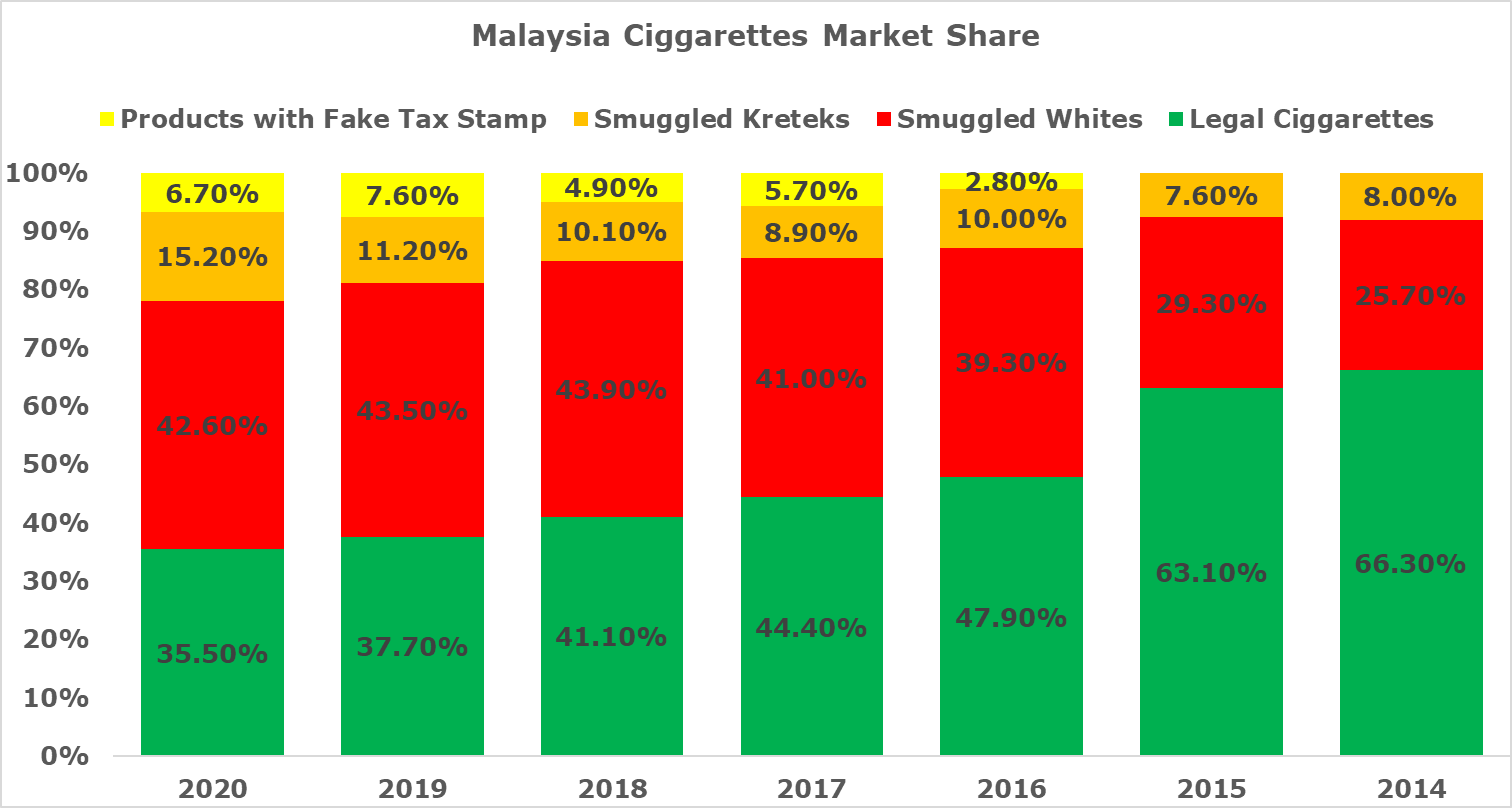

And here, we can see that the main method used to supply illegal cigarettes is via smuggling. (Vape is technically illegal as well, but as the market is very fragmented for them, coupled with lack of regulation, we don’t really know the numbers)

- The complete failure in enforcement against illegal cigarettes.

Now why is smuggling the most popular method in the supply of illegal cigarettes?

