YTL & YTL Power - The Best Performing Stocks May Again Double Up in AI Driven Rally

dragon328

Publish date: Thu, 23 May 2024, 03:02 PM

YTL Group is diversifying into AI data centre business, through YTL AI Cloud which is 60% owned by YTL Power, which in turn is 55% owned by YTL Corp, the flagship company. This new business segment is becoming the next major growth driver to YTL Power and YTL Group in general.

YTL Power has secured a Major Deal with Nvidia, More to come

On 8th December 2023, YTL Power announced to have secured a deal with Nvidia to collaborate on developing AI data centres in YTLP’s Kulai green data centre park. Total investment was reported to be RM20 billion over several years. While details are scarce due to sensitivity of the deal, it is widely expected that Nvidia will invest in new data centres in Kulai with its powerful H100 GPUs to provide AI cloud computing services to corporates in Malaysia and the region. This strategic tie-up with Nvidia has enabled YTL Power to subsequently secure more data centre deals with the big clouds.

Microsoft CEO, Satya Nadella when visiting Malaysia on 2nd May 2024 announced that Microsoft would invest US$2.2 billion (RM10.5 billion) over next 4 years on AI infrastructure to accelerate its push on AI cloud computing services in Malaysia.

Amazon Web Services (AWS) on 8th May 2024 announced plans to invest an additional S$12 billion into its existing cloud infrastructure in Singapore from 2024 to 2028, with the aim of meeting growing customer demand for cloud technology and services in Singapore. AWS has invested a total of S$11.5 billion in the AWS Asia Pacific region through 2023. AWS had earlier on 7th March 2023 announced to invest at least RM25.5 billion (US$6 billion) by 2037 in the new AWS Region in Malaysia. An AWS Region is comprised of multiple geographically separated Availability Zones, each of which contains a cluster of data centres that provide a high availability, reliable and secure infrastructure and services. The new AWS Region in Malaysia will consist of three Availability Zones at launch, bringing the latest cloud technologies – from compute and storage, to artificial intelligence and machine learning, and more – closer to customers, while servicing growing demand for digital services across Southeast Asia.

On 6th May 2024, Prime Minister Datuk Seri Anwar Ibrahim had a virtual meeting with Google president and chief investment officer Ruth Porat and other senior management members of the tech giant. The Investment, Trade and Industry Minister Tengku Datuk Seri Zafrul Abdul Aziz confirmed that an announcement on Google’s investment in Malaysia would be made in the near future. He said the Digital Ministry will coordinate the use of AI while in terms of investment, the ministry and the Malaysian Investment Development Authority (Mida) are making preparations with Google.

In building new AI data centres, YTL Power has the following competitive advantages:

· It is the only company outside the US which can get access to Nvidia’s latest Blackwell B200 GPUs within this year

· It has already got sufficient land in Kulai for building up to 500MW of data centres and 500MW of solar power to provide green and cheap electricity to the data centre

· It has a strategic stake in Ranhill Utilities, the only water company in Johor, so it can ensure sufficient water supply to the upcoming data centres in Kulai

· YTL group has inhouse core competence in construction and infrastructure works with a long and good track record of construction project delivery ahead of schedule and at cost competitive pricing

· YTL Power has the financial power and ability to raise necessary funds in innovative ways to fund the data centre projects

· YTL management is prudent and far-sighted, and has the reputation to deliver

I believe the above competitive strength that YTL Power possesses is the reason why Nvidia has chosen YTL as the partner in Malaysia to deliver AI data centre infrastructure and AI cloud services to Malaysia and the region.

After securing the first AI data centre project with Nvidia, reportedly at a capacity of 100MW, YTL Power has the capacity to secure more AI data centre jobs up to 300MW from the big clouds such as Microsoft, AWS, Google and Meta. Due to the competitive advantages of YTL Power as outlined above, it is only a matter of time before YTL Power secures more contracts from the big clouds, if not already have.

How it started

When YTL Power management saw the huge potentials in regional data centre business back in 2021, the company made the first move by acquiring Dodid Pte Ltd, a 12.5MW, Tier-III hyperscale data centre in Singapore in December 2021, in order to understand the business model better. Built and commissioned in 2018, Dodid is a green, state-of-the-art facility that serves the largest hyperscale customers in Asia. That marked YTL Group’s first foray into the data centre industry outside Malaysia, and its first step towards establishing a regional data centre platform in Southeast Asia.

YTL Power managing director Datuk Yeoh Seok Hong said the burgeoning growth of the data centre market in Southeast Asia amid digital transformation represents an exciting opportunity for YTL Power to expand its expertise in infrastructure to the digital age.

“This is a major strategic initiative as we seek to expand our infrastructure platform to build sustainable data-driven ecosystems powered by renewable energy, which will help meet the region’s growing appetite for cloud-based solutions and services.

With YTL’s deep expertise in key telecommunications and electricity markets in Singapore, Malaysia and Indonesia, we are able to extract synergies from across the YTL Group’s core businesses to bring cost efficiencies and long term value to customers,” he added.

Kulai Green Data Centre Park

Just months before the acquisition of Dodid, YTL Power announced in September 2021 to acquire a piece of 664ha plantation land from Boustead Plantation for RM429 million. The land was purchased by YTL Power’s 70%-owned subsidiary SIPP with the intention to develop large-scale solar plants.

YTL Power MD Datuk Yeoh Seok Hong said the acquisition of Kulai Young Estate is extremely strategic to the group with its accessibility and proximity to high growth industrial developments.

“We have been seeking opportunities for YTL Power to invest in renewable sources of energy and solar is definitely a priority as the country has substantial solar capacity,” he said.

On 21 April 2022, YTL Power through its subsidiary YTL Data Center Holdings Pte. Ltd. (“YTL DC”) announced the development of a 500MW data center campus in Kulai, Johor, the first data center park in Malaysia to be powered by renewable solar energy.

Located 30km from Singapore in the Iskandar region of Johor, the YTL Green Data Center Park will offer diversity in power and connectivity on a large industrial site, of which 275 acres will be dedicated towards data center development. This provides excellent opportunities for customers seeking green data centers to meet their needs.

Work has started on the first 72MW data center, expected to be in service by Q1 2024, with more in the pipeline.

Dato’ Yeoh Seok Hong noted, “With the development of the YTL Green Data Center Park, we are driving the expansion of our infrastructure platform to the digital age by combining our expertise in renewable energy, property development, telecommunications and data centers. This project will be the flagship of our integrated data center vision to serve our customers in the wider Singapore region, as well as catalyst for our regional expansion in this space.”

Notably, the YTL Green DC Park will have dark fibre connectivity to Singapore, due to its close proximity with the country. This benefits companies with operations in Singapore looking to expand, complement and optimize their data center processes. Dark fibre connectivity will provide direct and ultra-low latency network connections to data centers in Singapore and other locations in Malaysia.

