CONSUMER Sector (KingKKK) - Unveiling Potential Q2 Stars: APOLLO, DLADY, SPRITZER, FFB, F&N, GCB, QL, MRDIY, NESTLE, BJFOOD

KingKKK

Publish date: Sat, 06 Apr 2024, 12:28 AM

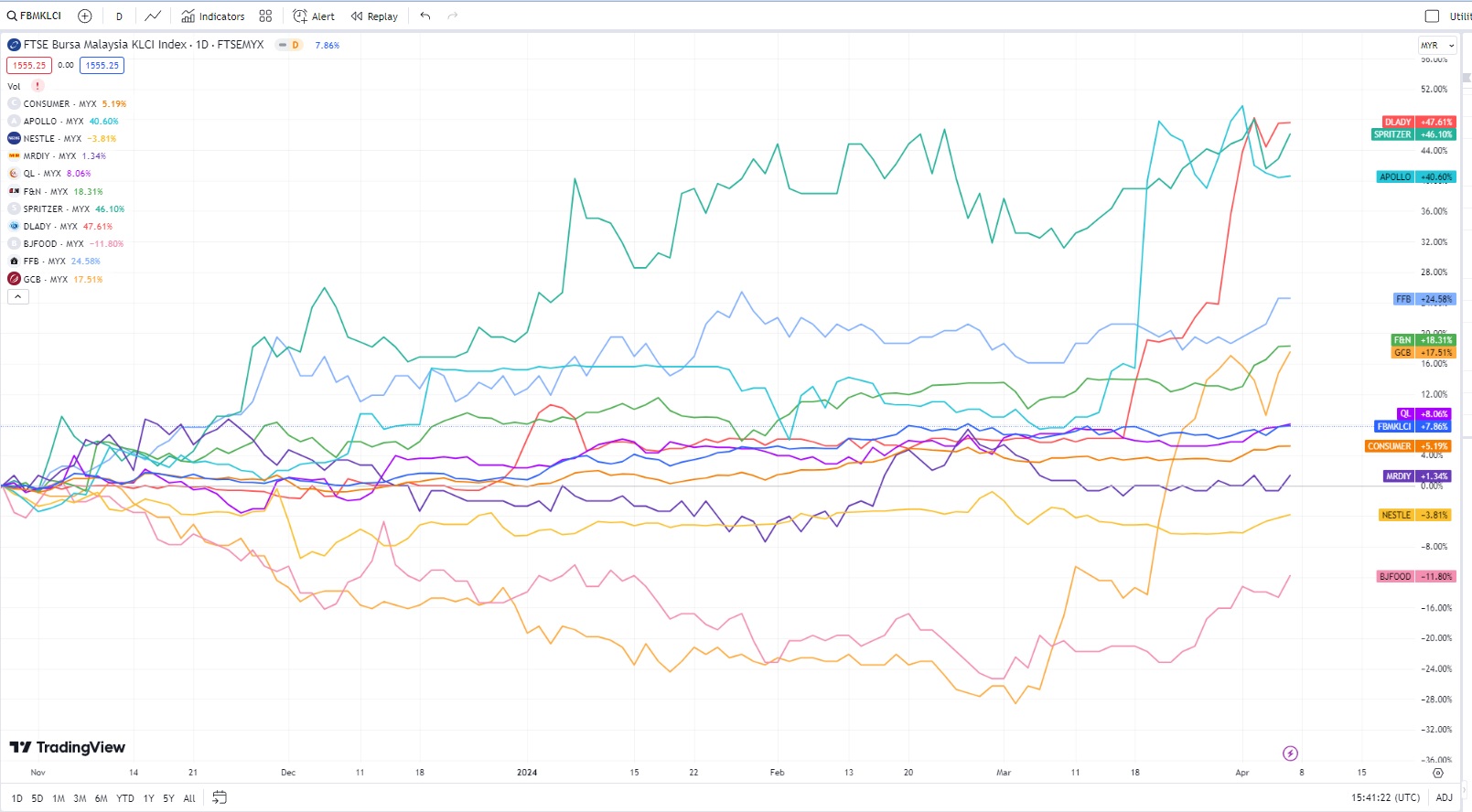

The chart above from TradingView shows the 6M (6 months) performance of FBMKLCI, Bursa Consumer Index, APOLLO, DLADY, SPRITZER, FFB, F&N, GCB, QL, MRDIY, NESTLE and BJFOOD.

These are what I see:

1. Consumer sector underperformed FBMKLCI 6-months up to 5-April. Bursa Consumer Index return is +5.19% against FBMKLCI +7.86%. Possible reason for slight underperformance is due to lack of details on how subsidy rationalisation will affect consumer in 2024. However, there are superperformer in consumer sector.

