CARLSBERG (2836) – On Track for Recovery

BuyCall

Publish date: Wed, 16 Dec 2020, 11:23 AM

Full original post please visit

CARLSBERG (2836) – On Track for Recovery

Although Malaysia is a Muslim majority country, alcohol is not banned as it is still considered as a multi-cultural country after all. Among all alcohol available in Malaysia, beer is by far the most popular alcohol which makes up to above 70% of the total alcohol consumed here. Brewery licenses are not easy to get here, as I know currently there are only two breweries with licenses in Malaysia – Carlsberg Malaysia Berhad (“Carlsberg”) and Heineken Malaysia Berhad (“Heim”).

Carlsberg and Heim are both public companies which are listed on the KLSE. Since Chinese New Year is coming, I will like to talk about Carlsberg in this article.

Business Summary

Established in 1969, Carlsberg Malaysia Group is a brewer with operations in Malaysia and Singapore, with stakes in a brewery in Sri Lanka. Carlsberg also have a regional presence via exports and intercompany sales to regional markets such as Taiwan, Hong Kong, Cambodia, Laos, Thailand, Sri Lanka, Timor Leste, Papua New Guinea, Maldives and Guam.

Portfolio of Beer Brands

Are you familiar with any of the brands above? Many of these brands are available in most of the clubs, bars, restaurants, entertainment outlets and also alcohol stores in Malaysia. My personal favorites are Asahi Super Dry, Connor’s Stout, Corona, Kronenbourg 1664 Blanc and of course the flagship brand Carlsberg itself.

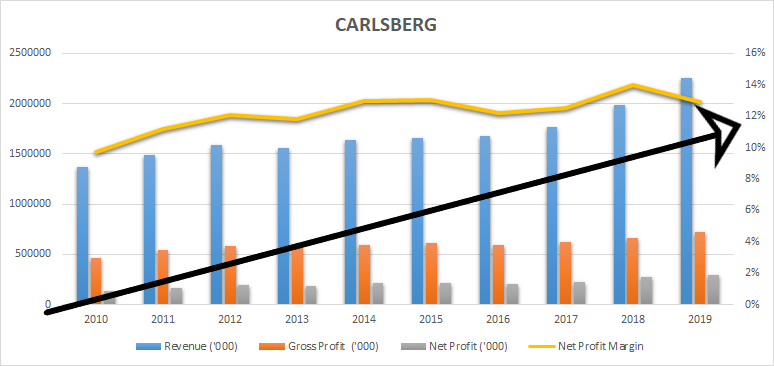

Profitability

In the past ten years, Carlsberg’s Revenue, Gross Profit, Net Profit and Net Profit Margin have been growing gradually. Companies with such consistent growth is rare in our local stock market as most companies’ business are cyclical in nature.

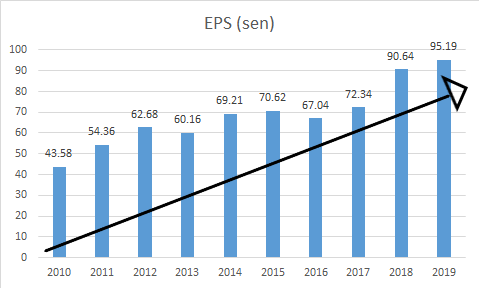

During the same period, Carlsberg’s Earning Per Share (EPS) has also been increasing gradually at a 10-years Compounded Annual Growth Rate of 8.13%. Consistent growth in EPS is by far the greatest catalyst to move up share price. Hence, this explains how the share price of Carlsberg managed to go from RM4 to the high of RM39 (875% gain) over the span of 10 years (I haven’t even adjusted for dividend yield yet!).

From these, we can conclude that Carlsberg is having a superb Management team that is capable of implementing successful corporate and marketing strategies. All these years we have witnessed Carlsberg’s successful promotional activities such as:

- Chinese New Year Limited-Edition Bottle Can Design Promotion

- Chinese New Year Carlsberg Events

- Football Competition Events

- Carlsberg Golf Events

- Food & Beer Tasting Events

- DJ events

and so on… which saw their mainstream and premium brands gaining popularity and sales growth. In 2019 alone, its mainstream brands – Carlsberg Danish Pilsner & Carlsberg Smooth Draught combined sales volume has increased by 7% year-on-year and its premium brands – Kronenbourg 1664 Blanc, Somersby Cider, Connor’s Stout Porter and Asahi Super Dry recorded a combined growth of 13% year-on-year for both Malaysia and Singapore, with Kronenbourg1664 Blanc and Connor’s Stout expanding in strong double-digit terms.