For Phase 1 of the project, YTL Power is investing RM1.5 billion to build a Tier-III certified facility equipped with the ability to accommodate up to 72MW of capacity.

“The three-storey building consists of two wings of Data Hall suites and mechanical and engineering rooms and also eight Data Hall suites spread over two wings per floor, with a total of 24 Data Hall suites,” RHB Research said in a report.

eCommerce firm SEA Ltd will be the anchor tenant for the 32MW IT load hyperscale DC. The first 8MW has been completed in March 2024 with the remaining 24MW to come online progressively. YTL Power is looking to secure a new client for the remaining 16MW.

“We are guided that the contract tenure is more than 10 years and the DC in Phase 1 could potentially generate pre-tax profit of RM100 million per annum.” RHB Research stated.

The DC’s electricity is currently supplied by Tenaga Nasional Bhd, and YTL Power is likely to construct solar power assets to help co-power the data centers in the future.

Nvidia and AI Data Center

On 8th December 2023, YTL Power announced a collaboration with Nvidia Corp to build artificial intelligence (AI) infrastructure in Malaysia, with the first phase to be operational in 2024. The AI infrastructure will be hosted at YTL’s data center park in Kulai.

The announcement was made in a meeting on Dec 8 between Jensen Huang, founder and CEO of Nvidia, and the Prime Minister of Malaysia, Dato’ Seri Anwar bin Ibrahim. Also present were Tengku Datuk Seri Zafrul Abdul Aziz, Minister of Investment, Trade and Industry (Miti) and Dato’ Yeoh Seok Hong, Managing Director of YTL Power.

Tengku Zafrul, speaking after the visit, said, ”We welcome partnerships such as the one between YTL and Nvidia, exactly the kind of strategic collaborations targeted by our New Industrial Master Plan 2030. By offering supercomputing cloud services and leveraging AI to power innovations, such partnerships enhance our economic complexity, paving the way for us to become a high technology and high-income nation while further positioning Malaysia as a top investment destination.”

YTL will deploy Nvidia H100 Tensor Core GPUs, which power today’s most advanced AI data centres, and use Nvidia AI Enterprise software to streamline production AI. Nvidia AI Enterprise includes Nvidia NeMo, an end-to-end, could-native framework for building, customizing and deploying generative AI models from anywhere.

Nvidia H100 GPUs deliver industry-leading generative AI and can speed up large language models (LLMs) by an incredible 30x compared with previous-generation GPUs.

The AI infrastructure will be hosted in the YTL Green Data Center Park in Kulai, Johor. YTL Communications Sdn Bhd, the telecommunications subsidiary of YTL, will own and manage the AI infrastructure that will provide AI computing services to the nation. YTL Communications owns and operates a national mobile network and was the first to offer 4G and 5G services in the country under its “Yes” brand.

The AI infrastructure will provide the foundation for scientific research and the development of solutions and applications that will accelerate Malaysia’s progress towards becoming an AI nation.

YTL will not only provide green, energy-efficient AI infrastructure to scientists, developers, and startups across the nation, it will also create AI-specific applications and services for its customers. YTL plans to use Nvidia NeMo to customize and deploy a Malay language foundation model that will be sensitive to Malaysia’s multi-cultural heritage.

“This collaboration with Nvidia comes at an opportune time. In the 12 months since the launch of ChatGPT, we have seen how AI is changing the way we work, live and learn. Having our own supercomputing infrastructure and the ability to train talent locally will accelerate Malaysia’s advancement towards being a top AI nation. This will be the foundation for a digital economy powered by innovative solutions and applications built on our very own sovereign LLM,” said Dato’ Yeoh Seok Hong. “This collaboration with Nvidia is posed to bring many benefits to the nation. Our green data centres and low energy solutions are an ideal fit to be used with their high-performance supercomputers. We are excited to begin this journey to bring our nation to the forefront of AI development.”

“Malaysia is embracing AI to enhance jobs, drive competitiveness, and supercharge innovation,” said Raymond The, Senior Vice President of the Asia-Pacific region at Nvidia. “This collaboration will help deliver advanced AI computing infrastructure to enable Malaysia to build its own LLMs and power the country’s next wave of generative AI applications.”

Nvidia Blackwell B200 GPUs

On March 18, 2024 during the AI Conference in California, Nvidia announced that the Nvidia Blackwell platform has arrived – enabling organizations everywhere to build and run real-time generative AI on trillion-parameter large language models at up to 25x less cost and energy consumption than its predecessor.

The Blackwell GPU architecture features six transformative technologies for accelerated computing, which will help unlock breakthroughs in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing and generative AI – all emerging industry opportunities for Nvidia.

“For three decades we’ve pursued accelerated computing, with the goal of enabling transformative breakthroughs like deep learning and AI,” said Jensen Huang, founder and CEO of Nvidia. “Generative AI is the defining technology of our time. Blackwell is the engine to power this new industrial revolution. Working with the most dynamic companies in the world, we will realize the promise of AI for every industry.”

Among the many organizations expected to adopt Blackwell are Amazon Web Services, Dell Technologies, Google, Meta, Microsoft, OpenAI, Oracle, Tesla and xAI.

In a statement after the Nvidia GTS24 AI Conference, Alexis Black Bjorlin, VP/GM of DGX Cloud at Nvidia said, “#GTC24 marks a significant milestone for NVIDIA as we unveil groundbreaking advancements in AI infrastructure and partnerships with industry leaders. I’m particularly excited about the DGX Cloud momentum we announced at the event.

NVIDIA GB200 NVL72 System on DGX Cloud: Introducing the powerful combination of 72 Blackwell GPUs and 36 Grace CPUs interconnected by fifth generation NVLink to accelerate the development of AI models on DGX Cloud.

Expanded Partnerships: Strengthening our collaboration with Amazon Web Services (AWS), Google Cloud, Microsoft Azure, Oracle Cloud and YTL Corporation Bhd to bring cutting-edge NVIDIA technology to their clouds.”

That statement confirms that YTL will be among the first and the only company outside the US to get access to NVIDIA’s latest Blackwell GPUs.

In a press release on 18 March 2024, YTL Power announced to create and manage one of the world’s most advanced supercomputers, powered by NVIDIA Grace Blackwell-based DGX Cloud. YTL Power also announced the formation of YTL AI Cloud, a specialized provider of massive-scale GPU-based accelerated computing.

YTL is among the first companies to adopt NVIDIA GB200 NVL72, which is a multi-node, liquid-cooled, rack-scale system with fifth generation NVLink. The supercomputer will be interconnected by NVIDIA Quantum InfiniBand networking platform. The platform acts as a single GPU with 1.4 exaflops of AI performance and 30TB of fast memory and is designed for the most compute-intensive workloads. The YTL AI Supercomputer will surpass more than 300 exaflops of AI compute, making it one of the fastest supercomputers in the world.

