WHO BENEFITS FROM FALLING CRUDE OIL PRICES FOR DUMMIES ? – SHELL REFINERY MALAYSIA and PETRONM

cooling

Publish date: Wed, 20 Jan 2016, 09:18 PM

WHO BENEFITS FROM FALLING CRUDE OIL PRICES? SHELL REFINERY MALAYSIA and PETRONM

http://www.oil-price.net/en/articles/who-benefits-from-lower-oil-prices.php

http://www.kosmo.com.my/kosmo/content.asp?y=2016&dt=0117&pub=Kosmo&sec=Negara&pg=ne_07.htm

Many may be frightened with the falling of crude oil prices, however many may have also missed the ....."ROSE AMONG THE THORNS" - YES.....OIL REFINERIES !...

These refineries have the capacity to utilize their big storage to buy raw crude oil at dirt cheap price to store it. After they have processed these raw crude oil, they sell their final product at high prices to the consumers. And their margin kept increasing...

Have you ever noticed why when raw crude oil prices have already touched USD28/barrel but consumers like you are still paying RM1.85/litre for RON95??? IMAGINE the profit margin of these OIL REFINERIES...!!

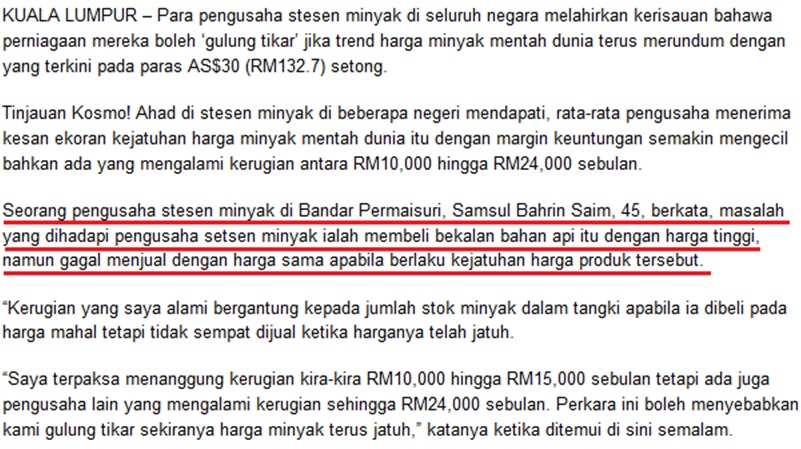

The other big losers are the Petrol Station Owners. Ever since the petrol prices are put on a float, they face difficulties in managing their stocks thus causing them losses when world crude oil drops. Refineries are smart as they know how to push the stocks to them at high prices.

OIL REFINERY stocks will well be your SAVIOR in times like this. Thus, there is why Warren Buffet have accumulated refinery stocks since YE2014.

OIL REFINERS in MALAYSIA:

1. SHELL REFINING COMPANY (FEDERATION of MALAYA) 125,000 bpd [this is different from Shell Europe]

2. PETRONM 88,000 bpd

TP: 8.00 - a race between Blaze and vPower Racing

Thinking of cutting your losses??....you may well be the loser in the end....

More articles on hotips

Discussions

Currently, Shell Refining's refinery plant in Port Dickson, Negeri Sembilan, has a capacity to process 156,000 barrels of crude oil per day.

The Port Dickson plant has been bleeding financially for the last four years since the financial year ended Dec 31, 2011 (FY11), as it grappled with poor refining margins.

The stock fell 29 sen or 5.33% to close at RM5.15 today, giving it a market capitalisation of RM1.56 billion.

2016-01-20 21:39

Wow 156,000 BPD...instead of 125,000 BPD.

Fantastic....looks like they have not been running full swing yet as per Q2-15 (without the MTA).

25% increase in PROFIT potential (not even considering the MARGIN rise yet!)

2016-01-20 23:10

it's a certainty when raw crude oil prices is going stay low these few years....

2016-01-20 23:12

petrol station loss because they have oil ron95 cheap for january sales, but febuay need to sell more cheaper.

