Traders Brief - Volatility Prevails as Market Await BNM’s Monetary Policy Decision Today and US-China Trade Tension

HLInvest

Publish date: Mon, 11 May 2020, 05:03 PM

MARKET REVIEW

Global: Led by heavy losses in India (5.6%), Hong Kong (4.2%) and Korea (2.7%), Asian markets were in a sea of red as investors braced for an escalation in US -China tensions, which could delay a return to normalcy from the virus-driven downturn and make any economic improvement exponentially more difficult.

The Dow slid 363 pts in the early session amid ugly US PMI manufacturing and factory orders data as well as heightened geopolitical risk tension as Trump and Pompeo sharpened rhetoric against China over Beijing’s handling of the coronavirus outbreak. However, the index staged a dramatic comeback with a 26-pt gain to end at 23750, led by big tech and energy shares.

Malaysia: Tracking sluggish regional markets and a selloff in banking stocks ahead of the BNM meeting today (consensus is expecting a 0.5% cut), KLCI tumbled 31.2 pts or 2.2% to 1376.6. Sentiment was also dampened by poor trade and PMI manufacturing data coupled with the conditional MCO (effective 4 May) was not followed by several state governments. Trading volume was 5.47bn shares worth RM2.48bn against Thursday’s 5.85bn shares worth RM3.35bn. Market breadth was bearish with 284 gainers vs 599 losers.

TECHNICAL OUTLOOK: KLCI

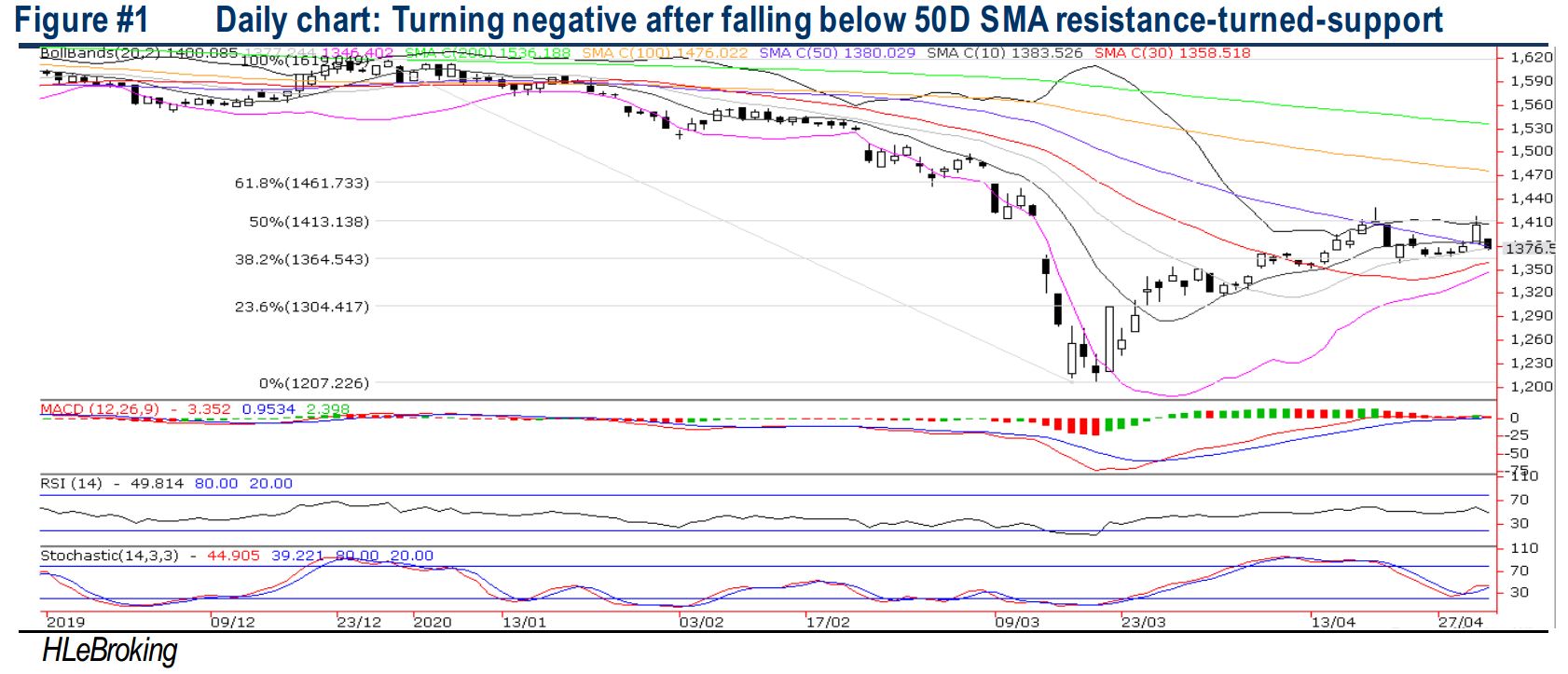

After staging a 27.5-pt rebound at 1407.8 last Thursday, KLCI plunged 31.2 pts to end at 1376.6 yesterday, closing below the 50D SMA (1380) again. MACD Indicator is hovering marginally above zero whilst the RSI and Stochastic oscillators are inching lower, indicating further sideways consolidation with key supports are 1359 (22 Apr low) and 1346 (lower BB). Conversely, only a decisive breakout above 50D SMA will lift KLCI out of current consolidation mode to retest 1400 and 1429 (20 Apr high) territory.

MARKET OUTLOOK

In this holiday-shortened week (Wesak day 7 May), KLCI is likely to remain choppy as we await the MPC decision today, the start of the May reporting season and renewed US China trade tensions coupled with the concern of new wave of infections over the premature move to ease MCO. Nevertheless, the downside risk may be cushioned (with key supports at 1346-1359) by rebound in oil prices and expectations of another 0.5% cut to revive a fast-weakening domestic economy. Technically, only a decisive breakout above 50D SMA will lift KLCI out of current consolidation mode to retest 1400 and 1429 (20 Apr high) territory.

Source: Hong Leong Investment Bank Research - 11 May 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024