“NVIDIA is working with YTL AI Cloud to bring a world-class accelerated computing platform to Southeast Asia – helping drive scientific research, innovation and economic growth across the region,” said Jensen Huang, founder and CEO of NVIDIA. “This latest supercomputer marks one of the first deployments of the NVIDIA GB200 Grace Blackwell Superchip on DGX Cloud, supporting the growth of accelerated computing in the Asia Pacific region.”

Prime Minister of Malaysia, Dato’ Seri Anwar bin Ibrahim, commented, “We congratulate YTL on this very significant milestone, a first for Malaysia, which will accelerate the country’s adoption of AI and spearhead the development of our own Sovereign Cloud. The collaboration with NVIDIA is testament to Malaysia’s attractiveness as a hub for digital investments.”

YTL Power International Managing Director Dato’ Seri Yeoh Seok Hong said, “We are proud to be working with NVIDIA and the Malaysian government to bring powerful AI cloud computing to Malaysia. We are excited to bring this supercomputing power to the Asia Pacific region, which has been home to many of the fastest-growing cloud regions and many of the most innovative users of AI in the world.”

YB Gobind Singh Deo, Minister of Digital, Malaysia, who was attending NVIDIA GTC24, said, “There is no doubt that AI is a critical tool that will power the global digital economy. Having one of the most powerful NVIDIA cloud computing infrastructures in Malaysia is a game changer and will spark innovation and development of solutions foundational to the success of the Malaysia Digital Economy Blueprint.”

Highlighting the economic benefit and spillover of such partnership, Tengku Datuk Seri Zafrul Abdul Aziz, Minister of Investment, Trade and Industry (MITI), Malaysia, commented, “This powerful AI Cloud will create high-value, high-income job opportunities for Malaysians, making a significant step forward in our mission to become a leading AI and Data Centre hub in the region. This initiative not only brings us closer to achieving out goals under the New Industrial Master Plan 2030 but also demonstrates Malaysia’s capability and readiness to play a significant role in the global technology landscape.”

Potential Market Size of AI Data Centre

Malaysia has a total of 47 data centre facilities across the country with a combined capacity of 248MW, among which is the YTL’s 48MW colocation data centre in Kulai. The AI data centre YTL is developing with Nvidia will be the first AI data centre in Malaysia using Nvidia superfast GPUs.

For Nvidia, AI data centre (or called AI factories by Jensen Huang) contributed about USD70-80 billion of revenue in 2023 to the group topline. When asked by investors at the 2024 GTC, Jensen Huang estimated that the data centre market size facing Nvidia is growing by as much as 25% annually, potentially surpassing USD250 billion. In the latest quarterly result for Q1 FY2024, Nvidia achieved total revenue of US$26 billion, out of which US$22.6 billion (+427% y-on-y) was from AI data center division.

As AMD launched the new processors in December 2023, company executives outlined how rapidly demand for AI chips has increased. The company said it now expects the market for data centre AI chips to grow to roughly USD400 billion by 2027.

AMD estimated that there was a US$45 billion market for its own AI processors this year. Analysts estimate that Nvidia has captured roughly 80% of the AI chip market, when including the custom processors built by companies such as Google and Microsoft.

Microsoft has aggressively invested in AI services, with capital expenditure rising to US$10.7 billion a quarter to support cloud demand and AI infrastructure. Additionally, Microsoft plans to spend over USD50 billion on AI data centres in 2024. This infrastructure buildup is aimed squarely at accelerating the path to AGI and bringing the intelligence of generative AI to every facet of life. Microsoft CEO Satya Nadella, while meeting Indonesia president on 30 April 2024, pledged US$1.7 billion investment in AI and cloud computing to help develop Indonesia’s AI infrastructure. During the Microsoft Build: AI Day in Kuala Lumpur, Malaysia on May 02, 2024, Microsoft CEO Satya Nadella announced a US$2.2 billion investment to advance new cloud and AI infrastructure in Malaysia.

AWS reported a revenue of about USD24.3 billion for Q1 2024, a 14% increase from Q1 2023. That will put AWS on a USD100 billion run rate for its AI cloud computing services. Amazon’s annual capital expenditure in 2019-2023 averaged about USD46.886 billion, with a peak of USD63.645 billion in 2022 and slightly lower USD53 billion in 2023. That will put it on par with Microsoft in terms of spending on AI data centre and chips.

Google’s parent Alphabet spent about USD12 billion on AI in Q1 2024, nearly doubling from last year. The parent of Facebook, Meta has raised its capex range by 12% for 2024, topping out around USD40 billion.

Potential Earnings Contribution from AI Data Centre

While details of the deal between YTL Power and Nvidia or other big clouds is scarce at the moment, I will try to do a rough estimate of the potential earnings to be contributed by the AI data centre deals to YTL Power.

Information from engineers’ posts in LinkedIn shows that the data centre, named DC1, that YTL Power built for SEA Ltd has 3 floors with 8 data halls per floor, i.e. 24 data halls in total. Each data hall has a capacity of 2MW, hence total 48MW for the first phase with SEA Ltd. There is enough space to add another MW to each data hall, hence there is space to ramp up to 72MW if SEA Ltd requires it in the future.

Using this as the module, I presume that future AI data centres will have modular size of 48MW in each project and will do a rough estimate of the potential earnings that new AI data centres may generate for YTL Power in the following section.

For a phase of 48MW AI data centre, I estimate that up to 27,000 Blackwell GB200 GPUs will be required (assuming 1,200W of power consumption per Blackwell GPU, and assuming 32.4MW as IT load, the rest 15.6MW for cooling and others). Based on the reported market price of US$30,000 to US$40,000 per Blackwell GPU, total capex will be US$810 million to US$1,080 million for Nvidia GPUs alone. Assuming capex of RM800 million for other infrastructure, I will put the total capex to RM4.6 billion to RM5.8 billion, or median RM5.2 billion.

Assuming a leasing rate of US$2.50/hour per GPU, annual revenue may be around US$590 million or RM2.8 billion.

Assuming the highest commercial rate of Tenaga, RM0.509/kWh, as the average electricity cost (ignoring solar power for now), I calculate that the potential electricity consumption cost will be RM0.509/kWh x 48MW x 8760h = RM214 million a year. Assuming water consumption cost to be about 20% of electricity costs, water consumption cost may be around RM43 million a year. Internet cost is assumed to be 5% of revenue, or RM140 million a year. Plus estimated AI manpower and administration costs of RM100 million a year, total operating costs may amount to RM500 million a year.

