YTL & YTL Power - Multiple Growth Engines Firing up

dragon328

Publish date: Thu, 23 Nov 2023, 11:29 PM

Another Excellent Set of Quarterly Results for YTL Power

YTL Power announced another set of excellent set of results in Q1 FY2024 with net profits totalling RM848 million, some 390% higher than last year corresponding period. A breakdown of segmental contributions to the profit before tax (PBT) is as follows:

| Profit / (Loss) before tax | RM ‘000s |

| Power generation | 1,025,142 |

| Water & sewerage | (34,764) |

| Telecommunications | (71,463) |

| Investment Holding activities | 112,572 |

| Total PBT | 1,031,487 |

Again the main profit contributor in the quarter was PowerSeraya which contributed PBT of RM1,025 million. Net profit contribution from PowerSeraya to YTL Power remained very strong at RM850 million a quarter, despite the implementation of TPC by EMA in July 2023. I shall discuss this in more details in a separate section below.

Wessex Waters reported a loss of RM34.7 million in Q1 FY2024, again due to higher interest accruals for index-linked bonds of RM156.4 million. I expect Wessex to report more meaningful earnings rebound from Q4 FY2024 after it secures another round of water tariff hikes from 1st April 2024, or when it stops to make provision for index-linked bond interest accruals.

The telecommunications segment turned in a smaller pretax loss of RM71.46 million, compared to pretax loss of RM84 million in the corresponding period last year.

Investment holding segment registered smaller PBT of RM112.57 million compared to RM350 million in Q4 FY2023 during which the company booked in some accrued technical service income following the commercial operations of the two power generating units.

PowerSeraya Strong Earnings to continue

As demonstrated in the latest Q1 FY2024 quarter, PowerSeraya earnings are expected to remain strong at least to FY2025 as there will be no new generating capacity coming on stream until EMA’s new 680MW Open-cycled Gas Turbines (OCGTs) are scheduled to commence operations in 2025. These OCGTs are meant for spinning reserves and as standby capacity to cater for any shutdown of the more efficient combined-cycle gas turbines (CCGTs), and not for base load operations. These OCGTs will be owned and operated by EMA for power system stability purposes and not for commercial operations, hence will not help to ease the supply tightness in the retails electricity market.

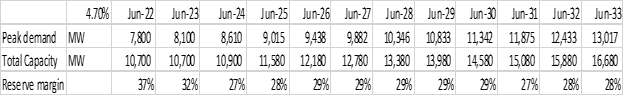

Next in 2026, a new 600MW cogen plant by Keppel is expected to commence operations followed by another 600MW cogen plant by Sembcorp. These will hardly be enough to cater to the projected peak demand growth from 8,100MW in June 2023 to 9,493MW in June 2026 (based on EMA projection). The power system reserve margin is projected to drop to sub-30% levels for the next 10 years from FY2024 to FY2033 as shown in the table below:

The peak demand figures above are all based on EMA projection. Total generating capacity is gross capacity figure (before allowing for plant internal consumption and spinning reserves). The projected new generating capacity addition is assumed to be:

· 680MW OCGTs by EMA in 2025

· 600MW cogen by Keppel in 1H 2026

· 600MW cogen by Sembcorp in 2H 2026

· 600MW 1st CCGT under EMA RFP in 2028

· 600MW 2nd CCGT under EMA RFP in 2029

· 600MW 3rd CCGT under EMA RFP in 2030

· Retirement of 300MW old CCGT unit in 2031

· 800MW 1st batch of RE import in 2031

· 800MW 2nd batch of RE import in 2032

· 800MW 3rd batch of RE import in 2033

In Singapore, the minimum reserve margin has been set at 27% to ensure system security. Hence, EMA is calling for new 600MW CCGT units to be built from 2028 under a Request for Proposal (RFP) issued in 2H 2023. In addition to this, EMA is calling for tenders to import up to 4,000MW of renewable energy (RE) from neighbouring countries by 2035. I have assumed the RE import to be staggered at 800MW every year from 2031 to 2035.

If the peak demand growth is not as strong as what EMA has projected above, EMA shall have the flexibility of calling off one or 2 of the tenders for new CCGTs to come in 2028-2030, or delaying the RE import in stages.

