My telegram reshares

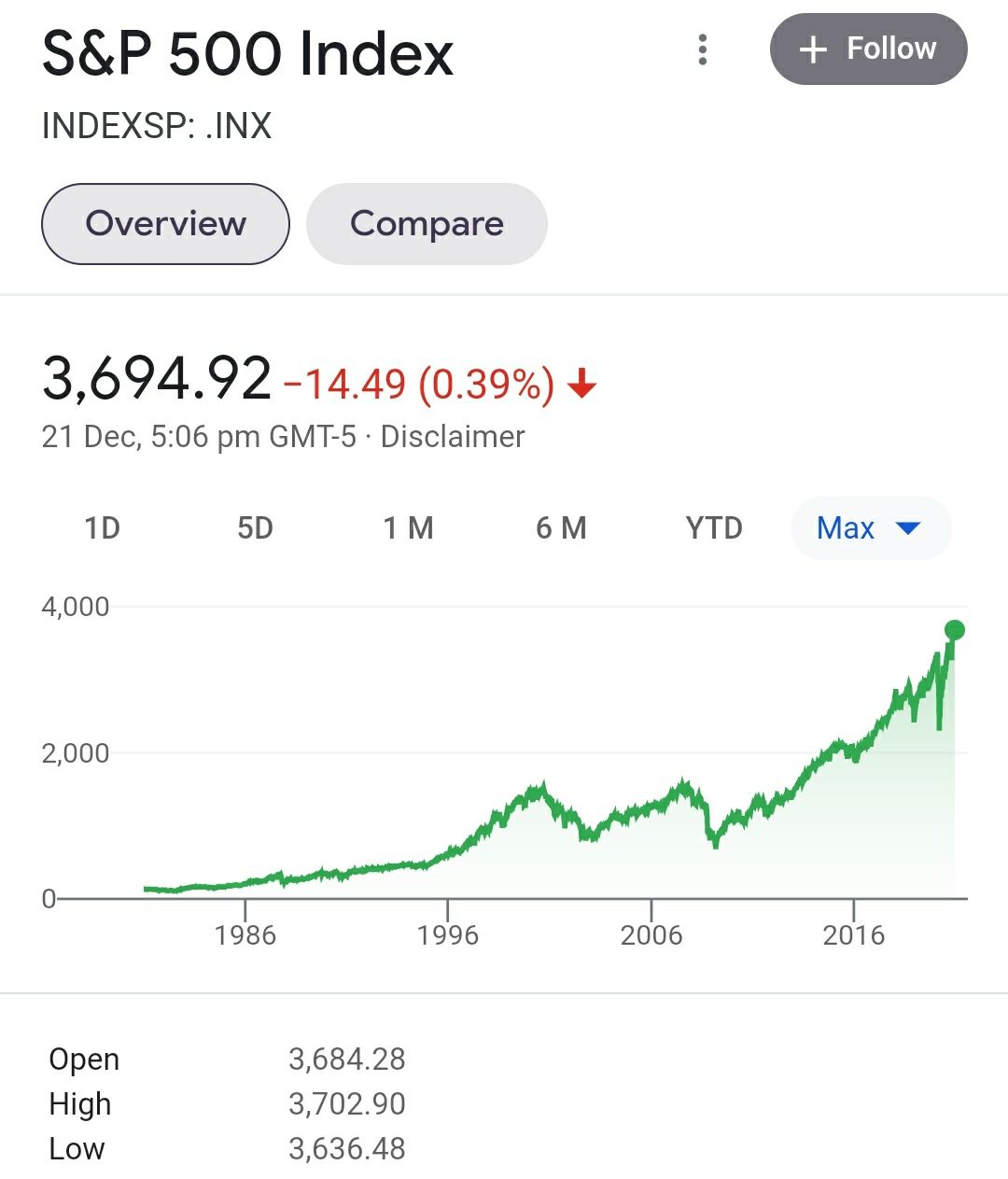

Is the market overvalued?

Philip ( buy what you understand)

Publish date: Tue, 22 Dec 2020, 07:47 AM

>>>>>>>

Qqq3:

The performance of DIY and Palantir after first results inspired me to buy Miniso, no mistake...... Didn't know make money stock market so easy one any others?

