IOIPG - The Dawn of Explosive Earnings Growth

dragon328

Publish date: Thu, 29 Aug 2024, 04:11 PM

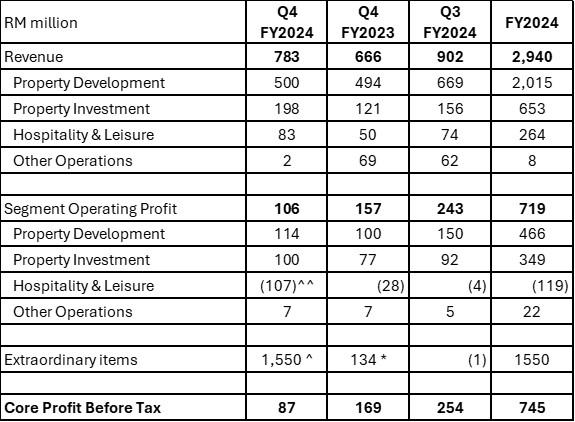

4Q FY2024 Results

IOIPG announced a good set of results for Q4 FY2024 with core pretax profit (PBT) of RM87.3 million and headline net profit of RM1.545 billion. A breakdown of the segmental profits is tabulated below:

*Extraordinary items in Q4 FY2023 include RM246m of investment property revaluation gain, RM19m of inventories write-down and RM93m of impairment loss on an investment property

^Extraordinary items in Q4 FY2024 include RM1.31 billion of revaluation gain at IOICB, RM645.5m of revaluation gains in Malaysia investment properties, offset by RM110.65m of PPE impairment and RM227.77m of inventories write-down at PRC operations.

^^The higher loss in the Hospitality segment in Q4 FY2024 is due to higher depreciation and write-off of hotel assets totalling RM96.7 million

The property development segment registered 1% increase in revenue y-on-y and 29% increase in pretax profit in Q4 FY2024. The better performance is primarily attributed to higher sales in Malaysian property operations resulting from clearance of unsold stocks.

The property investment segment registered 64% increase in revenue and 96% increase in pretax profit in Q4 FY2024. The improved performance is primarily bolstered by the successful leasing progress of IOI City Mall Phase 2. It was also boosted by the maiden contribution from IOI Central Boulevard (IOICB) Singapore which was 50% tenanted from April 2024.

The hospitality & leisure segment also registered a strong 68% increase in revenue in Q4 FY2024, primarily due to the first quarter of full contribution from the recently acquired W Hotel Kuala Lumpur and the opening of Moxy Hotel in February 2024. The higher pretax loss is mainly due to higher depreciation and write-off of some hotel assets totalling RM96.7 million. Excluding the write-off of hotel assets, the core pretax loss would have been around RM10 million only.

IOI Central Boulevard

IOICB received its first phase Temporary Occupancy Permit (TOP) in April 2024 and second TOP in early July 2024. The third phase of TOP is expected to be received in September 2024. As of 30 June 2024, IOICB is about 50% tenanted.

Based on the first quarter of contribution in Q4 FY2024, IOICB contributed RM40 of revenue and RM20 million of segmental profit. This is roughly in line with my earlier calculations:

Gross rental income (50%) = 1.29m sf x 50% x SGD13.00 psf x 2 months = SGD16 million

Deduct overhead of SGD30m/year or SGD7.5m/qtr, PBIT = SGD8.5 million per quarter

Interest cost during the quarter was still capitalized as IOICB has yet to receive the final TOP. After receiving the final TOP in September, IOICB will start expense off the interest costs in the P&L.

HLIB report on 9th August 2024 cited that IOICB has about SGD3.0 billion of debts, mostly at floating rates around 4.8%. Singapore lending rates tend to follow the movements of US fund rates. As US Fed is widely expected to lower its fund rates by 25-50 bps in its September meeting and by 1.0% by end of 2024, I expect the average interest rate of IOICB to be lower at 4.3% in Q2 FY2025 (Oct-Dec 2024), 3.8% in Q3 FY2025 (Jan-Mar 2025) and 3.55% in Q4 FY2025 (Apr-Jun 2025). I have assumed a total of 4 times 25bps cuts in CY2025, 2 times 25bps cuts in CY2026 and 1 time 25bps cut in CY2027.

I expect IOICB to achieve 70% tenancy by in Q2 FY2025, 80% in Q3 FY2025 and 90% in Q4 FY2025, bringing the average tenancy in FY2025 to 72.5%. I expect IOICB to achieve 95% tenancy in FY2026, then gradually increasing to 100% in FY2031.

Hence for FY2025, the total rental income expected from IOICB shall be:

1.29m sf x 72.5% x SGD13.00 psf x 12mths = SGD146 million

Deduct overhead of SGD30m and interest expense of SGD3.0b x 3.88% x 3 quarters (from Oct 24 to Jun 25) = SGD87m, PBIT from IOICB in FY25 = SGD29 million or RM98m.

The pretax profit contribution from IOICB will progressively increase to almost RM400 million by 2030 as interest rates decrease towards 1.80% and occupancy reaches 100%.

Shenton House

IOIPG on 28th August 2024 issued a Bursa statement that the board of directors have considered all aspects of the proposal for IOIPG to acquire Shenton 101 Pte Ltd for the redevelopment of Shenton House and has decided not to accept the offer to acquire Shenton 101. In particular, the Board has taken into consideration the IOIPG group gearing and the ongoing capital commitments from the recently announced acquisitions.

IOIPG though its subsidiary in Singapore, Multi Wealth has entered into management agreements with Shenton 101 to address and mitigate the potential conflict of interest situation arising from the role of the CEO in the redevelopment of Shenton House.

