YTL & YTL Power - Crouching Tiger & Hidden Dragon

dragon328

Publish date: Fri, 26 May 2023, 04:07 PM

Excellent Q3 FY2023 Results

Both YTL Corp and YTL Power announced an excellent set of results for the 3rd quarter ended 31 March 2023. YTL Power reported a record quarterly core net profit of RM507.6 million for Q3 FY2023 or Earnings per Share (EPS) of 6.4 sen, annualized to 25.6 sen. YTL Corp registered net profit of RM414.1 million or EPS of 3.78 sen, annualized to 15.1 sen. This makes the share price of YTL Power (RM1.15) and YTL Corp (RM0.78) extremely cheap at prospective PE ratio of just 4.5x and 5.1x.

The key earnings drivers are the Power Generation division for YTL Power and Utilities & Cement divisions for YTL Corp, which are the main areas of updates for my note today.

Record Quarterly Core Profit for YTL Power

PowerSeraya was the main profit contributor to YTL Power in Q3 FY2023 Profit before tax (PBT) as broken down below:

| Profit / (Loss) before tax | RM ‘000s |

| Power generation | 806,372 |

| Water & sewerage | (47,181) |

| Telecommunications | (103,185) |

| Investment Holding activities | (45,609) |

| Total PBT | 610,397 |

If I take out the share of results from associates (Indonesia Jawa Power & Jordan Power) of RM46.776 million from the Power Generation division PBT above, then PowerSeraya alone contributed profit before tax of almost RM760 million in this quarter. I shall talk in more details on PowerSeraya in the next section below.

The Water & Sewerage division registered a loss before tax of RM47.181 million in Q3, dragged down by interest accruals on index-link bonds, a non-cash impact of RM75 million. Excluding this extraordinary item, Wessex Waters registered a profit before tax of RM28 million. Wessex Waters has since raised water tariffs since 1st April 2023 and this will help raise the topline and the bottomline of the group from Q4 FY2023 onwards. Wessex is expected to get back to its normalized profit of RM130 million to RM170 million per quarter very soon. Wessex capital expenditure is well under plan as per the 5-year regulatory period guidance, now into the 4th year of the 5-year regulatory period. Hence by the end of this 5-year regulatory period in Mar 2025, its Regulated Asset Base (RAB) will have increased substantially and that will increase the water tariffs further for the next 5-year regulatory period. Before that, whatever inflationary cost impacts and high interest rates suffered in past few quarters will be compensated in higher water tariffs from next April.

Telecommunications division continues to be loss making. The management is confident that this division can turn around soon once it rolls out its 5G products nationwide when the 5G network is expected to cover 80% of population by end of the year.

Investment holding activities register small losses in the absence of any disposal gain (this division registered a huge profit of RM903.7 million in Q3 FY2022 due to the disposal gain of Electranet).

Hidden Dragon in PowerSeraya emerging in 2023

How could PowerSeraya make a profit before tax of RM760 million in a quarter? That is almost SGD 230 million of PBT and SGD262 million of gross profit (after added back with SGD6.5 million of interest expenses, SGD18.7 million of depreciation charge, SGD12.5 million of operating overhead per quarter, minus out PetroSeraya contribution of about SGD5.5 million a quarter).

Back-of-the-envelop calculations show that PowerSeraya could have achieved an average non-fuel generation margin of SGD 80/MWh:

3,300 GWh x SGD 80/MWh = SGD264 million

The increased generation of 3,300 GWh per quarter is achieved after incorporating the newly acquired Hyflux gas power plants. It is not a big surprise for a generation company (Genco) in Singapore to register a non-fuel margin of SGD 80/MWh as it always happens in a tight electricity supply market that is competitive like in Singapore. In fact, such tight supply situation happened in 2009 – 2013 in Singapore when no new generating capacity came on stream after the 2008 Financial Crisis. Gross non-fuel margin averaged at SGD60 – 80 / MWh during the 4 years. Only when LNG became available in 2013 then Gencos invested in new generating plants which gradually made the electricity market in Singapore become over-supplied. Generation margins collapsed in 2014 when more new generating plants came online and all Gencos suffered losses from 2014 to 2021 as non-fuel margin dropped to zero. Having learnt the mistakes made in 2013-2014 and losses suffered in 2014-2020, Gencos became more conservative in new plant-ups, which has caused the tight supply situation in Singapore electricity market.

The tight supply situation is expected to persist for another 3 years before a new gas and hydrogen-powered 600MW power plant by Keppel comes on stream in 1H 2026. The EMA has earlier targeted to import 1,200MW of renewable energy by 2027 but has since streamlined the requirement to 4,000MW by 2035, so near term power import is not certain at the moment.