>>>>>>>

FYI I have sold 30% of partnership portfolio in stoneco at 100k shares@75(bought 20.5), as well as 50k shares of palantir @28.3(bought 14.6). The recent market events have given me some pause on the market results.

Philip Farms:

This is another sign of bubble, when people says making money in stock market is easy... We need to be very very careful.

Is s&p500 overpriced? Is it the only game in town?

https://www.forbes.com/sites/mikepatton/2020/08/18/us-stock-market-hits-record-77-overvalued/?sh=9390d9b358c1

One of the biggest metrics that Warren buffett likes to use is real work versus accounting world

Or in this case market cap versus GDP

Market cap is an illusionary figure

Because of artificial supply versus demand

A company that has very little revenue and no earnings can actually sell for more than its production value

We call this speculation, trading, whatever.

But in the real world, companies produce products or services which sells for money and that reality defines the value of a company

No point buying 1 million acres of land on the Sahara desert after some research reports speaks of the potential of oil and diamonds

If you don't see a single point of production.

And yet this is how the stock market works.

This article here then is basically telling us that the overall market caps of all the listed companies in usa is selling for almost double what the GDP is

From here on out there are 2 possibilities, one is that us stocks GDP will increase to meet the valuations, the other one is valuations will drop to meet the GDP

I am sure there are a few companies that will meet or exceed their growth targets

But overall .. I believe that companies will sooner or later fall back to earth

There is no such thing as a free lunch.

The thing that you have to realize as a big picture idea is that the stock market is also a commodity, like wheat, soy, bonds, gold, btc etc

For the mass majority, when you buy the stocks you are not going to own the company, you are only hoping that management will give you a part of the growth of earnings in terms of share buybacks, dividends or retained earnings

Since we are owning small pieces of shares... We can't really do much other than put our trust into management.

So the rules of the game is the same as marriage, find someone that you can trust.

Here is the problem: are the tech companies really producing useful products? Or are they just undercutting the existing ones in a futile effort to grow.

Look at Australia, their explanation on FB and Google paying the local media companies is that if those 2 companies didn't exist, people would still be buying newspapers and supporting the local source. So the draw of Google and FB news is just free info that is taken advantage of to provide service to users.

In other words, FB and Google don't spend any money to produce any unique content, they just take advantage of other people's work to make money and sell ads, at the cost of people who produce unique content.

How many "tech" companies are doing this? Oyo, Airbnb, Uber, Lazada, shopee. If they didn't exist, would hotels die out? Would taxis die out? Would mom and pop shops die out? If it was a level playing field, who would we really choose? I think moving forward people would realize Airbnb users don't pay tax and safety codes ( hotels do), Lazada and shoppee sellers don't pay tax and rental ( physical stores do), Google and FB is selling your content for cheap prices ( which others work hard to do) and when people realize this and governments regulate this, those companies will have a big rerating of future prospects.

Those who are overpaying for future earnings today at high prices will be swimming naked when the tide goes out.

Yes, market is becoming increasingly overvalued, and yet how many people are starting to hold cash and drop earnings?

More articles on My telegram reshares

Why I bought Mynews & Kawan... another foray into trading gimmicks

Created by Philip ( buy what you understand) | Sep 30, 2022

Why I bought even more SERBADK bonds and stocks

Created by Philip ( buy what you understand) | Jun 15, 2021

HOW TO BUY LEAPS OPTION CALLS. No genting, no problem

Created by Philip ( buy what you understand) | Feb 25, 2021

My thoughts on palm oil industry. And the recent drop in palantir results.

Created by Philip ( buy what you understand) | Feb 17, 2021

MY BIG PURCHASE FOR 2021. THE COMPANY THOMAS EDISON FOUNDED.

Created by Philip ( buy what you understand) | Feb 10, 2021

My pump and dump stock for 2021 - foreign dumping edition

Created by Philip ( buy what you understand) | Jan 05, 2021

dawchok

Philip : it is grateful that there is still few genuine and good writer as you in i3.

2020-12-22 08:52