Hence EBITDA margin may be as high as 2300/2800 = 82%. The EBITDA margin appears to be high as electricity and water costs in Malaysia are relatively cheaper than other countries like Singapore. At current electricity prices of SGD280/MWh (retails & industrial customer contract prices), a 48MW AI data centre in Singapore would have electricity and water costs doubling to RM540m and EBITDA margin drop to 72%.

For IT equipment including GPUs, the depreciation period may be 3 to 10 years depending on the useful life of the chips. For other infrastructure, the depreciation period may be from 20 to 50 years. To be conservative, I assume an average depreciation period of 5 years for total capex, hence a total depreciation charge of RM1,040 million a year.

The project is assumed to have 75% gearing with average interest rate of 5.5% p.a., so interest expenses may amount to RM5,200m x 75% x 5.0% = RM215 million a year

Hence, for a 48MW AI data centre at Kulai park, the pretax profit may amount to

RM2,800m – RM500m – RM1,040m – RM215m = RM1,045 million a year

To be on the conservative side, I assume no investment tax allowance given to the project and assume a standard 25% corporate tax, hence

Net profit = RM1,045m x 75% = RM783 million

For its 60% equity stake in YTL Comms, net profit contribution to YTL Power will be:

Net profit contribution (60% stake) = RM470 million a year

Excluding some 100MW space for colocation data centres (1st phase taken up by SEA Ltd.), YTLP’s Kulai data centre park will be able to accommodate a total of 400MW AI data centre.

I will expect YTL Power to secure more customers to take up the remaining AI data centre space, and progressively build up a portfolio of 200MW (or 48MW x 4 = 192MW) in the next 3 years by 2027. That would be like additional 48MW of AI data centre to be built every year in 2026 and 2027, after the presumably 2x48MW Nvidia AI data centre is progressively completed in 2025.

Based on information posted in LinkedIn, YTL Power is already constructing DC2 for Nvidia AI data centre where concrete underground was being laid in April 2024. Adjacent to DC2, land is being cleared for DC3, which should be for one of the big clouds’ AI data centre.

When 200MW of AI data centres are taken up, total revenue from this will amount to RM11.2 billion a year and net profit contribution to YTL Power will amount to a whopping RM1.88 billion a year.

Operating cashflows will be higher at RM1.82 billion a year for a 48MW AI data centre.

Financing tenor will be short at 3 years as I assume the loans will be collateralized with the Nvidia chips as what CoreWeave did. Hence loan repayment will be heavy at RM1.3 billion a year, and this leaves free cashflows at still a hefty sum of RM520 million a year for 48MW AI data centre.

For 200MW AI data centres, free cashflows will amount to RM2.1 billion a year, and for YTLP’s 60% stakes, free cashflows to YTL Power will be RM1.25 billion a year.

Net Profit Projection for YTL Power

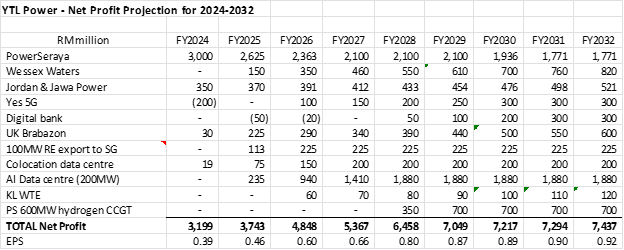

With the AI data centre business gaining tractions judging from the construction work on the ground and latest analysts’ reports, I think it is now appropriate to include potential earnings contribution from AI data centres into the net profit projections for YTL Power. I summarise below the net profit projection for the various assets of YTL Power for the next few years:

· PowerSeraya – should be able to maintain net profit of at least S$750 million or RM2.62 billion a year, given that electricity supply will get tighter from now to 2026 and PowerSeraya will be able to save interest expenses of some SG$30m a year after it pared down debts of over SGD1.0 billion in past 2 years. From mid 2026 when Sembcorb and Keppel’s new units come online progressively, I expect PowerSeraya’s net profit to drop gradually to S$600 million in FY2027 and FY2028, then dropping to S$506 million after 2030.

· Wessex Waters – projected to turn around after 1st April 2024 with net profit contribution of about RM150 million to YTL Power in FY2025, rising to RM350 million in FY2026 assuming it can get a tariff reset with a WACC of 5.0% and RM460 million in FY2027 as RCV expands to GBP5.0 billion by Mar 2026

· Jordan Power & Jawa Power – these 2 associate companies reported RM126 million PBT in Q2 FY2024, annualized to RM500 million. Net profit contribution to YTL Power will be steady at around RM350-400 million a year. Net profit contribution from Jordan Power will rise over the years as interest expenses reduces over time.

· Yes 5G – assuming breakeven by FY2025 and making net profit of RM300m a year from FY2030 when it rakes in over 4 million 5G subscribers

· Digital bank – I expect it to break even in 3 years after operation, i.e. by FY2028, thereafter a nominal RM100m net profit in FY2029 increasing every year

· UK Brabazon property project – the approved development plan of 6,500 new homes and 4 million sf of commercial areas may contribute net profit of RM225 million a year to YTL Power for next 10 years (based on assumed average selling price of GBP275k per house, total GDV of GDV1.8 billion over 10 years, 25%-30% gross margin and GBP50m gross profit a year at 25% tax rate), increasing over time to as high as RM600 million as the commercial areas are fully developed and leased out (assuming all 4 million sf of commercial space to be leased out at GBP25-30 psf per month to generate gross rental income of GBP100-120m/year, deduct 25% of miscellaneous charges and 25% tax).

· Export of electricity to Singapore – the trial 100MW of renewable energy export to Singapore has started since Jan 2024, right now YTL Power has a temporary arrangement with Tenaga Nasional to generate and export the RE to PowerSeraya in Singapore. When YTL Power installs sufficient solar power in Peninsular Malaysia, potential earnings contribution from this 100MW RE export will be about RM360 million a year (gross profit) based on average USEP of SGD158/MWh in Jan-Mar 2024. Oil prices have jumped up lately and so has USEP to around SGD180/MWh in April 2024, so it is safe to estimate for an average selling price of SGD170-175/MWh and gross profit of RM390 million a year. Assuming total capex of RM1.8 billion (for 500MWp of solar power plus battery storage installation), depreciation charge may come to RM90m a year and hence PBT may come to RM300m a year. Deduct 25% corporate tax, net profit contribution to YTL Power may be about RM225 million a year. I assume that the export of 100MW RE to Singapore will continue after the 2-year trial as Singapore aims for up to 4,000MW of RE import by 2035. There is room for more RE export by YTL Power to Singapore when the intertie between Malaysia and Singapore is expanded from the current 400MW capacity. On 15 April 2024, Malaysia government announced the set-up of a renewable energy exchange platform (“ENEGEM”) for cross-border electricity sales from Malaysia to its neighbouring countries, namely Singapore and Thailand. The first phase of ENEGEM offers capacity up to 300MW using the existing interconnection between Malaysia and Singapore.