How it works in Singapore Competitive Electricity Market?

I have earlier published an article on how Singapore competitive electricity market works (as per link below):

Very quickly I will add some more details here. In general, electricity prices are determined by demand and supply, i.e. when supply is more than demand, prices go up and when supply is more than demand, prices soften.

One thing to note is that the generating power plants in Singapore are primarily gas-fired plants, mostly the more efficient combined-cycled gas units and some less efficient open-cycled gas units. Take an example say for crude oil prices of USD90/bbl, an efficient combined-cyce gas unit may have a generation cost of about SGD160/MWh but the generation cost of a less efficient open-cycle gas unit may be 50% higher at SGD240/MWh. In the competitive wholesale electricity market in Singapore, when all the efficient combined-cycle gas units are already running but still not able to meet the power demand, then Gencos will need to run up the open-cycled gas unit to meet the power demand, otherwise the power grid will collapse. You can see that once an open-cycled gas unit runs up and becomes the marginal unit in the wholesale market, then the wholesale price will clear at the generating cost + margin of this open-cycled gas unit, which is SGD240/MWh in the earlier example. All other generating units, whether it is combined-cycled unit or open-cycled unit, will get the same wholesale price of SGD240/MWh for the period when an open-cycled unit is the marginal unit. Hence immediately all the combined-cycled gas units will get a non-fuel margin of SGD80/MWh (SGD240/MWh – SGD160/MWh) when an open-cycled gas unit sets the wholesale prices.

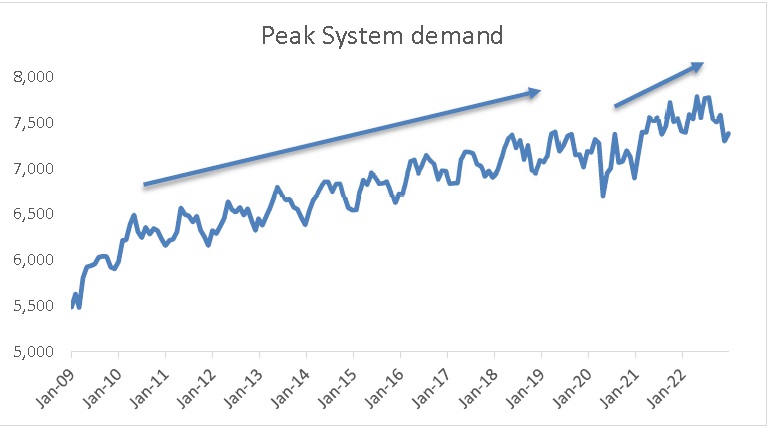

With the current heat wave in Singapore, electricity demand will remain at elevated level and the supply side will be tight. Gencos’ profit margin is expected to sustain at this SGD80/MWh for another 3 years or more if the 600MW new plant from Keppel can only fulfill the expected demand growth in next 3 years. The peak demand in Singapore has increased from about 5,500MW in Jan 2009 to 7,500MW in Jan 2022 or 2.8% p.a. More recently the peak demand has increased from about 6,800MW in Jan 2019 to 7,500MW in Jan 2022, an increase of 700MW in 3 years. So if the peak demand increases by the same 700MW in next 3 years, then the 600MW new capacity from Keppel will not be sufficient to even meet the expected 700MW increase in peak demand.

YTL Corp to scale new heights in Profits

YTL Corp profits are driven by the Utilities and Cement divisions as shown in the breakdown of PBT below for Q3 FY2023:

| Profit / (Loss) before taxation | RM ‘000s |

| Construction | 6,929 |

| Cement and building materials | 120,881 |

| Property investment & development | (14,099) |

| Management services & others | (13,793) |

| Hotels | 57,568 |

| Utilities | 658,267 |

| Total PBT | 815,753 |

The Utilities division is contribution from YTL Power, which has been discussed above.

The Hotel division registered commendable results of RM57.568 million PBT, a big turnaround from a loss of RM33 million last year. This excellent turnaround was mainly attributable to better performance of YTL hotels and resorts following easing of Covid-19 restrictions and re-opening of international borders.

The cement and building materials division contributed good profits of RM120.881 million in this Q3, a 130% increase from last year same period. Earnings could have been higher but for some reasons which I suspect might be its hedging strategy, it turns out to be slightly below market expectation.