Even with these planned additions of new capacity, the system reserve margin is projected to remain tight at around 27% to 29% for the next few years. EMA had projected for around 1,000MW of existing capacity to retire over the next 5 years from 2023 to 2028, but based on my projection above, the earliest for any existing capacity to be allowed to retire will be 2031 to ensure the reserve margin will not drop below 27%.

If the power demand grows as per EMA projection, then the electricity supply will remain tight for the next 7 to 9 years with reserve margin around 28%. If during this period, any CCGT plant (typically 360MW each) goes under maintenance or unscheduled shutdown, the reserve margin will drop below 27% and wholesale electricity price will spike up. Therefore, I am confident that PowerSeraya will continue enjoying healthy gross margin in its retails contract for next few years.

PowerSeraya is expected to participate in the RFP tender by EMA to solicit for up to 3 new CCGT units (of 600MW each) to come in from 2028. If it succeeds in winning one of the tenders, PowerSeraya’s total generating capacity will jump up, so will its retails market share. If the peak demand growth is not as strong as projected, PowerSeraya may still consider to drop one or more bids for any of such EMA tenders before any Final Investment Decision (FID) is made.

Potential Listing of PowerSeraya

YTL Power managing director, Dato’ Yeoh Seok Hong once mentioned to fund managers in a presentation in Singapore that YTL Power might consider listing of PowerSeraya if the market continued under-valuing the assets of YTL Power. That reinforces my earlier call for a listing of PowerSeraya as the Singapore market has presented an opportune time to do so (tight electricity supply, high USEP, good sustainable gross margin in retails electricity market, continued lower interest rate environment in Singapore, potential expansion in new CCGT plant-up in 2028-2030 and potential RE import from 2030 etc).

For a potential valuation of PowerSeraya if it is listed in SGX, let’s take a look at the current valuation of peers listed in SGX:

| S$ million | Sembcorp | Keppel | PowerSeraya |

| Latest Quarterly Net Profit | 265 | 445 (1H23 recurring net profit) | 245 |

| Current PER | 10.33x | 12.81x | 11.57x |

| Current Market Cap | 9,030 | 11,400 | 11,338 |

Annualising the latest Q1 FY2024 earnings and applying the average PER of Sembcorp and Keppel, 11.57x, I get a potential valuation of S$11.338 billion for PowerSeraya.

Taking a more conservative approach, I shall assume PowerSeraya earnings to normalize to S$200 million a quarter or S$800 million a year for next few years, and apply the lower PER of 10.33x, I get a valuation of S$8.26 billion for PowerSeraya.

PowerSeraya projected operating cashflows will be over S$870 million after added back depreciation charges, a 50% dividend payout ratio will see PowerSeraya paying some S$435 million dividend a year, while reserving 50% operating cash for potential new plant-up in 2028-2030 and continued paring down of debts (currently sitting at about S$1.0 billion to be completely paid off in 4 years). At 5% dividend yield, PowerSeraya may be valued at S$8.7 billion.

In short, whether by peer comparison or potential dividend yield, PowerSeraya should comfortably get a valuation of over S$8.0 billion. A potential listing of 30% stakes of PowerSeraya would bring in good cash of S$2.4 billion or RM8.3 billion to YTL Power.

When will Wessex turn around?

Wessex Waters again suffered losses due to non-cash provision for interest accruals of index-linked bonds. It is puzzling why Wessex needed to make a bigger provision of RM156.4 million (vs RM54 million provision in Q4 FY2023) while interest rates in the UK did not increase much during the quarter.

Let’s take a closer look at the latest quarterly results in comparison with the preceding quarter Q4 FY2023:

| RM million | Q1 FY2024 | Q4 FY2023 |

| Revenue | 1,214.3 | 1,181.3 |

| Profit before tax | (34.8) | (57.0) |

| Interest accruals on index-linked bonds | (156.4) | (54.0) |

| PBT before interest accrual | 121.6 | (3.0) |

We can see that Wessex actually reported a decent pretax profit of RM121.6 million if we exclude the non-cash provision for interest accruals in the latest quarter, which is a big improvement from a RM3 million loss in Q4 FY2023. This implies to me that Wessex management has managed to keep good control over operating costs. If this continues in following quarters, then Wessex will be able to turn around with decent profit of over RM100 million a quarter if interest accruals on index-linked bonds do not recur.