For one, its much cheaper to produce cigarettes overseas. And secondly, due to our long coastal lines and lax shipment laws regarding cigarettes, it is very easy to bring in illegal cigarettes.

For example, in the countries like Singapore and Australia, illegal cigarettes are only 10% of the market (Malaysia: 65% of the Market) despite prices being 2 – 3 times higher than Malaysia.

The main reason for this is because these countries banned the transhipment of cigarettes. This means no cigarettes can touch their ports, unless it is for local consumption.

This is not the case in Malaysia, where we have many ports, many of which are lax in enforcement, where containers of cigarettes meant for transhipment, can arrive full and leave empty for various reasons.

- The rise of vaping and electronic cigarettes, which was not regulated sufficiently, or enforced.

And lastly, there is the vaping and electronic cigarettes industry, which based on recent estimates, have become a RM2 billion industry. This is an industry there is until today is still unregulated and untaxed. This naturally affects the legal players like BAT.

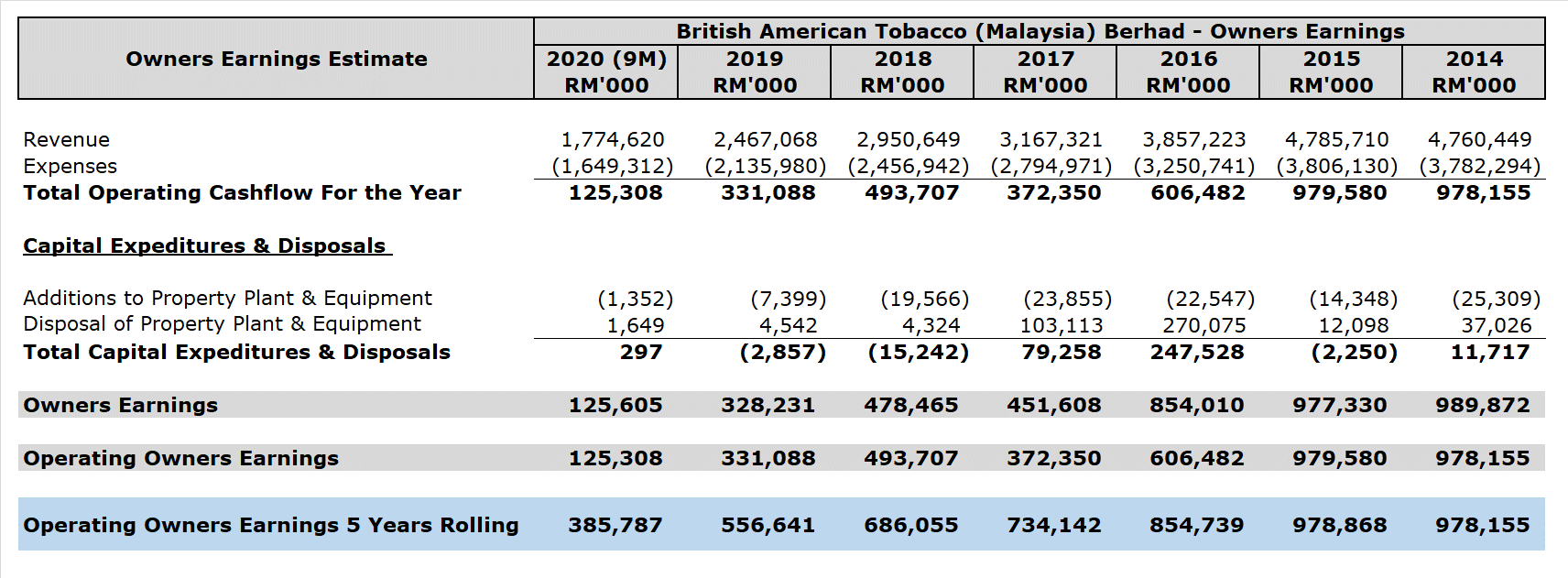

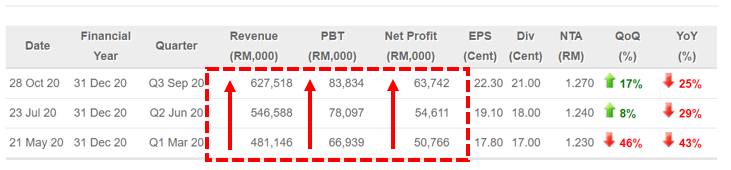

And how have this affected BAT in terms of the numbers?

