Automotive - A Slow Start for 2021

HLInvest

Publish date: Tue, 23 Feb 2021, 09:41 AM

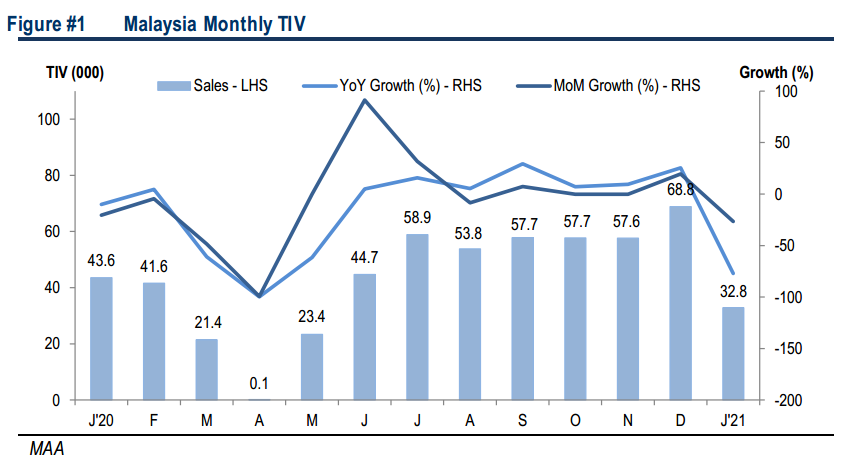

2021 TIV started at a slow pace of only 32.8k units for Jan (-24.7% YoY; -52.3% MoM), due to lower inventory available during the period (post accelerated deliveries in Dec 2020) and implementation of MCO2.0 since mid-Jan 2021. Note that Jan 2021 statistics lacks data from Mercedes, BMW, Mini and Scania. We maintain our 2021 TIV expectation at 585.4k units (+10.6% YoY), as we expect pent up sales toward 2Q2021, driven by the extended SST exemption measures to 30 Jun 2021 and the various new exciting models (launched late 2020 and early 2021). We reaffirm our OVERWEIGHT call on the automotive sector with a selective stock approach (national marque bias) in view of the recovery in 2021. Top picks are MBMR (BUY; TP: RM5.70) and Sime Darby (BUY; TP: RM2.68).

Malaysian Automotive Association (MAA) reported a slow start to the year 2021 at only 32.8k units (-24.7% YoY; -52.3% MoM), attributed mainly to the accelerated deliveries in Dec 2020 (resulting lower inventory for Jan 2021) and implementation of MCO2.0 since mid-Jan 2021. At current juncture, we are maintaining our TIV expectation of 585.4k units for 2021, a growth of +10.6% YoY, as we expect a pent-up sales toward 2Q2021 driven by the extension of SST exemptions (car prices have reduced 2-7%; paultan.org) to 30 Jun 2021 and the various attractive new model launches by major OEMs i.e. Proton, Perodua, Honda, Toyota and Nissan as well as the commencement of vaccination program in place. We expect that national marques Proton and Perodua will continue to outperform non-nationals.

With the broader recovery in demand as consumer sentiment improves with the progress of vaccination program and gradual relaxation of MCO2.0, we maintain our OVERWEIGHT rating on the sector with a stock selective approach with 4 BUY and 3 HOLD recommendations. Our top picks include MBMR (BUY; TP: RM5.70) and Sime Darby (BUY; TP: RM2.68). MBMR continued to leverage onto the strong performance of Perodua and benefits from strong cash flow and dividend yield. We also like Sime Darby for its strong balance sheet and potential leverage to the China market rebound.

Note that no data was provided for the following:

- Mercedes Malaysia has ceased to provide data.

- Monthly sales for BMW and Mini for Jan 2021

- Monthly sales for Scania for Oct 2020 to Jan 2021.

Perodua (UMW and MBMR) sales declined to 16.9k units (-3.4% YoY; -32.9% MoM), but outperformed the overall market with a new record 51.4% market share in Jan 2021. Management has set a new sales target of 240k units for 2021, indicating a targeted growth of 9% YoY. Perodua has recently opened the booking intake of the highly anticipated new SUV Ativa model with an attractive pricing of RM62.5-73.4k. We are also expecting the Myvi facelift model in later part of the year.

Proton (DRB) recorded a weak start for the year with 6.0k units (-29.9% YoY; -53.3% MoM), affected by accelerated deliveries for Dec 2020, lower inventory as well as supply constraints in Jan 2021. While Proton has not released its sales target for 2021, the CEO of Proton Edar has mentioned a further growth is expected in 2021 (after recording a growth in 2020 despite Malaysia being affected by Covid-19 pandemic), given the high backlog orders for X50 SUV model (launched in Oct 2020) as well as upcoming introduction of new Geely based sedan model 2021. Proton has also recently launched limited editions of 4 models - Saga, Iriz, Persona and Exora.

Honda (DRB) sales dropped drastically in Jan 2021 at 1.5k units (-76.0% YoY; -87.4% MoM) due to lower inventory at the start of the year, post accelerating deliveries for Dec 2020. Nevertheless, the production has caught up again during the month and sales are expected to regain traction in coming months. Honda will continue to leverage onto the strong demand of the newly launched City model as well as upcoming introduction of new City Hybrid model and new Jazz/City Hatchback model in 2021.

Toyota (UMW) registered +5.0% YoY growth to 3.8k units in Jan 2021 (mainly due to low base effect), but dropped -57.8% MoM, relatively in line with the market trend. Management has indicated their aims to overtake Honda in sales this year and reclaim the No.1 non national spot, banking on several new launches during the end 2020 (Vios facelift and Yaris facelift) as well as 2021 (recently launched Fortuner facelift and Innova facelift, with upcoming new SUV Corolla Cross).

Nissan (TCM) sales continued to disappoint in Jan 2021, at only 0.8k units (-43.8% YoY; -57.7% MoM), despite the launch of all new Almera model in Nov 2020. Nissan is expected to maintain its strategy to avoid stiff pricing competition, while leveraging onto its core models: new Almera, Serena and upcoming Navara facelift.

Mazda (BAuto) recorded a similar market trend with sales of only 0.4k units (-59.3% YoY; -73.4% MoM), due to lower inventory at the starting of the year. Bermaz has ended its attractive 6+6 warranty and free service program for new car sales in 2020 and reverted back to 5+5 program starting 2021. Upcoming attractive models for 2021 include CX-30 CKD, MX-30 and BT-50.

Source: Hong Leong Investment Bank Research - 23 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

BAUTO2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

SIME2024-11-21

DRBHCOM2024-11-21

PECCA2024-11-21

PECCA2024-11-21

PECCA2024-11-21

SIME2024-11-20

BAUTO2024-11-20

MBMR2024-11-20

PECCA2024-11-20

PECCA2024-11-20

SIME2024-11-20

SIME2024-11-20

SIME2024-11-19

BAUTO2024-11-19

DRBHCOM2024-11-19

MBMR2024-11-19

PECCA2024-11-19

PECCA2024-11-19

SIME2024-11-19

SIME2024-11-18

DRBHCOM2024-11-18

PECCA2024-11-18

PECCA2024-11-18

PECCA2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-15

BAUTO2024-11-15

DRBHCOM2024-11-15

PECCA2024-11-14

DRBHCOM2024-11-14

PECCA2024-11-14

SIME2024-11-14

SIME2024-11-13

SIME2024-11-13

SIME2024-11-12

DRBHCOM2024-11-12

SIME