Traders Brief - Brace for Choppiness Ahead of the 18 May Parliament Resitting, Results Season and US-China Trade Tension

HLInvest

Publish date: Tue, 12 May 2020, 09:11 AM

MARKET REVIEW

Global: Tracking firmer finish on Dow last Friday on optimism over lockdown restrictions being lifted across the globe, most Asian markets ended higher as sentiment improved after China's central bank signaled more policy measures to support a coronavirus-hit economy, overriding renewed concerns over the coronavirus outbreak as Wuhan reported its first cluster of infections since the lockdown was lifted a month ago. Overnight, the Dow slipped as much as 261 pts amid fear of 2nd wave of the pandemic after WHO warns that coronavirus cases have jumped in countries that eased lockdowns. However, it managed to pare off the losses to -109 pts at 24222, led by Apple, Microsoft, and Intel and news that the House Democrats said a vote on their next proposal for coronavirus relief will come no sooner than Friday.

Malaysia: KLCI rose as much as 15.3 pts in early session last Friday following a report that US and Chinese trade negotiators spoke on the phone and agreed to further cooperation. However, the gains were reduced to 5.4 pts at 1382.3 (-25.5 pts WoW) ahead of the Nuzul Al-Quran holiday on 11 May and renewed political concern following the consent of Dewan Rakyat Speaker to allow a motion for a vote of no confidence (during the Parliament resitting on 18 May) against the PM. Trading volume decreased to 4.68bn shares worth RM2.74bn against last Wednesday’s 5.89bn shares worth RM2.80bn. Market breadth remained positive with 540 gainers vs 340 losers.

TECHNICAL OUTLOOK: KLCI

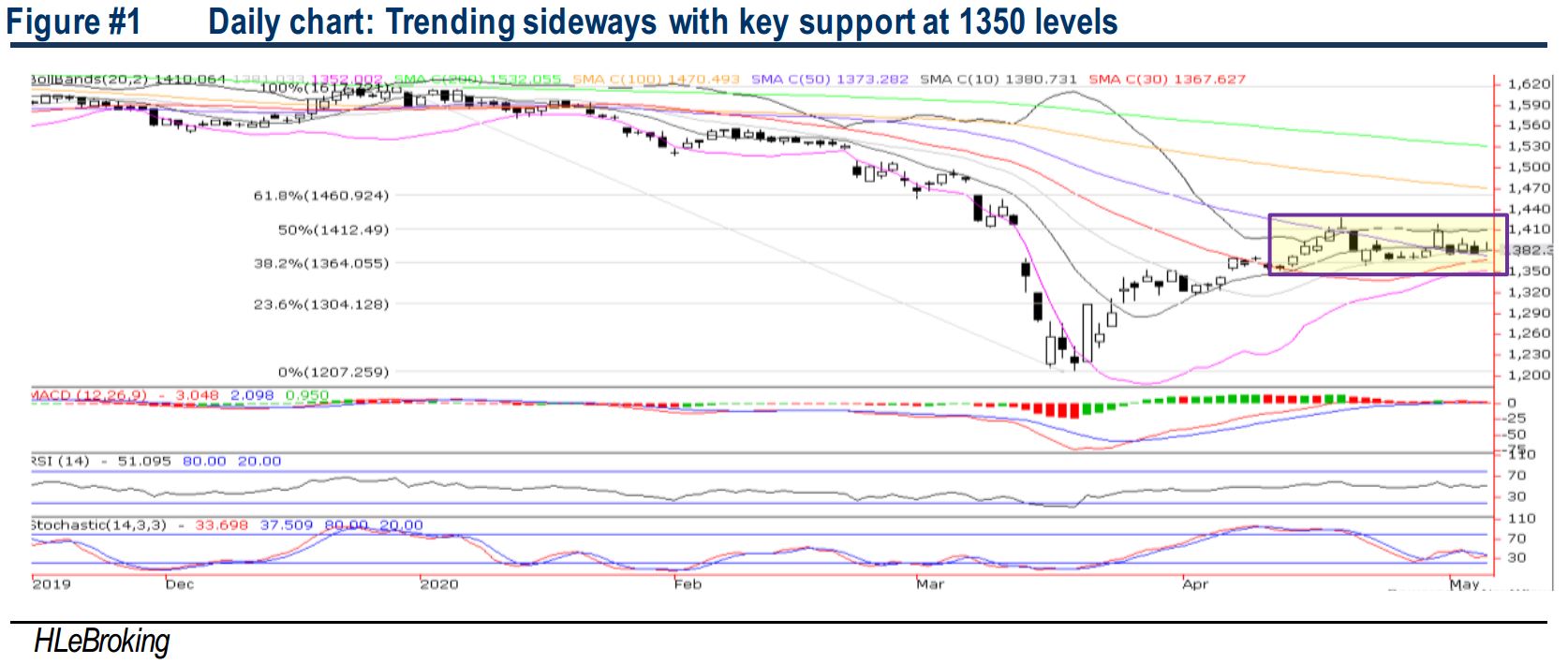

Discounting the 27.5-pt rally on 30 Apr, KLCI has been locked in sideways consolidation mode during the last 10 trading sessions. We reiterate that as long as the index stays comfortably above 20D/50D SMAs, the odds would remain in favour of the bulls to re challenge 1400, 1413 (50% FR) and 1429 (20 Apr high) zones. MACD Indicator is hovering marginally above zero whilst the RSI and Stochastic oscillators are hovering near neutral zones. In the short term, KLCI is expected to lock in range bound mode, with key supports at 1359 (22 Apr low) and 1352 (lower BB).

MARKET OUTLOOK

Following a 14.4% relief rally from its low of 1208 (19 Mar), KLCI could experience some degree of profit taking, due to the expectations of disappointments in the 1Q20 GDP (13 May), 1Q20 results season, potential no-confidence motion against the PM (on 18 May or the next Parliament sitting 13-29 July), collpasing oil prices and a resurgence in US-China trade tensions. We expect more range bound consolidation within 1352-1413 band.

Source: Hong Leong Investment Bank Research - 12 May 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024