· Colocation data centre – the 1st phase of 36MW with SEA Ltd is expected to contribute PBT of RM100m a year to YTL Power. When a total of 100MW colocation data centre is developed and leased out, total profit contribution to YTL Power may reach RM277m pretax and RM200 million net a year.

· AI data centre – the 1st phase of 48MW with Nvidia is projected to contribute net profit of RM470 million a year to YTL Power, then plus 2nd phase of another 48MW it will add up to RM940 million net profit a year. When a total of 200MW AI data centre is developed and leased out gradually by 2027, total net profit contribution to YTL Power may top RM1.88 billion a year.

· PowerSeraya new 600MW hydrogen-ready CCGT to be operational from early 2028 – gross generation margin may come to 600MW x 8760h x 70% x SGD70/MWh = SGD257 million a year once fully operational, assuming an average generation margin of SGD70/MWh (now retails contract margin is as high as SGD80/MWh, also this new CCGT will be the most efficient in the fleet). Assuming additional opex of SGD17m a year for the new CCGT, PBT may come to SGD240m and net profit contribution to YTL Power may top SGD200 million or RM700 million a year from 2028.

· KL WTE project – assuming total capex of RM4.5 billion, 80% gearing at 5.5% interest rate and a low teen IRR, I estimate that net profit contribution to YTL Power (for its 70% stakes in the project) may come to RM60 million in the initial year, rising to RM250 million a year as the project loan gets repaid.

The profit projection for the various assets to YTL Power over the next few years is best summarized in the table below:

YTL & YTL Power Share Price May still Double up by 2028

YTL and YTL Power have been the best performing stocks on Bursa in past 12 months. As

discussed in the sections above, the various assets of YTL Power will start contributing

significant earnings growth in next few years, driven mainly by a turnaround in Wessex,

more meaningful earnings contribution from the UK Brabazon property development

project and more prominently by AI data centre development in Malaysia.

Despite the stellar share price run up in past 12 months, YTL Power remains as one of the

cheapest blue chips in Bursa, trading at just 13.8x FY2024 and 11.2x FY2025 earnings. YTL

Power net profit is expected to more than double up by FY2028. Applying a similar PER

range of 11.2x to 13.8x on FY2028 EPS of RM0.80, I expect YTL Power share to trade to

RM8.96 - RM11.00 by 2028. As its net profit will be above RM6.0 billion by 2028 (in the same range as Tenaga Nasional), so I think it is fair for YTL Power to trade up to a PER of 15x (still lower than 17x-20x PER for Tenaga). Hence, I believe there is a chance for YTL Power to trade up to RM12.00 by 2028 and RM13.35 by 2030.

YTL owns 55% stakes in YTL Power. If YTL Power share price goes up from currently RM5.39

to RM12.00 by 2028 or RM13.35 by 2030, it will add a value of (12.00/13.35 – 5.39) x 8,150 x

55% = RM29.5 – 35.7 billion or up to RM3.25 per share to YTL. Added with increased earnings

from its construction, cement and hotels divisions, YTL earnings may also double up from

current levels by FY2028. Hence, I would expect YTL share price to also double up from

current RM3.80 by FY2028.

YTL Corp Business Life Cycle through Diversification

Investors buy into the shares of a company on the expectation that the company will create value, leading to higher share prices and returns for shareholders (from share price appreciation as well as dividends). Typically shareholders’ wealth increases when the company grows its profits (through higher revenue/sales, cost savings, increased efficiency or diversification) and/or valuations are rising (when investors become more confident in the stock because of proven management, good governance and improved earnings prospects / resilience).

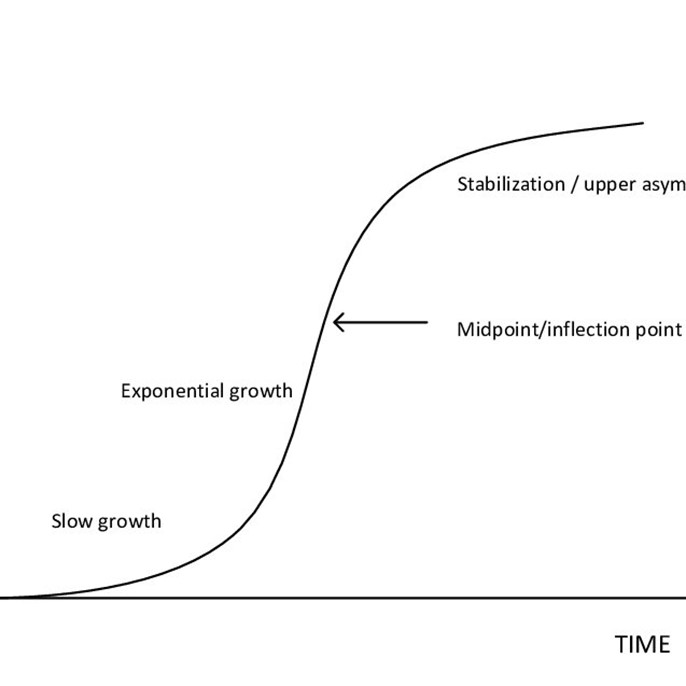

All businesses go through the S-curve life cycle, from infancy (low growth) to expansion (rapid growth) to maturity (low growth) (see chart below).

Obviously, some S-curves will be steeper than others, that is, their products or services have stronger rates of growth; for instance, owing to a major innovation that drives rapid adoption and demand across multiple market segments, or possessing certain competitive edge in a market segment that sees rapid expansion and/or demand outstripping supply . And some S-curves will have greater longevity, that is sustained high growth (expansion phase) for a longer period of time because of intellectual property protection, for example, or in other words enduring competitive advantage. Companies that have a steeper S-curve with longevity will also trade at higher valuations (share prices).

Inevitably, no matter how successful the product or service is, growth must slow at some point (the maturity phase). This could be due to a number of reasons, such as increased competition, market saturation, technology disruption, regulatory changes and changing consumer preferences.

Ultimately, whether a company remains creative or destructive depends on how well management understands this inevitability, its mindset and how successful it is in creating new S-curves – developing new engines of growth – ideally before the current cycle of growth enters maturity. New S-curves could include tapping into new selling channels and geographies for the existing product, or it could be expansion into a related business – for example, starting a new product line, or diversification into something entirely different.

In short, the S-curve is dynamic over the company’s life, that is, the company should continuously reinvent, reinvest and create new S-curves to start new growth cycles. I shall use YTL Group as a real-life example of how this is done effectively.

