Buying A RM 150K Car = Give Up Your Chance of Becoming Millionaire

NeoZach

Publish date: Wed, 03 Jul 2019, 05:01 PM

Guys, I have trouble copying the article to i3 in a readable format. Please go to https://www.2kupang.com/post/buying-a-car-give-up-chance-millionaire at the mean time. Sorry for the inconvenience.

Scenario: You're 25yo. Instead of buying a Rm 150K car, you put that money into your EPF, how much money do you think you'll have at retirement?

You’re 25yo. It has been years since you have graduated college. You have a pretty decent career now and you might or might not have a few people under your report. “To reflect my status and for my own comfort, maybe it’s time that I buy a decent car?”

If that’s what you’re thinking right now, I want you to hold on. You’re going to miss out on a chance to be a Millionaire. DO NOT, I repeat, DO NOT proceed without finish this article. (For those who aren’t at this stage yet, you might want to watch out too ^_^)

I am gonna let the numbers speak for me.

Calculation:

To make things simple, let’s assume the decent car costs around RM 150k. At this price, you can get a new Honda Accord, Volkswagen Tiguan or a Mitsubitshi Outlander.

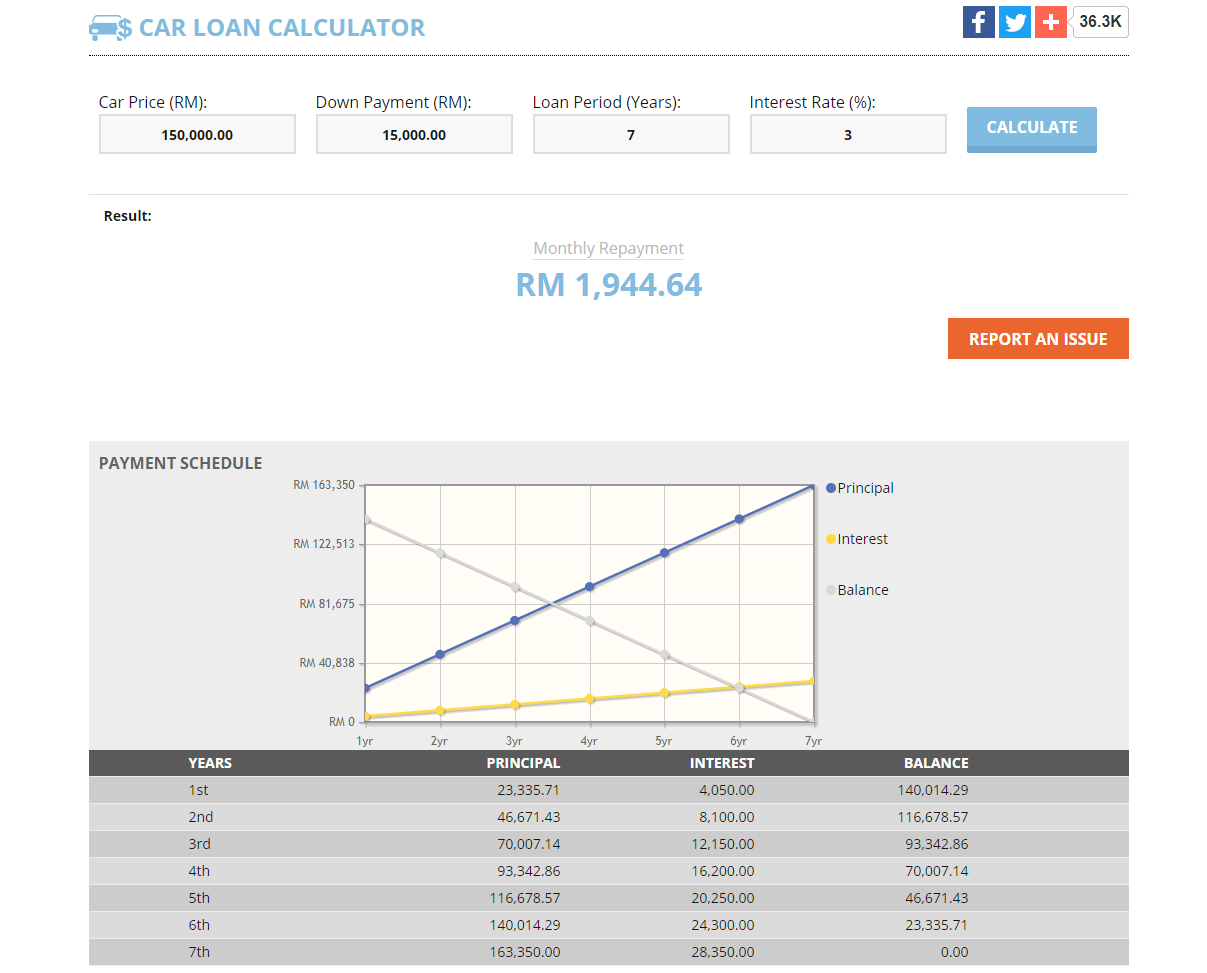

The car loan interest rate average about 3% in Malaysia, assuming you put down 10% (or RM 15,000) as deposit, 7-year tenure, how much do you pay per month?

