Genting Malaysia - RWG Soaring High in the Year of Dragon

dragon328

Publish date: Fri, 01 Mar 2024, 11:51 AM

Genting Malaysia (Genm) is listed in the main board of Bursa Malaysia with a market capitalization of RM17.0 billion @ current share price of RM2.87. Genm owns the only casino in Malaysia at Genting Highlands, 100% stakes in Resorts World New York City, a 76.3% stake in Empire Resorts that owns Resorts World Catskills & Resorts World Hudson Valley, some casinos under Genting UK and a piece of prime land in Miami, US. As of 31 Dec 2023, Genm had about RM12.2 billion of debts and RM3.9 billion of cash.

Strong Quarterly Result for 4Q FY2023

Genm announced a good set of results for 4Q FY2023 with net profit of RM239.6 million, resulting in the full year profit of RM436.8 million for FY2023. A breakdown of the revenue and EBITDA contribution from various divisions for Q3 and Q4 FY23 are tabulated below:

| Q3 FY2023 | Q4 FY2022 | Q4 FY2023 | |

| Revenue (RM m) | |||

| Malaysia | 1,680.9 | 1,587.2 | 1,798.8 |

| UK & Egypt | 494.9 | 335.1 | 429.7 |

| USA & Bahamas | 473.7 | 459.7 | 465.7 |

| Property | 23.6 | 23.8 | 24.3 |

| Investments & Others | 36.7 | 28.9 | 3.0 |

| Total Revenue | 2,709.8 | 2,434.7 | 2,721.5 |

| Adjusted EBITDA (RM m) | |||

| Malaysia | 563.9 | 467.3 | 529.5 |

| UK & Egypt | 99.1 | 60.3 | 90.2 |

| USA & Bahamas | 135.5 | 148.5 | 130.5 |

| Property | 4.8 | 0.2 | (9.4) |

| Others | (55.7) | (203.4) | 103.1 |

| Total Adjusted EBITDA | 747.6 | 472.9 | 843.9 |

| Share of results of Associates | (30.6) | (55.4) | (48.7) |

The share of results of associates narrowed from RM55.4m in Q4 FY2022 to RM30.6m in Q3 FY2023 despite a higher effective equity stake of 76.3% in Empire Resorts from 66.6% since 4Q 2022. The share of losses narrowed slightly to RM48.7m in Q4 FY2023, indicating improving y-on-y financial performance from Empire Resorts.

RPT in Empire Resorts

On 10th Jan 2024, Genm announced to subscribe for up to USD100 million of Series M Preferred Stock of Empire Resorts. The proceeds will be used for working capital and to fully repay an existing bank facility of USD58m at Empire. With this latest equity injection, Genm’s effective shareholdings in Empire will rise from 76.3% to 90% and bring its total investments in Empire to USD724.4m. The latest equity injection valued Empire at USD730 million, a drop from the earlier USD1.0 billion at the previous equity injection.

While the market generally dislikes such a related party transaction, I see some merits in the latest deal. With the latest equity injection, Empire will be able to reduce its debts by USD58 million and save interest expenses of about RM21 million a year. This will help Empire to achieve breakeven point sooner.

As per a more detailed analysis of Empire Resorts’ financials given in a section below, Empire Resorts may be able to achieve positive EBITDA of USD91 million in FY2024 and EBITDA of USD100 million a year thereafter. Positive cashflows may amount to close to USD50 million a year, and using a 5% cashflow yield valuation, Empire Resorts may be valued at USD1.0 billion, and hence Genm’s 90% equity stakes in Empire would be worth USD900 million then.

Disposal of Miami Land

On 27th April 2023, Genm announced to enter into a conditional sales and purchase agreement with Smart Maimi LLC for the disposal of 4 parcels of land in Miami measuring an aggregate land area of approximately 15.47 acres, for a total cash consideration of US$1.225 billion or RM5.433 billion. However, the deal was aborted on 22 June 2023 when the purchaser requested for an extension to the exclusivity period but the request was not granted. It was subsequently reported that Genm received a few bids for its Miami land with indicative bid value close to US$1.2 billion.