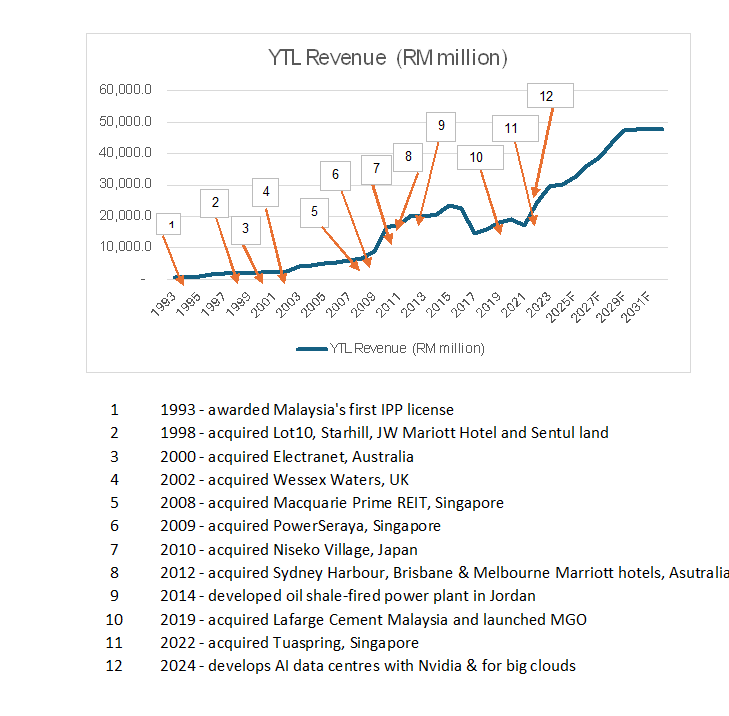

YTL Group, or its flagship company YTL Corp, generates new cycles of growth via diversification into different businesses and sectors. The company started in 1955 as a construction company, initially for defense and security installation, then property development and infrastructure. Its first major S-curve jump came in 1993, when it was awarded Malaysia’s first independent power producer license.

The power plant generated significant cash flows every year for 21 years, helping YTL build a huge war chest of cash, which it subsequently invested into different businesses, and notably acquiring quality assets at bargain prices during periods of economic downturn. The classic case was its acquisition of Lot 10, Starhill, JW Marriott Hotel and the Sentul landbank at the height of the Asian Financial Crisis in 1998.

After the end of AFC, YTL was the first company from Malaysia to acquire a major asset overseas immediately after the capital control was lifted. In 2000, YTL acquired a 22.5% stake in Electranet, an electricity transmission company that has a 200-year concession in South Australia. After learning how regulated asset model works, YTL then in 2002 made a bigger acquisition of 100 stakes in a water and sewerage operator, Wessex Waters in the UK.

Another new S-curve was created in 2009 when YTL acquired 100% stakes in PowerSeraya, the second largest power generation company in Singapore. YTL subsequently acquired Tuaspring in 2022 at a discount to a new build cost of a CCGT plant. Tuaspring owned a 400MW state-of-the-art CCGT power plant in Singapore but it was facing financial crisis.

Few years later in 2014, YTL successfully venture into Jordan to develop an oil shale-fired power plant in joint venture with Estonia national utility company Enefit. The Jordan power plant was fully commissioned and operational since 2022.

On the property segment, YTL acquired a 26% equity stake in Macquarie Prime REIT listed in Singapore at 49% discount to the net asset value. MP REIT owns two landmark properties on Orchard Road, Singapore’s premier shopping and tourist precinct. Its initial portfolio included a 74.23% strata title interest in Wisma Atria and a 27.23% strata title interest in Ngee Ann City.

In 2010, YTL acquired Niseko Village, that owns Niseko Village Resort, which sits on 617 hectares of land comprising 462ha of freehold land which sites the 506-room Hilton Niseko Village, 200-room Green Leaf Hotel and two 18-hole golf courses, and 155ha of leased ski mountain land on which seven ski lifts and 15 ski trails are situated, at the base of Mt. Niseko An’nupuri. YTL Hotels has since developed another 3 new hotels / resorts at Niseko Village over the past few years.

In 2012, YTL through Starhill REIT acquired the Sydney Harbour Marriott Hotel, Brisbane Marriott Hotel and Melbourne Marriott Hotel in Australia for a total purchase price of AUD415 million. The three Australia Marriott Hotels now contribute a substantial portion of earnings to Starhill REIT.

On the domestic front, YTL strengthened its cement market share by acquiring a 51% stake in Lafarge Malaysia in May 2019 and subsequently launched a mandatory general offer (MGO) to buy out the remaining shares in Lafarge Malaysia from the minority shareholders. That deal has elevated YTL Cement to the largest cement producer in Malaysia.

The next big S-curve to be created by YTL will be the AI data centre business it is currently developing at its Kulai green data centre park. When 200MW of AI data centre is developed over the next few years, YTL will see its revenue jump up by over RM11 billion a year and net profit jump up by RM1.9 billion a year.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-27

YTLPOWR2024-07-26

YTL2024-07-25

YTL2024-07-25

YTL2024-07-25

YTL2024-07-24

YTL2024-07-24

YTL2024-07-24

YTL2024-07-24

YTL2024-07-24

YTL2024-07-24

YTL2024-07-24

YTLPOWR2024-07-19

YTLPOWR2024-07-18

YTL2024-07-18

YTLPOWR2024-07-18

YTLPOWR2024-07-18

YTLPOWR2024-07-17

YTLPOWRMore articles on Dragon Leong blog

Discussions

@probability, I would expect the AI infrastructure (AI data centre) to be ready first before the big cloud like AWS could use it to provide cloud computing services. But it will be more or less the same timing, as I would expect big cloud like AWS will be able to secure customers months before the AI data centre is ready

2 months ago

nice write-up an insightful..... from my perspective SEA Ltd and its Shopee will play a big role in the AI DC build-up alongside the digital banking license that the partnership was also accorded.... not sure how the digital banking plays alongside the DC but Sea Ltd is YTL's first customer for the DC .... whatever the terms are, i can only see upside hereon while having powerseraya as "fixed deposit"... lets hope for the best :-) peace

2 months ago

Yes raymondroy, PowerSeraya still delivers solid earnings like a fixed deposit.

Unfortunately the market is full of short term traders and short-sighted investors who are taking the weak Q3 result to take profit and punish the stock.

The long term prospects are very good, the current share price weakness is a good opportunity to accumulate for long term investment.

2 months ago

YTLP and YTL are real.. the promise of GOD.!!!!!!

whispering words of wisdom!!!

haha

2 months ago

Otb cant be seen at ytlp forum today.

Isnt that a good enough sign of whats coming? With all due respects Dragon328,your timing skills cant compete with Otb.

2 months ago

Inside a Google Data Center

See

https://www.youtube.com/watch?v=XZmGGAbHqa0

See carefuly

At the Very "Center" of Data Center are HARD DISK DRIVES (HDD) Rows and Rows and Rows of HDD!!