Jordan Attarat Power

In my last quarterly update on YTL Power in August 2023, I already gave an overview of the power sector in Jordan and some background information on Attarat Power. The events that have unfolded since then are the outbreak of Israel – Palestine conflicts at Gaza Strip after the Islamic militant group Hamas launched unexpected air strikes on Israel killing some 1,400 civilians on 7 Oct 2023. Isreal has since retaliated by launching more air strikes on many buildings in Gaza Strip and ground incursion into the northern portion of Gaza Strip, killing over 13,000 Palestine civilians.

As mentioned in my earlier article, Jordan was getting a major gas supply from Israel before the conflicts started in Oct 2023. Days after the conflicts started, Israel announced to stop gas supply export to neighbouring countries including Jordan. Recent domestic checks indicate that gas supply to Jordan has indeed been disrupted and Attarat Power oil-shale power plant is required to run at maximum capacity. That reinforces my earlier view that the risk of Jordan relying on a major source of gas import to power up 70% of the country’s power generation was not to be under-stated.

As the ongoing international arbitration case of Nepco against Attarat Power will see a judgement in early 2024, the current dire situation on the ground would make the Nepco case difficult to stand ground. In any event, I expect a favourable outcome from this arbitration case and the original PPA to be honored by Nepco after the case.

Then, YTL Power would be able to recognize fully the PPA payments and also the interest income from shareholders’ loan to the project company Attarat Power. I have earlier projected for net profit contribution of up to RM100 million a year from Attarat Power to YTL Power. I did miss out on contributions from the mining company and the operating & maintenance (O&M) company, which would contribute another RM100 million a year of net profit to YTL Power. As of June 2023, the total shareholders’ loan injected from YTL Power into Attarat Power stood at about US$490 million, at a typical interest rate of 15%, shareholders’ loan interest income would top US$70 million or RM350 million a year.

So when the arbitration case is over, the Jordan power venture would potentially contribute RM550-600 million a year of net profit to YTL Power, inclusive of shareholders’ loan interest income.

In Q1 FY2024, Jordan Power is estimated to have contributed PBT of RM112.572m – RM75.149m (Jawa Power) = RM37.4 million. It implies to me that YTL Power only managed to recognize about half of the PPA earnings (supposedly RM100m a year or RM25 million a quarter) and RM25 million contribution from the O&M and mining companies, without any recognition of shareholders’ loan interest income.

Yes 5G Division

YTL Power’s 5G business under Yes is gaining traction as DNB 5G network coverage exceeds 70% nationwide. With the network assess fee structure and DNB equity structure more or less sorted out, YTL Yes has been aggressively rolling out attractive 5G packages such as:

1. Pakej Yes 5G Rahmah – from RM35/mth with 100GB 5G+4G data, unlimited calls, uncapped data speed and affordable 5G phones as low as RM240

2. Prepaid FT5G plan – RM30/mth with uncapped data and speed with 12GB hotspot

3. Super-Fast 5G Broadband – RM68/mth with uncapped 5G data and speed

4. Super-Fast 5G Broadband with free router – RM99/mth with uncapped 5G data and speed

5. All-new iPhone 15 – from RM21/mth with zero upfront fee, lowest monthly instalment and uncapped 5G data and speed

Telekom Malaysia (TM) has also lowered its fixed broadband unifi prices to the following:

· 30 MBps - RM69/mth Pakej Rahmah only

· 100 MBps - RM99/mth

· 300 MBps - RM139/mth

· 500 MBps - RM159/mth

· 800 MBps - RM299/mth

As we can see from the above, TM’s Pakej Rahmah plans are priced at almost double the price of Yes’ Rahmah plan (RM35/mth) or FT5G plan (RM30/mth). Yes’ Superfast 5G Broadband packages are reported to offer 5G speed of over 700 MBps at home, and are priced at just RM99/mth for 24 month contract with a free router, dropping to RM68/mth after 24 months. These are a lot cheaper than TM’s equivalent broadband plans of 300 MBps – 800 MBps (RM139/mth to RM299/mth).

TM had about 3.06 million fixed broadband customers as of 30 June 2023 with average revenue per user (ARPU) of RM130.00 per month. I reckon that these 3 million fixed broadband users of TM are low hanging fruits for Yes to grab, given that Yes’ 5G broadband plans are much faster and cheaper than equivalent TM’s ones.