Here you go. Below is a screenshot I take from a car loan calculator website. (https://www.calculator.com.my/car-loan#.XRm4cegzarw)

RM 1944 a month. For 7 years.

That’s the cash outflow that you need to sustain.

What if - instead of buying the Rm 150k car at age 25, you decided to put your money into your EPF (or any investment that yield 6% per year), how much do you have at retirement (age 60) ?

Scenario – Put the money in EPF/ Unit trust (6% return a year)

Two steps are required for the calculation.

First, using the monthly cash outflow, you project the Future Value of the cash outflow at year 7, which is when the car loan is paid off.

Second, fast forward to Year 7, the future value of Step 1 becomes the present value at Year 7. You project it additional 28 years out (60 yo – 25 yo = 35 years. 35 years – 7 years loan = 28 years left.) to age 60 at the same 6% a year to get the Future Value of your portfolio.

If you find the above explanation confusing, worry not. This is for the finance people. You may jump ahead to the Results part.

Step 1

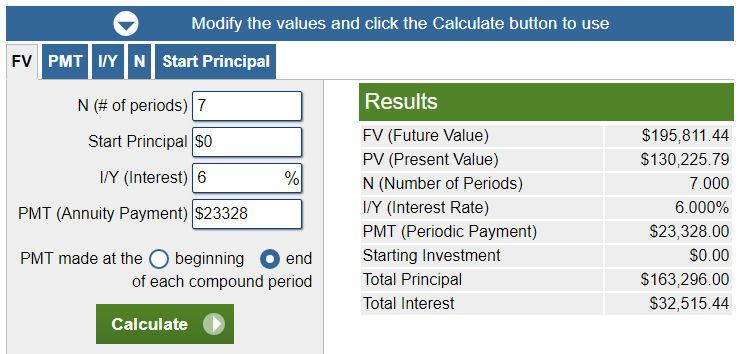

Using the Financial Calculator,

(https://www.calculator.net/finance-calculator.html?ctype=endamount&ctargetamountv=1000000&cyearsv=7&cstartingprinciplev=0&cinterestratev=6&ccontributeamountv=23328&ciadditionat1=end&printit=0&x=0&y=0)

N: Number of Years (We use 7 years here)

Start Principal: RM 0 (because you pay nothing at Year 0)

I/Y (Interest): 6% a year return

PMT (Payment per year): RM 1,944/month x 12 = RM 23,228/year

- We get RM 195,811 at Year 7.

Step 2

Using Financial Calculator,

(https://www.calculator.net/finance-calculator.html?ctype=endamount&ctargetamountv=1000000&cyearsv=28&cstartingprinciplev=195811&cinterestratev=6&ccontributeamountv=0&ciadditionat1=end&printit=0&x=86&y=17)

N: Number of Years (We use 28 years here. 35 working years – 7 years loan = 28 years left)

Start Principal: RM 195,811 (Future Value from Step 1)

I/Y (Interest): 6% a year return

PMT (Payment per year): RM 0 (To mimic the car loan payment cashflow, you don’t pay anymore after the car loan is settled.)

Results: You get #RM1million. Congratulations, you’re a millionaire!

Well, you’re supposed to, if you don’t buy that car.

Additional Info:

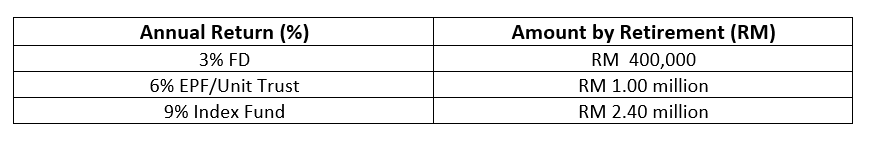

What if I don’t want to put the money into EPF? What about FD, or maybe something more aggressive?

I have created the table below for your comparison.

*I have explained what Index Fund is in another article. We also talked about how does it achieve 9% return a year there. See article here. (https://www.2kupang.com/post/freshgrad-extra-rm100k-retirement)

Conclusion:

What explains the big difference between buying a car and putting the money to work?

The biggest reason is definitely that a car is a #depreciating asset. It drops in value every year. On the other hand, if you invest the money, it grows into something far more significant.

