Construction related - Rising Optimism on the Reopening of Economic Sectors

HLInvest

Publish date: Thu, 30 Apr 2020, 09:36 AM

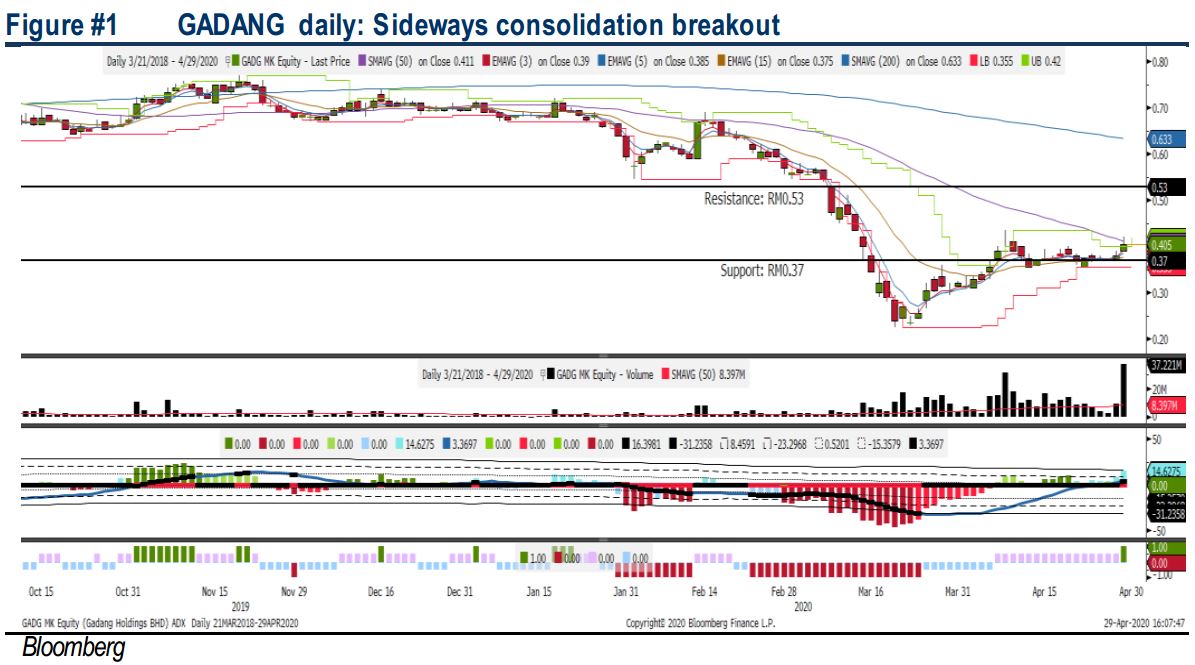

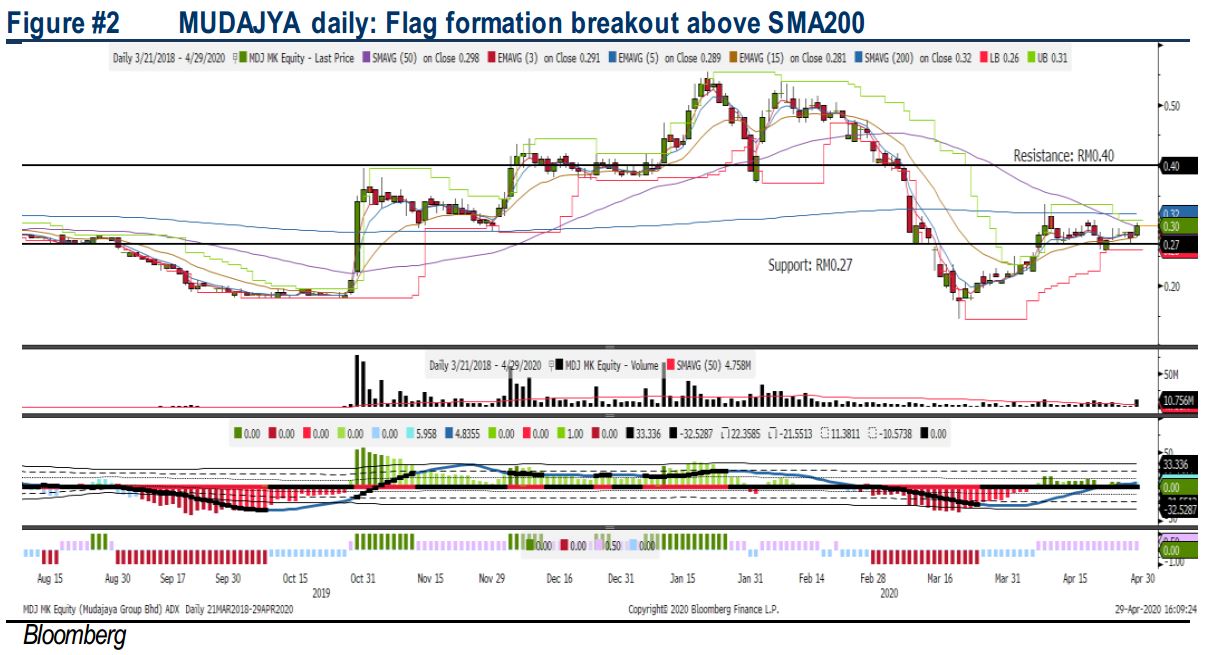

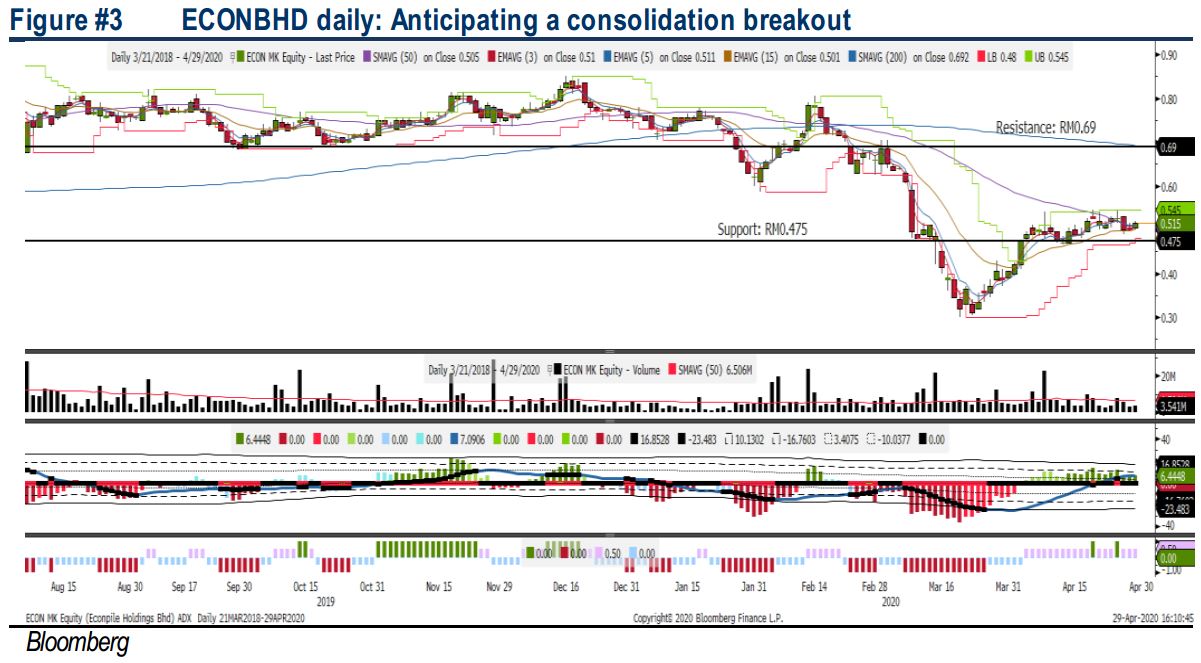

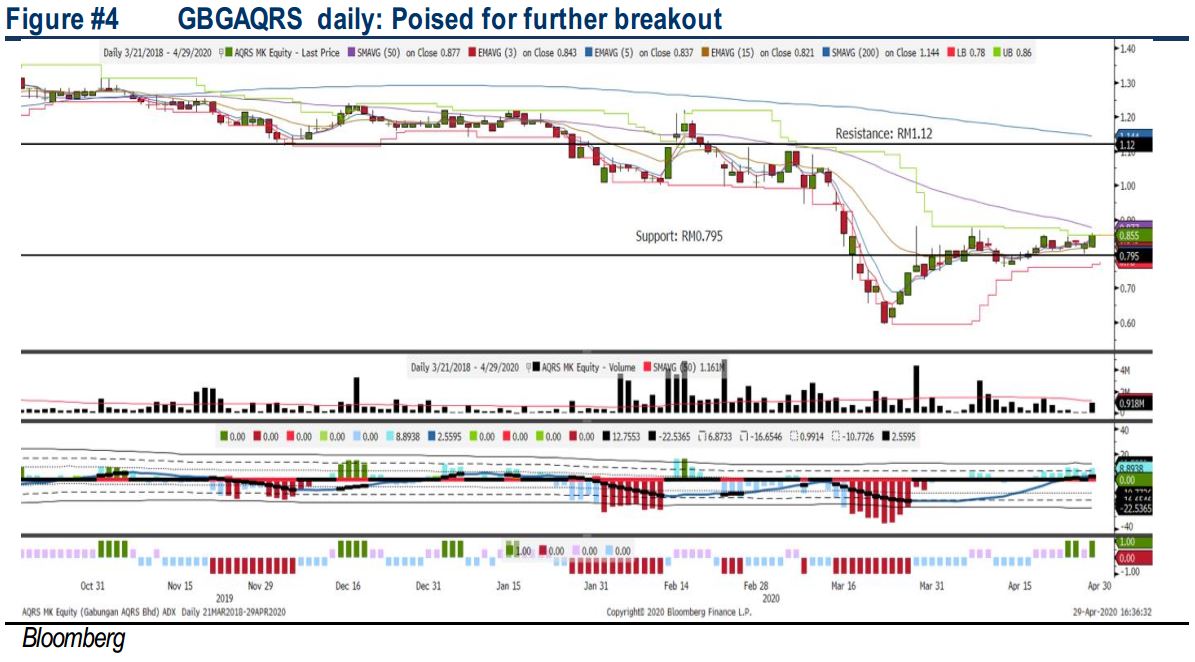

After International Trade and Industry Minister Datuk Seri Mohamed Azmin Ali commented on the reopening of economic sectors on Tuesday, construction index was the third leading sector (after technology and energy sectors), rising more than 1.5% yesterday. We believe the feel-good factor came in as construction companies are allowed to up their work forces from 50% to 100% effective in the current MCO. Some of the notable projects that are back online