As that was the first time for Genm to announce its intention to sell the Maimi land, the market was surprised with the potential huge value the Miami land could fetch. The original cost of investment of Genm in the Miami land was US$258 million, and the proposed disposal, if successful, would result in a huge disposal gain of US$967 million or RM4,289 million for Genm. After deducting an estimated corporate tax related to the land disposal of RM974.1 million, Genm is expected to realize a net cash proceed of RM4.459 billion or RM0.75 per share.

The proposed Miami land disposal would have come in handy for Genm to have the necessary fund to bid for a new full casino license in New York in 2023, but the deal fell through as US Fed was still in the cycle of rising interest rates in mid 2023. Property developers in the US were afraid of further tightening and hence were not willing to pay for the selling price asked by Genm for the Miami land. Now with the US Fed expected to start reducing interest rates in 2H 2024 by about 3 times and more in 2025, US property developers will be more optimistic in 2H 2024 to buy up prime land. I am confident that Genm will be able to dispose off the Miami land at a decent price in 2H 2024 or early 2025.

As the New York new casino license process was delayed from 2023 to 2024, that was no hurry for Genm to sell off the Maimi land in 2H 2023. Anyway, Genting has already raised sufficient funds of USD500 million in Singapore in 2H 2023, which I think would be used for the bidding of a New York casino license in 2024.

New York Casino License

If Genm successfully gets a full casino license in New York, the potential gaming revenue may top US$1.5 billion a year and based on my earlier projections (link below), annual cash flows may top US$400 million in the 1st year of operations in 2024 and exceed US$600 million a year by 2043. The NPV of projected cashflows at 5.0% discount rates is a whopping US$10.33 billion.

I will take the opportunity here to update on the calculations. Under my earlier projection, each of these 3 new casinos in NYC will generate gaming revenue of US$1.5 billion in 2024 once fully operational, increasing at 2% p.a. thereafter. I now take a more conservative assumption for annual gaming revenue of US$1.2 billion for each operator. I assume operating costs to be at 15% of annual gaming revenue (check: Genting Sentosa Singapore at c.10%, Genting Highlands Malaysia at c.20%), and staff costs to be also about 15% of gaming revenue (4 dealers + 1 supervisor per gaming table at average wages of US$72k p.a.). NYC has a higher gaming tax of 20% on gaming revenue (compared to 6.75% in Nevada), and a higher total combined corporate tax of 34% (US federal tax 21% + New York state tax 5% + New York City tax 7% + Metropolitan Transportation Authority tax 1%). Financial projections for Resorts World NYC for year 2025 and 2044 are summarized as follow:

| US$ million | 2025 | 2044 |

| Gaming Revenue | 1,200 | 1,748 |

| Operating + Staff costs (30%) | (360) | (524) |

| Gaming tax (20%) | (240) | (350) |

| EBITDA | 600 | 874 |

| EBITDA margin | 50% | 50% |

| Depreciation charges | (100) * | (100) |

| Interest Expense | (50) # | (50) |

| Pretax Profit | 450 | 724 |

| Total corporate tax (34%) | (153) | (246) |

| After-tax Profit | 297 | 478 |

| Capex | (24) ^ | (35) |

| After-tax free cashflows | 373 | 543 |

* depreciation charges assumed to be US$50m p.a. from existing facilities + US$1.0billion new capex/20 years

# interest expenses estimated at 5% p.a. x US$1.0 billion of capex outlay

^capex assumed to be at 2% gaming revenue as existing facilities are relatively older than that of RWLV

NPV of the free cashflows with a terminal growth rate of 1% at 2044 will amount to US$9.7 billion at 5.35% discount rate (compared to current US Fed rates of 5.25%-5.50% in Feb 2024).

Sources indicated that the Request for Proposal (RFP) would be launched soon by the New York city council in 2024, and industry experts in New York have picked Genm’s Resorts World New York City (RWNYC) at Queens to be one of the frontrunners to clinch one of the three new casino licenses to be issued. It is hence worth monitoring the progress of the RFP as ultimately this is the biggest jackpot to be won by Genm in near term.