However, there is still a lot of marketing work that needs to be done by Yes before it can secure more customers from TM or other telcos. While Yes has flagship stores in Lot10 shopping mall in KL and big sale stores in major shopping malls in the Klang Valley, it lacks presence in smaller cities and towns outside of Klang Valley. For instance, while there are over 20 Maxis or Celcom or TM dealer stores in Ipoh, there is only 1 or 2 Yes stores currently in Ipoh city that has a population of over 850,000, and none in other smaller towns in Perak that has over 2.5 million population. It also lacks physical presence in the east coast, northern states and East Malaysia.

If Yes wants to increase its 5G customer base, it has to capture the bigger general mass market, not only targeting the T20 and the more affluent groups in the Klang Valley. It also cannot rely on a flagship store in Lot10 and online prepaid packages sold in Shopee. As broadband services have become more like a necessity nowadays, general public from home offices, small businesses, cafes & restaurants, hawkers, small traders and the elderly need to access to good affordable broadband services for everything to do with their businesses or simply for children online education work or home streaming of TV shows. One cannot expect these groups of people to go all the way to Lot10 just to sign up for a broadband service, they naturally just go to nearby shops where other telcos like Maxis or TM has a dealer representative for ready advice and easy registration & technical support. For instance, a dealer store in Kinta City, Ipoh that sells U Mobile and Yes mobile & broadband packages could not sign me up for a Yes broadband plan as the dealer could not ascertain if Yes 5G coverage was available in my home area and the speed that could be achieved. Physical store presence and support of Yes is scarce currently and it will take months for them to open more physical stores to reach out to the bigger general mass market. Yes will need to be quick in rolling out more nationwide presence to grab more market share before other telcos and incumbents come out with defensive strategies.

For the first 6 months of 2023 to end of June, YTL Power registered total revenue of RM438.8 million from telecommunication services, or an average of RM73.1 million a month. Assuming an ARPU of RM36 per month, I estimate that Yes had about 2.0 million active subscribers as of June 2023, most of which are previous 4G plan subscribers as Yes only started aggressively rolling out 5G plans from May 2023. It made a pretax loss of RM268 million in 1H2023, but its quarterly statements stated that this segment remained EBITDA positive.

Total revenue from the telecommunication segment was RM603 million for 1H2023. Assuming a positive EBITDA of RM200 million, I estimate that the overhead costs are around RM400 million for 6 months. Assuming total debts of RM2.0 billion and average interest rate of 5.0% p.a., total interest expenses for the 6 months may be estimated at RM50 million, implying total depreciation & amortization charges of RM418 million for the 6 months:

RM m Jan-Jun 2023

Revenue 603

Overhead (403)

EBITDA 200

D&A (418)

Interest (50)

PBT (268)

If Yes could get additional 1.0 million 5G subscribers, and ARPU could be higher at RM60 per month (as mostly additional ones would opt for the RM68 or RM99/mth plans), it would add RM360 million revenue for a 6-month period. Minus out 20-25% for dealers’ commission and RM144 million for 6 months of DNB 5G network access fees, Yes could get additional EBITDA of RM125-145 million for 6 months and pretax loss could halve to about RM134 million.

If Yes could get additional 2.0 million 5G subscribers, then revenue would increase by RM720 million for 6 months and EBITDA would increase by RM400 million. Yes would then turn in pretax profit of some RM130 million for 6 months or RM260 million a year. EBITDA would total RM600 million on total revenue of RM1,320 million for 6 months, implying an EBITDA margin of 45%, slightly higher than TM’s 42% (due to Yes’ slimmer overhead and lack of legacy costs as in TM). Operating cashflows after tax would top RM1.0 billion a year. At 7% cashflow yield, YTL Yes would be valued at RM14.7 billion.

In Q1 FY2024, Yes registered a pretax loss of RM71.5 million, implying that they have got almost 1.0 million 5G subscribers in this quarter since 30 June 2023 (as calculated above, pretax loss would halve to RM134 million for a 6-month period if Yes got additional 1 million 5G subscribers). If such a momentum continues, Yes would add another 1 million 5G subscribers in the current quarter and would turn around earliest in Q2 FY2024.