In light of the decision of the Board not to accept the Proposal and following the entry by the subsidiaries of IOIPG into the Management Agreements to address and mitigate the Potential COI position, the Company intends at the request of LYS and in line with good corporate governance practice and the provisions of section 218 of the Companies Act 2016 (“Act”), to convene a general meeting for shareholders in due course to consider and if thought fit, pass a resolution to consent to the conflict of interest position arising by virtue of LYS holding an interest in Shenton 101, which constitutes a business held by LYS (being a director or officer of the Company) which is or may be deemed in competition with the business of the IOIPG Group.

As such, I will remove any future contribution from Shenton House in my earnings projection for IOIPG, and all IPO proceeds from injection of IOICB into a REIT will then go towards debt repayment to save interest expenses.

Hospitality Business

With the full quarter contribution from W Hotel, the hospitality segment contributed higher income to IOIPG in Q4 FY2024.

Going forward, the hospitality segment contribution will continue to grow after the following events:

· Completion of the acquisition of Courtyard Hotel, Penang in July 2024

· Completion of the construction of Sheraton Grand Hotel in Xiamen, China by Dec 2024

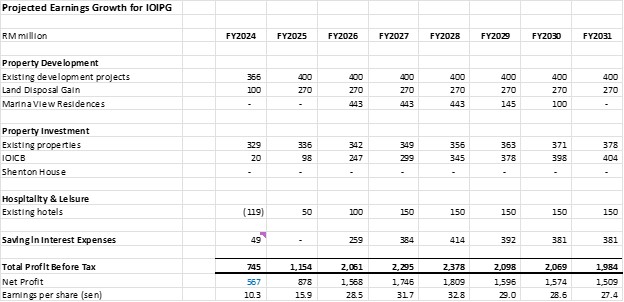

Revised Earnings Projection

I have revised the earnings projection for IOIPG for FY2024-2031 as follows. One key change is that I include the interest expense at IOICB from Q2 FY2025 and overhead costs of SGD30m a year at IOICB which will significantly reduce the net profit contribution from the RM700 million figure in the earlier projection.

As can be seen above, IOIPG net profit is expected to grow some 55% in FY2025 and another 79% in FY2026, driven by contribution from IOICB which will receive its final TOP in September 2024 and also maiden contribution from Marina View Residences in FY2026.

This is explosive growth hardly seen in big cap property companies especially with earnings of over RM1.0 billion. In fact, IOIPG will become the property company in Bursa with the highest profitability from FY2026 onwards.

Valuation of IOIPG

IOIPG is becoming the cheapest large cap property counter in Bursa with prospective PER of 12.3x in FY2025, falling to 6.9x PER in FY2026.

In comparison, other large cap property counters are trading at forward FY2024 PER of:

· Eco World - 16x PER

· Mah Sing – 17x PER

· Sime Darby Property – 22x PER

· SP Setia - 39x PER

· UEM Sunrise - 74x PER

I feel that it is unjustifiable for IOIPG to trade at such a huge discount to peers. The only concern that some analysts have is the slightly higher net gearing of IOIPG after the acquisition of Tropicana Gardens Mall and several other hotel assets from Tropicana. This concern is unfounded now as the revaluation gain of RM1.89b in Q4 FY2024 has effectively lowered the group gearing to 0.698x as of 30 June 2024. I expect the net gearing of IOIPG to drop further once we have the remaining revaluation gain of IOICB (estimated to be SGD880 million) in Q4 FY2025 and IOIPG injects IOICB into a REIT in Singapore some time in 2H 2025.

I think IOIPH should be trading at a PER of 15x minimum, or RM2.39 in FY2025 rising to RM4.27 in FY2026.

The original article was published on 28 August 2024 at dragonleong.substack.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Dragon Leong blog

Created by dragon328 | May 23, 2024

Discussions

I am not so sure about that connection to data centre business.

I see most analysts are concerned with the failed turn around of IOIPG hotel business in Q4 and inventory write-down in PRC property business. Some are concerned with the commencement of IOICB in Sept 2024 after which IOIPG will start expensing off the interest costs at IOICB in Q1 FY2025 (as opposed to earlier expectation of Q2 FY2025).

2024-08-29 17:12

Wenn Sie nach dem Anmeldeprozess für https://mywwude.de/ suchen, sind Sie vermutlich ein Student, Dozent oder Mitarbeiter der WWU Münster. Hier finden Sie alle relevanten Informationen.

2024-08-29 18:25

Wenn Sie nach dem Anmeldeprozess für https://mywwude.de/ suchen, sind Sie vermutlich ein Student, Dozent oder Mitarbeiter der WWU Münster. Hier finden Sie alle relevanten Informationen.

2024-08-29 18:25

Dawn yes

But Diesel Price rise by 52% means Cost of Construction Material going Forward will be up as high as 30%

Danger Storm Cloud Ahead

Hide in Safety Now

SOP (5126) A FANTASTIC RESULT AND A ROCK SOLID BALANCE SHEET FROM THIS PALM OIL COMPANY, Calvin Tan

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-08-29-story-h-153176392-SOP_5126_A_FANTASTIC_RESULT_AND_A_ROCK_SOLID_BALANCE_SHEET_FROM_THIS_PA

2024-08-29 19:50

sg999

Regarding the low valuation of IOIPG, If you all had observed, most of the peer had connected with DC. But IOIPG NO, that's why market never give IOIPG high valuation because it's not on market trend.

2024-08-29 16:54