JCY

NOTION

DUFU

BEST POTENTIAL TO UP 300% TO 500%

NOW

2 months ago

Dan Zanger, a renowned trader known for his record-breaking returns, emphasizes the importance of caution after a prolonged bull run, even for the best-performing stocks. According to Zanger, when a stock or the overall market has experienced a significant and extended upward trend, the risk of a massive sell-off increases. This is because:

1. **Profit-Taking:** Investors who have seen substantial gains may decide to lock in profits, leading to increased selling pressure.

2. **Overvaluation:** Prolonged bull runs can push stock prices beyond their fundamental value, making them susceptible to sharp corrections when market sentiment changes.

3. **Market Sentiment:** After an extended period of optimism, any negative news or economic indicators can trigger fear and prompt a rapid shift to bearish sentiment.

4. **Technical Indicators:** Indicators such as overbought conditions, divergence between price and momentum indicators, and other technical signs often signal that a correction is imminent.

5. **Institutional Selling:** Large institutional investors may also start selling to rebalance their portfolios, which can exacerbate the downward pressure on stock prices.

Zanger advises traders and investors to be vigilant during these times, employing strategies such as tighter stop-loss orders, reducing exposure to high-risk positions, and being prepared to act quickly to preserve capital.

2 months ago

seagate

SHARE PRICE UPTRENDING\

https://www.google.com/search?q=SEAGATE+PRICE+CHART&oq=SEAGATE+PRICE+CHART&gs_lcrp=EgZjaHJvbWUyBggAEEUYOTIICAEQABgWGB4yCAgCEAAYFhgeMg0IAxAAGIYDGIAEGIoFMgoIBBAAGIAEGKIEMgoIBRAAGIAEGKIEMgoIBhAAGIAEGKIEMgoIBxAAGIAEGKIEMgoICBAAGIAEGKIE0gEJMTA3NDhqMGo0qAIAsAIB&sourceid=chrome&ie=UTF-8

2 months ago

@dragon328, two years ago you made the bold call that YTL Power would be 10 bagger. This is the best call I’ve ever come across! Thank you,

Since then, data center, which was only a small part of the valuation then, has become prominent. Not to mention the subsequent development in AI Data Center.

However, it’s very challenging to put a value on the DC business. I have a few questions and hope to get your input.

First, let’s start with Hong Leong’s latest report. It has two parts:

1. YTL DC – valued at RM8.4b by assuming 200MW, and valuation extrapolated from Keppel DC REIT 300MW (its latest market cap is SG$ 3.136b or RM11b)

2. AI DC through the 60% owned YTL Communication – valued at RM12.9b based on 25x FY26 P/E

On (1), MIDF also wrote that “Rollout is expected to be gradual with the first 8MW having been commissioned early-May with further additions of 8MW per annum thereafter.”

I understand SEA has committed on 32MW. It will take delivery in stages. It just feels that it will take a few years to fully deploy the capacity.

So the valuation approach by Hong Leong analyst is a bit troubling. In (1), he applied the valuation of Keppel DC REIT (which is already up and running) on YTL DC (which will not be fully deployed at least for a few years).

I’m not sure how he worked out (2). The total value is RM12.9b/0.6 = RM21.5b. Minus the telco business which is about RM1b, he put a value of RM20b on the future AI DC without mentioning the basis.

2 months ago

Hong Leong analyst used MW as the basis for valuation (at 8,400/200 = RM42m per MW). I wonder, for colocation DC (i.e. 1), will lettable floor space be a better metric?

Keppel DC REIT 2023 Annual Report mentions that it has 3.066 million sf of lettable floor space. FY23 core PBT (I ignored FV changes of investment properties) is SG$166m. So it works out that PBT is SG$54 psf (or RM189 psf)

Actually, Keppel DC REIT is not entirely on co-location business. The fully-fitted segment provides better margin. Therefore, the PBT for co-location service is actually even lower than SG$54 psf

According to YTL Power company website, YTL Johor Data Center 1 is up to 72 MW with 535,000 sf.

Applying Keppel DC REIT valuation (which is already at the higher end), the PBT is 535,000 * RM189 = RM101m

Even if extend to 200MW though future development, the projected PBT is only RM101m * 200/72 = RM281m

Assume 15% tax (there will be some tax incentives), net profit for 200MW is RM239m

Even at 20X PE, valuation is “only” RM238m * 20 = RM4.8b, about half of Hong Leong’s RM8.4b

Not to mention my approach also suffers from the fallacy of putting a 20X PE on earning streams which will take at least a few more years to develop.

2 months ago

DCF is a better valuation approach, but there is insufficient details to use that method.

But I see some similarities with property development business, where analysts will estimate the contribution of individual projects. I also observe that typically the projected contribution is around 5% to 15% of the GDV.

Can the same concept be applied here, where the DC business valuation is somewhere between 5% to 15% of the project cost?

2 months ago

I just read the Hong Leong report on 23 Aug 2023. It mentioned “Data centre of 48MW (32MW undertaken by SEA Limited) is guided to provide RM100m PBT when fully commissioned (in stages over 4 years)”

The RM100m PBT is very close to my estimate above of RM101m based on floor space by referencing Keppel DC REIT. The difference is company website mentions 72MW and analysts talk of Phase 1 being 48MW.

2 months ago

@klee, let's put this straight, I am not competing with anyone here in promoting this stock. Mr. OTB has my respect and he just happened to be promoting the same stock.

My intention of releasing this article was to give a full picture of the earnings potential of YTL Power in the long run, and hopefully those who were still holding the stock would not sell off just because of one weak quarterly result. But apparently the market was full of short term traders and investors with very short span of investment horizon.

I am not sure what Mr. OTB has done but it would not bother me, as he has his own followers to guide and answer to. My intention has always to discover undervalued gems and promote long term investment for 2 years to 10 years or beyond.

2 months ago

@observatory, thank you for your comments above, it helps to prompt for more studies into the valuation of data centre businesses of YTL Power.

Firstly, I will try to answer some of your questions on Hong Leong report.

On YTL DC valuation, Hong Leong used the valuation of the consensus target price for Keppel DC REIT to apply to a total of assumed 200MW of co-location data centres for YTL Power. I think it is quite fair as Keppel DC REIT is the only listed entity of regional co-location data centres, which are similar to what YTLP is developing in Kulai with SEA Ltd being the first customer.

Yes it may not be a like-to-like comparison as you said, but we also do not know how much of the ~300MW data centres of Keppel is in operation, how much has how many years of lease left and how much EBITDA margin for each. While YTL DC1 only has 1st phase of 8MW in operation for SEA, but the timeline for subsequent phases of 8MW in 2025-2026 are pretty much fixed. I cannot be sure of the total committed capacity by SEA, some reports say 36MW while others say 48MW. YTL DC1 can actually be expanded to 72MW by putting additional 1MW in each of the 24 halls in DC1, so I would expect SEA to gradually commit more after the 36-48MW.