2. Boring stocks are the champions.

3. DLADY won the gold medal. DLADY share price gained 47.6% in the past 6M as raw material price decline enhancing margin.

4. SPRITZER won silver medal. SPRITZER share price gained 46.1% in the past 6M as sales of bottled mineral water improved along with improvement in economy and to a certain extent the hot weather. Spritzer is in my portfolio with 5% allocation and supported my overall portfolio gain of +19.6% in Q1. I am ranked #8 in i3investor competition.

Stock Pick Year 2024 - 29 Mar Result | I3investor

5. APOLLO is ranked 3rd, won the bronze medal. APOLLO gained 40.6% in the past 6M.. The latest Q3 earnings was up 179% YoY and 204% QoQ. New management seems to be working hard in improving sales and margin for APOLLO. APOLLO is also in my portfolio with 5% allocation and supported my overall portfolio gain of +19.6% in Q1. Recently, I have increased the intrinsic value for Apollo Food to RM11.30, details as below.

6. BJFOOD is the underperformer. Share price is down 11.8% in the past 6M. The boycott against Starbucks has affected the company's earnings.

7. Conclusion: Fundamental analysis work and boring stocks such as DLADY, SPRITZER and APOLLO can generate sexy return for those who did their homework.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-26

F&N2024-07-26

F&N2024-07-26

F&N2024-07-26

F&N2024-07-26

FFB2024-07-26

FFB2024-07-26

MRDIY2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

NESTLE2024-07-26

QL2024-07-26

QL2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-26

SPRITZER2024-07-25

DLADY2024-07-25

F&N2024-07-25

F&N2024-07-25

F&N2024-07-25

FFB2024-07-25

MRDIY2024-07-25

NESTLE2024-07-25

NESTLE2024-07-25

NESTLE2024-07-25

QL2024-07-24

F&N2024-07-24

F&N2024-07-24

MRDIY2024-07-24

NESTLE2024-07-24

QL2024-07-23

F&N2024-07-23

F&N2024-07-23

FFB2024-07-23

FFB2024-07-23

MRDIY2024-07-23

NESTLE2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-23

SPRITZER2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

F&N2024-07-22

FFB2024-07-22

FFB2024-07-22

FFB2024-07-22

MRDIY2024-07-22

NESTLE2024-07-22

NESTLE2024-07-22

QL2024-07-19

DLADY2024-07-19

F&N2024-07-19

F&N2024-07-19

F&N2024-07-19

F&N2024-07-19

FFB2024-07-19

FFB2024-07-19

FFB2024-07-19

FFB2024-07-19

FFB2024-07-19

FFB2024-07-19

FFB2024-07-19

MRDIY2024-07-19

MRDIY2024-07-19

NESTLE2024-07-19

QL2024-07-19

QL2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-19

SPRITZER2024-07-18

DLADY2024-07-18

F&N2024-07-18

FFB2024-07-18

FFB2024-07-18

FFB2024-07-18

FFB2024-07-18

FFB2024-07-18

FFB2024-07-18

MRDIY2024-07-18

NESTLE2024-07-18

QL2024-07-17

DLADY2024-07-17

F&N2024-07-17

F&N2024-07-17

FFB2024-07-17

FFB2024-07-17

FFB2024-07-17

FFB2024-07-17

FFB2024-07-17

FFB2024-07-17

MRDIY2024-07-17

MRDIY2024-07-17

MRDIY2024-07-17

NESTLE2024-07-17

QL2024-07-16

DLADY2024-07-16

F&N2024-07-16

F&N2024-07-16

FFB2024-07-16

FFB2024-07-16

FFB2024-07-16

FFB2024-07-16

FFB2024-07-16

FFB2024-07-16

FFB2024-07-16

FFB2024-07-16

NESTLE2024-07-16

QL2024-07-16

QL2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZER2024-07-16

SPRITZERMore articles on Stock Market Enthusiast

Created by KingKKK | May 13, 2024

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024

Discussions

seems like powerroot also not quite catching up with the consumer theme. the latest net profit not powerful enough

2024-04-07 20:46

MAGNI +11.9% in the past 6 months, would have ranked 6th if included in the chart.

2024-04-07 21:27

KAWAN almost flat in the past 6 months but has dividend yield of 2.3%. Stable but don't expect huge growth.

2024-04-07 21:28

PWROOT -15.3% in the past 6 months. Latest Q earnings was down YoY and QoQ, maybe that's the reason. Share price should recover once earnings show significant improvement.

2024-04-07 21:30

KingKKK

Do you have boring stock in your portfolio? Did it increase in price in 2024?

2024-04-06 20:50