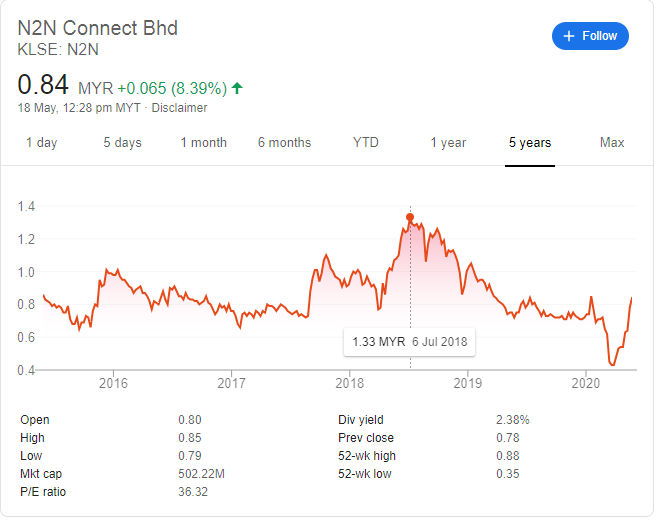

10BIL SHARES TRADED BENEFICIARIES - EFORCE (200% to 5-year high) & N2N (58% to 5-year high)

boostmy

Publish date: Mon, 18 May 2020, 02:30 PM

THESIS

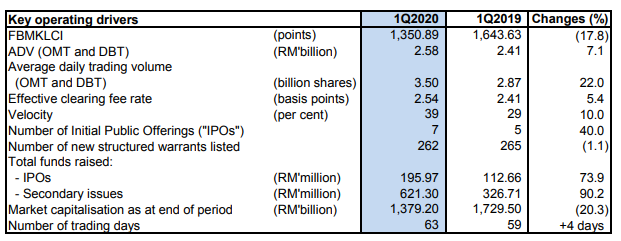

1. According to Bursa Malaysia's results, average daily trading volume increased 22% in 1Q20 which ultimately led to a 34% increase in its quarterly net profit. Bursa Malaysia earns a fee on trading volume, hence it is an obvious beneficiary of the recent increase in trading volume. However, Bursa Malaysia's share price has performed well, it is now 13% from reaching its 5-year high of RM8.07.

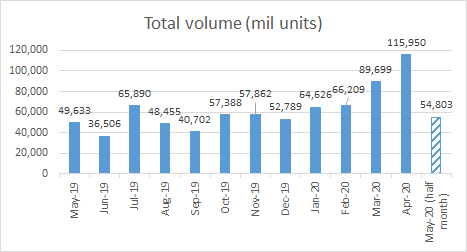

2. While 1Q was good in terms of trading volume, 2Q will be better. Total shares traded hit 89bil for the month of March 2019, but in April 2020, that figure was 116bil shares traded - an increase of 30%. Despite the higher number of public holidays, the month of May 2020 will likely exceed April 2020 as we have seen record trading activity take place over the past week.

3. Besides the stock exchange, bank-backed stockbrokers such as CIMB, Maybank and RHB will benefit, but equities trading only makes up a small percentage of their overall profits. Depending on their contributions to bottomline, non bank-backed stockbrokers such as Berjaya Corp (Inter-Pacific), Kenanga Investment Bank, TA and Insas (M&A securities) will benefit as well.

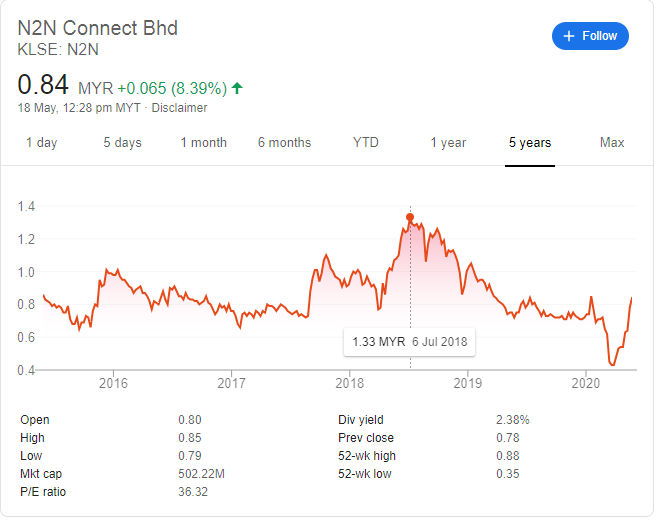

4. However, my chosen proxy to ride on the rising trade volume are the trading platform providers, comprising of EFORCE and N2N. This is because both companies earn a fee on total volume traded on their platforms. As you might be aware, EFORCE is the platform provider for Maybank, among others while N2N provides the platform for CIMB. Besides just the trading fee, the sudden rise in trading volume requires brokerages to invest more in front-end and back-end software and conduct more maintenance.

5. While trading volumes are at a 11-year high, only comparable to the month of May 2009, EFORCE and N2N current trade significantly below their 5-year share price highs. EFORCE trades at a 67% while N2N at a 37% discount. This implies a 207% upside to its 5-year share price high (RM1.63) for EFORCE and 58% for N2N (RM1.33). Bear in mind, Bursa Malaysia is only 13% from its 5-year high.

APPENDIX

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on boostmy

Created by boostmy | Aug 14, 2019

Created by boostmy | May 16, 2019

Fear Trend

Thanks for the article. the second quarter result which will be out by July/August will be better. hold till then.

2020-05-22 00:35