Other Land parcels in Miami

Besides the 4 parcels of land earmarked for disposal for US$1.225 billion, Genm owns another 2 parcels of land in Miami:

- 0.1 hectare at 1601 Biscayne Boulevard, Miami (NBV of RM56.1 million)

- 0.9 hectare at Downtown Miami (NBV of RM72.6 million)

Based on the previously proposed transaction value of the larger 15.47-acre plot, this (0.1ha + 0.9ha) = 2.471 acres of vacant land may potentially fetch a value of US$1.225bn x 2.471/15.47 = US$196 million or RM930 million.

On the 0.1-ha land at 1601 Biscayne Boelevard Miami, Genm owns an office building with 184,412 m2 built-up and a 29-storey Omni Hilton Hotel, which carry a book value of RM342.6m and RM320.8m respectively.

Hence, the total value of remaining land and the office building + hotel at Miami owned by Genm may amount to RM1.6 billion.

Resorts and Land in Bimini, Bahamas

Based on Annual Report 2022, Genm owns a total of 18.3 hectares of freehold land, a casino and a hotel in Bimini, Bahamas, US. These assets carry a total new book value of RM1,082.6 million as of 31 Dec 2022.

Online checks show that freehold land in Bimini is transacted at around US$20 psf, so valuing Genm’s 18.3 ha land there at about US$40 million. Added with the book value of the hotel and casino of around RM1.0 billion, total assets owned by Genm in Bimini, Bahamas may come to RM1.2 billion.

Huge Value in Resorts World New York City

Resorts World New York City (RWNYC) is 100% owned by Genm. This resort is located at Queens which is just 6-8 km away from Manhattan. It is one of the largest resort complex in NYC with over 1.0 million sf of gaming floor area, over 6,000 slot machines and 400 hotel rooms, occupying 64 acres of prime land at Jamaica, Queens.

Though the 64-acre land where RWNYC sits is not owned by Genm but leased from Aqueduct Racetrack with 25 years of lease remaining, but the casino complex owned by RWNYC (total build-up area of 83,801 m2 or 902,034 sf) there is valuable, carried with a book value of RM3,269.8 million. Land is expensive and scarce in New York City, especially prime land with such a big size (64 acres).

If we take the average land price (US$2,590 psf) transacted for commercial / industrial land in Queens from April 2022 to March 2023 (based on data from Department of Finance, New York City), the 64 acre of prime land at Queens will be worth 64 x 43,560 x US$2,590 = US$7.2 billion. I would attach a 30% discount to this 64-acre land at Queens due to its large size, so valuing it at US$5.0 billion. For a developer who wants to develop from scratch a casino complex or resorts cum hotel at Queens in New York City, it would probably need to spend easily US$6.0 billion to build a complex with 902,034 sf on a 64-acre of land.

Hence should Genm fail to get a full casino licence in New York City, I think Genm would be able to dispose of its casino complex at Queens to another casino developer who wins a full casino license for a minimum consideration of US$2.0 billion. It would make perfect sense for the casino developer to take over the complex at Queens as it would only need to incur 1/3 of the cost of building a new casino and would be able to roll out the casino business almost immediately rather than spending US$6.0 billion looking for a new land and building a new casino over a construction period of minimum 4 years.

[Please see appendix below on average land pricing at Queens and at Manhattan, New York.]

Genm registered annual revenue of RM1,660 million and EBITDA of RM477.6 million for its USA & Bahamas division for FY2022. I suspect the bulk of such revenue and earnings were contributed by RWNYC and less from Bahamas. The EBITDA for Q4 FY2022 was encouraging at RM148.5 million, annualized to RM594 million. Assuming 80% from RWNYC, I expect RWNYC to contribute EBITDA of RM475 million to Genm a year. This is equal to annual free cashflows of almost US$100 million from RWNYC, at 5% cashflow yield, RWNYC may be valued at US$2.0 billion.