You must have known at least a few friends or relatives that changes car often. That’s the worst financial decision ever. Like EVER. And I am not saying that you shouldn’t buy a car. In fact, for the sake of convenience, you should.

What I am saying is that don’t buy fancy cars unless your wealth far outweighs the cost of the car. Stay within your means on cars, if you seriously want to grow wealth.

RM 1 million. That’s your price of buying a RM 150K car today. And that doesn't include road tax, maintenance, gas/petrol, parking and tolls yet.

Buy a RM 50K car if you may. A rule of thumb is that for every RM 50K increase in car price, you're giving away RM 333K by retirement.

If we #Malaysian handle our finances properly, many would have become #millionaire already.

#fancycars #financialsuicide #wealth #baddecision #milennial #malaysian

Discussions

so many offers n choices it is now even easier n faster to bankrupt in 2020, buy a discount 550k property and get cash back 150k to buy a car

2019-07-03 17:22

register n resell in 1 month already about 20% clouding,no need wait few years but at least can show off lar!

2019-07-03 17:35

Fabien "The Efficient Capital Allocater"

work hard in you career, climb up the ladder and get your employer to reward you with car allowance, not forking out your hard earned money on continental cars! earned it through your career advancement

2019-07-03 17:41

nowadays save electricty n be enviromental freindly,prime night time many not lighted up

2019-07-03 17:41

just be contented a safe road worthy car ,enuff foods on table....,no need to headache to pay at end of every coming months n years

2019-07-03 17:54

thats precisely the reason why young generations should NOT buy these properties at inflated price...

they will sell their self for the rest of their life to payback..

Let the property price collapse...

after all its just made of sands and cements dug from the soil

2019-07-03 17:54

You can live in a 'Container House"...you need not buy these properties......its not that you can afford to raise 5 kids like your parents did.

remember the money you fork out to buy these properties is what comes back as salary to you with a thin margin to motivate you to work and earn....its cyclic flow of money...

and at the end you stand a risk of this property price collapsing

all your had earned money to pay this property becomes nothing at the end

you are made worst than cattles and chicken reared to work and feed the rich...like a fish asked to swim around with a moving hook in front of it...

2019-07-03 18:02

let the property collapse...it will inevitably collapse anyway...as the even distant future generation will never be able to afford it anyway..

this is already at last stage of the bubble...'this pyramid scheme' will collapse eventually..

dont be the last victim at the end of the pyramid scheme.

the supply has to bow and meet the demand...consumer is the KING

Let the property price collapse

...............................

2019-07-03 18:06

Just go n rent mah....!!

Renting is cheaper & much more affordable than owning properties loh...!!

With the money u save on accomodation, u can use it to buy or invest in undervalue margin of safety stock like insas in order to grow your capital & protect u from inflation loh.......!!

Do not despair if property price remain unaffordable mah....!!

It is blessing in disguise loh...!!

2019-07-03 19:15

In the US, people buy car because it's cheap and they need it to travel due to poor public transport system in many outskirt areas. But people here tend to see things differently. Not that I am against the idea of owning a luxury car, just that people here just can't wait till the day to enjoy their prize. Imagine someone who can afford a Kancil buying Vios. Who can afford an Accord buying Mercedez Benz. It's the future you are trading with the car that won't worth much later on. Some more they are so happily doing that.

My relative recently 'upgraded' their car to HRV, took 9 years loan. We were so amazed by their courage as they are just ordinary working class earning less than RM 10k combined income. They even have another car loan to pay each month. With house loan, study loan, kids' education fee, etc. Really wonder how they make ends meet. But they are so 'proud' showing off their car to us when we visit them.

I am speechless.

2019-07-04 14:49

The best car u can have is a 2nd hand perodua myv....u will save alot of monies loh...!!

Just imagine if your whole life just own a myv all the way, how much can u save leh ?

2019-07-04 15:23

No everything can be translated into dollar sense, if driving Myv (milo tin), meet a severe accident, life is gone, what is the purpose of having thousand $ in the bank

2019-07-04 18:12

In a way true loh....!!

But must be balance mah, if your objective is to accumulate wealth now bcos u r not rich enough or could not afford benz or bmw...driving a myv is a good solution bcos affordable mah....!

Meanwhile it help u build up your future wealth thru prudent savings for investment

I remember in my old days, i even use honda kap cai too mah....!!

Posted by MG9231 > Jul 4, 2019 6:12 PM | Report Abuse

No everything can be translated into dollar sense, if driving Myv (milo tin), meet a severe accident, life is gone, what is the purpose of having thousand $ in the bank

2019-07-04 18:25

probability

exactly what i did (i stayed with my first car of just RM 20k second hand for 10 years)...and its true indeed you can gain a million.

the gap between the paragraphs is too big..suggest you edit

2019-07-03 17:13