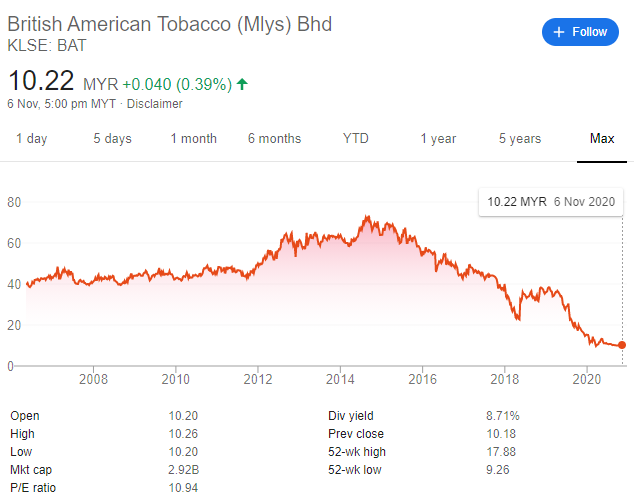

As we can see here, since their high in 2015, earnings have only gone down for BAT. And this has naturally led to this very depressing looking chart which we can see here.

Since reaching their high of RM72.50 back in 2015, it has only going downhill due to the last excise duty rate increase in 2016 which have resulted in the explosion of the illegal cigarettes industry and the decline in their profits.

Except something incredibly (and unthinkable just a few months ago) good for BAT have happened with budget 2021.

The Turnaround – KYO

Even before the 2021 budget announcements, BAT have started turning things around by introducing KYO, a budget range of cigarettes at around RM11.50 for a pack of 20. In addition, the movement restriction orders meant that more people are ordering their cigarettes from online (you cannot find vape and illegal cigarettes on Shopee and Lazada etc), culminating in 2 consecutive quarter of q-o-q profit increases.

The Turnaround – Budget 2021

Naturally, this was not something that BAT took laying down. Since 2015, they have spoken endlessly about the loss in tax revenue for the government due to the illegal market.

However, they were too many fingers in this pie. And the ball was thrown around with the Ministry of Health (MOH) stating that it has no authority to enforce legislation against illegal cigarettes, and it is up to the Customs department.

The customs department naturally (and conveniently might I add) disagrees and says it is the MOH’s prerogative to clamp down on illegal cigarette packets which don’t portray health warnings (which is irrelevant as even illegal cigarettes have health warnings). You should read up on our Customs department and its placing on the corruption index.

That was, until today.

Facing an unprecedented squeeze in our budgets, with the government more desperate than ever for additional revenues, all gloves are off.

According to the 2021 Budget, effective from 1 January 2021, the Government will implement the following measures:

- Freezing the issuance of new import license for cigarette;

- Tightening the renewal of import license for cigarette through review of license conditions including the imposition of import quota;

- Limiting transhipment of cigarette to dedicated ports only;

- Imposition of tax on the importation of cigarettes with drawback facilities for re-export;

- Disallow transhipment of cigarettes and re-export of cigarettes by small boats including kumpit and instead be allowed only in ISO containers; and

- Making cigarettes and tobacco products as taxable goods in all Duty-Free Islands and any free zones that have been permitted retail sale of duty-free cigarettes.

- Impose excise duty of 10 percent on devices for all types of electronic and non-electronic cigarettes including vape effective from 1 January 2021.

- Liquid used in electronic cigarettes will be imposed an excise duty at a rate of 40 cents per millilitre.

This is an unpresented level of enforcement on illegal cigarettes by the Malaysian Government and is very close to the level of enforcement done by countries such as Singapore and Australia where illegal cigarettes is only 10% of the market.

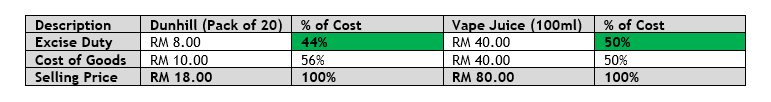

In addition, the tax of vape liquids of 40 sen per millilitre translates to around RM40 in excise tax for one standard 100 ml bottle.

Given that each 100ml bottle is on average RM40 per bottle this translates to around the excise tax being around 50% of the total selling price for vape liquids.

This brings it in line with the current cigarette excise tax levels.

