Traders Brief - Facing stiff resistances at 1700-1730 levels

HLInvest

Publish date: Thu, 17 Dec 2020, 08:49 AM

MARKET REVIEW

Global. Asia markets ended higher, boosted by the progressive rollouts of Covid-19 vaccinations and US stimulus deal optimism coupled with expectations that the Fed will keep its interest rate near zero until it sees 'substantial progress' in the US economy. Overnight, the Dow fell as much as 119 pts to 30080 on sluggish retail sales report and record high coronavirus deaths and hospitalisations. However, the Dow ended only 45 pts lower at 30154 after the Fed’s commitment to keep rates near-zero through 2023 and growing expectations for a stimulus deal by end Dec to support the ailing US economy.

Malaysia. KLCI surged as much as 21.9 pts to 1695.9, underpinned by a bullish close on Dow overnight, ongoing window-dressing activities and the approval of Budget 2021. However, strong profit-taking interests and concern of a possible uplifting of the temporary RSS suspension (expired on 31 Dec) restricted the gains to 7.4 pts at 1681.4. Market breadth turned positive for a 2nd day with gainers/losers ratio improved to 1.83 from 1.26 yesterday, supported by higher volume traded at 11.2bn shares worth RM5.2bn.

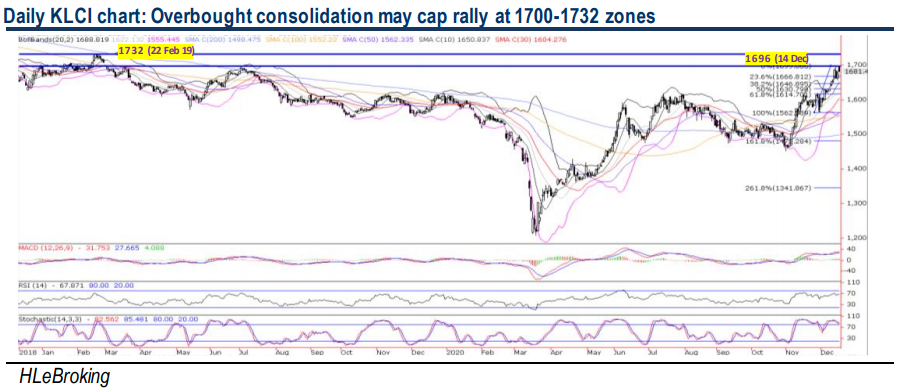

TECHNICAL OUTLOOK: KLCI

KLCI reduced its strong gains of 21.9 pts to 7.4 pts at 1681 after failing to break the 1696 resistance for the 2nd time yesterday on strong profit-taking (after a stellar run from 2 Nov low of 1452). In our view, as long as the benchmark is able to consolidate its recent gains near 1650 or 10D SMA territory, its near-term bullish trend would stay intact. Should the 1696 hurdle be taken out decisively, higher upside target is pegged at 1710-1730 levels. Conversely, a breakdown below 1650 support will drag the index lower towards 1630, 1615 and 1600 zones.

MARKET OUTLOOK

As long as the benchmark is able to consolidate its recent stellar gains near 1650 territory, KLCI’s near-term bullish trend would stay intact (with stiff resistances at 1696-1710-1730), supported by the vaccines’ optimism, hopes of further US stimulus package, traditional Dec window dressing (average +3.8% return from 1990-2019 with a 87% successful hit rate) and more funds flowing into recovery/value play themes. While the market may have an optimism bias in the near term, the SC/Bursa announcement yesterday to uplift the temporary suspension of RSS (on 1 Jan 2021) will bring volatility along this recovery path after enjoying an outstanding run from 1452 (2 Nov low). Hence, our HLIB Research 2021 top picks have a recovery bias (Tenaga, AMMB, DRB, MBM and FocusP), combined with volatility (Bursa), defensives (TM, MQREIT), value (IJM, Sunway, Armada) and sold down pandemic beneficiaries (Top Glove).

Source: Hong Leong Investment Bank Research - 17 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

AMBANK2024-11-23

ARMADA2024-11-22

ARMADA2024-11-22

BURSA2024-11-22

BURSA2024-11-22

BURSA2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

FOCUSP2024-11-22

FOCUSP2024-11-22

IJM2024-11-22

IJM2024-11-22

IJM2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TM2024-11-22

TM2024-11-22

TM2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-21

AMBANK2024-11-21

AMBANK2024-11-21

BURSA2024-11-21

BURSA2024-11-21

DRBHCOM2024-11-21

FOCUSP2024-11-21

IJM2024-11-21

IJM2024-11-21

IJM2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TM2024-11-21

TM2024-11-21

TM2024-11-20

AMBANK2024-11-20

AMBANK2024-11-20

AMBANK2024-11-20

BURSA2024-11-20

IJM2024-11-20

IJM2024-11-20

MBMR2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TM2024-11-20

TM2024-11-20

TM2024-11-20

TM2024-11-20

TOPGLOV2024-11-19

AMBANK2024-11-19

AMBANK2024-11-19

AMBANK2024-11-19

BURSA2024-11-19

DRBHCOM2024-11-19

IJM2024-11-19

MBMR2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TM2024-11-19

TM2024-11-19

TM2024-11-19

TOPGLOV2024-11-18

AMBANK2024-11-18

AMBANK2024-11-18

ARMADA2024-11-18

ARMADA2024-11-18

BURSA2024-11-18

DRBHCOM2024-11-18

IJM2024-11-18

IJM2024-11-18

SENTRAL2024-11-18

SUNWAY2024-11-18

SUNWAY2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TM2024-11-18

TM2024-11-18

TM2024-11-16

ARMADA2024-11-15

AMBANK2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

DRBHCOM2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

SUNWAY2024-11-15

SUNWAY2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-14

AMBANK2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

BURSA2024-11-14

BURSA2024-11-14

DRBHCOM2024-11-14

IJM2024-11-14

IJM2024-11-14

IJM2024-11-14

SUNWAY2024-11-14

SUNWAY2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-14

TOPGLOV2024-11-13

AMBANK2024-11-13

AMBANK2024-11-13

IJM2024-11-13

IJM2024-11-13

IJM2024-11-13

IJM2024-11-13

SUNWAY2024-11-13

SUNWAY2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-13

TOPGLOV2024-11-12

AMBANK2024-11-12

AMBANK2024-11-12

DRBHCOM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TM2024-11-12

TM2024-11-12

TM