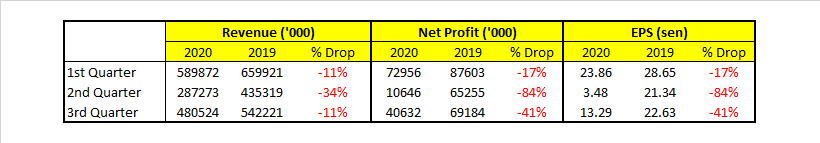

Covid19’s Impact

Like any other businesses, Carlsberg is also impacted by the pandemic. Carlsberg’s production was suspended for seven weeks during the MCO period in Malaysia which greatly affected its operation, sales and distribution. On top of that, overall lower consumption of alcohol due to the mandatory temporary closure of restaurants, bars, clubs and entertainment outlets in Malaysia and Singapore have also caused Carlsberg to have lower sales orders for its beer. As a result, Carlsberg’s first, second, and third quarter results were severely impacted.

Weak quarterly results have caused Carlsberg’s share price to fall from the high of RM37.282 to the lowest point of RM16.642 (a 55.4% dropped in price). Even though the price has rebounded from the lowest, based on 14/12/12’s closing price of RM22.20, Carlsberg’s share price is still 40.45% lower from its peak.

My Opinion

Personally, I believe Carlsberg will definitely be able to weather through this pandemic. This is why:

Beer demand is inelastic

Inelastic demand means buyer’s demand does not change as much as the price changes. This means that when beer prices increase, beer consumers will still purchase and consume the same amount of beer regardless of the price increase. This is because beer is addictive, in a way. It does not matter whether the economy is good or bad, people still drink beer after work, weekends, or during celebration events. This is why I strongly believe that demand for beer will improve and possibly back to pre-pandemic level in near future.

Year End Holiday & Chinese New Year

Beer sells best during festive seasons. This means that it is highly possible that we are seeing an improved quarterly results for the coming next two quarters of Carlsberg due to Christmas, New Year, and Chinese New Year. Historically, Carlsberg always have better quarter results on their first and forth quarter. As Carlsberg’s share price is still hovering at the low point between RM23.20 and RM19.00, a better quarterly results might give the share price a push up north.

Sales Recovery

Following the ease of movement control measures, we witness 51.5% improvement in sales from their latest released quarter result released. This again proves that despite Covid-19 new cases are still increasing everyday, beer’s demand is still recovering at a convincing rate. I strongly believe Carlsberg has went through its worst period and is poised for fast recovery back to pre-pandemic level.

E-Commerce & Off-trade Channels

To overcome the decrease of sales volume due to the movement control order and the temporary closure of certain entertainment outlets, Carlsberg has started investing into its own e-commerce platform. This implementation is right on time to tackle the possible rise in demand during the festive period as I believe majority people will prefer to have their beer delivered to their home for home consumption given the new norm and behavior created by the pandemic.

Off-trade channels such as grocery stores and supermarkets are also experiencing higher sales order after the ease of MCO restriction because nightclubs and pubs are still not allowed to operate. With the right marketing strategies, the increase in sales volumes through its e-commerce and off-trade channels can then compensate its loss in on-trade channels.

Risks to be considered:

Of course, there are a few risks that we might need to take into consideration.

- Extension of Movement Control Order (MCO) – Lock Downs

- Further Hike in Alcohol Tax Duty

- Contraband Products

Majority businesses will not survive through another round of total MCO lock down. Based on the government’s latest decisions to uplift travel restrictions, it seems that the Government has started to prepare for gradual economy recovery despite having high number of new covid19 daily cases. This gives us the impression that it is very unlikely that the government will impose another round of total lock down MCO which will greatly affect our local economy.

Malaysia has the second-highest alcohol excise duty in the world, at RM175 per liter of alcohol by volume. A further hike in alcohol excise duty will pose a serious risk to the company’s business as consumers might switch to contraband alcohol instead. Personally, I think there will not be any increase in alcohol excise duty in near future by the government. Malaysia’s brewery business contributes more than RM2.2 billion in alcohol taxes annually to the country. A further hike in alcohol excise duty will only spur the demand for contraband alcohol products which will result in lower alcohol tax collection income for the country.