Steady Growth in Empire Resorts

Empire Resorts has two resorts in New York, i.e. Resorts World Catskill and Resorts World Hudson Valley. Resorts World Catskills is smaller than RWNYC with 1,600 slot machines, 332 hotel rooms and 100,000 sf of gaming space. The 1.6-million-square-foot casino, hotel and entertainment complex at Catskills was built at a cost of US$920 million in Dec 2014. There is a 1700-acre, 18-hole golf course and clubhouse at Adelaar, adjacent to RW Catskills. All in, Resorts World Catskills is worth about US$1.2-1.3 billion conservatively.

Resorts World Hudson Valley (RWHV) is located at the former Bon-Ton department store in the Newburgh Mall in New York State, just 60 miles north of Manhattan. It was opened on 28 Dec 2022. Newburgh Mall is a 388,000-square-foot community shopping centre, in which RWHV occupies 60,000 sf for gaming floor. It has 1,200 slot machines and electronic table games as well as the always-happening Resorts World Bet Sports Bar. Empire Resorts was reported to have spent US$50 million on this latest attraction RWHV which is now worth some US$100 million roughly.

Empire Resorts financials have been improving steadily after Covid-19 pandemic with gross gaming revenue reaching pre-pandemic level of US$60 million per quarter by 3Q 2022. Net loss of Empire Resorts has narrowed from RM183.7m in FY2021 to RM153.3m (US$34m) in FY2022. For FY2023, Empire Resorts contributed RM218 million losses in share of results of associates in Genm. Genm had a total of USD1.75 billion of US dollar debts as of 30 Sept 2023, with an estimated USD750 million at Empire Resorts. Assuming an average interest rate of 7.5%, total interest expenses at Empire Resorts amounted to USD56 million a year. Added back with depreciation charges of about USD41m, hence Empire achieved EBITDA of USD(46) + 56 + 41 = USD51 million in FY2023.

Empire Resorts management expected mobile sports betting to contribute EBITDA of US$26m in FY2023 and US$40m in FY2024. If we take it as face value, then Empire Resorts may turn in total EBITDA of US$91 million in FY2024. With the latest equity injection, Empire’s total debts will be reduced by USD58m and interest expenses reduced by about USD5m a year to about USD50m, hence Empire would achieve positive cashflows of USD 91m – USD50m = USD41m in FY2024. With the steady growth in visitation to Resorts World Catskill and Resorts World Hudson Valley, Empire’s EBITDA for FY2025 may touch USD100m and free cashflows may reach USD50m. Again using a 5% cashflow yield valuation, Empire Resorts may be valued at close to US$1.0 billion.

US Assets are worth more than Genm market cap

Even if Genm fails to win a full casino license in New York, its existing three resorts (RWNYC at Queens, RW Catskills and RWHV) are worth a lot as prime real estate in New York. Genm could consider selling one or more of these resorts to the winning bidders of New York casino license or to other real estate developers. Judging from the good price that could be fetched by the Miami land, I believe the assets at Queens and Catskills would be able to fetch reasonably good prices as well. In summary, the three resorts in New York are worth about US$3.3 billion (US$2.0bil for RWNYC, US$1.2bil for RW Catskills, US$0.1bil for RWHV) at current conditions and may potentially be worth US$11.0 billion (US$9.7bil for RMNYC, US$1.2bil for RW Catskills, US$0.1bil for RWHV) if it wins a full casino license in New York.

Added with the book value of remaining Miami land and hotel, and Bimini hotel and land, Genm’s US assets will be worth RM9.5 billion (RWNYC) + RM5.5 billion (90% in RWC + RWHV) + RM1.6 billion (Miami) + RM1.2 billion (Bimini) = RM17.8 billion or RM3.00 per share of Genm, which is higher than Genm current market capitalization. Plus the larger parcel of Miami land earmarked for disposal, which may fetch a conservative USD1.2 billion, total US assets owned by Genm will amount to RM23.5 billion or RM3.96 per share.