include LRT3, MRT2, Pan Borneo, TRX, WCE & ECRL. With that, traders are advised to lookout for breakout opportunities such as GADANG, MUDAJYA and GBGAQRS, while ECONBHD will be anticipating a breakout.

GADANG: It experienced a sideways breakout above RM0.40. Indicator has started to trend positively and we believe it may retest the resistance along RM0.44-0.46- 0.53. Support is pegged around RM0.385-0.39, with a cut loss set around RM0.37.

MUDAJYA: It has formed a small triangle formation over the past three weeks and volume was significant yesterday with a breakout above RM0.29 level. Although it is below SMA200, we expect trading interest to build up, targeting RM0.32-0.355-0.40. Support is anchored around RM0.275-0.285, with a stop loss below RM0.27.

ECONBHD: It has trended sideways over the past month ranging between the RM0.47-0.54 levels. With the positive technicals, we are anticipating a sideways consolidation breakout above RM0.53, targeting RM0.57-0.60-0.69. Support is located around RM0.48-0.49, with a cut loss set below RM0.475.

GBGAQRS: It has turned slightly positive after yesterday’s mild flag formation breakout with volumes. With the indicator turning mildly positive, we expect follow through buying support to emerge in the near term, targeting RM0.90-0.95-1.12. Support will be envisaged around RM0.81-0.82, with a cut loss set below RM0.795.

Source: Hong Leong Investment Bank Research - 30 Apr 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024