Currently, each cigarette is tax at RM0.40. Using Dunhill (since the above is a premium juice product) as a comparison.

Now if you ask most cigarette users, the feeling of the vape liquid is just not comparable to that of smoke.

And given that prices are going to equalize (and with there being strong enforcement on illegal cigarettes) , I think most smokers will be going back to normal cigarettes.

In addition, let’s not forget the various initiatives BAT have done to cut cost and win back market share, such as shutting down their Malaysian factories to move to a full import model to reduce costs, as well as, introducing KYO (the budget cigarettes) and GLO (their heating based solutions).

All of which resulted in earnings increasing for Q2 2020.

And lastly, now that the vape market is regulated, BAT can bring in their own solutions VYPE. Which holds a 41% market share in the UK, and high teens in other countries.

Valuation

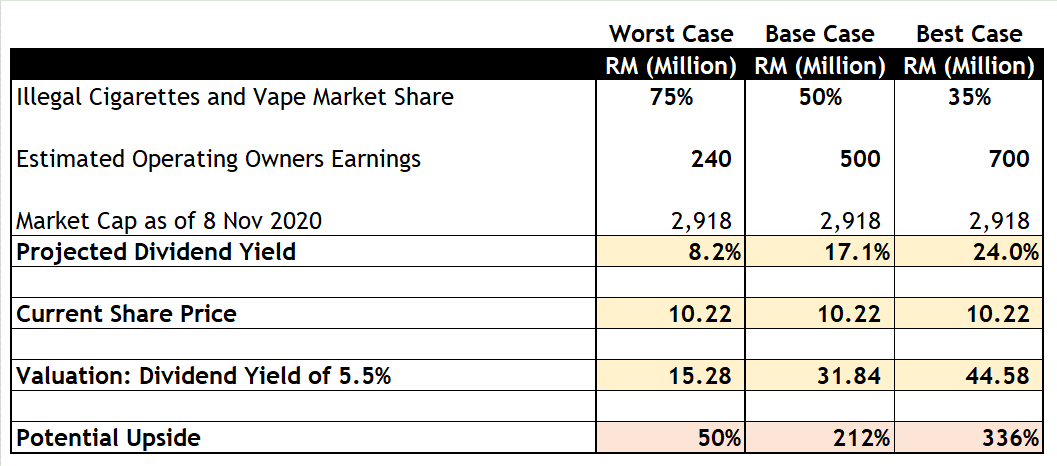

Due to its very stable business (with proper regulations and enforcement now in play) with high dividend pay-outs of 100% or more and close to zero capex (now that everything is imported in due to lower cost of producing overseas), I’ve always looked at BAT as a dividend play.

Now, for our worst-case scenario, I’m going to assume that all these actions done by the government did nothing in reducing the market share of illegal Cigarettes and Vape market share, and only maintained the current status quo.

In which case, we are only looking at a 50% upside given dividend yield requirements of 5.5% with a target price of RM15.28.

Now, what if due to these actions, the market share of illegal cigarettes and vape, goes back to 2017 - 2018 levels of 50% vs the 75% today?

Well, we are now looking at 212% upside or a target price of RM31.84.

Now what if things went back to its 2016 levels, except instead of making RM900 million a year, we adjust it downwards to RM700m a year due to there being new players like the vaping industry?

Well, we are now looking at a target price of RM44.6 and an upside of 336%.

One last thing,

And where is BAT price today? Is it priced in?

Well, it went up a little, but not by much.

Personally, when I first found out, I wanted to buy as much as possible that Friday on 4.50pm but was unable to do so.

During the weekend, I was personally scared that it would limit up without me getting a share, however, I only needed to pay 5-6% extra.

One thing to note about this company, is that for a long time, this company was a local and foreign fund darling, and many of them still hold it as it is too cheap to sell given the dividend yields.

And like many here, they are also all very familiar with the problem that plagued this company, and given the 2021 Budget announcements, would likely want to top up, or stop selling.

However, for the foreign funds, chances are they have not read the news yet this morning, and there fore still queued to sell, while the local funds, chances are, they need to write something up for their investment committee to approve.

They are inherently unable to be as agile as a retail participant.

Let me quote you something I wrote back in 20 January 2020.

Well, what do you think I’ll be doing?

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/Choivo_Capital

========================================================================

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020