Sum-of-Parts Valuation of Genm

Genm’s Malaysian operations are almost back to normal after Covid-19 pandemic and the opening of the outdoor themed park, so the latest quarterly result is a good indication of what to expect in quarters to come. After Malaysia secured visa-free travelling from China in Jan 2024, we can expect more Chinese tourists to come in quarters ahead. But to be conservative, I just use the Q4 FY2023 result as the reference for further calculations.

Q4 FY2023 EBITDA for Malaysia operations amounted to RM530 million, annualized to RM2.12 billion. Genm had a total of RM4,418 million of debts denominated in ringgit as of 31 Dec 2023. Assuming an average interest rates of 6.0% p.a., Genm’s total interest expenses for the Malaysia operations amount to about RM265 million a year, and hence Genm’s Malaysia operations may have after-tax free cashflows of about RM1.6 billion a year (after deducting RM260m of estimated tax expenses). At 7% FCF yield, Genm’s Malaysia operations, Resorts World Genting Highlands, may be worth RM22.9 billion or RM3.85 per share.

As calculated above, Genm’s total US assets (RWNYC, 90% in Empire Resorts, Miami land & Bimini assets) is worth about RM23.5 billion. Deduct off total US borrowings of RM7.8 billion as of 31 Dec 2023, the US assets owned by Genm will be worth RM15.7 billion or RM2.64 per share.

In summary, Genm will be worth RM3.85 (Malaysian operations) + RM2.64 (US operations) = RM6.50 per share in equity value after taking into account all its assets and debts.

If Genm wins a full casino license in New York, then Resorts World New York City valuation will jump up by another US$7.7 billion or RM36.6 billion or RM6.16 per share for Genm to a potential RM12.65.

While we wait for any further news of asset disposal, it may be prudent to take a 50% discount to the above valuation for the US assets. At 50% discount, Genm will still be worth RM5.17 per share, or a good 80% upside above current share price of RM2.87.

Appendix

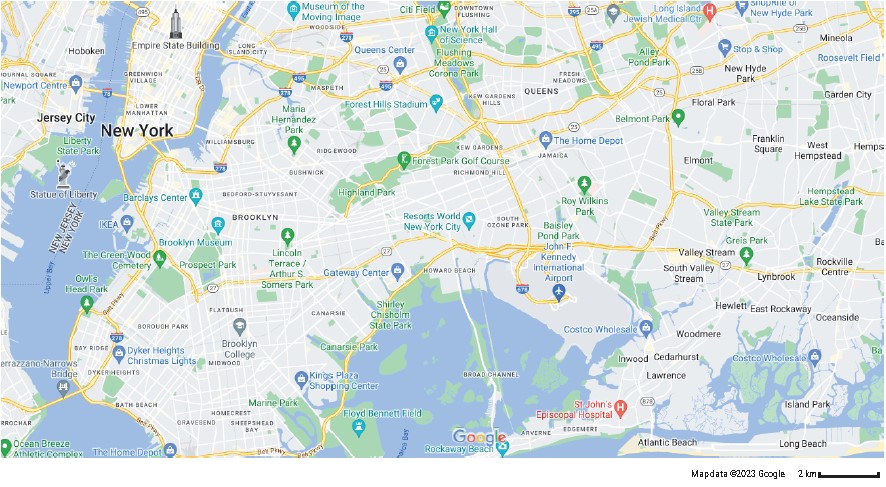

Queens county is located just 4km to 10km away from Manhattan or New York financial centre, and is adjacent to the most sought-after residential area Brooklyn.

As can be seen from the map above, Resorts World New York City is located next to John F. Kennedy International Airport at the east, and about 4km from Brooklyn, and about 8km from Empire State Building in Manhattan.