Let’s take a look at MCement Q3 quarterly results compared to its Q2:

| RM ‘000s | Q3 ended 31 Mar 2023 | Q2 ended 31 Dec 2022 |

| Revenue | 990,710 | 896,969 |

| Cost of Sales | (712,983) | (690,249) |

| Gross Profit | 277,727 | 206,720 |

| Other Operating Income | 21,543 | 21,057 |

| Other Operating Expenses | (158,892) | (165,618) |

| Profit from Operations | 140,378 | 62,159 |

| Finance Costs | (49,374) | (49,871) |

| Share of results of joint venture | 7,660 | 12,026 |

| Profit before tax | 98,664 | 24,314 |

| Taxation | (35,379) | (8,997) |

| Profit after tax | 63,285 | 15,317 |

The revenue increased by 10.4% q-on-q due to higher volume and selling prices of domestic cement. Cost of sales increased by 3.3% q-on-q, instead of falling as market expected it to be based on falling coal prices. If we assume the 3.3% increase in cost was entirely due to production volume increase, then the average coal and electricity prices incurred in Q3 did not record any drop at all compared to Q2, even though coal prices have dropped by 50% since Jan 2023. This can only be explained by a possible reason – the hedging strategy of the company. The company might have hedged forward its coal prices for 2-3 months ahead, as it did while coal prices were climbing up in 2021-2022. Hence it is possible that the company had hedged the coal prices at elevated prices back in Dec 2022 for the period of Jan-Mar 2023, so when coal prices dropped in early Jan 2023, the company would suffer losses in its hedging derivatives which offset against the drop in actual coal costs purchased.

If such assumption is right, then we may expect MCement to register substantially higher profits in Q4 FY2023 if bulk cement prices remain at current level and coal prices also remain at current level. It is a crouching tiger ready to leap high.

Anyway, MCement registered decent operating cashflows of RM277 million in 9 months ended 31 Mar 2023, annualized to RM370 million. Allowing for capex, MCement will still have some RM290 million of free cashflows a year, which will support dividend payouts of 20 sen a share. The company registered strong operating cashflows of RM171 million in this Q3 alone, much higher than Q1 & Q2 combined. So if the performance of this Q3 can sustain, then operating cashflows may top RM680 million a year, which is not too far off from my earlier projection. After allowing for capex, MCement will have free cash flows of some RM600 million a year, to support dividend payouts of 40 sen a share. This will provide almost RM400 million of annual dividend income to YTL Corp who owns 76% stakes in MCement.

How much is YTL worth?

I have earlier calculated the valuation of YTL to be RM4.39 per share based on sum-of-parts valuation and RM6.35 in the blue-sky case when YTL Power re-rates to RM7.55 (see links below).

Now let’s look at the valuation again based on its latest earnings. YTL registered operating cashflows (before capex) of RM2,548 million for the 9 months ended 31 Mar 2023 and RM1,245 million for this Q3 alone. If we assume this Q3 to sustain going forward, YTL operating cashflows may top RM5.0 billion a year. Capex is expected to be about RM2.0 billion a year, so YTL’s free cashflows may amount to RM3.0 billion a year or 27 sen per share. Based on cashflow yield of 7%, YTL should be worth RM3.90 per share which is not too far off from my sum-of-parts valuation.

YTL group will have multiple catalysts going forward for earnings growth:

1. PowerSeraya to report sustainable good profits over next 3 years due to current heat wave and strong Singapore dollars

2. Wessex Waters to report stronger profits from Q4 FY2023 onwards due to water tariff hikes and larger RAB

3. Maiden contribution from Jordan Power from Q4 FY2023

4. YTL Power green data centres to start contributing earnings from Q1 2024

5. YTL Power digital bank venture to start contributing earnings from Q2 2024

6. Potential more green data centre jobs to be secured for its Kulai site

7. Potential power export to Singapore in next few years

8. Potential MCement earnings explosive growth from Q4 FY2023

9. Appreciating long term asset value in Niseko and Sentul land bank

10. Appreciating long term asset value in Wessex Waters due to expanding Regulated Asset Base

11. Huge construction jobs from building green data centres for YTLP and storage centres for Shopee

12. Potential revival of KL-Singapore high speed rail project

I am very confident that YTL share price will continue to climb up to the cashflows valuation of RM3.90 in next 3-5 years when YTL is able to pay dividends of 20 sen a share every year and towards RM6.35 eventually when all the assets realize their potential value.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

YTL2024-11-17

YTLPOWR2024-11-15

YTL2024-11-15

YTL2024-11-15

YTL2024-11-15

YTLPOWR2024-11-15

YTLPOWR2024-11-15

YTLPOWR2024-11-15

YTLPOWR2024-11-14

YTLPOWR2024-11-12

YTLPOWR2024-11-11

YTL2024-11-11

YTLPOWR2024-11-08

YTL2024-11-08

YTLPOWR2024-11-08

YTLPOWR2024-11-07

YTLMore articles on Dragon Leong blog

Created by dragon328 | May 23, 2024

Discussions

Royce Chan, the disposal gain was booked in last year, not this year. There was not exceptional item in this Q3, so the strong earnings will sustain in coming quarters.