Potential valuation of YTL Power

As discussed above, YTL Power registered a “normalized” net profit of RM850 million in Q1 FY2024, in the absence of the one-off accrued technical service fee from Jordan Power (which inflated the Investment Holding segment PBT to RM350 million in Q4 FY2023) and the absence of any extraordinary profit from PowerSeraya long generation into the wholesale electricity pool that saw spikes in pool prices in Q4 FY2023. The “normalized” net profit in Q1 would have been higher if not for Wessex to book in a large provision of RM156.4 million for index-linked bond interest accruals.

Taking a more conservative approach, I just assume the normalized net profit to be RM850 million per quarter for YTL Power, annualized to RM3.4 billion a year or EPS of 42 sen. YTL Power registered strong operating cashflows (before working capital changes and capex) of RM1.7 billion in Q1 FY2024, annualized to RM6.8 billion. Deduct assumed capex of RM3.4 billion a year, YTL Power would easily have free cashflows of RM3.4 billion or 42 sen per share every year. At a dividend payout ratio of 40%, YTL Power would afford paying dividends of 16 sen a share or RM1.3 billion every year to support its parent YTL Corp’s own dividend target payout of RM1.0 billion a year.

As comparison, I summarise below the valuation of utilities peers in Bursa:

| RM million | Tenaga | Petronas Gas | Dialog | YTL Power |

| Market Cap | 58,000 | 33,400 | 11,900 | 18,800 |

| FY23 Net profit | 5,000 | 1,800 | 530 | 3,400 |

| PE Ratio | 11.6x | 18.6x | 22.4x | 5.5x |

| Dividend yield | 4.8% | 4.2% | 1.6% | 7.0% |

As can be seen above, YTL Power is trading at an unjustifiably low PER of 5.5x, not even half of Tenaga’s valuation. Petronas Gas and Dialog though making less profit than YTL Power are trading at about 20x PER. If re-valued to Tenaga’s valuation of 11.6x PER, YTL Power should be trading at RM4.87; if re-valued to PetGas/Dialog valuation of 20x PER, YTL Power would be trading at RM8.40. To me, YTL Power should at least trade at 10x PER or RM4.20 per share. When Wessex turns around by Q4 FY2024, or Yes turns profit from Q2 FY2024, or 1st phase data centre starts contributing profit from Q4 FY2024 or Jordan Power can fully recognize PPA profits and shareholders’ loan interest income from Q3 FY2024, YTL Power net profit will gradually improve further towards RM4.0 billion or EPS of 50 sen, and its share price should trade above RM5.00 if based on 10x PER.

YTL also registered excellent quarterly results

YTL registered an excellent set of results for Q1 FY2024, powered by strong earnings from YTL Power and MCement. The breakdown of its PBT is summarised below:

| Profit / (Loss) before taxation Q1 FY24 | RM ‘000s |

| Construction | 1,093 |

| Cement and building materials | 163,049 |

| Property investment & development | 55,602 |

| Management services & others | 16,849 |

| Hotels | 46,860 |

| Utilities | 930,832 |

| Total PBT | 1,214,285 |

The cement and building materials division reported a strong quarter. The bulk cement selling price remained at around RM360-380/MT while coal prices have fallen significantly since March 2023. The big jump in earnings from MCement in this quarter was driven by a good 13.6% increase in revenue from the preceding quarter (as shown in the table below).

| RM ‘000s | Q1 ended 30 Sep 2023 | Q4 ended 30 Jun 2023 |

| Revenue | 1,148,061 | 1,010,513 |

| Cost of Sales | (807,717) | (697,805) |

| Gross Profit | 340,344 | 312,708 |

| Other Operating Income | 27,155 | 35,513 |

| Other Operating Expenses | (171.857) | (181,344) |

| Profit from Operations | 195,642 | 166,877 |

| Finance Costs | (50,828) | (48,702) |

| Share of results of joint venture | 9,739 | 7,835 |

| Profit before tax | 154,553 | 126,010 |

| Taxation | (58,419) | (46,329) |

| Profit after tax | 96,134 | 79,681 |

Strong Operating Cashflows for YTL

YTL achieved a record EBITDA of RM6.9 billion in FY2023, a 32% increase from RM5.4 billion in FY2022. Operating cashflows before capex and working capital changes amounted to RM4.08 billion in FY2023, minus off capex of RM2.34 billion, free cashflows amounted to RM1.74 bilion in FY2023.