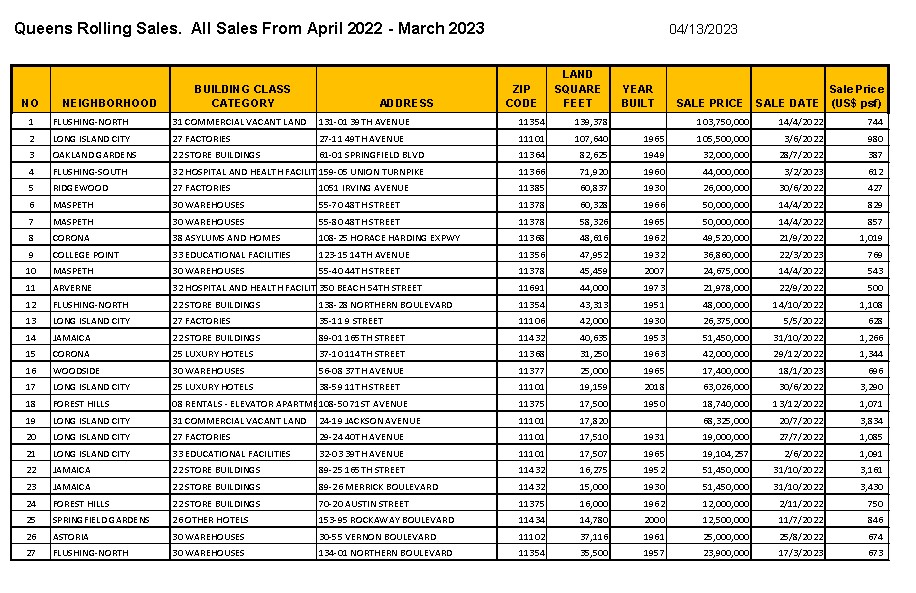

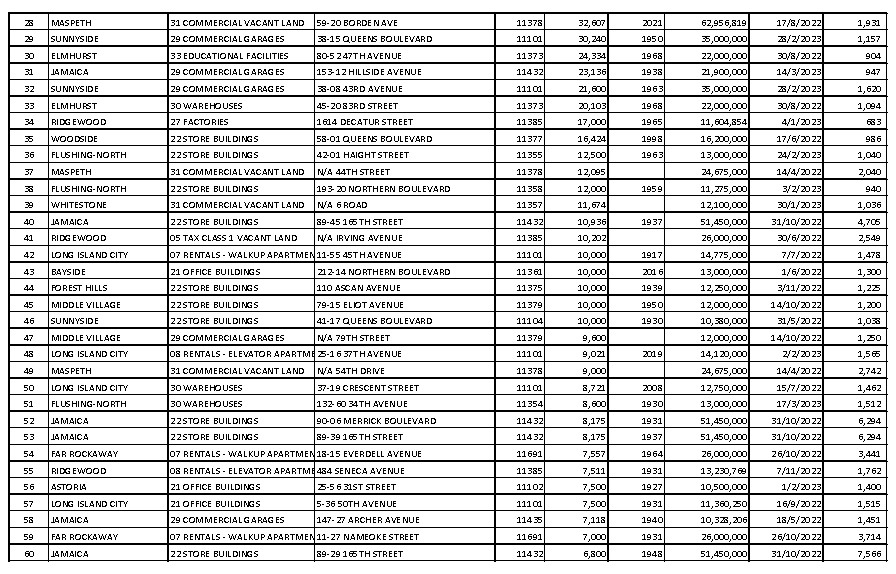

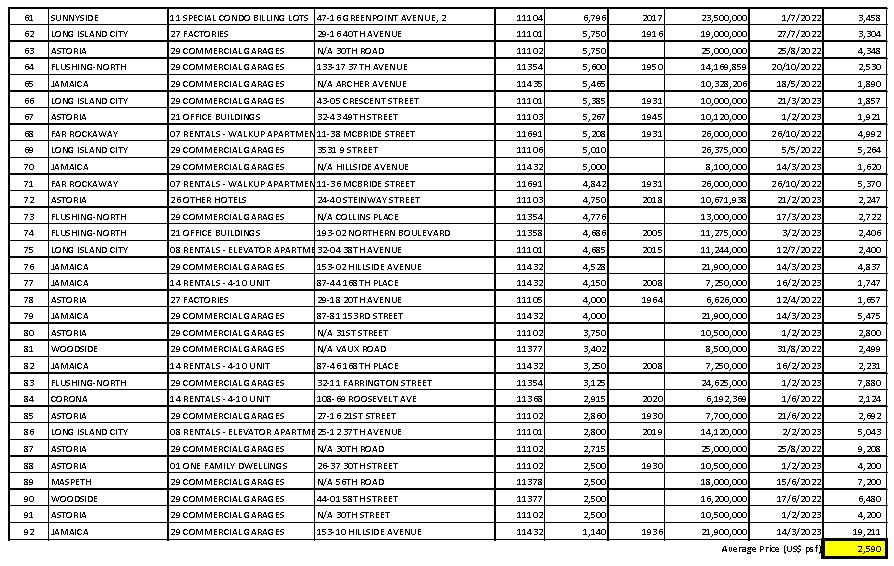

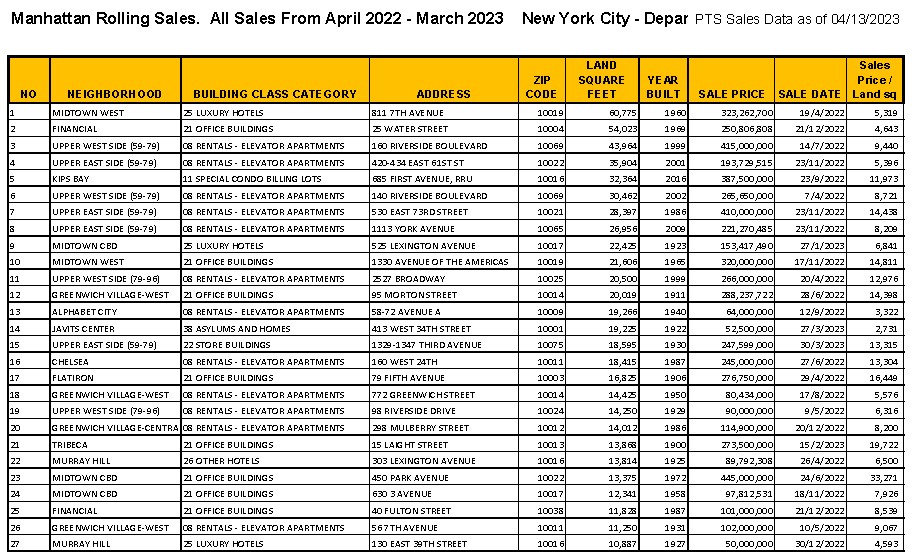

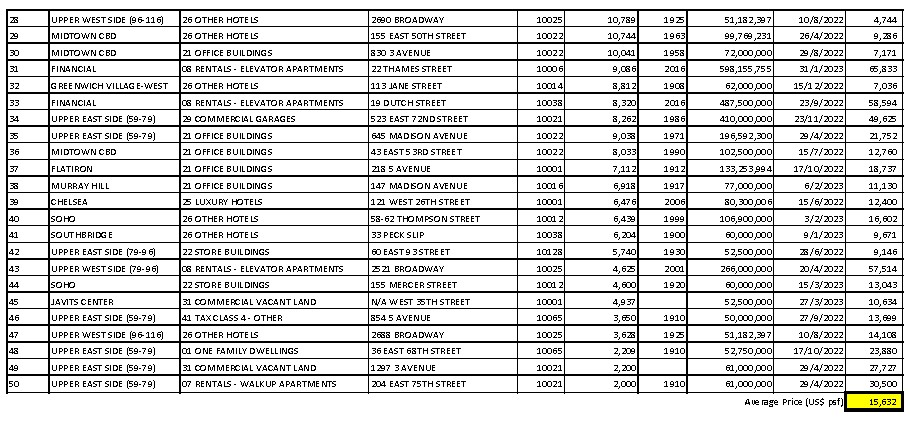

I have taken the data (in excel file) from Department of Finance of New York City on land / real estate sales transacted between April 2022 and March 2023 in Queens county (where RWNYC is located) and in Manhattan which is the most expensive area in New York, and summarized the relevant data in tables below.