I agree with you that it is not a good comparison with Keppel DC REIT but that is the only reference right now.

That's the reason I chose to estimate the potential earnings from the co-location data centres and assume gradual commissioning of the data centres up to 100MW in modules of 36MW each year by 2027.

For 36MW of co-location data centre, I assume capex of RM1.5 billion, 80% gearing, project cashflows of 15 years, project IRR of 15%, I get first year PBT of RM119 million rising to RM250m in year 15 as project loan gets paid off.

That's how I got the net profit projection of RM19m from co-location data centres in FY24 rising to RM200m in FY2027 as YTLP secures enough customers for a total 100MW co-location data centres. I feel this better reflects the earnings potential and valuation of co-location data centres for YTLP, which should add valuation to YTLP every year to 2027, rather than based on a lump sum at current year.

2 months ago

As to valuation method using the lettable floor space, I am not too sure if it is appropriate, as each data centre building design is different. For example, YTL DC1 is designed such that each of the 24 halls has space to accommodate 1MW more of data centre equipment if needed. That would immediately add 50% IT load to the floor space (from 2MW each hall to 3MW each hall).

Data centre buildings are not like commercial office space where we typically value it per square foot basis.

2 months ago

DCF valuation is a good method to value the AI data centre business but one needs to have sufficient data for a DCF valuation. The AI data centre is a relatively new business, and hence analysts struggle to come out with a proper valuation using traditional method like DCF or PER.

Hong Leong used a PER of 25x on projected FY26 earnings of AI data centres.

CLSA used 3x multiples of sales, or implied PER of 29x with reference to CoreWeave valuation.

Macquarie used DCF valuation for YTLP's AI data centre, by making many assumptions, including 100MW AI data centre in 2026, another 100MW in 2029 and another 100MW in 2032, US$3.42/Hour/GPU of leasing rate etc. The DCF valuation comes to RM50.5 billion for this total 300MW AI data centres, and RM30.3 billion for YTLP's 60% stakes. Again some would argue too high, but it all depends on assumptions made.

After studying the valuation and revenue calculations made by CLSA, Ambank and Macquarie, I decided to make my own calculations of potential revenue and earnings to be contributed by AI data centres to YTLP. You may challenge my calculations and assumptions made, but those are my assumptions based on indications from the company as well as from various analysts.

2 months ago

You can see my assumptions are more conservative than some of the analysts, eg. I assume a leasing rate of US$2.50/hour per GPU compared to US$3.42/hr per GPU assumed by Macquarie and US$3.00/hr per GPU assumed by CLSA.

I have assumed a total of 200MW of AI data centres to be commissioned by mid 2027, while Macquarie has assumed a total of 300MW while CLSA has assumed a total of 150MW AI data centres.

2 months ago

I just received RHB latest report on YTL Power where RHB raised target price from RM4.69 to RM6.68.

In valuation AI data centre, RHB analyst assumed 15x EV/EBITDA, total 60MW of AI data centre only, 14% project IRR, 60% stake and USD3 billion capex to come out with a valuation of RM18.5 billion.

Had he assumed a total of 200MW, the valuation would balloon to RM61.7 billion !

2 months ago

Dear Klee,

I was sick for a few days, hence I did not post anything in I3.

dragon328 is the best analyst in YTLPower, I always consult him when I have any doubt on YTLPower.

dragon328 is the person that I respected a lot, he is always better than me.

Thank you.

2 months ago

Dear dragon328, do u think profit from powerseraya on coming Q42024 will match back Q42023? Or even break new high? What is your forecast? Thanks for your sharing.

2 months ago

@dragon328, thank you for the very useful explanation. It saves me lots of efforts and possibly dead ends in my research.

Your assumed capex of RM1.5b for 36MW co-location data center (or US$9m per MW) is in line with what I read. The cost for building a green field data center in US is in the range of US$7m to $12m.

I also checked out the RHB report you mentioned which says “we impute a higher AI- DC valuation assuming 15x EV/EBITDA (from 12x previously; still below global peers’ average of 18x) with a 60% ramp up (from 20% ) in 100MW DC, USD3bn capex, and 14% IRR”

The AI-DC capex is US$3,000m/100MW = US$30m per MW.

As I understand (correct me if I’m wrong), the AI DC requires much higher capex because YES Communications will own the servers and sells the service

Next, I tried to do some sanity check. Nvidia list price for H100 is about US$30k. A back of the envelope shows:

Power consumption of H100 is 700W.

Number of GPU per MW = 1,000,000/700 = 1,429

At USD30k per GPU, the GPU cost alone per MW is US$43m

The GPU cost alone is much higher than RHB’s US$30m per MW assumption. But I suppose YTL Power can get a good deal from Nvidia. Besides prices drop over time. Right?

Can you share a bit more details on your DC and AI-DC valuation, like the CoE, CoD, WACC? Given computing equipment become obsolete fast, what are the replacement capex assumptions? Would you consider sharing your spreadsheet in your next blog? That will be really wonderful.

2 months ago

Hi dragon328, interesting read on YTL & YTLPower

For the AI DC (48MW; 75% debt) assumption, what is the equity IRR ?

2 months ago

@Edison Cheah, I expect PowerSeraya earnings for Q4 FY2024 to be similar to the RM700m achieved in Q3 FY2024. I expect the same level of quarterly profit to continue into 2026 then drop to S$600 million in FY2027 & FY2028 or quarterly net profit of S$150m or RM525m.

2 months ago

@observatory, I had also struggled for a while on the capex figure until I read CLSA report on YTL Power. Apparently, not all the power requirement for AI data centre is for powering the GPUs, CLSA report said about 67% was for GPUs and the rest for cooling & others. In my calculations, I have assumed 67.5% of power for GPUs.

In your example above, for a 100MW AI data centre, the required number of H100 GPUs may be 100,000x67%/0.700 = 95,714

Assuming US$30k per H100 GPU, the required capex would be 95,714 x US$30k = US$2.9 billion close to the figure of RHB's US$3.0b.

2 months ago

@emsvsi, the equity IRR would be very high as typically AI data centre developers look to get back all returns within 3 years, as the product life of GPUs is short.

I didn't calculate the IRR but you may refer to CLSA or Macquarie reports for reference

2 months ago

@observatory, I do not have a spreadsheet for AI data centre project, as I only aimed to calculate the potential net profit contribution to YTL Power.

I assumed a product cycle of 3 years, after which YTLP would re-invest in the newest technology chips and lease out for another 3 years. This is similar to what Macquarie analyst has assumed.

2 months ago

probability

thanks dragon328, wonder would the cloud providers like VSTECS (with link to AWS) benefit from the AI demand first before the AI DC providers like YTLP....

2 months ago