YTL achieved an EBITDA of RM2.43 billion for Q1 FY2024, annualised to RM9.7 billion for FY2024. YTL achieved operating cashflows (before working capital changes and capex) of RM2.0 billion in Q1 FY2024, annualised to a whopping RM8.0 billion. Deduct assumed capex of RM4.0 billion a year, free cashflows may top RM4.0 billion a year for FY2024 & beyond, easily supporting a dividend payout of RM1.0 billion a year for FY2024 and FY2025.

Multiple Re-rating Factors for YTL Group of Companies

Despite the latest strong quarterly results and recent stellar share price rally, there are still multiple re-rating factors for YTL group of companies in coming quarters:

- Continued strong earnings from PowerSeraya contributing >RM700 million net profit every quarter to YTL Power

- Potential listing of PowerSeraya on SGX, which may potentially fetch a valuation of over SGD 8.0 billion

- Turnaround of Wessex earnings after interest rate hike cycle in the UK ends, high inflation starts to cool off and water tariff revision for 2024

- Potential listing of Wessex Waters in in 2025-2026 which may fetch a valuation of over RM23 billion

- Favourable outcome from the international arbitration on Jordan power venture which will enable it to fully realise PPA earnings and shareholders’ loan interest income of over RM550 million a year

- Maiden earnings contribution from the first phase of green data centre project from Q3-Q4 FY2024

- Maiden earnings contribution from the digital bank venture from 2025

- Potential turnaround of Yes 5G business as early as Q2 FY2024 and decent profit contribution of RM260 million and operating cashflows topping RM1.0 billion a year from 2024 after it secures another 1.0 million 5G subscribers

- Potential listing of Yes business or placement of strategic stakes in Yes after registering profits from 2024, to pay off debts and realise cash for YTL Power

- Financial close for the Waste-to-Energy (WTE) power plant project in Rawang

- Potential securing some of the RE power export to Singapore from 2024-2026

- Continued strong earnings and dividend payouts from MCement

- Potential placement of MCement shares to strategic investors at over RM4.00 per share to improve public spread (YTL owns 78.6%) and to realise cash for YTL

- Rolling out of mega infrastructure projects in Malaysia and new Indonesia capital city development in Nusantara to boost cement demand

- Strong rebounds in YTL shopping malls and hotels business division

- Strong dividend payouts from YTL Power (15-18 sen) and YTL (9.5 sen) from FY2024

- Potential clinching of MRT3 package by YTL construction arm

- Potential revival of KL-Singapore High Speed Rail (HSR) project

- Potential start of KL-Ipoh HSR project

- Potential monetisation of assets by YTL – injection of unlisted hotels and shopping malls into the REIT, monetisation of some landbank at Niseko Japan, potential listing of Japan Niseko assets on Japan stock exchange, potential disposal of peripheral assets and land parcels etc.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-05

YTLPOWR2025-02-04

YTL2025-02-04

YTL2025-02-04

YTL2025-02-04

YTL2025-02-04

YTLPOWR2025-02-03

YTL2025-02-03

YTL2025-02-03

YTLPOWR2025-01-31

YTLPOWR2025-01-31

YTLPOWR2025-01-29

YTLPOWR2025-01-28

YTL2025-01-28

YTL2025-01-28

YTL2025-01-28

YTLPOWR2025-01-28

YTLPOWR2025-01-28

YTLPOWR2025-01-27

YTL2025-01-27

YTL2025-01-27

YTL2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWRMore articles on Dragon Leong blog

Created by dragon328 | May 23, 2024

Discussions

Wessex Water PBT before interest accrual turnaround to +RM121.6m from -3.0m.

Potential listing of Wessex Waters in in 2025-2026 which may fetch a valuation of over RM23 billion

Water business is the future!

YTL and YTLP very powerful indeed!

If you want to have a pure water play in Penang for stocks with potential to double, come and read this blog about PBA (Penang water company).

https://klse.i3investor.com/web/blog/detail/bestStocks/2023-11-09-story-h-215206834-PBA_6_reasons_why_PBA_is_worth_RM2_50

2023-11-24 06:29

Uniholder

Thanks for the wonderful insight, Mr Dragon328 ! Shall we see YTLP close to 3.28 soon ?? 😁

2023-11-24 00:43