The table above summarises all the real estate transactions in Queens from April 2022 to March 2023, with a transaction value above US$6.0 million, from a total record of 26,350 transactions from Department of Finance, New York City.

Incidentally, all the above transactions were for commercial or industrial land. The highest value transacted was US$105.5 million or US$980 psf, and the highest value psf transacted was at US$19,211 psf for a piece of commercial land of 1,140 sf for US$21.9 million at Jamaica which is about 2km away from Resorts World New York City.

The average price psf for the above 92 transactions was at US$2,590 psf which is a good indication of the land value for RWNYC which is a prime commercial land.

The largest piece of land transacted during that period was 3.2 acres, and most transactions were for land parcels of size from 8,000 sf to 20,000 sf. This shows that large land parcels above 10 acres are very difficult to come by in New York City.

The above table summarises all the real estate transactions in Manhattan area from April 2022 to March 2023 for transaction value above US$50 million.

The biggest transacted land was 1.4 acres at US$323 million or US$5,319 psf. The highest transacted value was at US$598 million for a 9,086-sf land or at US$65,833 psf (a record high). The average transacted value in Manhattan was at US$15,632 psf, which was 6 times higher than the transacted value in Queens in the same period.

More articles on Dragon Leong blog

Created by dragon328 | May 23, 2024

Discussions

With Trump American first I don't think Genting can get the license solo! They need some partnership to be able to get the license. To say America is not corrupt is overstatement.

2024-03-03 11:42

Now USD is still high if FED reduces interest rate ringgit might be stronger and expected 20% depreciation of asset value.

2024-03-03 12:00

@Jack Khan, you are probably right there.

As Genm owns 100% equity stakes in Resorts World New York City at Queens which I believe will house the new New York full casino when the new license is awarded, the capex required will not be too big, reportedly at around USD1.0 billion, half of which is for the bid bond.

Genting group has already raised sufficient fund for the US$500 million bid requirement, it may probably spend another USD500m to upgrade the facilities at RWNYC in order to roll out full casino products.

To enhance its bid, I do not rule out the possibility of GNM robing in a local partner to win one of the full casino license.

2024-03-03 12:23

Agreed that US dollars are high against ringgit now, and it may come down later this year when US Fed starts cutting rates.

FX only affects the paper accounting value, so I won't bother much. More importantly it is for Genm to win one of the 3 casino licences in New York.

2024-03-03 12:25

All fiat currencies including USD have ZIRO value as they are created from nothing and as such they have ZIRO value !!! 😁😁😁

2024-03-03 16:20

@Permutation, Genm has more near term catalysts while Genting is more undervalued and has greater long term upsides.

Genm for one announced a better than expected quarterly result for Q4 FY2023 while Genting disappointed with a weak result dragged down by impairments at Genting Singapore.

While the outlook for both Genting Highlands and Genting Singapore are bright as both Malaysia and Singapore have allowed visa free travels from China and India, I am not sure if there will be more impairments at Genting Singapore in coming quarters.

Next, Genm will have a good chance to dispose off its Maimi land in 2H 2024 when US Fed starts cutting rates, that will be a good catalyst to Genm share price, I believe.

New York city council will be launching the RFP to solicit interests for 3 new full casino licenses and Genm shall stand a good chance to clinch one of the licenses. As I calculated in my article, the potential from a new casino license in New York is huge and that will be another catalyst to Genm.

Genting long term is still very good, underpinned by Sentosa 2.0 expansion by Genting Singapore. I expect Genting Singapore earnings to expand by at least 40% to achieve EBITDA of close to SGD1.8b - 2.0 billion by 2030 when the expansion completes.

Whether Genm or Genting is better, I will leave it to you to decide one that suits your investment horizon. I have both.

2024-03-04 20:11

Income

Ini kalilah

2024-03-03 08:37