2023-05-28 12:17

YTL typically declares dividend only in the final quarter, you can expect higher dividend than last year when they report Q4 in August.

2023-05-28 12:17

whether I syok sendiri or someone has missed out on this stock, time will tell. Friday huge buying volume already speaks louder than @speakup.

2023-05-28 12:19

Dragon328 spent lots of time researching YTL group of companies.Contributors like him are rare in i3.

2023-05-28 13:02

He shared his findings unselfishly.Whether his final targets will be met is not an issue to me.Why expect someone to babysit you from day 1?Hahaha.

2023-05-28 13:05

I do not set a target price for the stocks that I cover, but rather I just suggest a fair price based on cashflow yield or sum-of-parts.

At times, the fair price I suggest looks high to some, it is just that the company has yet to show the earnings growth I projected or the market has not realised the earnings potential of the company.

For example, when I first published the article on YTL Power in last May, I already stated that PowerSeraya had made gross margin of S$60-80/MWh before back in 2009-2013 based on my studies, but nobody believed it then and the company had not shown such earnings power yet. Now in this Q3, PowerSeraya has showed that it has indeed made gross margin of S$80/MWh but some analysts/investors tend to think that such high margin is not sustainable and is just one-off. Let the time proves it wrong or right.

Now I have been talking about the potential of the green data centres, but nobody or no analyst has given any value to this new business division as it has not yet started contributing earnings yet. By the time this division starts to contribute tens of millions of profit every quarter, it will be too late to chase this stock.

For us to beat the market, we need to study well and make reasonable assumptions on earnings potential, and see things before the market does, then only we can outperform and buy at low prices. FYI, I have grabbed plenty of YTLP shares at around 70 sen when I first published the 1st article. Again patience is the key.

2023-05-28 23:46

I am glad many have found my articles useful, especially those who have the knowledge and patience to really study the accounts and the numbers. As you have probably noticed, stocks that I cover do not immediately go up in share prices, so my articles and recommendations are not suitable for short term traders who tend to skip the contents of the article but purely look at the "high target price". When they see share prices do not move up in few days, they will complain and talk down on the "high target price". I don't give a damn. It is better for short term traders to sell quickly so that I can accumulate more. I welcome constructive comments and critics but please back them with facts and sincerity.

2023-05-28 23:54

Thanks for your valuable contribution.

I always take it positively and welcome others contributions as well and of course decision of my investment is based on own thinking and digestion of what I read without blaming to any contributor.

2023-05-29 07:35

SINGAPORE: Singapore will import 100 megawatts (MW) of electricity from Malaysia as part of a two-year trial, under a joint agreement between YTL PowerSeraya and TNB Genco.

This marks the first time that electricity from Malaysia will be supplied to Singapore on a commercial basis.

Announcing this on Monday (Jan 30), YTL PowerSeraya said the electricity will be exported via a newly upgraded interconnector.

The electricity will first be purchased from TNB Pasir Gudang Energy, a wholly owned special vehicle company by TNB Genco, before being exported.

This will make up about 1.5 per cent of Singapore’s peak electricity demand, enough to power about 144,000 four-room HDB flats for a year.

“Both parties will work closely with the Energy Market Authority of Singapore (EMA) and the (Malaysian) Energy Commission to refine all technical settings and regulatory arrangements under the Electricity Import Framework and the agreement will be effective upon fulfilment of conditions precedent,” a joint statement read.

The partnership was made official on Monday and was witnessed by Manpower Minister Tan See Leng and Malaysia's International Trade and Industry Minister Tengku Zafrul Tengku Abdul Aziz.

2023-05-29 08:35

@Sslee, this 100MW power export deal was announced before our government lifted the ban on RE export. So YTL Power needed to get the power from Tenaga Nasional gas-fired power plant first. For this trial export, YTL Power may just earn a small commission by buying power from TNB and selling it to Singapore via PowerSeraya.

2023-05-29 08:48

The 100MW is just a starter that will be increase to balance the Singapore power demand and supply.

2023-05-29 10:10

heard that their staff also did not get more bonus even declare so much of UNTUNG..!!!what a shame

2023-05-29 11:17

I really appreciate your articles and help me hold YTLP shares tightly until now. Thanks bro.

2023-05-29 13:21

Royce Chan

If YTL Corp is so strong as you wrote why didn't they declare any dividend in their just reported sterling quarter? And not to be discounted that the respective exceptional strong quarter was mainly due to disposal gain from a power unit overseas being a one off gain.

2023-05-27 14:44