2016-01-20 23:21

makcik kat petrol station tak tau manage inventory.....hanya tau dapat lesen station minyak

2016-01-20 23:27

must also see chemical pricing trends, must also notice that market will demand lower prices as feed is low price. Price will eventually soften. But they will enjoy the low price at least for now.

2016-01-20 23:32

It's a no win situation. Can't the big boys sit down & resolve? Dragging whole world into recession!

2016-01-20 23:46

Lets take a snap look at Shell's financial performance for 3 QR in 2015.Its Q4R 2015 will be released soon.

YTD 3 QR 2015 EPS =85 cents/share. With Conservative forecast Q4 2015 EPS of 50 cents/share , forecast Full FY 2015 EPS= 135 cents/share.

Forward EPS for full year 2015 based on YTD 2015 3QR of 85 cents/share = 113 cents/share

Assuming Market gives pure refinery a conservative PE of say 8.5, the TP range ranges from RM 9.60 to RM 11.40

If Refineries make good profits in future(which they will achieve with benign crude oil prices) and declare a dividend payout policy, the market will instead give it a PE higher than 10 as in the case of PETDAG/PETCHEM

If crude oil price remain benign for FY 2016, the Earnings per share for SHELL in FY 2016 will be much better than FY 2015.

2016-01-21 00:26

Aiyo....when money is taking out from the market....the market crash la.... after that...where you want to put back the money? Bond?

Market again laa...

Now the question is... which Market??

REFINERIES laa...

2016-01-21 01:21

on the edge news Daily today

http://www.businesstimes.com.sg/wealth/this-billionaires-wealth-grew-most-in-world-as-oil-plunged

NEW DELHI] Oil's plunge and the impact on the global economy is hurting many a billionaire. Indian tycoon Mukesh Ambani isn't one of them.

Reliance Industries Ltd, controlled by Mr Ambani, is benefiting from low crude prices as margins swell at the company's refining complex, the world's largest.

Mr Ambani's net worth increased US$620 million as of Friday, the most in the world in 2016, according to the Bloomberg Billionaires Index.

That's almost five times more than the second-biggest gainer this year, Wal-Mart heiress Alice Walton, who's up US$130 million.

Among India's 13 billionaires in the world's richest 400, Mr Ambani is also the only one to see an increase in his fortune.

Profit for the December quarter, to be announced later Tuesday, is projected to rise to an eight-year high to 69.8 billion rupees (S$1.48 billion), from 50.9 billion rupees a year earlier, according to the median estimate of 16 analysts in a Bloomberg survey.

Higher refining margins will underpin the performance as oil prices during the quarter were 42 per cent lower on average from the year-earlier period.

That's attracted investors including BlackRock Inc to Reliance, making the Mumbai-based company the best performer on the Bloomberg World Oil & Gas Index over the past three months.

"Any increase in refining margin helps Reliance's profit significantly because that business is the largest contributor to the bottom line," said Sanjeev Panda, Mumbai-based analyst at Sharekhan Ltd. The shares have gained "because of the sharp fall in crude reflecting positively on the margins."

Brent oil has fallen more than 70 per cent the last 18 months as the Organisation of Petroleum Exporting Countries (Opec) effectively abandoned output limits amid a surplus. The global benchmark crude on Tuesday added 54 cents, or 1.9 per cent, to US$29.09 a barrel on the London-based ICE Futures Europe exchange at 2.31 pm Singapore time.

Reliance's shares climbed about 14 per cent in 2015, ending a seven-year jinx of under-performing the S&P BSE Sensex. The stock slid 37 per cent from 2008 through 2014, versus a 35 per cent advance in India's benchmark equity gauge, as the company spent billions of dollars to expand its chemicals capacity and plowed US$15 billion in a telecommunications venture.

Reliance Jio Infocomm Ltd, Mr Ambani's telecom unit, plans to sell 150 billion rupees of shares to existing stockholders, according to an exchange filing late Monday.

"Start of projects worth US$30 billion across segments will make 2016 the biggest year in Reliance's history," Vikash Kumar Jain, an analyst at CLSA, wrote in a Jan 4 note.

2016-01-21 07:06

Mohd Fahmi Bin Jaes

Benefit to price petronm down

2016-01-20 21:33