At the same time, the Royal Malaysian Customs and other law enforcement agencies are putting in extra efforts to curb illegal alcoholic beverages. Any progresses in curbing illegal alcoholic beverages will benefit Carlsberg in a big way.

Technical Analysis

As you can see from the chart, its price has been dropping since February 2020. Although the share has been on down trend since the beginning of the year, we have started to witness a turnaround for stock. There are a few points to take note:

- We have our first buy signal on 17/11/2020 – The Golden Cross of 20-days moving average & 70-days moving average

- We have our second buy signal on 30/11/2020 – RSI blue line crosses the red line from below 20 and trending upward

- We have our third buy signal on 9/12/2020 – MACD blue line crosses the red line above zero

These three are strong buy signals indicating that the stock is bullish now.

We have immediate price support line at around RM19.10 and immediate price resistance line at RM24.40. If the stock is able to break through its immediate resistance of RM24.40 and stay above this price level, the stock will then break through its 200-days MA. When a stock price crosses its 200-days moving average it is indicating the stock could be starting its bull run again.

Conclusion

Even though the Covid19 situation is still very serious in our country, at current share price level, I think the risk is minimal as compared to the possible reward we could gain from the stock. We only look at blue chip companies like Carlsberg when they have a big correction in price as any other time these stocks are usually very expensive.

It is a good that brewery licenses are not easily obtained in Malaysia. This means that Carlsberg will always enjoy a big chunk of market share due to the barrier of entry into this industry. Despite the near term uncertainties in earnings and dividend yield, I still deem Carlsberg as attractive given its current low price level and the solid foundation in terms of its business and financial status.

Fundamentally, Carlsberg is strong in its cash management. With its strong record of operating cash flow that has been consistently providing excellent free cash flow, coupled with healthy cash and cash equivalent balance, Carlsberg is in strong position to handle its short term sales disruption due to the pandemic.

Based on Technical Analysis, it seems that the price has gained traction lately from its previous down trend. The stock has formed a higher low and is on track to break through its recent high point. Convincing buy signals like the Golden Cross, MACD cross and RSI cross have also surfaced which further indicating that the stock is moving upward. Once it breaks through its recent high, it will then cross above its 200-days moving average which means the stock has came out from its downward trend and begin its bullish trend.

In view of the recent news on successful vaccine developments and the relaxation of movement control order by the government, I strongly believe the worst has passed for Carlsberg. The recovery seen in its sales volumes also indicates that demand is gradually recovering to pre-pandemic level. As we welcome year-end festive seasons and Chinese New Year season in two months time, we could very well welcome a much better quarterly results for the next two quarters for Carlsberg. This could be the best catalyst to move the share price of Carlsberg back to its previous peak (mid-term).

To be safe, you could consider buying in only when the price crosses its 200-days moving average and break through its previous high. Separate your fund into few tranches and invest each tranche near the support, or when it breaks through certain resistance (make sure it could stand strong above its resistance after breakthrough before you invest).

The dividend yield by Carlsberg has always been convincing. Even though recently Carlsberg has declared that it will reduce its dividend payout amount in order to preserve cash for operation during the pandemic. When the business recovers, Carlsberg’s dividend payout will also recover. Assuming having the same dividend payment amount in 2019 (total dividend in 2019 was RM1.284) in near future, if your average purchase price is RM23, your dividend yield will then be around 5.5%.

Carlsberg has always been a great blue chip stock with attractive capital gain and dividend yield. All this while no one paid much attention to it because the stock has always been deemed expensive. Today, we are presented with this great opportunity to collect it at a much cheaper price, and this opportunity does not come by all the time. We all know that beer demand will always be there, and the business foundation itself is solid. Due to the pandemic, the business is going through a temporary headwinds which saw its price to fall for more than 40% from its peak. When things are back to normal, which I think it won’t take long, do you think the share price will recover and head back to its previous peak, or even higher? I will leave it to your imagination.

And remember, invest at your own risk.

=====================================================================================

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

============================================================================================

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Feb 01, 2021

Created by BuyCall | Jan 26, 2021