YTL - A Fantastic Year with Pleasant Surprises in Q4 FY2024

dragon328

Publish date: Thu, 22 Aug 2024, 12:22 PM

Q4 FY2024 Quarterly Result

YTL posted a stellar set of results for Q4 FY2024. Net profit for Q4 came in at RM534 million, bringing the total net profit for FY2024 to RM2.1 billion or EPS of 19.5 sen.

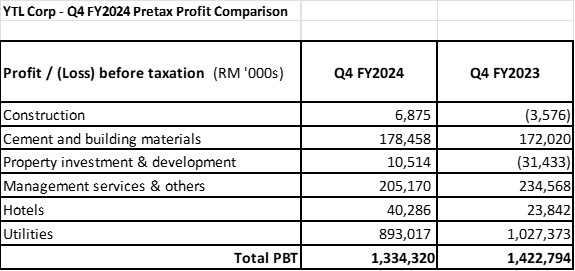

A breakdown of the segmental pretax profits is tabulated below:

Construction

The construction segment registered pretax profit of RM6.875 million in Q4 FY2024 on revenue of RM240.8 million. For FY2024, total construction profit amounted to RM21.2m million on revenue of RM787 million, or a pretax margin of 2.7%.

The pretax margin was relatively low as the construction jobs in FY2024 were mainly internal jobs. The revenue in FY2024 was low compared to RM1.2 billion in FY2023 but it achieved better margin due to variation orders in construction contracts recognized in the year.

Going forward, I expect the construction segment to take a major leap forward to become a major earnings contributor to YTL. This is because there will be a slew of major construction projects coming out in Malaysia and Singapore in next few years:

· MRT3 in KL (YTL put in the lowest bid at RM13 billion)

· KL-Singapore HSR (YTL consortium is among the 3 shortlisted consortiums)

· Singapore Changi Terminal 5 (S$10 billion)

· Integrated Resorts expansion (S$9 billion)

· Tuas Mega Port (S$20 billion)

· Singapore MRT projects (S$57 billion)

Profit margin of YTL construction segment is set to rise from 2.7% if it wins more of these external construction jobs. Besides the above external mega projects, YTL will be doing the construction work for the various internal jobs:

· YTL Power data centres (RM20 billion)

· YTL Power 500MW solar power farm in Kulai (RM2 billion)

· UK Wessex Waters capex programmes in 2025-2030 (GBP2.4-3.4 billion or about RM17 billion)

· UK Brabazon project projects (GBP1.3 billion or about RM7 billion)

Hence, it is reasonable to assume that YTL may get RM3.0-5.0 billion worth of construction jobs every year in next few years and the pretax margin to rise to 5.0% blended for external and internal jobs. That will contribute PBT of RM150-250 million or net profit of RM112 – 188 million a year to YTL every year going forward.

Cement & Building Materials

The cement & building materials segmental profits are mainly contributed by Malayan Cement, a 73%-owned subsidiary of YTL. I expect the PBT of RM178 million achieved by this segment in Q4 FY2024 to remain steady going forward due to stable bulk cement selling prices and coal prices.

Deduct corporate tax 25%, this segment shall contribute net profit of RM133 million to YTl every quarter, annualized to RM535 million a year.

Property Investment & Development

The property investment & development segment registered PBT of RM10.5 million in Q4 FY2024 and RM65.4 million in FY2024 (compared to a loss of RM78m in FY2023). The higher profit achieved in FY2024 was mainly due to profit recognition from ongoing projects and sale of land. The turnaround in this segment is a positive surprise.

Going forward, I expect this segment to provide steady earnings of about RM50 million pretax profits from ongoing projects and occasionally bumpy profits as it recognize disposal gain from land sales or injection of unlisted assets into the REITs.

YTL may inject the unlisted hotels into YTL REIT gradually over the next few years as and when it deems appropriate or when each asset matures. Potential value of assets injection from YTL alone may amount to RM700m (UK assets) + RM1.7 billion (non-UK hotels) + RM1.0 billion (other 4 resorts in Niseko Japan) = RM3.4 billion.

As an unlisted asset is injected into the REIT, YTL will recognize a one-off disposal gain. I would put a figure of RM100 million a year (based on asset injection of average RM500m a year and a disposal gain of 20%).

Hence, I would assume an average total PBT of RM150 million and net profit contribution of RM112 million a year to YTL from this segment.

Management Services & Others

This segment registers earnings from management services provided to third parties, mainly the technical services at Jordan Power, any fair value gain from investments and shareholders’ loan interest income.

The RM205 million PBT achieved by this segment in Q4 FY2024 was boosted by fair value gains from the acquisition of Ranhill Utilities. The bumpy PBT in Q4 FY2023 was boosted by some technical service fees recognized after the successful commissioning of Jordan Power oil shale-fired power plants. Striping out these one-off items, I assume the normalized PBT recognized by this segment to be about RM100 million a year and net profit contribution of RM75 million a year to YTL.

Hotels

The hotel segment registered a 69% jump in PBT from last year Q4. Total pretax profit from this segment in FY2024 amounted to RM290 million. The strong earnings from the hotel segment is another positive surprise.

Of note is that there was some RM25 million of additional profit recognized by YTL REIT, a 58.6%-owned subsidiary of YTL, in FY2024 due to the repayment schedule of rental variations of master leases. If I strip out such additional income (amounting to RM15m), I expect the hotel segment to contribute steady PBT of RM275 million and net profit contribution of RM200 million a year to YTL, adjusted by inflation going forward.

Utilities

The utility segment is mainly contribution from YTL Power, a 49%-owned subsidiary of YTL. YTL Power registered net profit of RM3.5 billion in FY2024 and its net profit is expected to rise to RM3.7 billion in FY2025 and to RM7.0 billion by FY2030 due to earnings contribution from a turned around Wessex Waters, RE exports to Singapore, data centres and PowerSeraya new 600MW hydrogen-ready CCGT.

This segment will continue to be the biggest earnings contributor to YTL in years to come.

YTL Earnings Projection

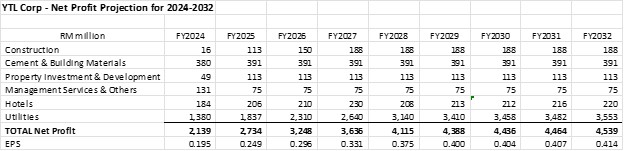

I summarise my earnings projection for YTL in FY2025-2032 in the table below:

As can be seen above, YTL net profit is expected to rise to RM2.7 billion or EPS of 25 sen in FY2025, and further to RM4.43 billion or EPS of 40 sen in FY2030.

Valuation for YTL

YTL is one of the cheapest construction / conglomerate stocks in Bursa, trading at historical PER of 16.0x falling to 12.5x PER in FY2025. In comparison, Gamuda is trading at 23x PER on FY2024 earnings, Sunway at 31x PER on FY2024 earnings.

This is unjustifiable as YTL earnings are at a higher level of above RM2.0 billion a year (vs RM900m for Gamuda and RM800m for Sunway in FY2024) and YTL has more diversified earnings base.

I believe YTL should be trading at 20x PER minimum, i.e. RM3.90 in 2024 and RM5.00 in 2025.

Original article was first published on 21 Aug 2024 at dragonleong.substack.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Dragon Leong blog

Created by dragon328 | May 23, 2024

.png)